Solana Company Accumulates $525M in SOL Treasury as Stock Surges 190%

Solana Company (NASDAQ: HSDT), formerly Helius Medical Technologies, said it continues to acquire Solana SOL $236.0 24h volatility: 3.1% Market cap: $128.47 B Vol. 24h: $7.36 B as part of a digital asset treasury (DAT) program and now holds more than 2.2 million SOL, alongside over $15 million in cash earmarked to expand the strategy, according to an Oct. 6 press release.

At a reference price of $232.50 per SOL as of 12:00 AM ET on Oct. 6, the firm stated that the combined value of SOL and cash exceeds $525 million, surpassing the gross proceeds from its private placement that closed on Sept. 18. The company described the move as a long-term commitment to the Solana ecosystem, while continuing to develop its neurotech and medical device operations.

Solana Company is Looking to Stake SOL and Follow The Treasury Trend

The company highlighted Solana network data to justify the accumulation, citing processing capacity above 3,500 transactions per second, roughly 3.7 million daily active wallets, and more than 23 billion transactions year to date, with SOL offering an estimated 7% native staking yield by design, unlike non-yield-bearing assets such as BTC, according the announcement.

“Following in the footsteps of Michael Saylor at MSTR and Tom Lee at BMNR, HSDT Solana Company is focused on maximizing shareholder value by efficiently accumulating Solana. As evidence of that focus on efficient accumulation, HSDT’s Solana and cash holdings now exceed the initial capital raise amount in less than three weeks,” said Cosmo Jiang, General Partner at Pantera Capital and Board Observer at HSDT.

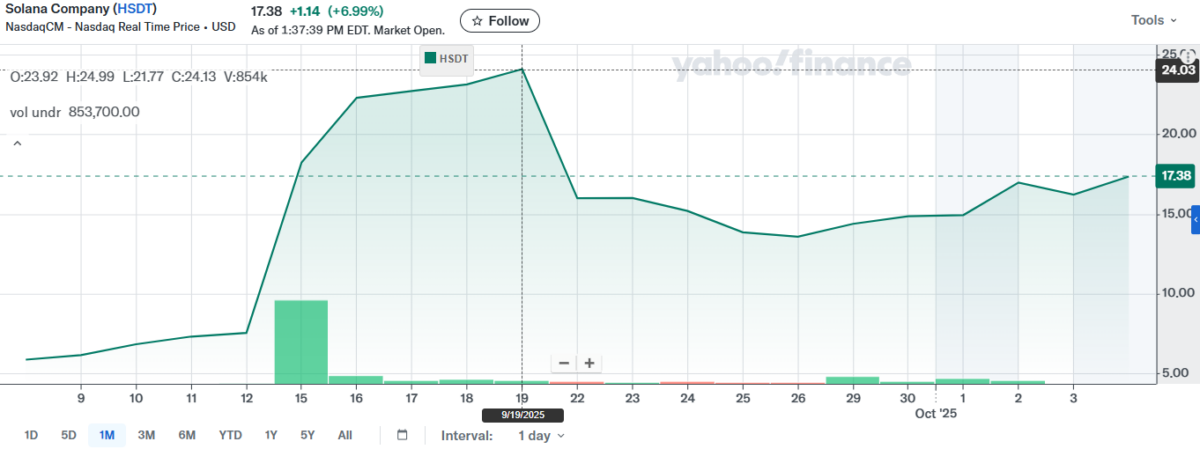

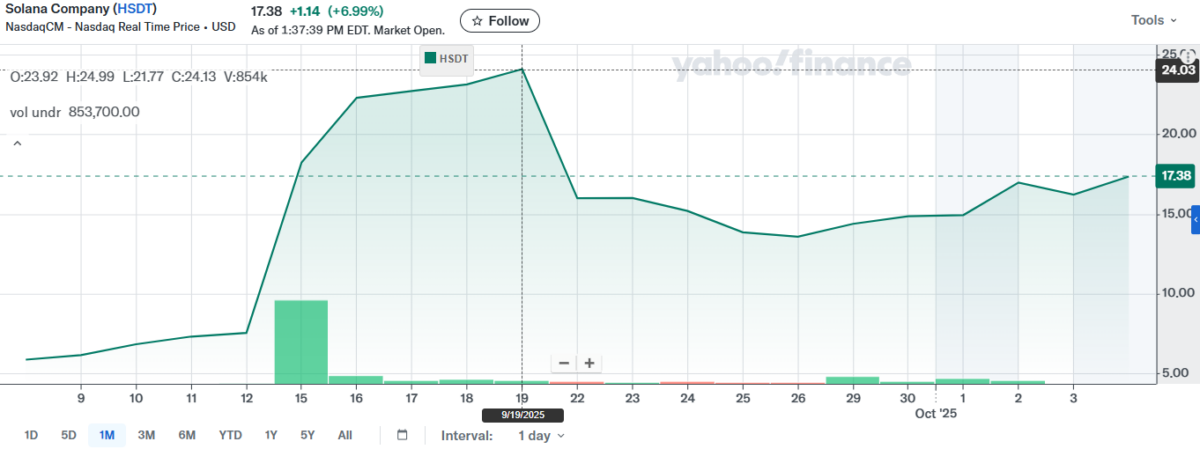

Upon examining market activity, HSDT is trading actively on Nasdaq, with recent sessions marked by sharp swings as the company pivots to a Solana-focused treasury profile and rebrands on the ticker page to “Solana Company” under HSDT.

Graphical price of shares for the Solana Company. Source: Yahoo! Finance

According to Yahoo! Finance, reflecting a volatile tape into early October, aligning with the firm’s capital raise in September and subsequent treasury disclosures, today its stock prices are near $17.38 with gains of 7%, and since the Solana treasury announcement, there has been an increase in its share that is almost 190%.

Solana Treasuries are Growing Elsewhere

Solana treasuries have expanded among public market participants in 2025, with trackers and coverage indicating multi-billion-dollar cumulative holdings across companies and funds, with a forecast putting SOL at $300 thanks to this trend.

Recent reporting highlights Pantera Capital’s position size of approximately $1.1 billion in SOL, accompanied by an increase in corporate activity. This includes Fitell’s launch of an Australian SOL treasury with an initial $10 million and up to $100 million in financing capacity, alongside US-listed firms building sizable SOL reserves.

According to Coingecko data, currently, more than nine public companies with a Solana treasury exist, from three different countries. They together hold more than 13 million SOL, and when compared to other digital asset treasuries, they have only 2.46% dominance of the DATs.

Larger Pipeline For SOL Accumulation

As Coinspeaker reported, Galaxy Digital, Multicoin Capital, and Jump Crypto have indicated plans to raise approximately $1 billion to acquire a public company and establish a Solana-focused treasury. This bid would surpass existing vehicles if completed.

Additional reports cite companies like Forward Industries and others pursuing large programs to finance and expand SOL holdings, reflecting a broader corporate treasury rotation beyond BTC toward Solana’s staking-enabled profile and network activity metrics.

The post Solana Company Accumulates $525M in SOL Treasury as Stock Surges 190% appeared first on Coinspeaker.

Solana Company Accumulates $525M in SOL Treasury as Stock Surges 190%

Solana Company (NASDAQ: HSDT), formerly Helius Medical Technologies, said it continues to acquire Solana SOL $236.0 24h volatility: 3.1% Market cap: $128.47 B Vol. 24h: $7.36 B as part of a digital asset treasury (DAT) program and now holds more than 2.2 million SOL, alongside over $15 million in cash earmarked to expand the strategy, according to an Oct. 6 press release.

At a reference price of $232.50 per SOL as of 12:00 AM ET on Oct. 6, the firm stated that the combined value of SOL and cash exceeds $525 million, surpassing the gross proceeds from its private placement that closed on Sept. 18. The company described the move as a long-term commitment to the Solana ecosystem, while continuing to develop its neurotech and medical device operations.

Solana Company is Looking to Stake SOL and Follow The Treasury Trend

The company highlighted Solana network data to justify the accumulation, citing processing capacity above 3,500 transactions per second, roughly 3.7 million daily active wallets, and more than 23 billion transactions year to date, with SOL offering an estimated 7% native staking yield by design, unlike non-yield-bearing assets such as BTC, according the announcement.

“Following in the footsteps of Michael Saylor at MSTR and Tom Lee at BMNR, HSDT Solana Company is focused on maximizing shareholder value by efficiently accumulating Solana. As evidence of that focus on efficient accumulation, HSDT’s Solana and cash holdings now exceed the initial capital raise amount in less than three weeks,” said Cosmo Jiang, General Partner at Pantera Capital and Board Observer at HSDT.

Upon examining market activity, HSDT is trading actively on Nasdaq, with recent sessions marked by sharp swings as the company pivots to a Solana-focused treasury profile and rebrands on the ticker page to “Solana Company” under HSDT.

Graphical price of shares for the Solana Company. Source: Yahoo! Finance

According to Yahoo! Finance, reflecting a volatile tape into early October, aligning with the firm’s capital raise in September and subsequent treasury disclosures, today its stock prices are near $17.38 with gains of 7%, and since the Solana treasury announcement, there has been an increase in its share that is almost 190%.

Solana Treasuries are Growing Elsewhere

Solana treasuries have expanded among public market participants in 2025, with trackers and coverage indicating multi-billion-dollar cumulative holdings across companies and funds, with a forecast putting SOL at $300 thanks to this trend.

Recent reporting highlights Pantera Capital’s position size of approximately $1.1 billion in SOL, accompanied by an increase in corporate activity. This includes Fitell’s launch of an Australian SOL treasury with an initial $10 million and up to $100 million in financing capacity, alongside US-listed firms building sizable SOL reserves.

According to Coingecko data, currently, more than nine public companies with a Solana treasury exist, from three different countries. They together hold more than 13 million SOL, and when compared to other digital asset treasuries, they have only 2.46% dominance of the DATs.

Larger Pipeline For SOL Accumulation

As Coinspeaker reported, Galaxy Digital, Multicoin Capital, and Jump Crypto have indicated plans to raise approximately $1 billion to acquire a public company and establish a Solana-focused treasury. This bid would surpass existing vehicles if completed.

Additional reports cite companies like Forward Industries and others pursuing large programs to finance and expand SOL holdings, reflecting a broader corporate treasury rotation beyond BTC toward Solana’s staking-enabled profile and network activity metrics.

The post Solana Company Accumulates $525M in SOL Treasury as Stock Surges 190% appeared first on Coinspeaker.