Antpool mines consecutive Bitcoin blocks, earns nearly $2 million amid Babylon staking surge

Quick Take

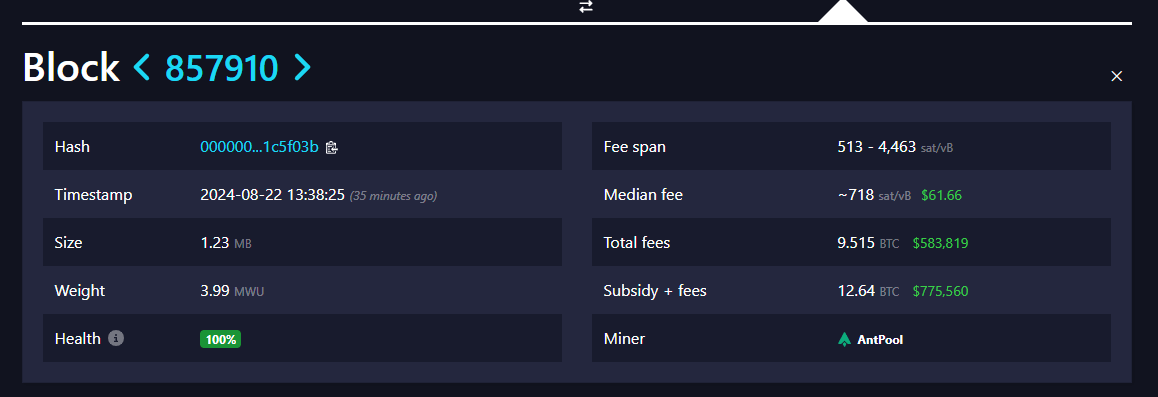

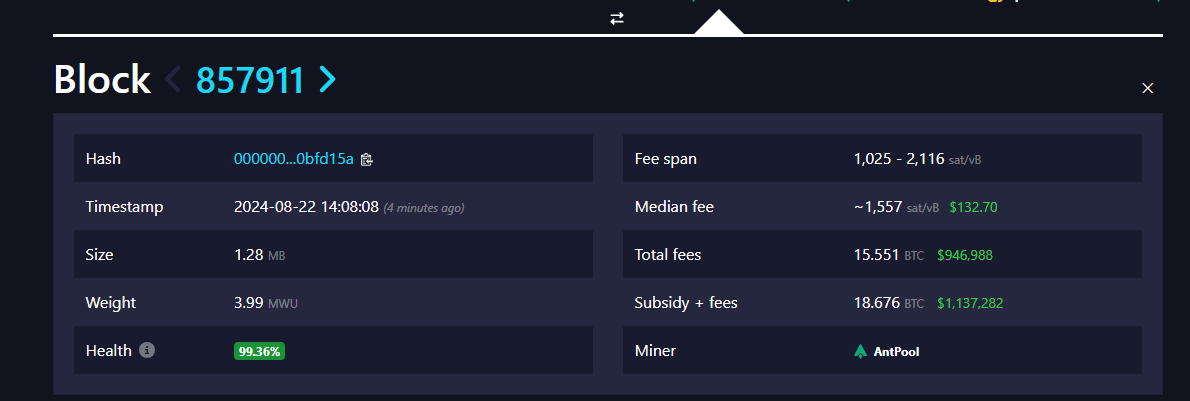

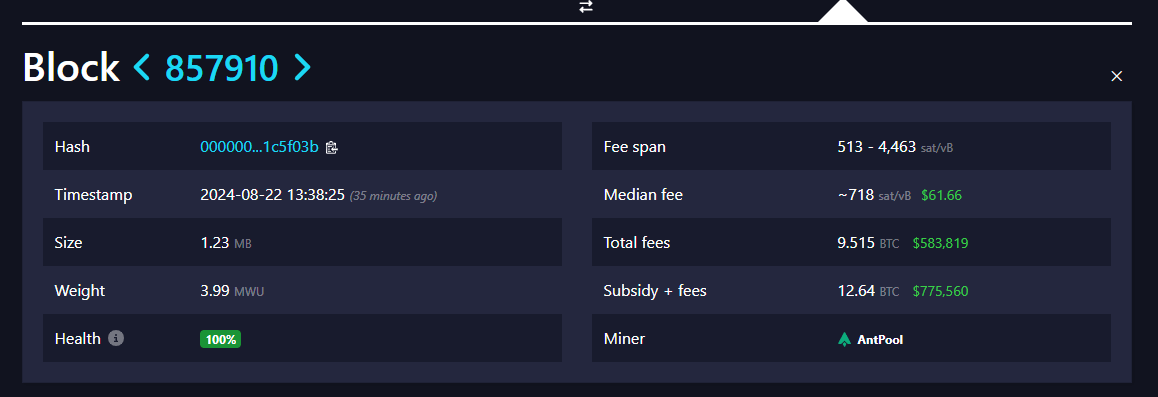

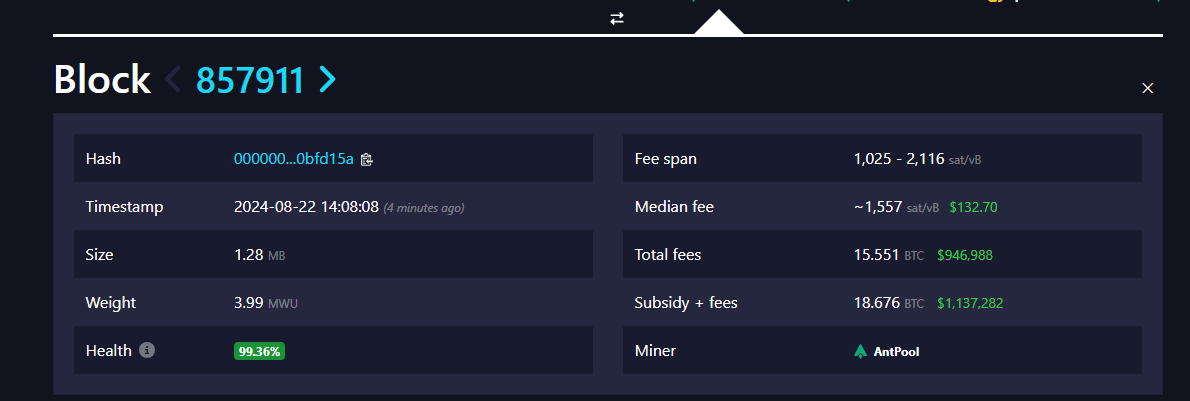

Antpool has recently mined two consecutive Bitcoin blocks, securing nearly $2 million in total revenue from both block subsidies and transaction fees, according to mempool.space.

Block 857910, mined by Antpool, contained 9.5 BTC in fees, equivalent to approximately $583,000.

Following that, Block 857911 featured 15.55 BTC in fees, amounting to around $950k. This surge in transaction fees is largely attributed to Babylon, a Bitcoin staking platform that recently gained significant traction.

Babylon, which raised $70 million in a funding round earlier this year, allows users to stake up to 1,000 BTC in total; stakes are accepted on a first-come-first-serve basis, according to Chorus.one. Within 48 hours of its testnet launch, Babylon attracted over 100,000 stakers, driving up network activity and, consequently, transaction fees.

According to Mononaut, a developer at Mempool, Babylon has no functionality yet.

“As far as I can tell, Babylon has no functionality yet, other than staking. There are no staking rewards and no yield”.

The post Antpool mines consecutive Bitcoin blocks, earns nearly $2 million amid Babylon staking surge appeared first on CryptoSlate.

Antpool mines consecutive Bitcoin blocks, earns nearly $2 million amid Babylon staking surge

Quick Take

Antpool has recently mined two consecutive Bitcoin blocks, securing nearly $2 million in total revenue from both block subsidies and transaction fees, according to mempool.space.

Block 857910, mined by Antpool, contained 9.5 BTC in fees, equivalent to approximately $583,000.

Following that, Block 857911 featured 15.55 BTC in fees, amounting to around $950k. This surge in transaction fees is largely attributed to Babylon, a Bitcoin staking platform that recently gained significant traction.

Babylon, which raised $70 million in a funding round earlier this year, allows users to stake up to 1,000 BTC in total; stakes are accepted on a first-come-first-serve basis, according to Chorus.one. Within 48 hours of its testnet launch, Babylon attracted over 100,000 stakers, driving up network activity and, consequently, transaction fees.

According to Mononaut, a developer at Mempool, Babylon has no functionality yet.

“As far as I can tell, Babylon has no functionality yet, other than staking. There are no staking rewards and no yield”.

The post Antpool mines consecutive Bitcoin blocks, earns nearly $2 million amid Babylon staking surge appeared first on CryptoSlate.