XRP Consolidates at $2.8 as Derivatives Signal the Next Big Move

- XRP is consolidating around $2.8 after a sharp rally to $3, with open interest cooling off from record highs.

- Derivatives markets remain active, suggesting traders are still positioning for a potential breakout in either direction.

- A move above $3 could fuel a run toward $3.5, while failure to hold $2.8 risks a drop toward $2.5 support.

XRP is sitting in an interesting spot right now. After spiking to the $3 mark and pulling in a flood of speculative bets, the token has cooled off, hovering around $2.8. The pause feels less like weakness and more like the market catching its breath before deciding where to run next.

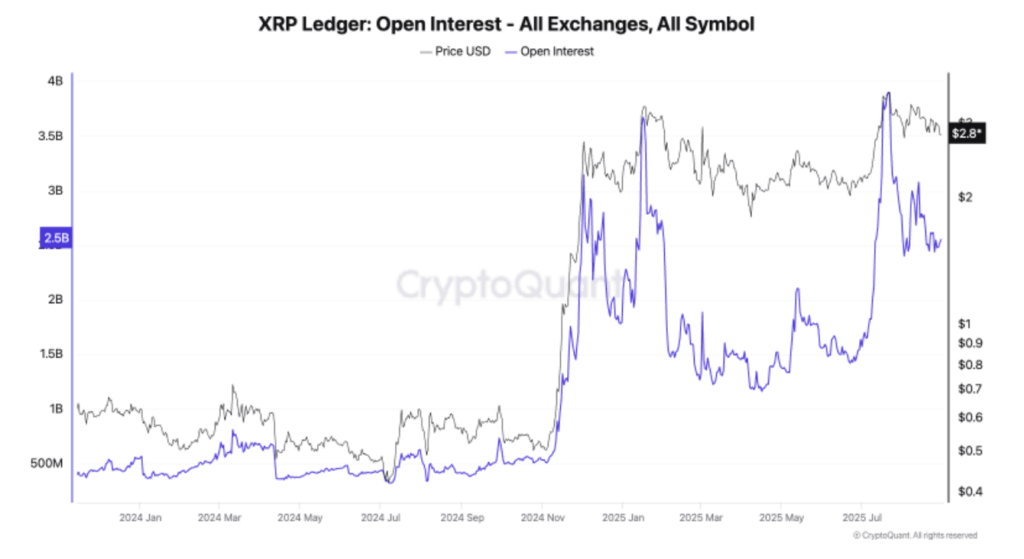

Open Interest Pullback and Market Strength

When XRP touched $3.00, open interest across exchanges ripped past $3.5 billion. That kind of leverage build-up doesn’t last forever—so the recent pullback was almost inevitable. But here’s the thing: holding above $2.8, even after traders unwound some of those positions, shows there’s still strength underneath the noise.

Derivatives Activity Driving Volatility

Derivatives remain the driver here. Futures and options activity has basically been steering XRP’s price action, both in the run-up and the retrace. Even now, volumes in those markets are staying high, hinting that traders are still circling, waiting for the next breakout trigger. If XRP clears $3 again, momentum could easily carry it toward $3.5. On the flip side, failing to defend $2.8 might see the token tumble fast toward $2.5 support.

What Comes Next for XRP?

So the big question—what’s next? It really comes down to whether derivatives traders decide to re-load. If fresh money piles back into open interest, a sharp upside move wouldn’t be surprising at all. But with broader market jitters and some cooling in speculation, the next breakout could swing violently in either direction. For now, XRP sits in that tense middle ground, and the fuse is already lit.

The post XRP Consolidates at $2.8 as Derivatives Signal the Next Big Move first appeared on BlockNews.

Read More

XRP Price Prediction 2025–2033 – Here is When Analysts Expect $4, $5, $9, and $10

XRP Consolidates at $2.8 as Derivatives Signal the Next Big Move

- XRP is consolidating around $2.8 after a sharp rally to $3, with open interest cooling off from record highs.

- Derivatives markets remain active, suggesting traders are still positioning for a potential breakout in either direction.

- A move above $3 could fuel a run toward $3.5, while failure to hold $2.8 risks a drop toward $2.5 support.

XRP is sitting in an interesting spot right now. After spiking to the $3 mark and pulling in a flood of speculative bets, the token has cooled off, hovering around $2.8. The pause feels less like weakness and more like the market catching its breath before deciding where to run next.

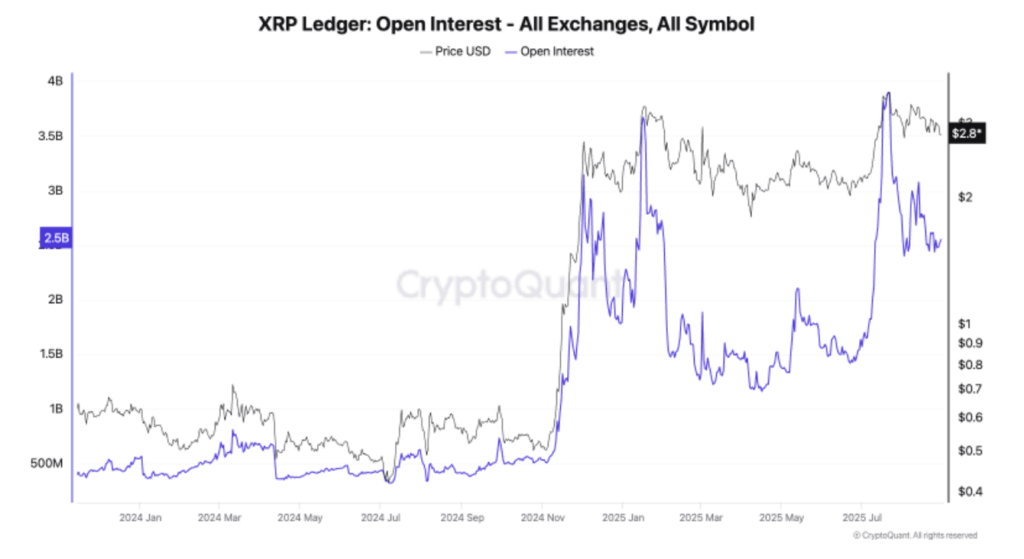

Open Interest Pullback and Market Strength

When XRP touched $3.00, open interest across exchanges ripped past $3.5 billion. That kind of leverage build-up doesn’t last forever—so the recent pullback was almost inevitable. But here’s the thing: holding above $2.8, even after traders unwound some of those positions, shows there’s still strength underneath the noise.

Derivatives Activity Driving Volatility

Derivatives remain the driver here. Futures and options activity has basically been steering XRP’s price action, both in the run-up and the retrace. Even now, volumes in those markets are staying high, hinting that traders are still circling, waiting for the next breakout trigger. If XRP clears $3 again, momentum could easily carry it toward $3.5. On the flip side, failing to defend $2.8 might see the token tumble fast toward $2.5 support.

What Comes Next for XRP?

So the big question—what’s next? It really comes down to whether derivatives traders decide to re-load. If fresh money piles back into open interest, a sharp upside move wouldn’t be surprising at all. But with broader market jitters and some cooling in speculation, the next breakout could swing violently in either direction. For now, XRP sits in that tense middle ground, and the fuse is already lit.

The post XRP Consolidates at $2.8 as Derivatives Signal the Next Big Move first appeared on BlockNews.

Read More