ETH Rally May Have $4,400 in Sight

- Short gamma positioning between $4K–$4.4K may force dealers to buy ETH as prices climb.

- Above $4K, this feedback loop could accelerate gains toward $4,400.

- At $4,400, gamma dynamics flip, potentially cooling volatility.

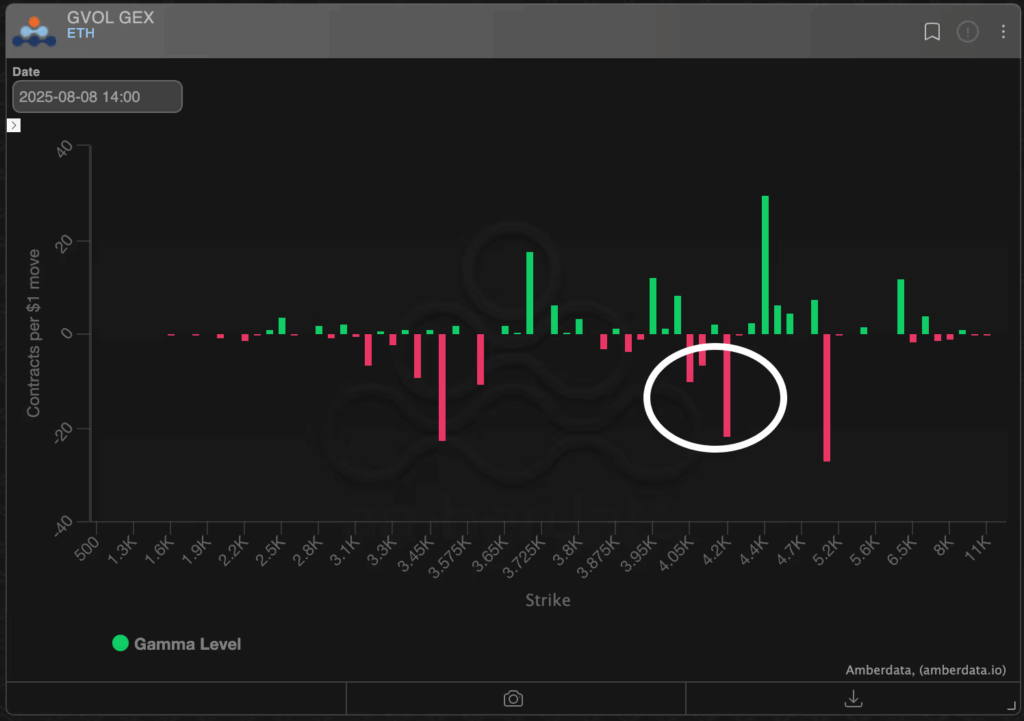

A key signal from the ether (ETH) options market is hinting the current rally could quickly push prices toward $4,400. The focus is on net gamma exposure among dealers and market makers trading Deribit-listed ETH options. Gamma measures how an option’s delta—its sensitivity to the underlying asset—changes when the asset’s price moves.

Why Short Gamma Matters

When dealers are short gamma, they’re forced to buy ETH as prices rise and sell when prices fall in order to stay market-neutral. This feedback loop can magnify price swings in either direction. Data from Amberdata shows a notable cluster of short gamma between $4,000 and $4,400.

Now that Ethereum has broken above $4,000, dealers caught short gamma may be forced to keep buying to hedge exposure—creating a self-reinforcing upward push until prices approach $4,400. At that point, the gamma positioning flips positive, which would likely dampen volatility rather than fuel it.

$4,400 as a “Price Magnet”

Greg Magadini, Amberdata’s director of derivatives, told CoinDesk that if momentum holds above $4,000, dealers could become net ETH buyers at even higher prices. This buying pressure could propel ETH rapidly toward $4,400—identified as the next significant gamma inventory level.

The takeaway: derivatives positioning could act as an accelerant for the rally, making $4,400 a logical short-term target if market momentum continues.

The post ETH Rally May Have $4,400 in Sight first appeared on BlockNews.

ETH Rally May Have $4,400 in Sight

- Short gamma positioning between $4K–$4.4K may force dealers to buy ETH as prices climb.

- Above $4K, this feedback loop could accelerate gains toward $4,400.

- At $4,400, gamma dynamics flip, potentially cooling volatility.

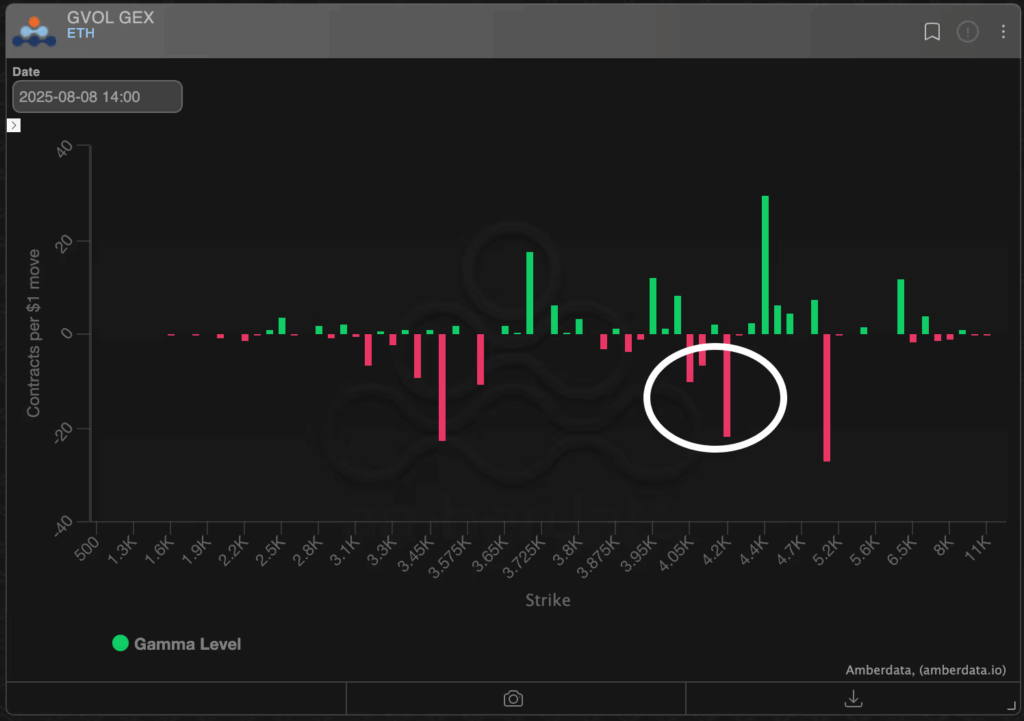

A key signal from the ether (ETH) options market is hinting the current rally could quickly push prices toward $4,400. The focus is on net gamma exposure among dealers and market makers trading Deribit-listed ETH options. Gamma measures how an option’s delta—its sensitivity to the underlying asset—changes when the asset’s price moves.

Why Short Gamma Matters

When dealers are short gamma, they’re forced to buy ETH as prices rise and sell when prices fall in order to stay market-neutral. This feedback loop can magnify price swings in either direction. Data from Amberdata shows a notable cluster of short gamma between $4,000 and $4,400.

Now that Ethereum has broken above $4,000, dealers caught short gamma may be forced to keep buying to hedge exposure—creating a self-reinforcing upward push until prices approach $4,400. At that point, the gamma positioning flips positive, which would likely dampen volatility rather than fuel it.

$4,400 as a “Price Magnet”

Greg Magadini, Amberdata’s director of derivatives, told CoinDesk that if momentum holds above $4,000, dealers could become net ETH buyers at even higher prices. This buying pressure could propel ETH rapidly toward $4,400—identified as the next significant gamma inventory level.

The takeaway: derivatives positioning could act as an accelerant for the rally, making $4,400 a logical short-term target if market momentum continues.

The post ETH Rally May Have $4,400 in Sight first appeared on BlockNews.