Bitcoin Reclaims $83K Ahead of FOMC Meeting, HYPE Explodes by 11% (Market Watch)

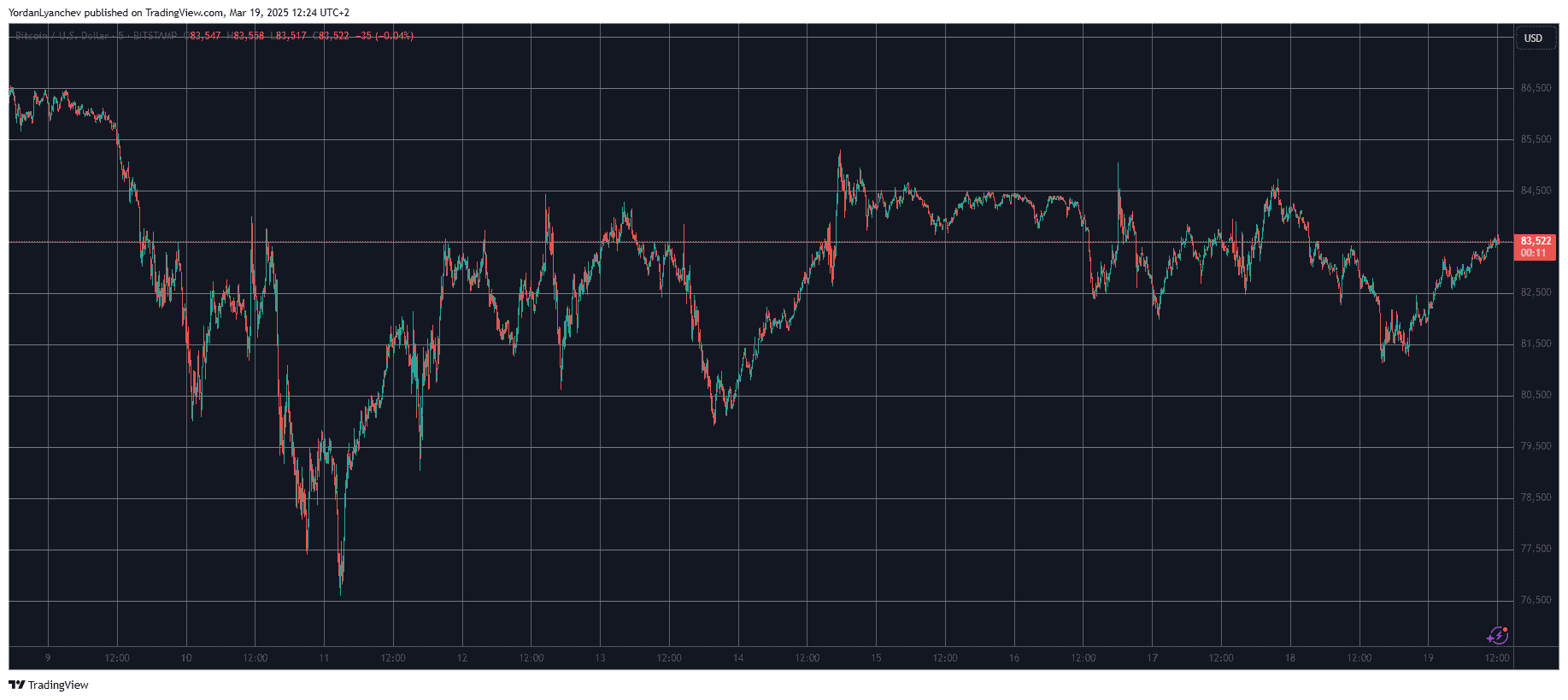

Bitcoin’s price tumbled toward $81,000 yesterday but managed to defend that level and now sits above $83,000 ahead of the second FOMC meeting for the year.

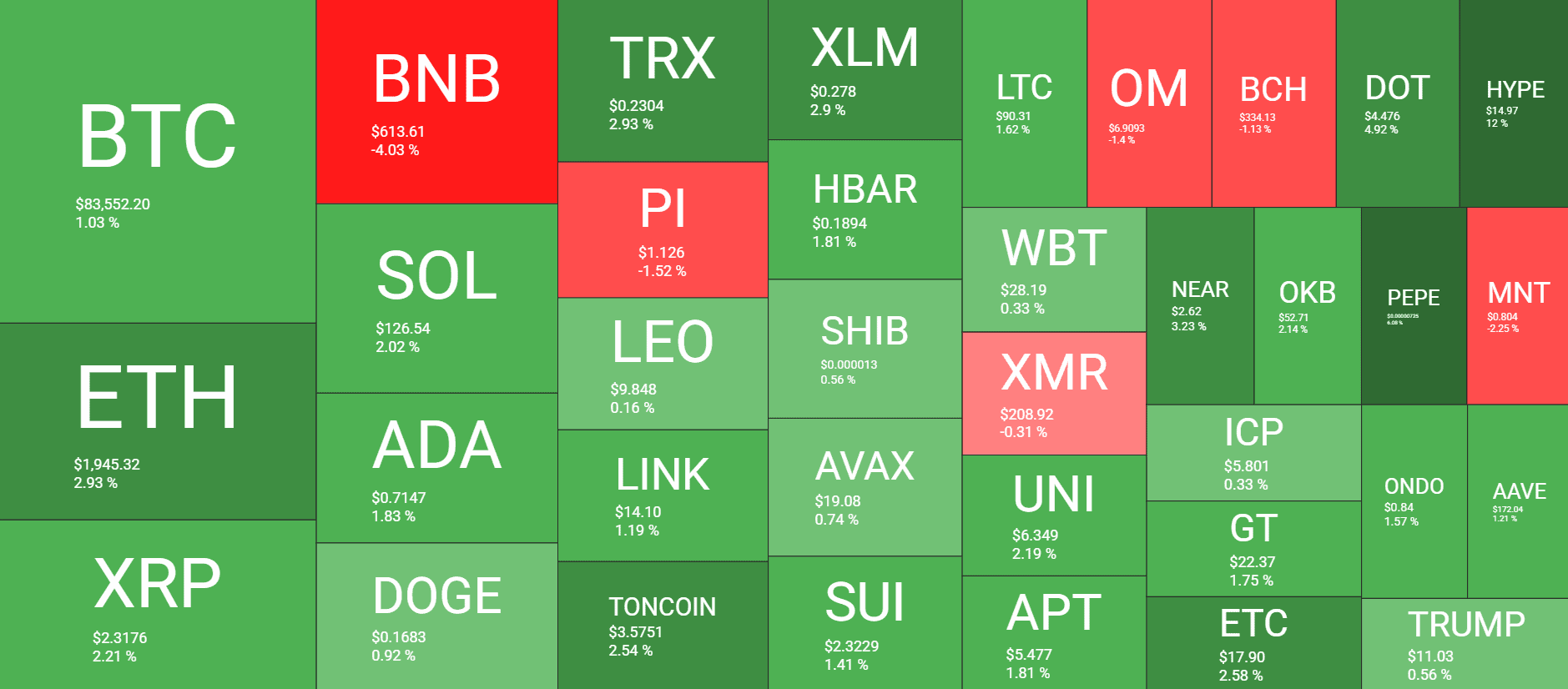

Most altcoins are slightly in the green on a daily scale today, led by HYPE and PEPE. In contrast, BNB has dropped by 4%.

BTC Prepares for FOMC

Following the massive volatility experienced at the start of the previous week, when BTC plunged below $77,000 for the first time in four months, the cryptocurrency has traded mostly above $80,000 and has been able to prevent a price drop beneath that line.

Furthermore, the bulls attempted a few leg ups that pushed the asset north to $85,000 but each was followed by an immediate rejection. There was an obvious example during the weekend after which bitcoin plunged below $82,000 and one more on Monday when it was stopped even ahead of $85,000.

The decline came on Tuesday as BTC dropped below $81,500 to mark a multi-day low. However, it bounced off that level and now trades about two grand higher.

More volatility is expected later today as the US central bank is set to announce whether there will be any changes to the key interest rates. Although almost every anticipates that the rates will be left unchanged, BTC tends to react with at least minor fluctuations after each meeting.

For now, its market capitalization stands above $1.650 trillion, while its dominance over the alts has declined slightly to 58.5% on CG.

HYPE on the Run

Most altcoins are slightly in the green today. Ethereum is up by 3% and now trades close to $1,950, but it’s still away from the $2,000 mark. Ripple, Solana, and Tron have posted similar gains, followed by ADA, LINK, DOGE, and TON. In contrast, BNB has dropped by 4% and now sits beneath $615.

The biggest gainers from the mid-cap alts are HYPE and PEPE. The former has added over 12% of value and trades at $15, while the meme coin is up by 8% and stands north of $0.0000072.

The total crypto market cap is up by $25 billion since yesterday to $2.830 trillion on CG.

The post Bitcoin Reclaims $83K Ahead of FOMC Meeting, HYPE Explodes by 11% (Market Watch) appeared first on CryptoPotato.

Bitcoin Reclaims $83K Ahead of FOMC Meeting, HYPE Explodes by 11% (Market Watch)

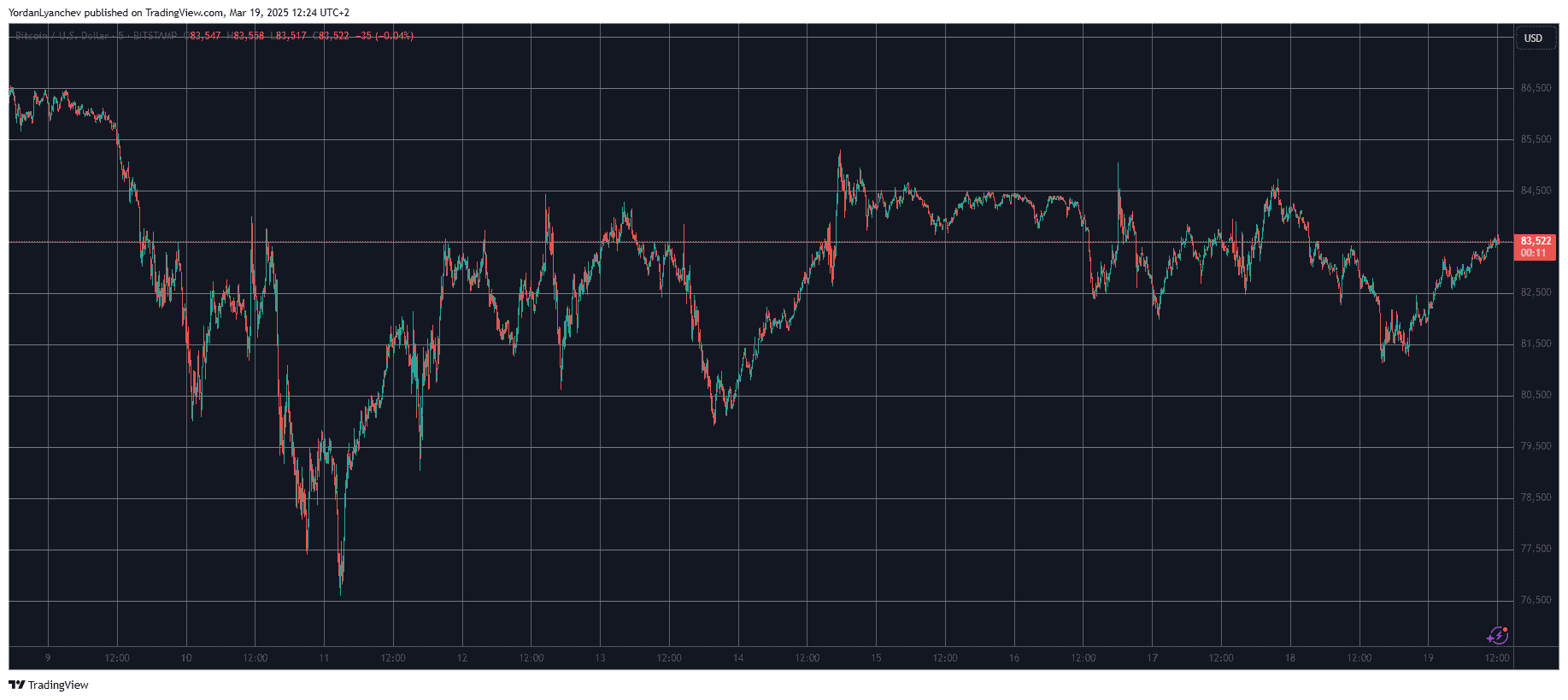

Bitcoin’s price tumbled toward $81,000 yesterday but managed to defend that level and now sits above $83,000 ahead of the second FOMC meeting for the year.

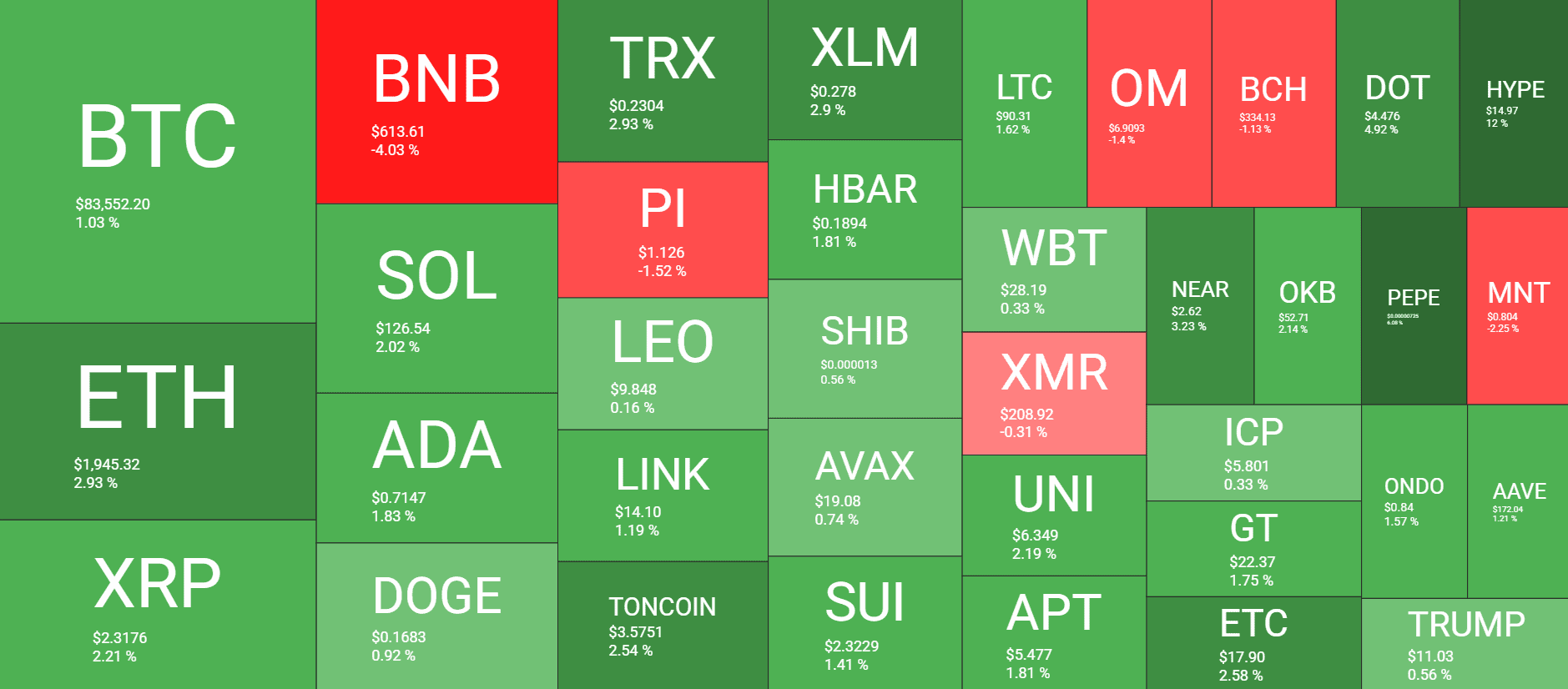

Most altcoins are slightly in the green on a daily scale today, led by HYPE and PEPE. In contrast, BNB has dropped by 4%.

BTC Prepares for FOMC

Following the massive volatility experienced at the start of the previous week, when BTC plunged below $77,000 for the first time in four months, the cryptocurrency has traded mostly above $80,000 and has been able to prevent a price drop beneath that line.

Furthermore, the bulls attempted a few leg ups that pushed the asset north to $85,000 but each was followed by an immediate rejection. There was an obvious example during the weekend after which bitcoin plunged below $82,000 and one more on Monday when it was stopped even ahead of $85,000.

The decline came on Tuesday as BTC dropped below $81,500 to mark a multi-day low. However, it bounced off that level and now trades about two grand higher.

More volatility is expected later today as the US central bank is set to announce whether there will be any changes to the key interest rates. Although almost every anticipates that the rates will be left unchanged, BTC tends to react with at least minor fluctuations after each meeting.

For now, its market capitalization stands above $1.650 trillion, while its dominance over the alts has declined slightly to 58.5% on CG.

HYPE on the Run

Most altcoins are slightly in the green today. Ethereum is up by 3% and now trades close to $1,950, but it’s still away from the $2,000 mark. Ripple, Solana, and Tron have posted similar gains, followed by ADA, LINK, DOGE, and TON. In contrast, BNB has dropped by 4% and now sits beneath $615.

The biggest gainers from the mid-cap alts are HYPE and PEPE. The former has added over 12% of value and trades at $15, while the meme coin is up by 8% and stands north of $0.0000072.

The total crypto market cap is up by $25 billion since yesterday to $2.830 trillion on CG.

The post Bitcoin Reclaims $83K Ahead of FOMC Meeting, HYPE Explodes by 11% (Market Watch) appeared first on CryptoPotato.