XRP Technical Setup Resembles 2017 and 2021 Cycles – Is $3 Just the Beginning?

- XRP price patterns and RSI are mirroring 2017 and 2021, hinting at another breakout cycle.

- Ripple is rolling out zero-knowledge privacy tools to attract institutions and expand XRP’s utility.

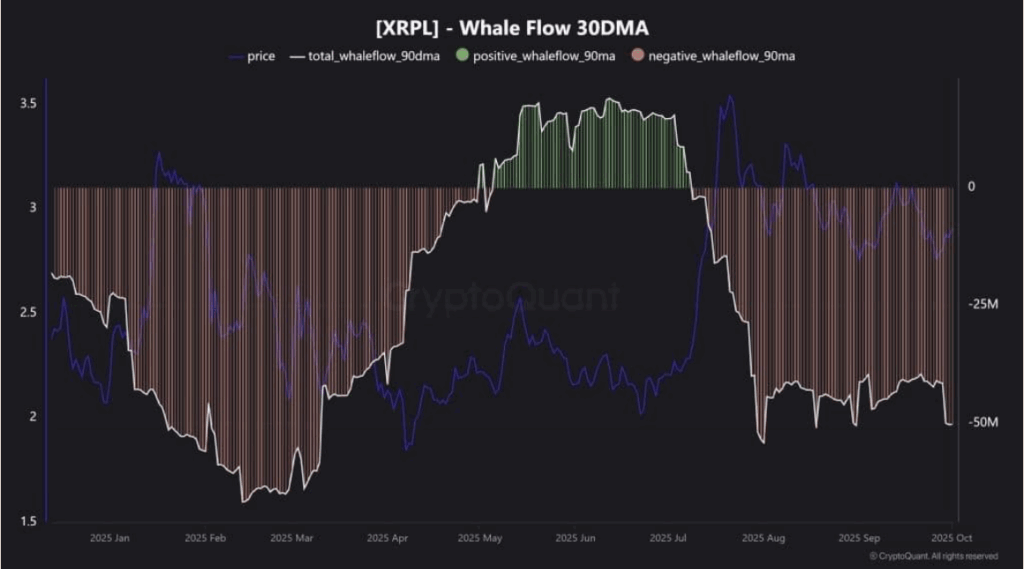

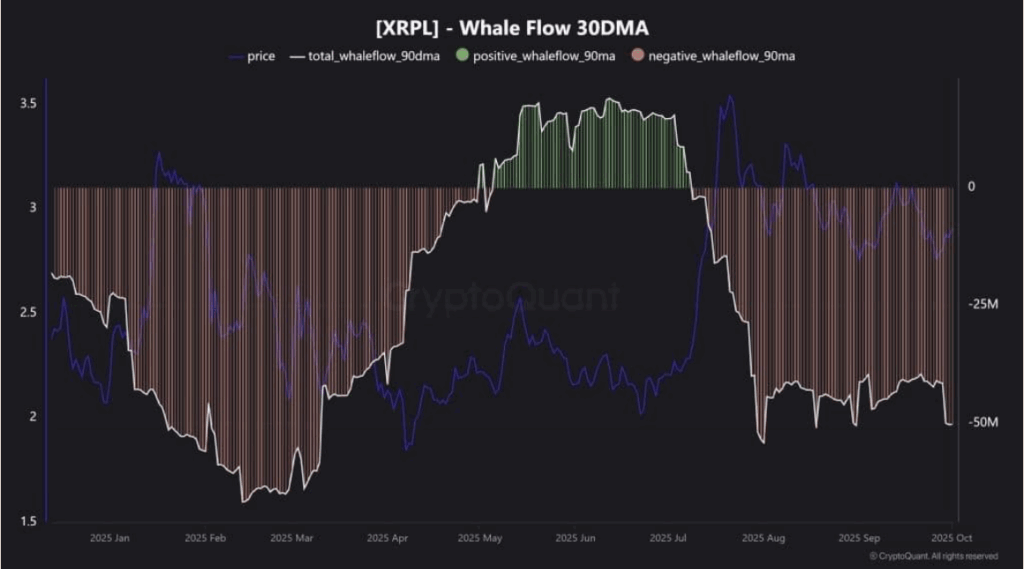

- Whale flows remain mixed — some showing accumulation, others signaling caution.

XRP’s latest chart action is giving traders déjà vu. Price patterns and RSI are starting to look like the setups seen in 2017 and again in 2021 — both of which kicked off major rallies. Even with a small dip of about 1% in the last day, the token is still steady around $3, keeping its spot as the third-largest crypto by market cap.

The big question floating around now: are we looking at another cyclical breakout? Weekly price action has XRP consolidating near familiar Fibonacci levels, the same kind of structure that came right before its explosive runs in the past. In both 2017 and 2021, XRP tested the mid-band before ripping higher, only to face rejection at the top range. The latest climb to $3 in late 2024 seems to have completed that pattern once more.

And here’s where it gets interesting — the RSI right now is under 70, the exact zone that fueled previous surges. If momentum builds, XRP could be setting the stage for another leg up, history-style.

RippleX Plans Privacy Tools to Woo Institutions

While charts are lining up, Ripple’s developers are also pushing something new. J. Ayo Akinyele, Ripple’s Head of Engineering, confirmed that fresh privacy tools are on the way. These will use zero-knowledge proofs to allow private but still compliant transactions on the XRP Ledger.

RippleX has already outlined that the rollout will happen in phases, with its Multi-Purpose Token (MPT) standard planned for 2026. The idea is to unlock tokenized real-world assets and compliant DeFi opportunities — something that could make XRP a bigger magnet for institutional liquidity.

If institutions really buy into this privacy framework, it could act as the fuel XRP needs for its next big liquidity wave.

Whale Activity Sends Mixed Signals

Meanwhile, whale behavior isn’t giving a clear signal. Whale Alert flagged a massive 18.74 million XRP transfer — worth nearly $56 million — to an unknown wallet. That kind of movement usually points to accumulation.

But at the same time, CryptoQuant’s data shows that whales have been pulling capital out over the past few months. So while some are stacking, others seem hesitant, maybe preparing for volatility. That mix of caution and accumulation makes the short-term outlook murky, even though technicals lean bullish.

Outlook: Pattern or Fakeout?

All in all, XRP’s setup looks eerily similar to its past cycles. Add Ripple’s upcoming privacy tools into the picture, and institutions could end up driving the next wave. But the uncertainty from whale flows is something to keep an eye on — it’s not all green lights yet.

For now, XRP is balanced between history repeating itself and whales staying cautious. If bulls take control and institutions step in, though, that $3 level might just be the start of something bigger.

The post XRP Technical Setup Resembles 2017 and 2021 Cycles – Is $3 Just the Beginning? first appeared on BlockNews.

XRP Technical Setup Resembles 2017 and 2021 Cycles – Is $3 Just the Beginning?

- XRP price patterns and RSI are mirroring 2017 and 2021, hinting at another breakout cycle.

- Ripple is rolling out zero-knowledge privacy tools to attract institutions and expand XRP’s utility.

- Whale flows remain mixed — some showing accumulation, others signaling caution.

XRP’s latest chart action is giving traders déjà vu. Price patterns and RSI are starting to look like the setups seen in 2017 and again in 2021 — both of which kicked off major rallies. Even with a small dip of about 1% in the last day, the token is still steady around $3, keeping its spot as the third-largest crypto by market cap.

The big question floating around now: are we looking at another cyclical breakout? Weekly price action has XRP consolidating near familiar Fibonacci levels, the same kind of structure that came right before its explosive runs in the past. In both 2017 and 2021, XRP tested the mid-band before ripping higher, only to face rejection at the top range. The latest climb to $3 in late 2024 seems to have completed that pattern once more.

And here’s where it gets interesting — the RSI right now is under 70, the exact zone that fueled previous surges. If momentum builds, XRP could be setting the stage for another leg up, history-style.

RippleX Plans Privacy Tools to Woo Institutions

While charts are lining up, Ripple’s developers are also pushing something new. J. Ayo Akinyele, Ripple’s Head of Engineering, confirmed that fresh privacy tools are on the way. These will use zero-knowledge proofs to allow private but still compliant transactions on the XRP Ledger.

RippleX has already outlined that the rollout will happen in phases, with its Multi-Purpose Token (MPT) standard planned for 2026. The idea is to unlock tokenized real-world assets and compliant DeFi opportunities — something that could make XRP a bigger magnet for institutional liquidity.

If institutions really buy into this privacy framework, it could act as the fuel XRP needs for its next big liquidity wave.

Whale Activity Sends Mixed Signals

Meanwhile, whale behavior isn’t giving a clear signal. Whale Alert flagged a massive 18.74 million XRP transfer — worth nearly $56 million — to an unknown wallet. That kind of movement usually points to accumulation.

But at the same time, CryptoQuant’s data shows that whales have been pulling capital out over the past few months. So while some are stacking, others seem hesitant, maybe preparing for volatility. That mix of caution and accumulation makes the short-term outlook murky, even though technicals lean bullish.

Outlook: Pattern or Fakeout?

All in all, XRP’s setup looks eerily similar to its past cycles. Add Ripple’s upcoming privacy tools into the picture, and institutions could end up driving the next wave. But the uncertainty from whale flows is something to keep an eye on — it’s not all green lights yet.

For now, XRP is balanced between history repeating itself and whales staying cautious. If bulls take control and institutions step in, though, that $3 level might just be the start of something bigger.

The post XRP Technical Setup Resembles 2017 and 2021 Cycles – Is $3 Just the Beginning? first appeared on BlockNews.