SUI Holds Support in Wedge Breakout with $4.63-$6 Targets Ahead

- SUI maintains bullish wedge breakout above $3.30.

- Open interest rises 2.10% to $1.81 billion as derivatives show optimism.

- Technical analysis points to $4.63 and $6 potential price targets.

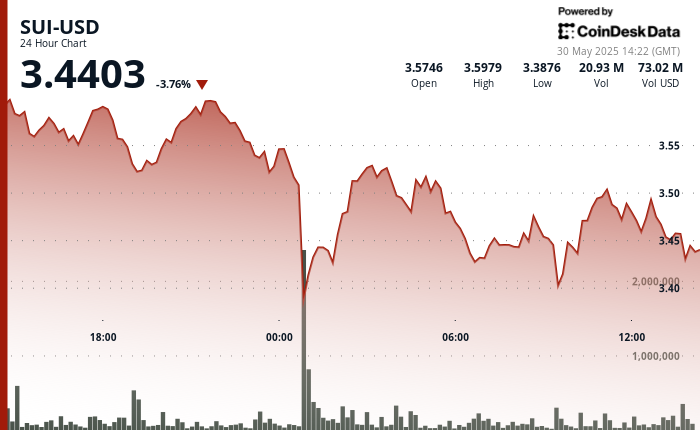

SUI has maintained its position above the $3.30 demand zone. The token’s ability to reject lower prices near the 50-day EMA and hold this critical support level has raised questions about whether a bullish reversal could materialize this week.

The daily chart shows SUI attempting to sustain its falling wedge breakout rally, having surpassed the 23.60% trend-based Fibonacci level at $3.30. However, the token is struggling to establish a consistent higher-high pattern, creating some uncertainty about near-term direction.

After testing the $3.30 demand zone for a second time, SUI has moved to test the 50-day EMA at $3.38.

SUI resistance trendline caps upside attempts

The short-term price activity indicates that SUI is up against a resistance trendline that was established following the rejection at $4.29. This technical barrier has limited the token’s ability to extend its uptrend, while the daily RSI indicates weakening momentum.

The RSI has fallen below the overbought region’s midpoint, suggesting that short-term bullish strength may be ebbing. This technical divergence suggests traders should monitor for potential consolidation or retracement.

Despite these short-term challenges, a successful bounce from the 23.60% Fibonacci level could open the door to testing the 38.20% level at $4.63, provided SUI can break through the local resistance trendline that has capped recent rallies.

If bullish momentum returns, the uptrend could extend toward the 50% Fibonacci level near the $6 psychological mark, which would target a new all-time high for the token. This scenario would require sustained buying pressure and a clear break of current resistance levels.

Conversely, failure to hold current support could see SUI retreat toward the 200-day EMA near the $3 psychological level, which serves as crucial support in case of a breakdown.

Read More

SUI Plunges 6% Overnight Before Buyers Step in at $3.40 Support

SUI Holds Support in Wedge Breakout with $4.63-$6 Targets Ahead

- SUI maintains bullish wedge breakout above $3.30.

- Open interest rises 2.10% to $1.81 billion as derivatives show optimism.

- Technical analysis points to $4.63 and $6 potential price targets.

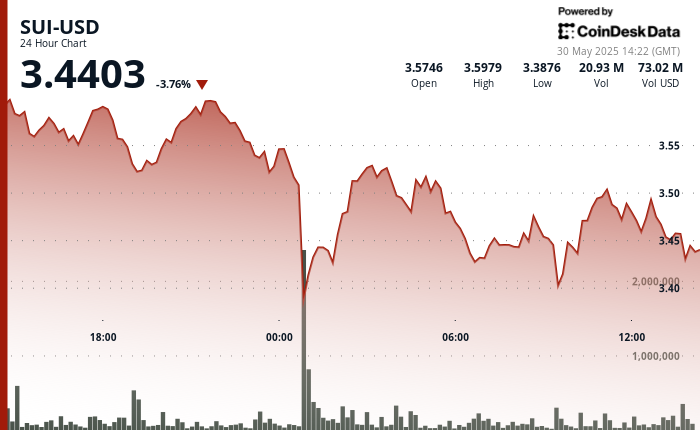

SUI has maintained its position above the $3.30 demand zone. The token’s ability to reject lower prices near the 50-day EMA and hold this critical support level has raised questions about whether a bullish reversal could materialize this week.

The daily chart shows SUI attempting to sustain its falling wedge breakout rally, having surpassed the 23.60% trend-based Fibonacci level at $3.30. However, the token is struggling to establish a consistent higher-high pattern, creating some uncertainty about near-term direction.

After testing the $3.30 demand zone for a second time, SUI has moved to test the 50-day EMA at $3.38.

SUI resistance trendline caps upside attempts

The short-term price activity indicates that SUI is up against a resistance trendline that was established following the rejection at $4.29. This technical barrier has limited the token’s ability to extend its uptrend, while the daily RSI indicates weakening momentum.

The RSI has fallen below the overbought region’s midpoint, suggesting that short-term bullish strength may be ebbing. This technical divergence suggests traders should monitor for potential consolidation or retracement.

Despite these short-term challenges, a successful bounce from the 23.60% Fibonacci level could open the door to testing the 38.20% level at $4.63, provided SUI can break through the local resistance trendline that has capped recent rallies.

If bullish momentum returns, the uptrend could extend toward the 50% Fibonacci level near the $6 psychological mark, which would target a new all-time high for the token. This scenario would require sustained buying pressure and a clear break of current resistance levels.

Conversely, failure to hold current support could see SUI retreat toward the 200-day EMA near the $3 psychological level, which serves as crucial support in case of a breakdown.

Read More