Why Is Crypto Down Today? – September 26, 2025

The global cryptocurrency market cap has dipped 2.2% over the past 24 hours, now standing at $3.83 trillion, according to the latest data. Trading volume is up to $237.1 billion, but major digital assets remain under downward pressure as investor sentiment weakens.

TLDR:

- Crypto market slides deeper, with 9 of the top 10 coins down;

- BTC at $109,027 and ETH at $3,894;

- Fear & Greed Index drops to 32, lowest since April;

- BTC faces deeper correction as long-term holders realize $3.4M in profits;

- ETH struggles near $3,900, with bulls needing $4,400 breakout to regain control;

- US BTC spot ETFs see $258.46M in outflows;

- US ETH spot ETFs post $251.20M in outflows;

- SEC, FINRA launch probe into suspicious stock movements tied to crypto treasury plans;

Crypto Winners & Losers

At the time of writing, nine of the top 10 cryptocurrencies by market cap are in the red.

Bitcoin (BTC) has fallen 2.1% on the day to $109,252, down 6.6% over the past week.

Ethereum (ETH) has dropped 3.3% in the past 24 hours, trading at $3,895 and logging a 13.9% weekly loss.

Solana (SOL) leads the day’s losses among major assets, falling 4.6% to $193.51, extending its 7-day decline to 20.7%.

XRP (XRP) is down 3.3% to $2.74, while BNB (BNB) has slid 4.8% to $941.32.

Dogecoin (DOGE) lost another 3.5% to trade at $0.2247, marking an 18.4% weekly decline.

Among trending tokens, Plasma, Aster, and Avantis are attracting attention—but not for the right reasons. Aster has slipped 5.4% to $1.86, while Avantis has taken a sharper dive, plunging 22.6% to $1.54, making it one of the biggest daily losers.

On the flip side, a few lesser-known tokens have emerged as the day’s standout performers. SQD leads with a massive 94.8% gain, followed closely by Concordium, which is up 66.6%. Wrapped XPL is also on the rise, posting a 65.2% increase.

Meanwhile, Bitcoin sentiment has sharply declined, with the Crypto Fear & Greed Index dropping to 28, the lowest since April, as BTC dipped below $109,000 and triggered fresh liquidations.

The index fell 16 points overnight, reflecting growing fear in the market despite prices still holding well above previous lows, highlighting a widening gap between sentiment and price action.

Bitcoin Faces Potential Correction as Onchain Metrics Signal Exhaustion

Bitcoin is showing signs of a deeper correction, with long-term holders realizing profits at levels typically seen near market cycle tops.

According to Glassnode, 3.4 million BTC in realized gains and slowing ETF inflows suggest investor exhaustion following the recent Fed rate cut. BTC recently dropped to a four-week low of $108,700, falling below key support levels.

10x Research’s Markus Thielen warned that many investors positioned for a Q4 rally may be caught off-guard, with current price action hovering near previous stop-loss zones. Glassnode also reported the profit/loss ratio has hit extreme highs three times this cycle—each previously marking a cycle peak—implying a cooling phase is likely.

Additional stress is seen in the SOPR and NUPL indicators. Some short-term holders are now selling at a loss, and the NUPL for newer investors is nearing zero, which may lead to further capitulation. Analysts caution that renewed downside pressure could dominate unless market momentum returns quickly.

Levels & Events to Watch Next

Bitcoin is trading at $109,027 at the time of writing, largely flat on the day after a sharp decline from recent highs. The asset is testing a key support zone after shedding more than $6,000 in the past week, raising concerns of further downside if $108,700 gives way.

If BTC breaks below that level, the next major support sits at $107,000, followed by $105,000. On the upside, bulls will look to reclaim the $111,000–$113,000 band to avoid further cascading liquidations. A sustained move above $115,000 is needed to shift sentiment back in favor of buyers.

Meanwhile, Ethereum is trading at $3,894, up 0.47% in a modest bounce after a heavy sell-off earlier in the week. ETH remains vulnerable, hovering just below the key $4,000 psychological level, after dropping from near $4,750 earlier this month.

If ETH fails to hold above $3,850, support lies at $3,750 and $3,600. A short-term recovery could face resistance at $4,000, with further hurdles at $4,200 and $4,400. Bulls need a break above $4,400 to regain control and challenge the September highs.

Market sentiment has taken a sharp turn toward caution. The CMC Crypto Fear and Greed Index now sits at 32, slipping into the “Fear” category after hovering in “Neutral” territory for weeks. The index dropped from 41 yesterday and 52 last week, reflecting a growing sense of unease among investors.

This decline in sentiment mirrors the broader market retracement, with BTC and ETH testing key support zones. With traders spooked by macro uncertainty and recent price drops, the shift suggests participants are retreating to the sidelines, awaiting stronger signals before placing aggressive bets.

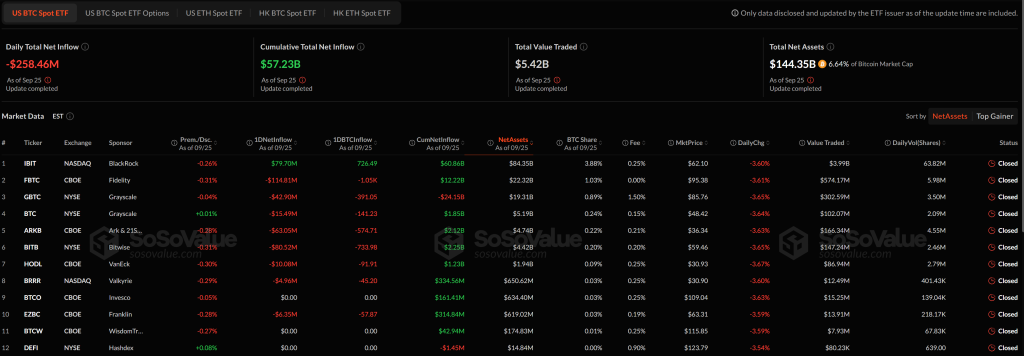

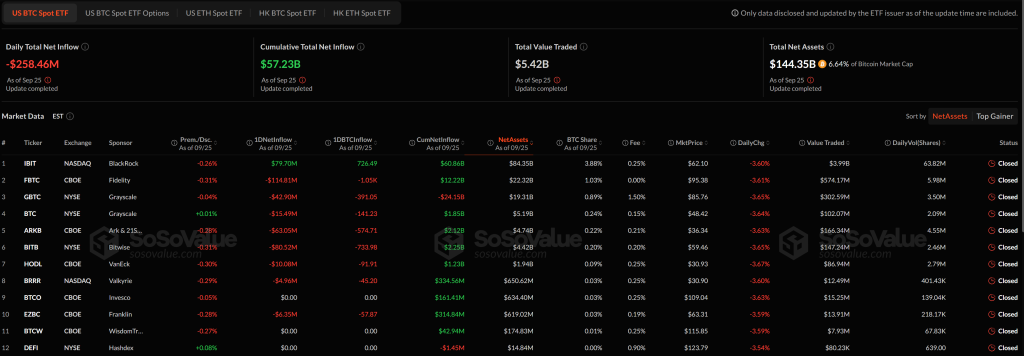

The US Bitcoin spot ETFs posted a sharp net outflow of $258.46 million on September 25, halting their previous recovery streak. Despite this setback, the cumulative net inflow remains substantial at $57.23 billion, with total assets under management at $144.35 billion, accounting for 6.64% of Bitcoin’s market cap.

Fidelity’s FBTC led the withdrawals with a $114.81 million outflow, followed by Bitwise’s BITB with $80.52 million and ARKB with $63.05 million.

Grayscale’s GBTC also saw $42.90 million pulled from the fund. Only BlackRock’s IBIT recorded a notable inflow of $79.70 million. IBIT also led trading activity, with nearly $4 billion in volume, indicating sustained investor attention despite the broader outflows.

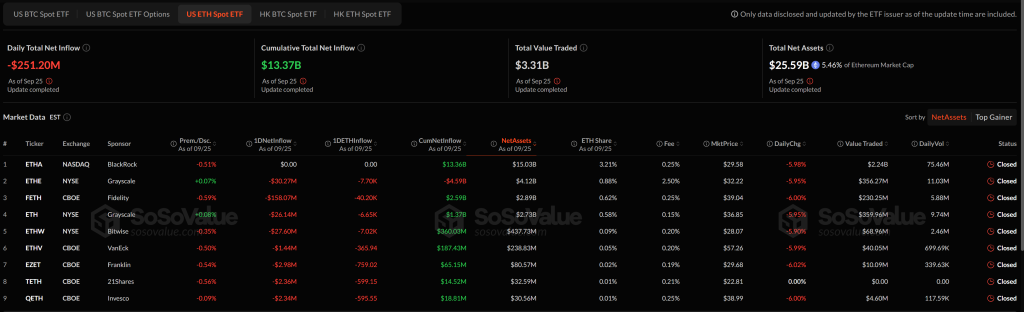

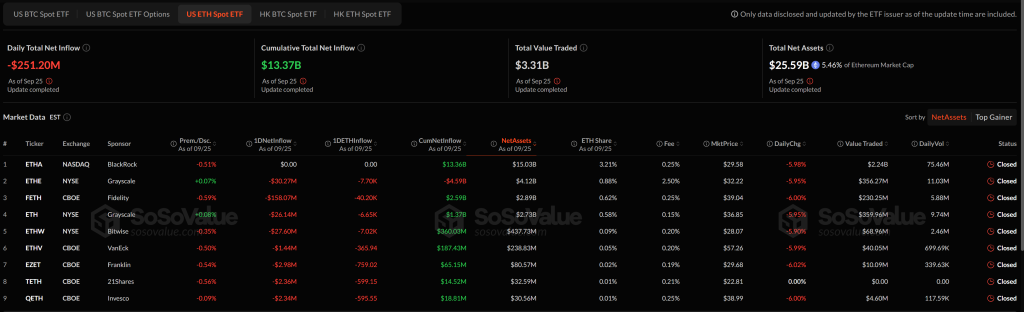

The US Ethereum spot ETFs recorded a steep net outflow of $251.20 million on September 25, reflecting increased selling pressure and fading investor confidence. Despite this drop, cumulative net inflows remain at $13.37 billion, while total assets under management now sit at $25.59 billion, roughly 5.46% of Ethereum’s market cap.

Fidelity’s FETH saw the largest single-day withdrawal at $158.07 million, followed by BlackRock’s ETHA with a $30.27 million outflow.

Grayscale’s ETHE and ETH funds lost $26.14 million and $26.14 million, respectively. Bitwise’s ETHW also recorded $27.60 million in outflows. No ETF recorded any inflow for the day, underscoring widespread profit-taking and caution among institutional ETH investors.

Meanwhile, US regulators are probing unusual stock price movements ahead of public announcements by over 200 firms planning crypto treasury strategies. The SEC and FINRA are investigating potential breaches of insider trading rules, particularly around the selective sharing of non-public information.

The post Why Is Crypto Down Today? – September 26, 2025 appeared first on Cryptonews.

Why Is Crypto Down Today? – September 26, 2025

The global cryptocurrency market cap has dipped 2.2% over the past 24 hours, now standing at $3.83 trillion, according to the latest data. Trading volume is up to $237.1 billion, but major digital assets remain under downward pressure as investor sentiment weakens.

TLDR:

- Crypto market slides deeper, with 9 of the top 10 coins down;

- BTC at $109,027 and ETH at $3,894;

- Fear & Greed Index drops to 32, lowest since April;

- BTC faces deeper correction as long-term holders realize $3.4M in profits;

- ETH struggles near $3,900, with bulls needing $4,400 breakout to regain control;

- US BTC spot ETFs see $258.46M in outflows;

- US ETH spot ETFs post $251.20M in outflows;

- SEC, FINRA launch probe into suspicious stock movements tied to crypto treasury plans;

Crypto Winners & Losers

At the time of writing, nine of the top 10 cryptocurrencies by market cap are in the red.

Bitcoin (BTC) has fallen 2.1% on the day to $109,252, down 6.6% over the past week.

Ethereum (ETH) has dropped 3.3% in the past 24 hours, trading at $3,895 and logging a 13.9% weekly loss.

Solana (SOL) leads the day’s losses among major assets, falling 4.6% to $193.51, extending its 7-day decline to 20.7%.

XRP (XRP) is down 3.3% to $2.74, while BNB (BNB) has slid 4.8% to $941.32.

Dogecoin (DOGE) lost another 3.5% to trade at $0.2247, marking an 18.4% weekly decline.

Among trending tokens, Plasma, Aster, and Avantis are attracting attention—but not for the right reasons. Aster has slipped 5.4% to $1.86, while Avantis has taken a sharper dive, plunging 22.6% to $1.54, making it one of the biggest daily losers.

On the flip side, a few lesser-known tokens have emerged as the day’s standout performers. SQD leads with a massive 94.8% gain, followed closely by Concordium, which is up 66.6%. Wrapped XPL is also on the rise, posting a 65.2% increase.

Meanwhile, Bitcoin sentiment has sharply declined, with the Crypto Fear & Greed Index dropping to 28, the lowest since April, as BTC dipped below $109,000 and triggered fresh liquidations.

The index fell 16 points overnight, reflecting growing fear in the market despite prices still holding well above previous lows, highlighting a widening gap between sentiment and price action.

Bitcoin Faces Potential Correction as Onchain Metrics Signal Exhaustion

Bitcoin is showing signs of a deeper correction, with long-term holders realizing profits at levels typically seen near market cycle tops.

According to Glassnode, 3.4 million BTC in realized gains and slowing ETF inflows suggest investor exhaustion following the recent Fed rate cut. BTC recently dropped to a four-week low of $108,700, falling below key support levels.

10x Research’s Markus Thielen warned that many investors positioned for a Q4 rally may be caught off-guard, with current price action hovering near previous stop-loss zones. Glassnode also reported the profit/loss ratio has hit extreme highs three times this cycle—each previously marking a cycle peak—implying a cooling phase is likely.

Additional stress is seen in the SOPR and NUPL indicators. Some short-term holders are now selling at a loss, and the NUPL for newer investors is nearing zero, which may lead to further capitulation. Analysts caution that renewed downside pressure could dominate unless market momentum returns quickly.

Levels & Events to Watch Next

Bitcoin is trading at $109,027 at the time of writing, largely flat on the day after a sharp decline from recent highs. The asset is testing a key support zone after shedding more than $6,000 in the past week, raising concerns of further downside if $108,700 gives way.

If BTC breaks below that level, the next major support sits at $107,000, followed by $105,000. On the upside, bulls will look to reclaim the $111,000–$113,000 band to avoid further cascading liquidations. A sustained move above $115,000 is needed to shift sentiment back in favor of buyers.

Meanwhile, Ethereum is trading at $3,894, up 0.47% in a modest bounce after a heavy sell-off earlier in the week. ETH remains vulnerable, hovering just below the key $4,000 psychological level, after dropping from near $4,750 earlier this month.

If ETH fails to hold above $3,850, support lies at $3,750 and $3,600. A short-term recovery could face resistance at $4,000, with further hurdles at $4,200 and $4,400. Bulls need a break above $4,400 to regain control and challenge the September highs.

Market sentiment has taken a sharp turn toward caution. The CMC Crypto Fear and Greed Index now sits at 32, slipping into the “Fear” category after hovering in “Neutral” territory for weeks. The index dropped from 41 yesterday and 52 last week, reflecting a growing sense of unease among investors.

This decline in sentiment mirrors the broader market retracement, with BTC and ETH testing key support zones. With traders spooked by macro uncertainty and recent price drops, the shift suggests participants are retreating to the sidelines, awaiting stronger signals before placing aggressive bets.

The US Bitcoin spot ETFs posted a sharp net outflow of $258.46 million on September 25, halting their previous recovery streak. Despite this setback, the cumulative net inflow remains substantial at $57.23 billion, with total assets under management at $144.35 billion, accounting for 6.64% of Bitcoin’s market cap.

Fidelity’s FBTC led the withdrawals with a $114.81 million outflow, followed by Bitwise’s BITB with $80.52 million and ARKB with $63.05 million.

Grayscale’s GBTC also saw $42.90 million pulled from the fund. Only BlackRock’s IBIT recorded a notable inflow of $79.70 million. IBIT also led trading activity, with nearly $4 billion in volume, indicating sustained investor attention despite the broader outflows.

The US Ethereum spot ETFs recorded a steep net outflow of $251.20 million on September 25, reflecting increased selling pressure and fading investor confidence. Despite this drop, cumulative net inflows remain at $13.37 billion, while total assets under management now sit at $25.59 billion, roughly 5.46% of Ethereum’s market cap.

Fidelity’s FETH saw the largest single-day withdrawal at $158.07 million, followed by BlackRock’s ETHA with a $30.27 million outflow.

Grayscale’s ETHE and ETH funds lost $26.14 million and $26.14 million, respectively. Bitwise’s ETHW also recorded $27.60 million in outflows. No ETF recorded any inflow for the day, underscoring widespread profit-taking and caution among institutional ETH investors.

Meanwhile, US regulators are probing unusual stock price movements ahead of public announcements by over 200 firms planning crypto treasury strategies. The SEC and FINRA are investigating potential breaches of insider trading rules, particularly around the selective sharing of non-public information.

The post Why Is Crypto Down Today? – September 26, 2025 appeared first on Cryptonews.

US regulators are circling after stocks that spiked ahead of crypto treasury news, as non-crypto firms rushed to load up on digital assets.

US regulators are circling after stocks that spiked ahead of crypto treasury news, as non-crypto firms rushed to load up on digital assets.