BitMEX Launches Multi-Asset Margining

Crypto derivatives exchange BitMEX has launched its Multi Asset Margining feature.

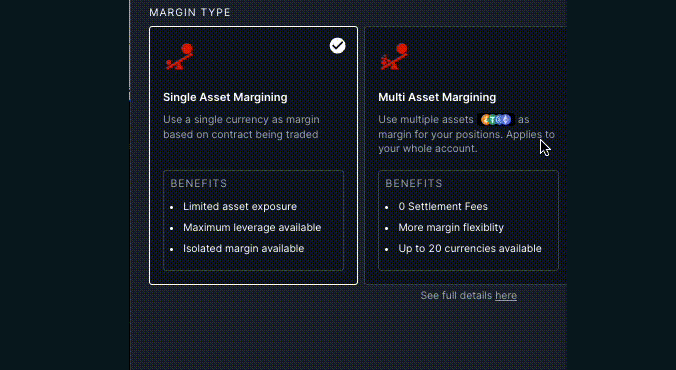

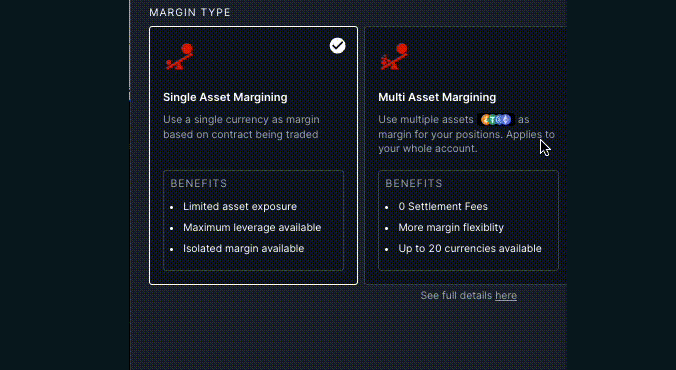

According to the press release, the novel tool enables traders to use multiple margin currencies to trade derivatives contracts without converting assets or moving funds between wallets.

Users can deposit the preferred currency and start trading immediately.

Currently supported currencies including USDT, USDC, ETH, and BTC, with more to come “soon,” the exchange said.

The team said that the goal of the newly launched feature is to simplify the trading process, improve flexibility, and increase capital efficiency.

This enables users to utilize more currencies for trading, they added.

“The result,” says the blog post, is “a simpler and more convenient trading experience. […] Simply deposit a currency of your choice and get trading. We’ll take care of the rest to make sure your funds are used as efficiently as possible,” it claims.

Streamlining the Trading Process

The exchange highlighted that Multi Asset Margining allows users to open and maintain positions utilizing currencies other than a contract’s settlement currency.

“This eliminates the step of time-consuming asset conversions, allowing users to hold multiple currencies to gain exposure to diverse markets simultaneously,” the press release said.

The new system automatically and efficiently allocates a user’s funds across their position requirements.

Traders can easily enable the feature through their account settings and monitor their available margin on the Wallet page.

That said, users are encouraged to monitor and manage their account-level margin balance to avoid liquidation.

To start trading, a user needs to deposit a Margin Currency into their BitMEX account, choose a contract, and click to trade. The process will proceed automatically.

Stephan Lutz, CEO of BitMEX said, commented that the launch of Multi Asset Margining “marks a transformative milestone in simplifying trading for our users and to enhance their capital efficiency.”

The feature has removed the need for “tedious asset conversions and wallet transfers,” thus streamlining the trading process and unlocking “new opportunities for our users to maximize their capital and engage seamlessly with the crypto derivatives market.”

Meanwhile, BMEX price is down 5.6% over the last 24 hours, currently trading at $0.1537.

BMEX 1-year price chart:

Additionally, it’s up 1.4% in a week and 1% in a month, while it’s down 47.6% in a year.

The coin’s highest price was $1.29, recorded in November, 2022. It has decreased by 88% since.

The post BitMEX Launches Multi-Asset Margining appeared first on Cryptonews.

BitMEX Launches Multi-Asset Margining

Crypto derivatives exchange BitMEX has launched its Multi Asset Margining feature.

According to the press release, the novel tool enables traders to use multiple margin currencies to trade derivatives contracts without converting assets or moving funds between wallets.

Users can deposit the preferred currency and start trading immediately.

Currently supported currencies including USDT, USDC, ETH, and BTC, with more to come “soon,” the exchange said.

The team said that the goal of the newly launched feature is to simplify the trading process, improve flexibility, and increase capital efficiency.

This enables users to utilize more currencies for trading, they added.

“The result,” says the blog post, is “a simpler and more convenient trading experience. […] Simply deposit a currency of your choice and get trading. We’ll take care of the rest to make sure your funds are used as efficiently as possible,” it claims.

Streamlining the Trading Process

The exchange highlighted that Multi Asset Margining allows users to open and maintain positions utilizing currencies other than a contract’s settlement currency.

“This eliminates the step of time-consuming asset conversions, allowing users to hold multiple currencies to gain exposure to diverse markets simultaneously,” the press release said.

The new system automatically and efficiently allocates a user’s funds across their position requirements.

Traders can easily enable the feature through their account settings and monitor their available margin on the Wallet page.

That said, users are encouraged to monitor and manage their account-level margin balance to avoid liquidation.

To start trading, a user needs to deposit a Margin Currency into their BitMEX account, choose a contract, and click to trade. The process will proceed automatically.

Stephan Lutz, CEO of BitMEX said, commented that the launch of Multi Asset Margining “marks a transformative milestone in simplifying trading for our users and to enhance their capital efficiency.”

The feature has removed the need for “tedious asset conversions and wallet transfers,” thus streamlining the trading process and unlocking “new opportunities for our users to maximize their capital and engage seamlessly with the crypto derivatives market.”

Meanwhile, BMEX price is down 5.6% over the last 24 hours, currently trading at $0.1537.

BMEX 1-year price chart:

Additionally, it’s up 1.4% in a week and 1% in a month, while it’s down 47.6% in a year.

The coin’s highest price was $1.29, recorded in November, 2022. It has decreased by 88% since.

The post BitMEX Launches Multi-Asset Margining appeared first on Cryptonews.

Multi Asset Margining is now LIVE on BitMEX

Multi Asset Margining is now LIVE on BitMEX