Grayscale Bitcoin Sell-Offs Slowing Down After Sending Over $5,000,000,000 in BTC to Coinbase: Arkham

Grayscale’s BTC sell-offs are in the beginning stages of slowing down after the financial giant sent over $5 billion worth of Bitcoin to the top US crypto exchange Coinbase.

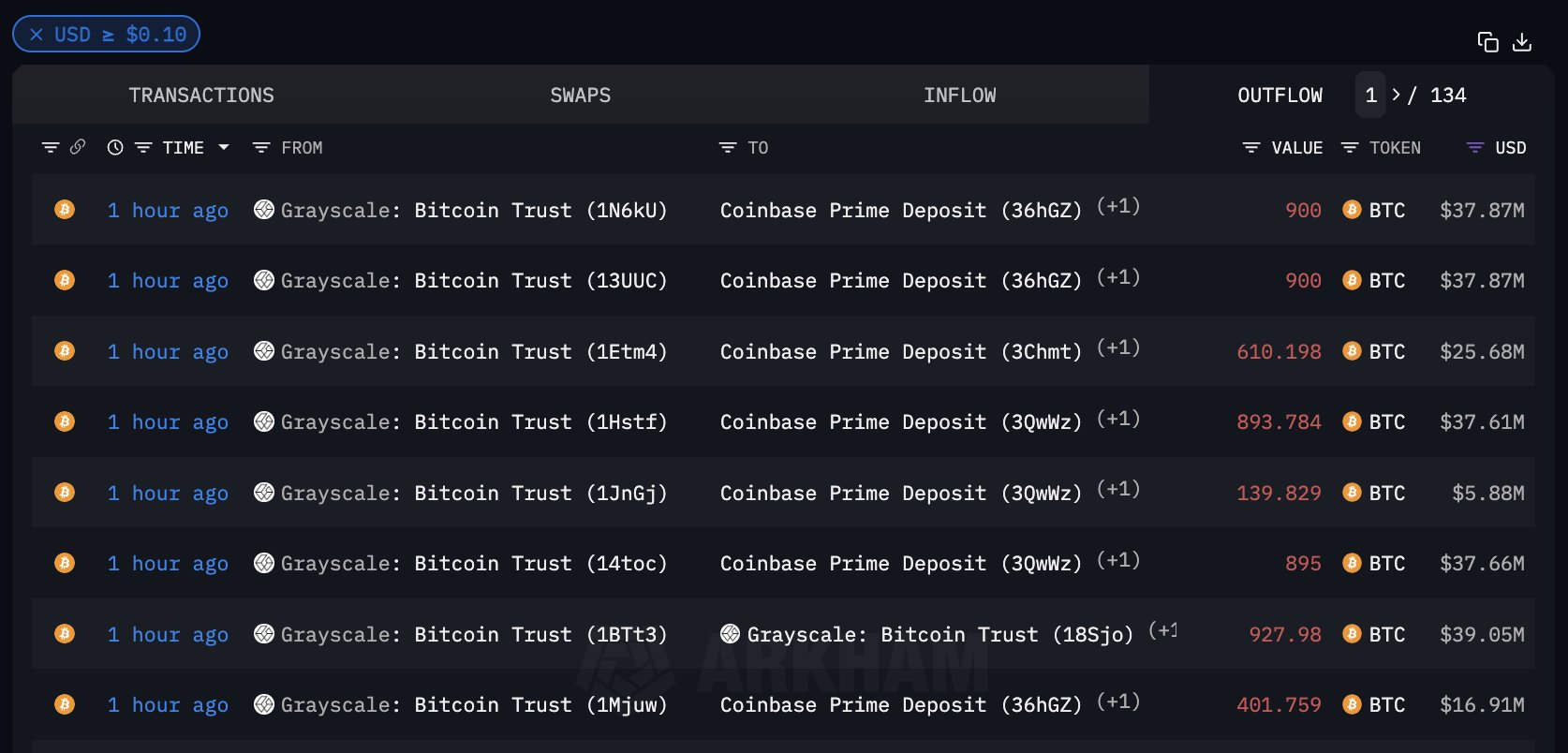

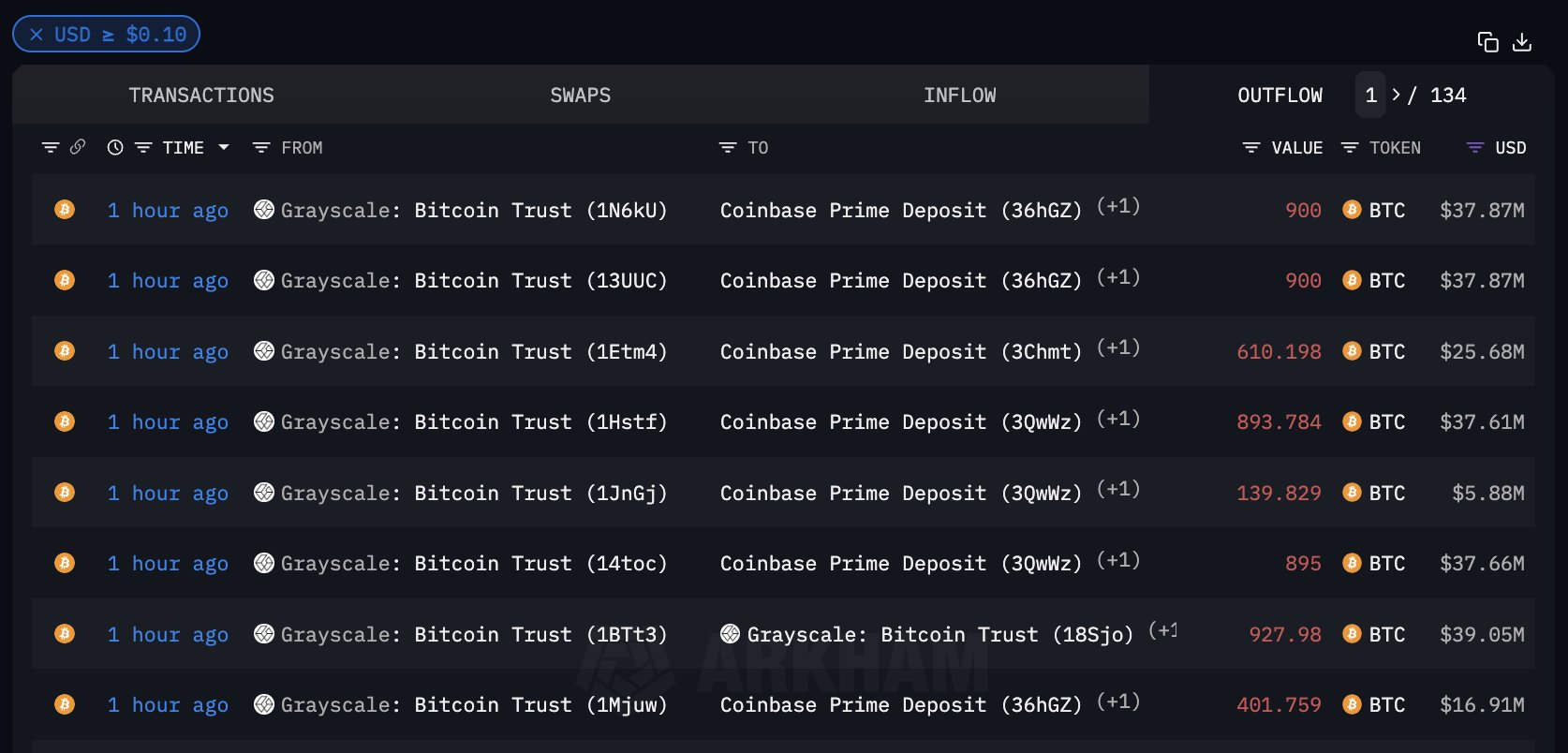

Lookonchain says that on Friday, Grayscale deposited $410.9 million in BTC to Coinbase Prime, the crypto exchange’s platform that caters to institutional clients.

The deposit added to an already large stream of BTC deposits from Grayscale, which according to Lookonchain, totaled over $4.64 billion since the exchange-traded fund (ETF) approvals. Even after the massive deposits, Grayscale remained the third-largest holder of Bitcoin with 502,043.26 BTC worth $20.67 billion.

Today, Arkham Intelligence, a crypto intelligence aiming to “deanonymize the blockchain,” says that Grayscale’s flows are starting to “significantly lessen.”

“Seems like Grayscale flows are starting to significantly lessen this week.

Today, Grayscale sent 6.9K BTC ($289.5M) to Coinbase.

This is down almost 34% from their last transfer on Friday, and a decrease of over 45% from their average daily transfer size last week, $530.2M.”

Last week, former White House official and Skybridge Capital founder Anthony Scaramucci said that his trading desk reported that GBTC holders booked losses on their shares in order to hold ETFs with lower fees, leading to a large amount of Bitcoin sell pressure.

BTC is worth $43,200 at time of writing, up 6% in the last week.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Grayscale Bitcoin Sell-Offs Slowing Down After Sending Over $5,000,000,000 in BTC to Coinbase: Arkham appeared first on The Daily Hodl.

Grayscale Bitcoin Sell-Offs Slowing Down After Sending Over $5,000,000,000 in BTC to Coinbase: Arkham

Grayscale’s BTC sell-offs are in the beginning stages of slowing down after the financial giant sent over $5 billion worth of Bitcoin to the top US crypto exchange Coinbase.

Lookonchain says that on Friday, Grayscale deposited $410.9 million in BTC to Coinbase Prime, the crypto exchange’s platform that caters to institutional clients.

The deposit added to an already large stream of BTC deposits from Grayscale, which according to Lookonchain, totaled over $4.64 billion since the exchange-traded fund (ETF) approvals. Even after the massive deposits, Grayscale remained the third-largest holder of Bitcoin with 502,043.26 BTC worth $20.67 billion.

Today, Arkham Intelligence, a crypto intelligence aiming to “deanonymize the blockchain,” says that Grayscale’s flows are starting to “significantly lessen.”

“Seems like Grayscale flows are starting to significantly lessen this week.

Today, Grayscale sent 6.9K BTC ($289.5M) to Coinbase.

This is down almost 34% from their last transfer on Friday, and a decrease of over 45% from their average daily transfer size last week, $530.2M.”

Last week, former White House official and Skybridge Capital founder Anthony Scaramucci said that his trading desk reported that GBTC holders booked losses on their shares in order to hold ETFs with lower fees, leading to a large amount of Bitcoin sell pressure.

BTC is worth $43,200 at time of writing, up 6% in the last week.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Grayscale Bitcoin Sell-Offs Slowing Down After Sending Over $5,000,000,000 in BTC to Coinbase: Arkham appeared first on The Daily Hodl.