48-Hour Ultimatum: SEC’s Gensler Threatens Elon Musk with Charges

SEC’s charges against Elon Musk have reached a critical point. SEC Chair Gary Gensler has given Musk 48 hours to settle or face legal action. The cryptocurrency legal issues around Musk grew as the SEC regulatory crackdown now targets several of his companies. The Elon Musk SEC investigation covers both Twitter (X) stock disclosure problems and new Neuralink probes.

Also Read: Top 3 Cryptocurrencies You Should Buy Before Bitcoin Hits $120K

What SEC’s Charges Against Elon Musk Mean for Cryptocurrency and Market Regulation

Settlement Demand and Multiple Charges

The SEC charges against Elon Musk have come with a strict deadline. He must settle in 48 hours or face multiple charges. The Elon Musk SEC investigation now includes Neuralink. The SEC sent a subpoena to his lawyer, Alex Spiro. They threatened a process server if he didn’t comply. Musk responded by calling the SEC “just another weaponized institution doing political dirty work.”

Legal Timeline and Violations

The SEC regulatory crackdown began when Musk broke the Hart-Scott-Rodino Act rules. He waited too long to reveal his 9.2% stake in Twitter. The cryptocurrency legal issues increased after Musk missed his SEC testimony. He had agreed to testify in May 2024. His absence led the SEC to seek penalties in San Francisco court.

Also Read: AMD Vs META: Which is the Best AR Stock to Invest in Now?

Industry-Wide Implications

The SEC charges against Elon Musk show the challenges facing cryptocurrency regulation. Pro-XRP lawyer John Deaton compared it to the LBRY case. He said, “This is how the SEC treats the richest man in the world.” He pointed out that smaller companies face even tougher treatment. The Elon Musk cryptocurrency controversy highlights the clash between new technology and regulations.

Broader Market Impact

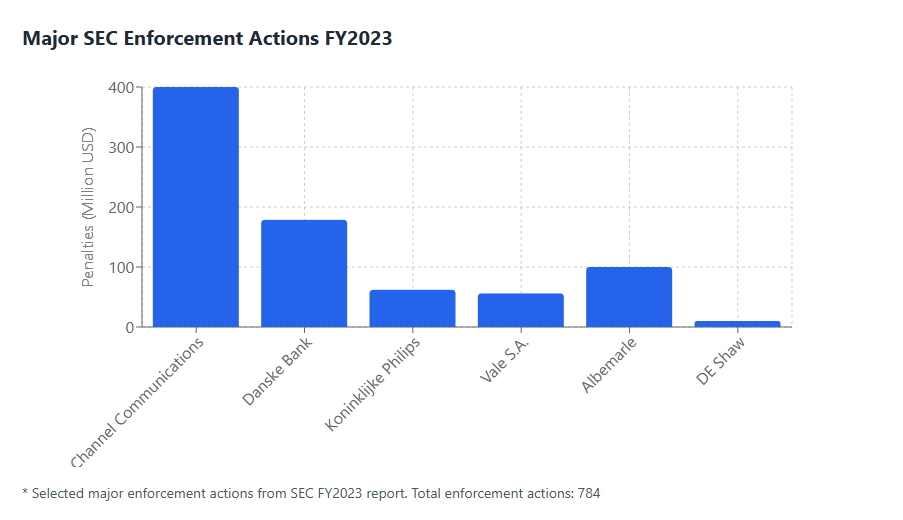

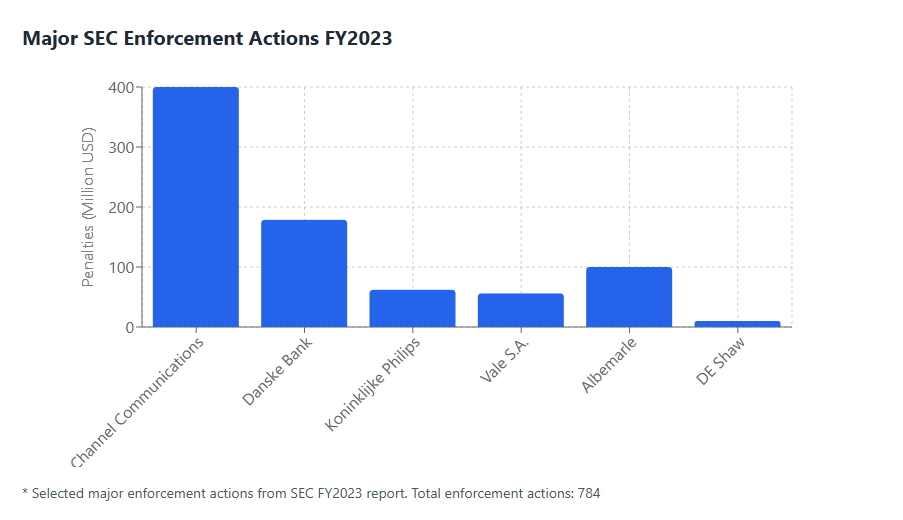

These SEC charges against Elon Musk mean stricter oversight of tech leaders and cryptocurrency projects. The SEC regulatory crackdown affects many companies. Ripple spent $150 million defending itself in a registration case without fraud charges. This pressure shapes how cryptocurrency legal issues will be handled in the future.

Also Read: Walmart (WMT) Leads Key Sector as It Becomes Must Buy Stock Before 2025

48-Hour Ultimatum: SEC’s Gensler Threatens Elon Musk with Charges

SEC’s charges against Elon Musk have reached a critical point. SEC Chair Gary Gensler has given Musk 48 hours to settle or face legal action. The cryptocurrency legal issues around Musk grew as the SEC regulatory crackdown now targets several of his companies. The Elon Musk SEC investigation covers both Twitter (X) stock disclosure problems and new Neuralink probes.

Also Read: Top 3 Cryptocurrencies You Should Buy Before Bitcoin Hits $120K

What SEC’s Charges Against Elon Musk Mean for Cryptocurrency and Market Regulation

Settlement Demand and Multiple Charges

The SEC charges against Elon Musk have come with a strict deadline. He must settle in 48 hours or face multiple charges. The Elon Musk SEC investigation now includes Neuralink. The SEC sent a subpoena to his lawyer, Alex Spiro. They threatened a process server if he didn’t comply. Musk responded by calling the SEC “just another weaponized institution doing political dirty work.”

Legal Timeline and Violations

The SEC regulatory crackdown began when Musk broke the Hart-Scott-Rodino Act rules. He waited too long to reveal his 9.2% stake in Twitter. The cryptocurrency legal issues increased after Musk missed his SEC testimony. He had agreed to testify in May 2024. His absence led the SEC to seek penalties in San Francisco court.

Also Read: AMD Vs META: Which is the Best AR Stock to Invest in Now?

Industry-Wide Implications

The SEC charges against Elon Musk show the challenges facing cryptocurrency regulation. Pro-XRP lawyer John Deaton compared it to the LBRY case. He said, “This is how the SEC treats the richest man in the world.” He pointed out that smaller companies face even tougher treatment. The Elon Musk cryptocurrency controversy highlights the clash between new technology and regulations.

Broader Market Impact

These SEC charges against Elon Musk mean stricter oversight of tech leaders and cryptocurrency projects. The SEC regulatory crackdown affects many companies. Ripple spent $150 million defending itself in a registration case without fraud charges. This pressure shapes how cryptocurrency legal issues will be handled in the future.

Also Read: Walmart (WMT) Leads Key Sector as It Becomes Must Buy Stock Before 2025