Origin Defi Review: A Prominent Protocol In LSDFi Trends With High Profits

Origin Defi emerged in the LSDFi segment as a protocol that uses a combination of different strategies to increase revenue and thereby bring high profits to users. Origin DeFi’s OTokens use the same codebase but accept different collateral and utilize various strategies depending on the market’s opportunities. OUSD is designed to help you accumulate more dollars, whereas OETH enables you to earn more ETH. So what is Origin Defi? How does it work?

What is Origin Defi?

As a new member of the LSDFi racetrack, Origin Protocol uses various income strategies to enhance earnings. The Native Protocol is a platform powered by Ethereum that aims to bring Non-fungible Tokens (NFT) and Decentralized Finance (DeFi) to the masses.

In 2020, Origin sought to make everyone profitable by launching its first profitable stablecoin, OUSD. We are now taking the next step forward, delivering continuous, accessible, and advanced returns on Ether. Origin recently launched Origin Ether (OETH), an innovative yield token that uses top-tier LSD as collateral.

Origin’s NFT and DeFi ecosystems are managed by the OGN token, allowing holders to ensure transparent monitoring and development of the Origin platform.

Origin Defi products

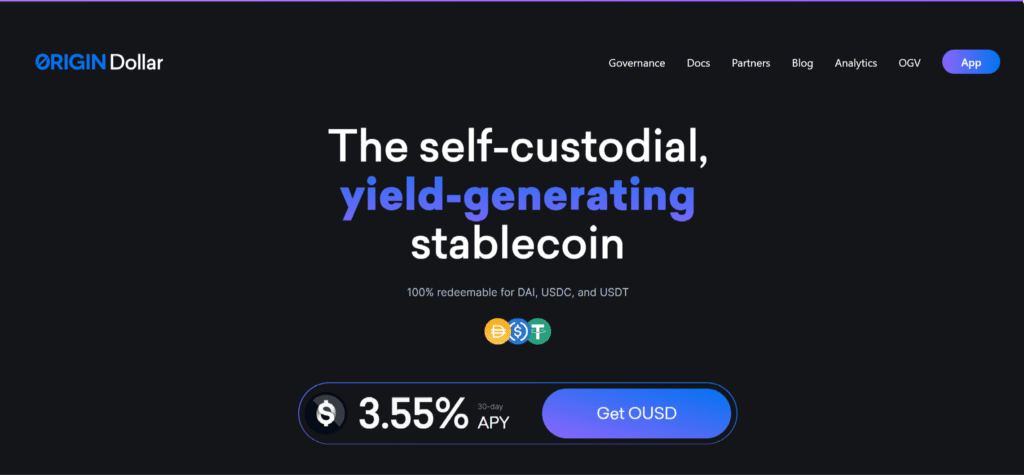

Origin Dollar (OUSD)

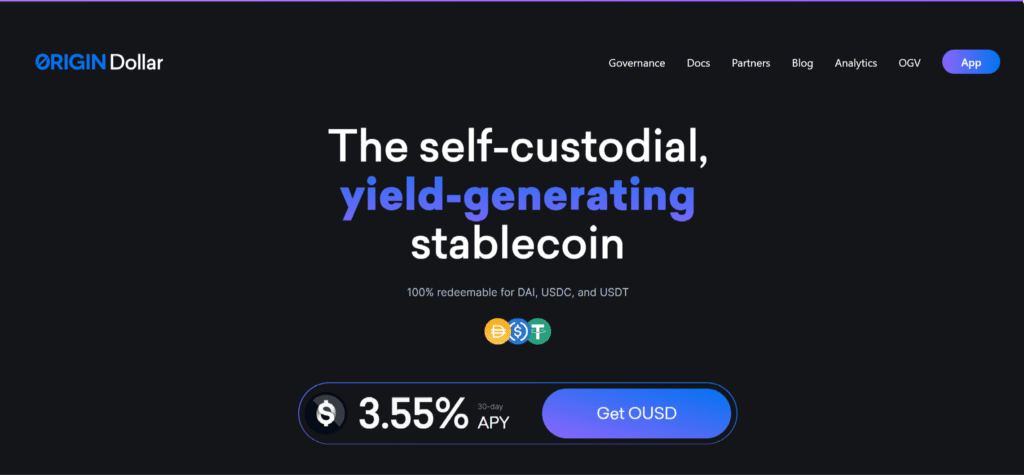

Origin Dollar (OUSD) marks the entry of the Origin team into the DeFi ecosystem. OUSD is an Ethereum-based stablecoin whose value is pegged to the US Dollar. OUSD was initially launched in September 2020 and has been battle-tested over time with hundreds of millions of dollars in circulating supply. The smart contracts have also been thoroughly audited by some of the top firms in the space, including Trail of Bits and OpenZeppelin.

OUSD is different from other stablecoins in that holders can earn a return on their assets directly from their wallets without the need to constantly stake and cancel or lock their funds in liquidity pools. Origin claims that OUSD is always accessible to make trades while holders earn this passive income from their wallets.

OUSD smart contracts automatically rebalance funds in a set of lending protocols such as Aave, Compound, and Curve in a method commonly known as yield farming.

Origin Ether (OETH)

OETH launched in May 2023 using the same core contracts as OUSD. The main difference is that OETH uses ETH and liquid staking tokens (LSTs) as the backing collateral instead of dollar-backed stablecoins. OETH also normalizes the accounting across the various supported LSTs, so you don’t need to do any math to figure out the amount of underlying ETH. 1 OETH is always worth 1 ETH.

Origin Ether shares much of its codebase with Origin Dollar, with the key distinction being that OETH is an ether-denominated token, whereas OUSD is denominated in USD. OETH takes advantage of liquid staking yield, boosting APYs through DeFi strategies and rewards tokens.

Ethereum staking participation currently pales in comparison to Solana (68% staked), Cardano (72% staked), Polkadot (46% staked), and Avalanche (62% staked). This is significantly due to stakers being unable to withdraw staked ETH until the recent Shanghai upgrade. Of the 15% of Ether staked, around 40% is provided through LST providers like Lido, Coinbase, Frax, and others.

Origin Ether earns yield from liquid staking tokens stETH, rETH, and sfrxETH. Holders earn superior yield with Origin Ether, as APYs are optimized between LSTs and liquidity provision strategies within DeFi. At launch, OETH utilizes an AMO strategy on Curve and Convex through the OETH-ETH pool. In doing so, Origin Ether accumulates increased trading fees and rewards tokens on top of validator rewards from the aforementioned LSTs.

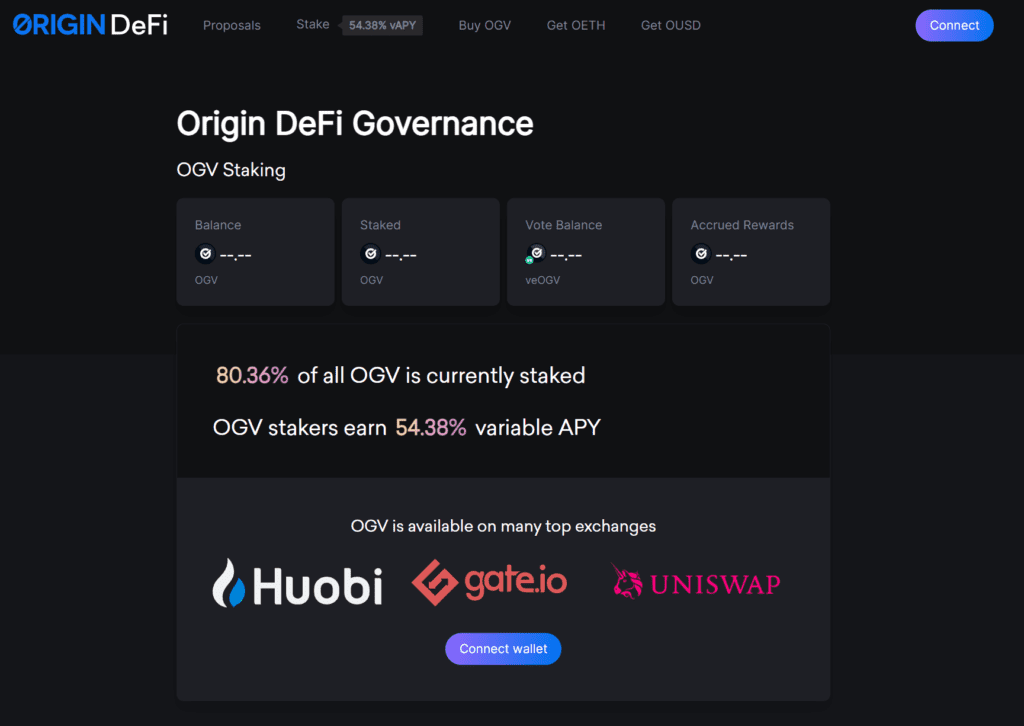

Staking

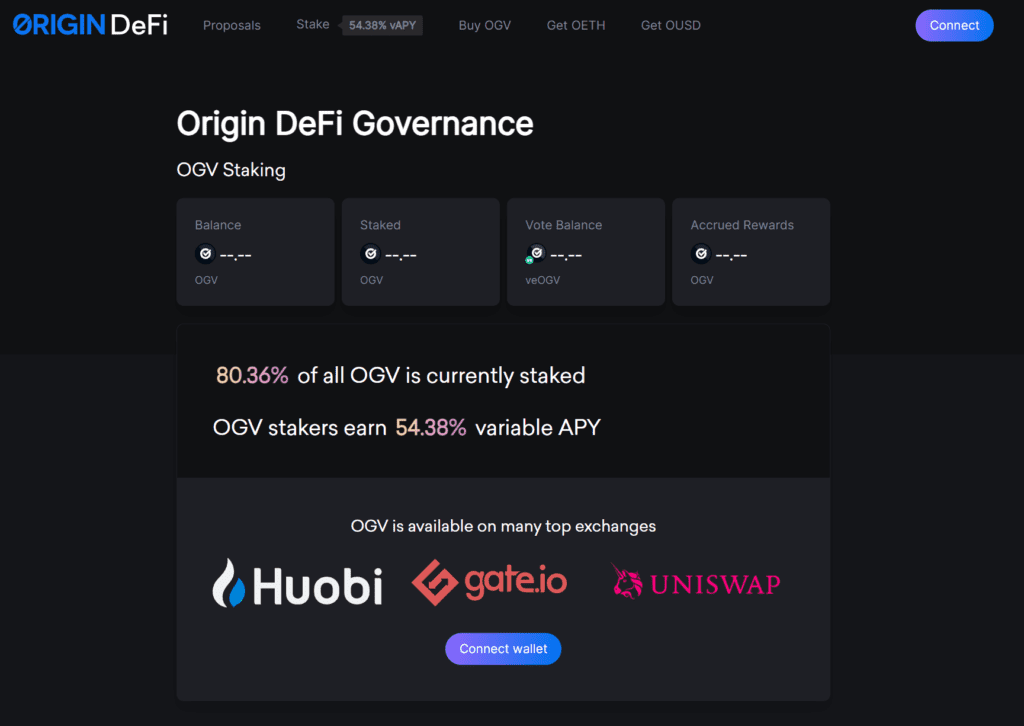

Staking OGV

Staking OGV for a period of time in exchange for economic and voting power in the form of Vote-Escrowed Origin DeFi Governance tokens (veOGV). The longer users choose to stake, the more power they receive. This ensures that power is held by those who are most committed to the long-term success of the protocol. In return for staking OGV, users not only earn the ability to create proposals and vote on the future of the protocol. They are also rewarded with additional OGV that can be collected at any time.

Staking other tokens

In addition to supporting ETH as collateral, Origin Ether supports liquid staking tokens stETH, frxETH, and rETH. The vault holds exposure to Frax Staked Ether (sfrxETH), but the vault does not support sfrxETH as a collateral type.

Mechanism of action

Buying Tokens

Users can upgrade their existing stablecoins to OUSD using app.ousd.com or convert their ETH or supported LSTs to OETH using app.oeth.com. Once upgraded, your OUSD or OETH will immediately begin accruing yield that compounds automatically.

The Origin Defi dapps will intelligently route consumers’ transactions while considering slippage and gas prices into account to provide them with the cheapest pricing. This implies that occasionally the dapps will advise users to purchase OUSD or OETH that is currently in use rather than creating fresh currencies from the vault. The dapps will select from various liquidity providers and recommend the one that offers the customer the best rate.

Selling Tokens

Users can redeem their OUSD or OETH for the underlying collateral. Just as with buying, the Origin dapp will intelligently route users’ transactions to give them the best available price while considering slippage, gas costs, and the vault’s exit fee. This means that the dapps will often help users sell their OUSD or OETH on AMMs instead of redeeming with the vault and incurring the protocol’s exit fee.

On redemption of OUSD (0.25%) or OETH (0.5%) through the vault, a minor departure fee is assessed. The remaining vault participants (i.e., other OUSD or OETH holders) get this charge as an extra yield. In the event of mispriced underlying assets, the charge acts as a security measure to make it impossible for attackers to exploit lagging oracles. It prevents them from stealing stablecoins from the vault. The charge was put in place to reward long-term investors over short-term speculators.

The vault will choose which coins to provide the user after redemption. Coins will be returned from the vault in proportion to the present stock. In the case that any of the supported stablecoins loses its peg, the vault is safeguarded by the lack of user optionality.

Automated Yield Farming

The smart contracts generate yield by deploying the collateral into trusted DeFi protocols as Compound, Aave, Curve, Convex, and Morpho. There may be new diversified strategies added to the vault in the future as approved by governance. Earned interest, trading fees, and rewards tokens are swapped and reinvested to produce yield on OTokens.

Over time, the protocol will rebalance assets between different earning strategies in order to maximize yields. Users are able to benefit from faster compounding and rebalancing of assets as the farming costs are shared across the entire pool.

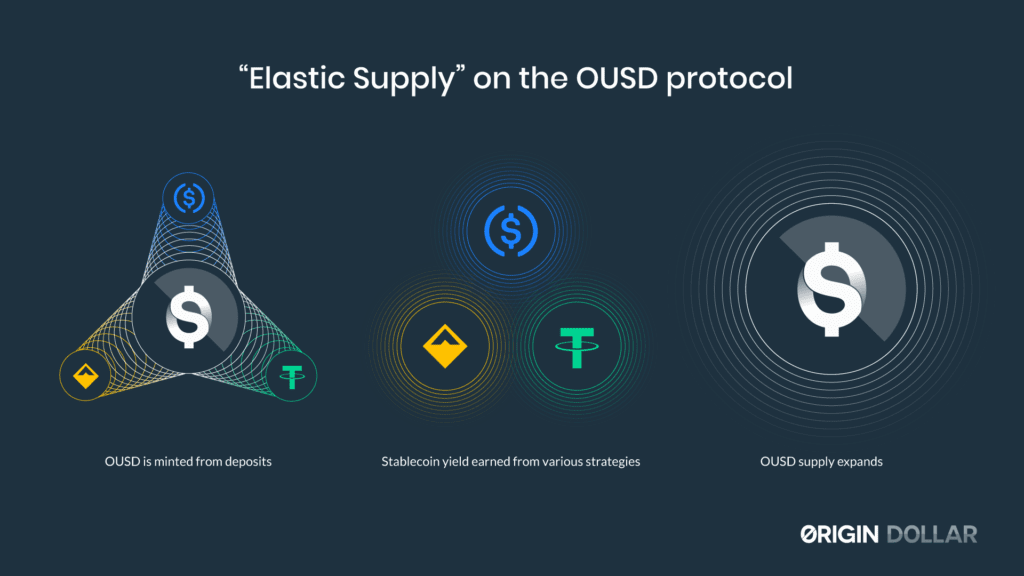

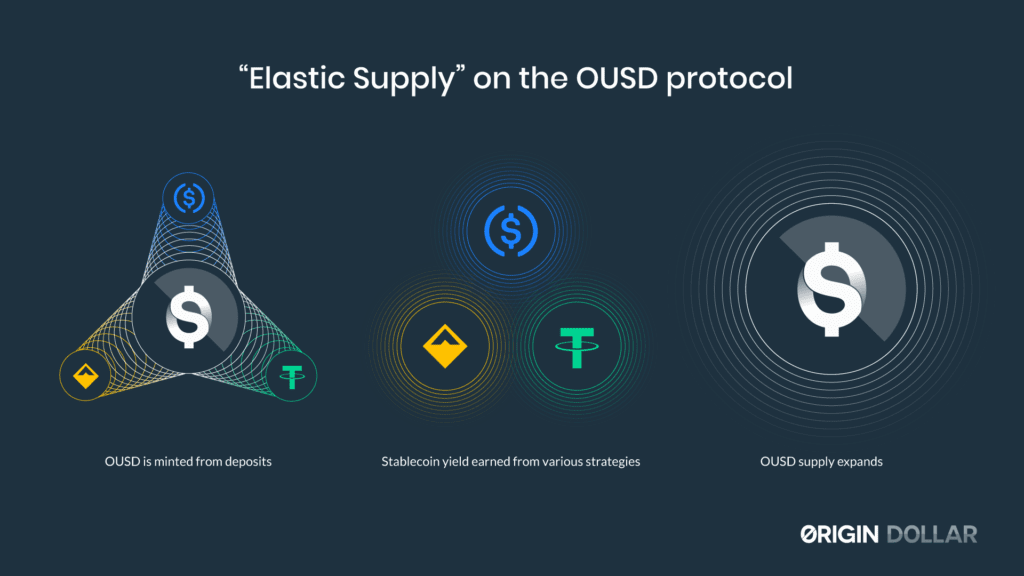

Elastic Supply

Through ongoing (up only) rebasing of the money supply, the created returns are distributed to holders of OToken. In response to the protocol’s yield, both currencies steadily raise the amount of money in circulation. As a result, the price of OUSD and OETH may remain fixed at $1 USD and $1 ETH, respectively, while the balances in token holders’ wallets can be updated in real-time to reflect yields the protocol has received.

The result is tokens that are easy to spend, earn outsized risk-adjusted yields automatically, and are more desirable to hold than Ether, stablecoins, or liquid staking tokens.

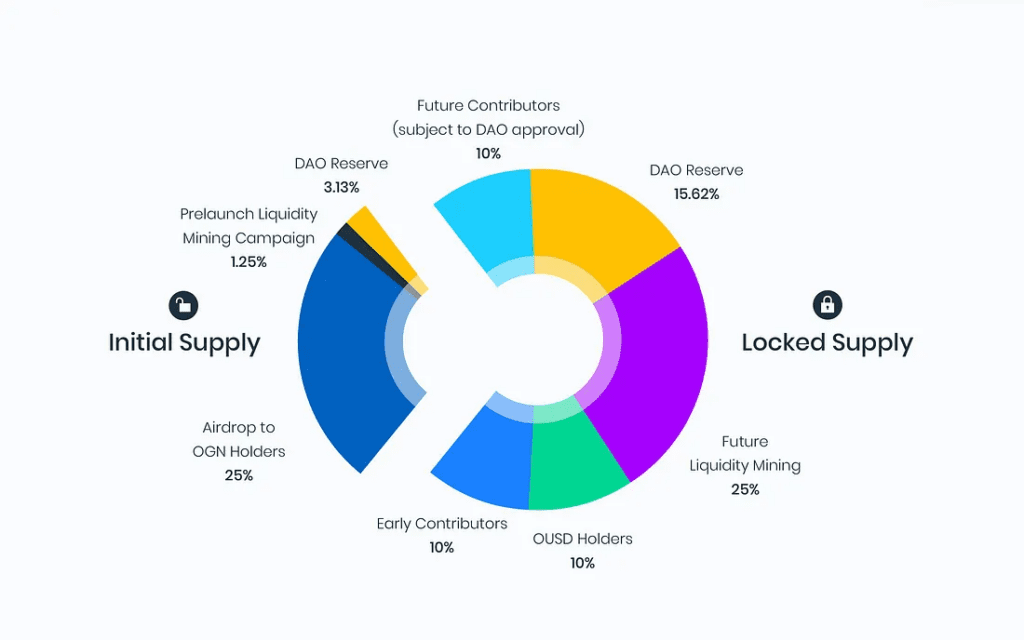

Tokenomics

Native DeFi Governance (OGV) serves as the token that accumulates value and governance at the heart of Origin DeFi. Formerly a Native Dollar Governance, OGV has been used as a governance token for the Native Dollar protocol. With Origin DeFi, the utility of OGV is expanding to cover both OUSD and OETH.

OGV further innovates the voting margin token model pioneered by Curve Finance. Holders can stake their OGV for up to four years in exchange for veOGV, which carries voting and economic rights. veOGV holders also enjoy a generous passive profit from their staked OGV.

As part of our commitment to user autonomy, all OUSD and OETH strategic allocations are decided on a weekly basis through governance votes. This model has been carefully honed since its initial launch with impressive results.

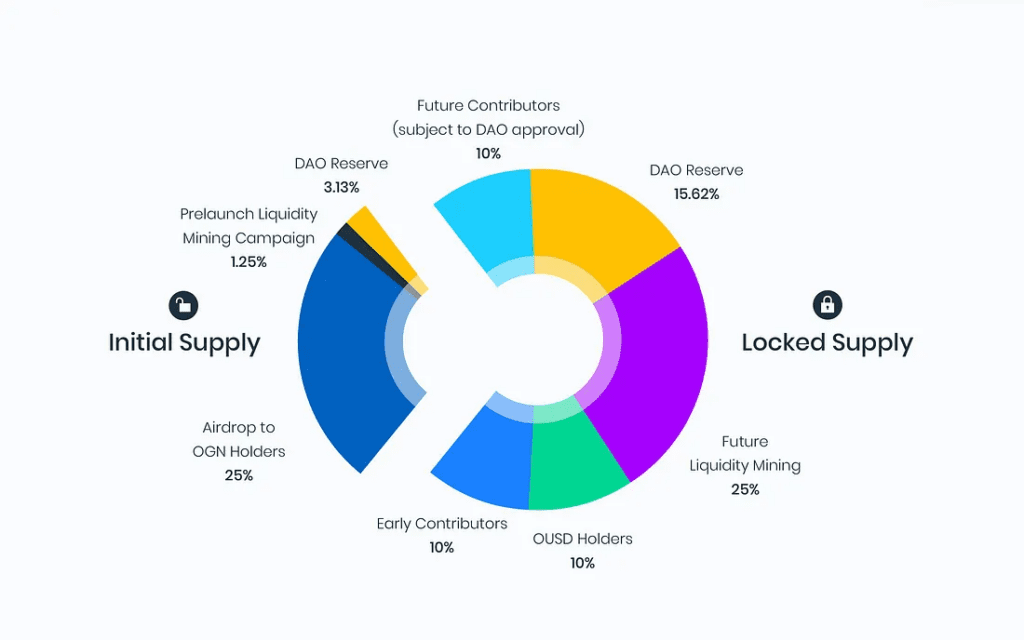

1 billion OGV will be distributed to OGN holders along with rewards for liquidity mining campaign participants before launch on July 12. The total supply of OGV on July 12 will be 4 billion, with the majority locked for 1 to 4 years.

The only other exception is 125 million OGV which will be immediately available to the DAO to support the launch with initial liquidity provision and market-making efforts on centralized exchanges and DEXs. The remaining 2.825 billion OGV will be locked to vote for up to 4 years.

Having a gradual release schedule helps ensure a smooth release process and protects OGV’s performance. Pool tokens will be locked at launch and unlocked every year for 4 years as a retroactive bonus for OUSD holders.

Similarly, the rest of the DAO holdings will unlock gradually over a 4-year period to fund liquidity mining campaigns, liquidity provisioning, and partnerships with exchanges and exchanges. DeFi knowledge, future contributors and open source developers, new projects built on top of OUSD, long-term incentive programs, and other community-voted initiatives. We predict that the circulating supply at launch will be 1 billion OGV or less.

Team

Origin Ether is created by Origin Protocol Labs and is managed by the existing OGV staking community. Origin was founded by Josh Fraser and Matthew Liu, who later joined PayPal co-founders, executives from Coinbase, Lyft, Dropbox, and Google, as well as many top engineers from the companies. web2 startup to build Native Protocol.

Origin Defi’s main investor is Pantera Capital, the world’s oldest crypto fund. Other notable investors include Foundation Capital, Blockchaintower, Blockchain.com, KBW Ventures, Spartan Capital, PreAngel Fund, Hashed, Kenetic Capital, FBG, QCP Capital, and Smart Contract Japan. Notable angel investors include YouTube founder Steve Chen, Reddit founder Alexis Ohanian, Y Combinator partner Garry Tan, and Akamai founder Randall Kaplan.

Conclusion

As a new member of the LSDFi racetrack, Origin Defi is using a variety of income strategies to help users on the platform have attractive income and improve competitiveness with other competitors.

Underpinned by OGV’s unparalleled governance, Origin Dollar and Origin Ether provide powerful platforms for users to enjoy the full benefits of DeFi – from new adopters to veterans across the globe chain, DAO, protocol, and organization.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Read more...

Coincu News

Read More

Sui Price Analysis: Bulls Defend $3.10 as Market Waits for a Break

Origin Defi Review: A Prominent Protocol In LSDFi Trends With High Profits

Origin Defi emerged in the LSDFi segment as a protocol that uses a combination of different strategies to increase revenue and thereby bring high profits to users. Origin DeFi’s OTokens use the same codebase but accept different collateral and utilize various strategies depending on the market’s opportunities. OUSD is designed to help you accumulate more dollars, whereas OETH enables you to earn more ETH. So what is Origin Defi? How does it work?

What is Origin Defi?

As a new member of the LSDFi racetrack, Origin Protocol uses various income strategies to enhance earnings. The Native Protocol is a platform powered by Ethereum that aims to bring Non-fungible Tokens (NFT) and Decentralized Finance (DeFi) to the masses.

In 2020, Origin sought to make everyone profitable by launching its first profitable stablecoin, OUSD. We are now taking the next step forward, delivering continuous, accessible, and advanced returns on Ether. Origin recently launched Origin Ether (OETH), an innovative yield token that uses top-tier LSD as collateral.

Origin’s NFT and DeFi ecosystems are managed by the OGN token, allowing holders to ensure transparent monitoring and development of the Origin platform.

Origin Defi products

Origin Dollar (OUSD)

Origin Dollar (OUSD) marks the entry of the Origin team into the DeFi ecosystem. OUSD is an Ethereum-based stablecoin whose value is pegged to the US Dollar. OUSD was initially launched in September 2020 and has been battle-tested over time with hundreds of millions of dollars in circulating supply. The smart contracts have also been thoroughly audited by some of the top firms in the space, including Trail of Bits and OpenZeppelin.

OUSD is different from other stablecoins in that holders can earn a return on their assets directly from their wallets without the need to constantly stake and cancel or lock their funds in liquidity pools. Origin claims that OUSD is always accessible to make trades while holders earn this passive income from their wallets.

OUSD smart contracts automatically rebalance funds in a set of lending protocols such as Aave, Compound, and Curve in a method commonly known as yield farming.

Origin Ether (OETH)

OETH launched in May 2023 using the same core contracts as OUSD. The main difference is that OETH uses ETH and liquid staking tokens (LSTs) as the backing collateral instead of dollar-backed stablecoins. OETH also normalizes the accounting across the various supported LSTs, so you don’t need to do any math to figure out the amount of underlying ETH. 1 OETH is always worth 1 ETH.

Origin Ether shares much of its codebase with Origin Dollar, with the key distinction being that OETH is an ether-denominated token, whereas OUSD is denominated in USD. OETH takes advantage of liquid staking yield, boosting APYs through DeFi strategies and rewards tokens.

Ethereum staking participation currently pales in comparison to Solana (68% staked), Cardano (72% staked), Polkadot (46% staked), and Avalanche (62% staked). This is significantly due to stakers being unable to withdraw staked ETH until the recent Shanghai upgrade. Of the 15% of Ether staked, around 40% is provided through LST providers like Lido, Coinbase, Frax, and others.

Origin Ether earns yield from liquid staking tokens stETH, rETH, and sfrxETH. Holders earn superior yield with Origin Ether, as APYs are optimized between LSTs and liquidity provision strategies within DeFi. At launch, OETH utilizes an AMO strategy on Curve and Convex through the OETH-ETH pool. In doing so, Origin Ether accumulates increased trading fees and rewards tokens on top of validator rewards from the aforementioned LSTs.

Staking

Staking OGV

Staking OGV for a period of time in exchange for economic and voting power in the form of Vote-Escrowed Origin DeFi Governance tokens (veOGV). The longer users choose to stake, the more power they receive. This ensures that power is held by those who are most committed to the long-term success of the protocol. In return for staking OGV, users not only earn the ability to create proposals and vote on the future of the protocol. They are also rewarded with additional OGV that can be collected at any time.

Staking other tokens

In addition to supporting ETH as collateral, Origin Ether supports liquid staking tokens stETH, frxETH, and rETH. The vault holds exposure to Frax Staked Ether (sfrxETH), but the vault does not support sfrxETH as a collateral type.

Mechanism of action

Buying Tokens

Users can upgrade their existing stablecoins to OUSD using app.ousd.com or convert their ETH or supported LSTs to OETH using app.oeth.com. Once upgraded, your OUSD or OETH will immediately begin accruing yield that compounds automatically.

The Origin Defi dapps will intelligently route consumers’ transactions while considering slippage and gas prices into account to provide them with the cheapest pricing. This implies that occasionally the dapps will advise users to purchase OUSD or OETH that is currently in use rather than creating fresh currencies from the vault. The dapps will select from various liquidity providers and recommend the one that offers the customer the best rate.

Selling Tokens

Users can redeem their OUSD or OETH for the underlying collateral. Just as with buying, the Origin dapp will intelligently route users’ transactions to give them the best available price while considering slippage, gas costs, and the vault’s exit fee. This means that the dapps will often help users sell their OUSD or OETH on AMMs instead of redeeming with the vault and incurring the protocol’s exit fee.

On redemption of OUSD (0.25%) or OETH (0.5%) through the vault, a minor departure fee is assessed. The remaining vault participants (i.e., other OUSD or OETH holders) get this charge as an extra yield. In the event of mispriced underlying assets, the charge acts as a security measure to make it impossible for attackers to exploit lagging oracles. It prevents them from stealing stablecoins from the vault. The charge was put in place to reward long-term investors over short-term speculators.

The vault will choose which coins to provide the user after redemption. Coins will be returned from the vault in proportion to the present stock. In the case that any of the supported stablecoins loses its peg, the vault is safeguarded by the lack of user optionality.

Automated Yield Farming

The smart contracts generate yield by deploying the collateral into trusted DeFi protocols as Compound, Aave, Curve, Convex, and Morpho. There may be new diversified strategies added to the vault in the future as approved by governance. Earned interest, trading fees, and rewards tokens are swapped and reinvested to produce yield on OTokens.

Over time, the protocol will rebalance assets between different earning strategies in order to maximize yields. Users are able to benefit from faster compounding and rebalancing of assets as the farming costs are shared across the entire pool.

Elastic Supply

Through ongoing (up only) rebasing of the money supply, the created returns are distributed to holders of OToken. In response to the protocol’s yield, both currencies steadily raise the amount of money in circulation. As a result, the price of OUSD and OETH may remain fixed at $1 USD and $1 ETH, respectively, while the balances in token holders’ wallets can be updated in real-time to reflect yields the protocol has received.

The result is tokens that are easy to spend, earn outsized risk-adjusted yields automatically, and are more desirable to hold than Ether, stablecoins, or liquid staking tokens.

Tokenomics

Native DeFi Governance (OGV) serves as the token that accumulates value and governance at the heart of Origin DeFi. Formerly a Native Dollar Governance, OGV has been used as a governance token for the Native Dollar protocol. With Origin DeFi, the utility of OGV is expanding to cover both OUSD and OETH.

OGV further innovates the voting margin token model pioneered by Curve Finance. Holders can stake their OGV for up to four years in exchange for veOGV, which carries voting and economic rights. veOGV holders also enjoy a generous passive profit from their staked OGV.

As part of our commitment to user autonomy, all OUSD and OETH strategic allocations are decided on a weekly basis through governance votes. This model has been carefully honed since its initial launch with impressive results.

1 billion OGV will be distributed to OGN holders along with rewards for liquidity mining campaign participants before launch on July 12. The total supply of OGV on July 12 will be 4 billion, with the majority locked for 1 to 4 years.

The only other exception is 125 million OGV which will be immediately available to the DAO to support the launch with initial liquidity provision and market-making efforts on centralized exchanges and DEXs. The remaining 2.825 billion OGV will be locked to vote for up to 4 years.

Having a gradual release schedule helps ensure a smooth release process and protects OGV’s performance. Pool tokens will be locked at launch and unlocked every year for 4 years as a retroactive bonus for OUSD holders.

Similarly, the rest of the DAO holdings will unlock gradually over a 4-year period to fund liquidity mining campaigns, liquidity provisioning, and partnerships with exchanges and exchanges. DeFi knowledge, future contributors and open source developers, new projects built on top of OUSD, long-term incentive programs, and other community-voted initiatives. We predict that the circulating supply at launch will be 1 billion OGV or less.

Team

Origin Ether is created by Origin Protocol Labs and is managed by the existing OGV staking community. Origin was founded by Josh Fraser and Matthew Liu, who later joined PayPal co-founders, executives from Coinbase, Lyft, Dropbox, and Google, as well as many top engineers from the companies. web2 startup to build Native Protocol.

Origin Defi’s main investor is Pantera Capital, the world’s oldest crypto fund. Other notable investors include Foundation Capital, Blockchaintower, Blockchain.com, KBW Ventures, Spartan Capital, PreAngel Fund, Hashed, Kenetic Capital, FBG, QCP Capital, and Smart Contract Japan. Notable angel investors include YouTube founder Steve Chen, Reddit founder Alexis Ohanian, Y Combinator partner Garry Tan, and Akamai founder Randall Kaplan.

Conclusion

As a new member of the LSDFi racetrack, Origin Defi is using a variety of income strategies to help users on the platform have attractive income and improve competitiveness with other competitors.

Underpinned by OGV’s unparalleled governance, Origin Dollar and Origin Ether provide powerful platforms for users to enjoy the full benefits of DeFi – from new adopters to veterans across the globe chain, DAO, protocol, and organization.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Read more...

Coincu News

Read More