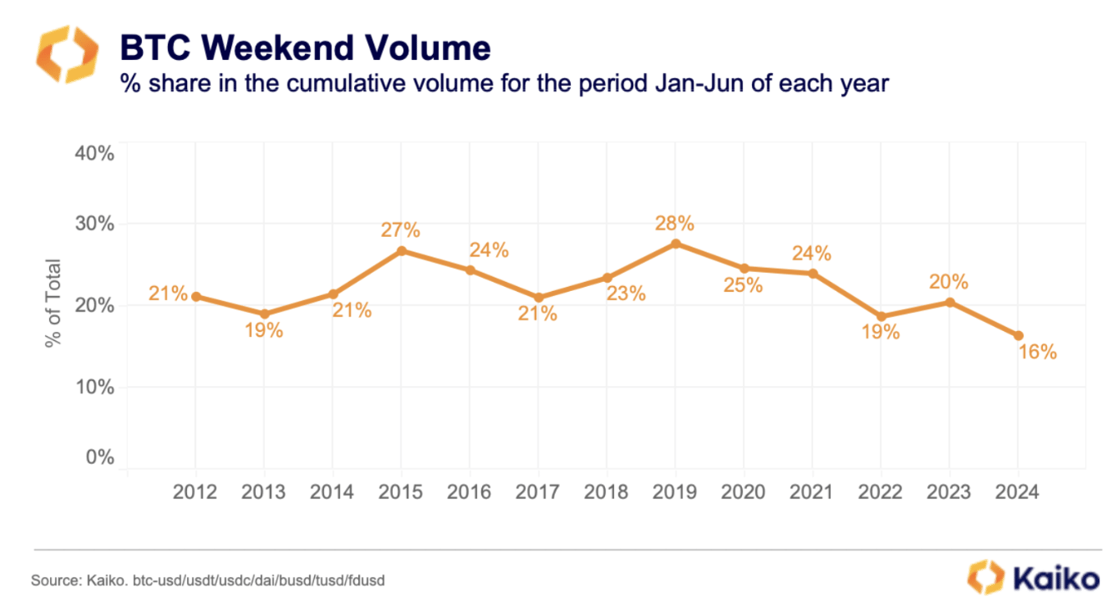

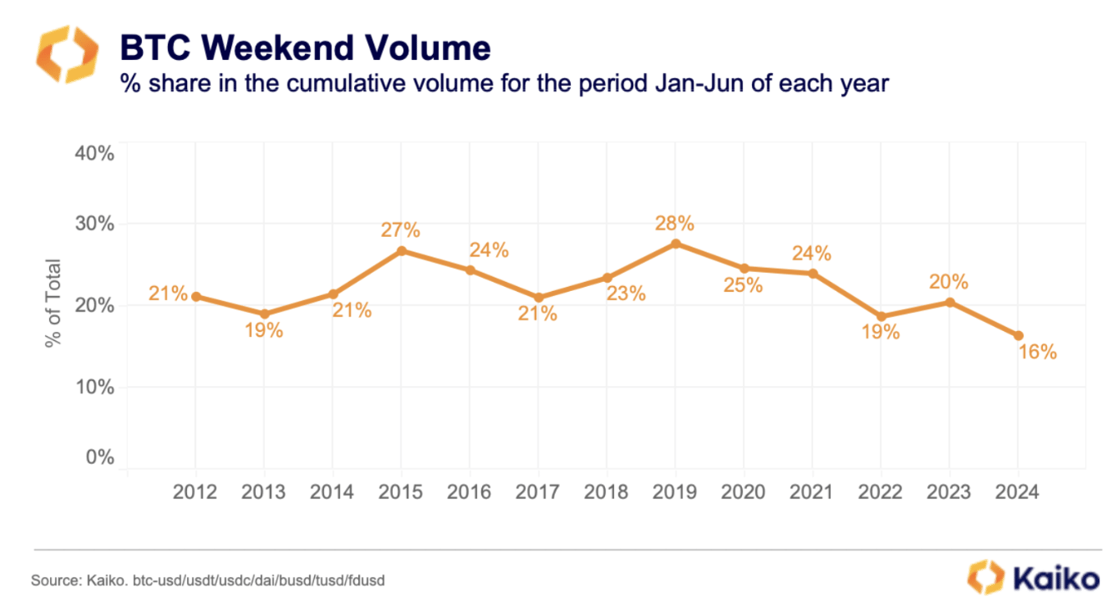

Weekend Bitcoin trading drops to record low of 16%

Bitcoin’s weekend trading volume has plummeted to an all-time low of 16% this year. According to Kaiko, the launch of spot Bitcoin ETFs has changed BTC’s trading patterns, making them more like traditional stock trading schedules and reducing Bitcoin’s price volatility.

A quick look at Bitcoin benchmarks shows that these benchmarks provide a daily index price for one BTC in USD. They calculate their prices based on aggregated trade data from selected exchanges.

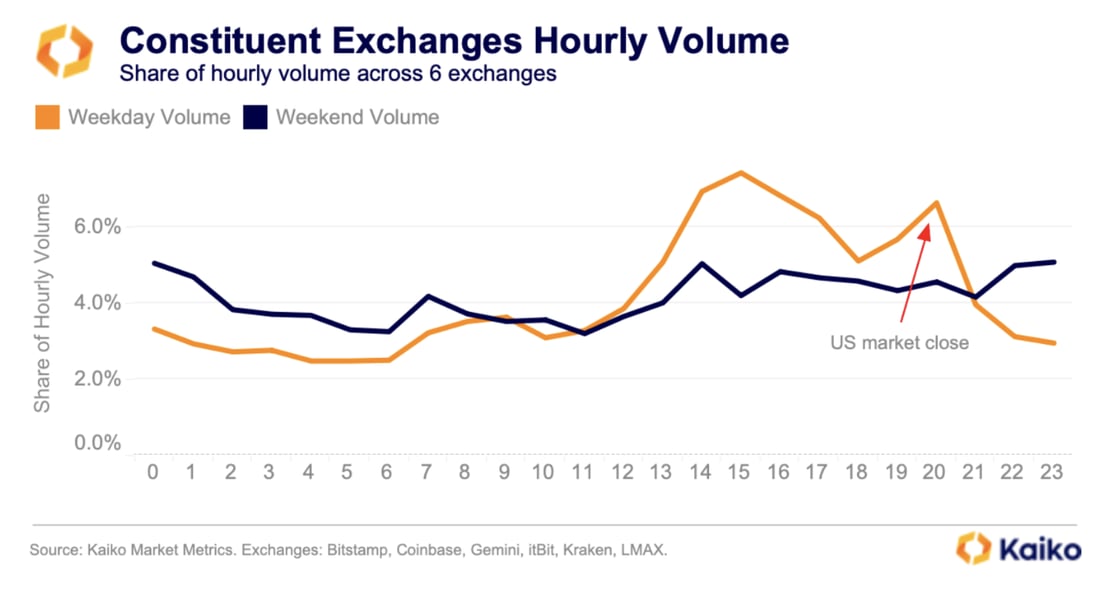

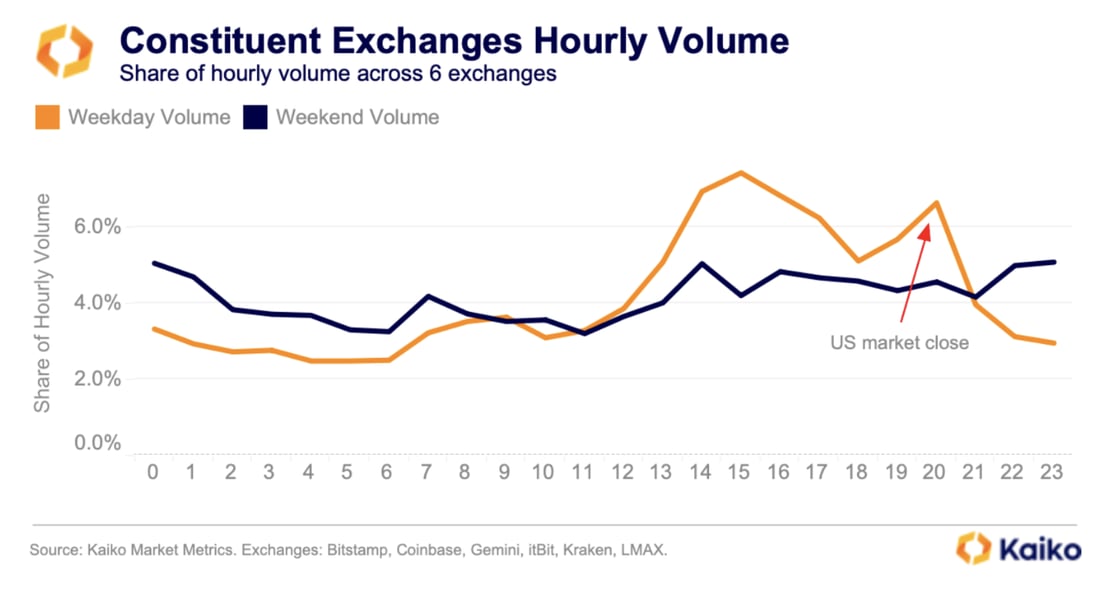

The introduction of spot Bitcoin ETFs has changed the game by increasing spot Bitcoin liquidity throughout the ETF trading day.

Liquidity providers and market makers now trade and hedge in the spot market, leading to higher spot trading volumes during the ETF benchmark fixing window.

Spot ETFs determine their net asset value (NAV) based on the fixing price, used for share creations and redemptions. To closely reflect the benchmark price, Bitcoin buying and selling for creations and redemptions must occur during the fixing window, boosting spot volumes.

Bitcoin reference rates calculate the index price using trade data received between 3 pm and 4 pm New York time. The main exchanges for this purpose are Bitstamp, Coinbase, itBit, Kraken, Gemini, and LMAX Digital. Each ETF then calculates its NAV using its benchmark index price after market close at 4 pm.

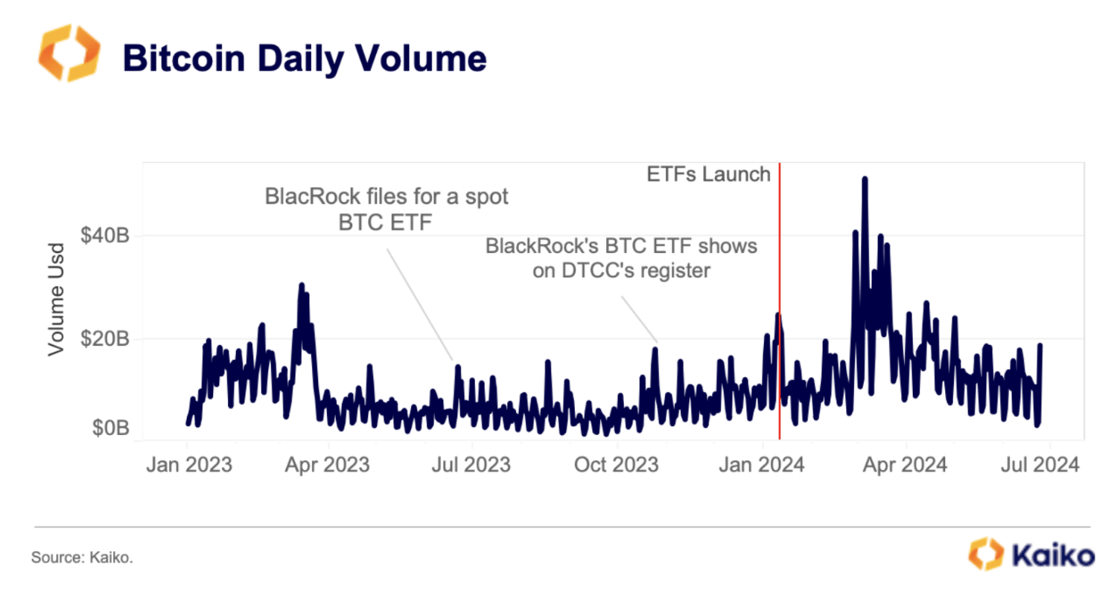

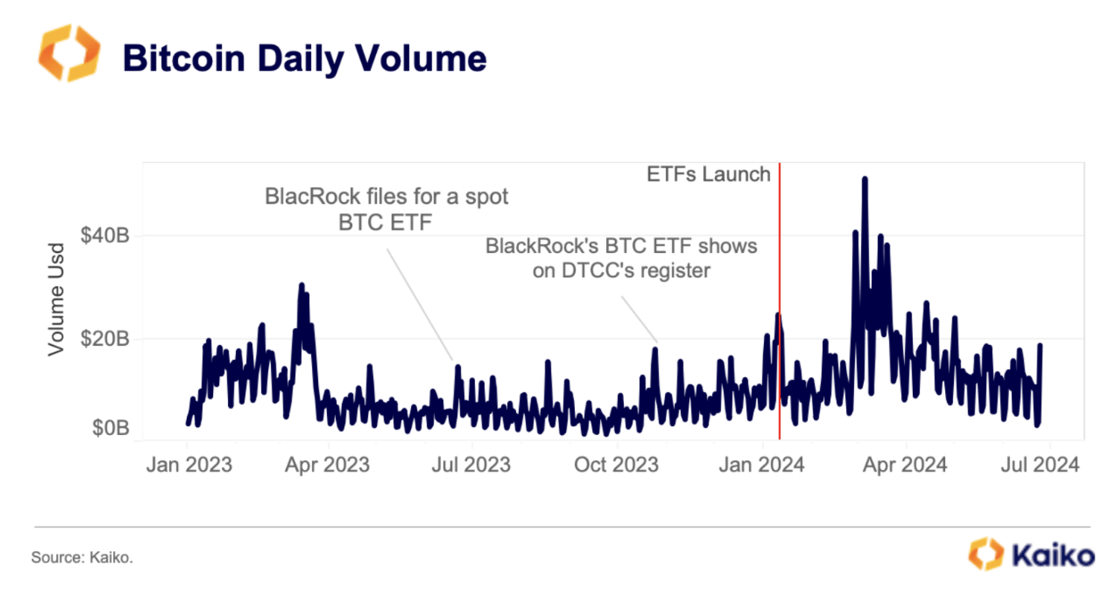

Since the approval of spot BTC ETFs, Bitcoin trade volumes have surged. Volumes rebounded in October from multi-year lows seen during the summer when signs of imminent ETF approval became evident.

This boost was driven by market optimism and a favorable macro environment for risk assets, with predictions of six U.S. rate cuts in December 2024.

“In particular, volumes during the benchmark fixing window, between 3 pm and 4 pm New York time, have improved. This changing dynamic helps to improve liquidity and price discovery in BTC markets but could also lead to increased intra-day volatility.”

Kaiko

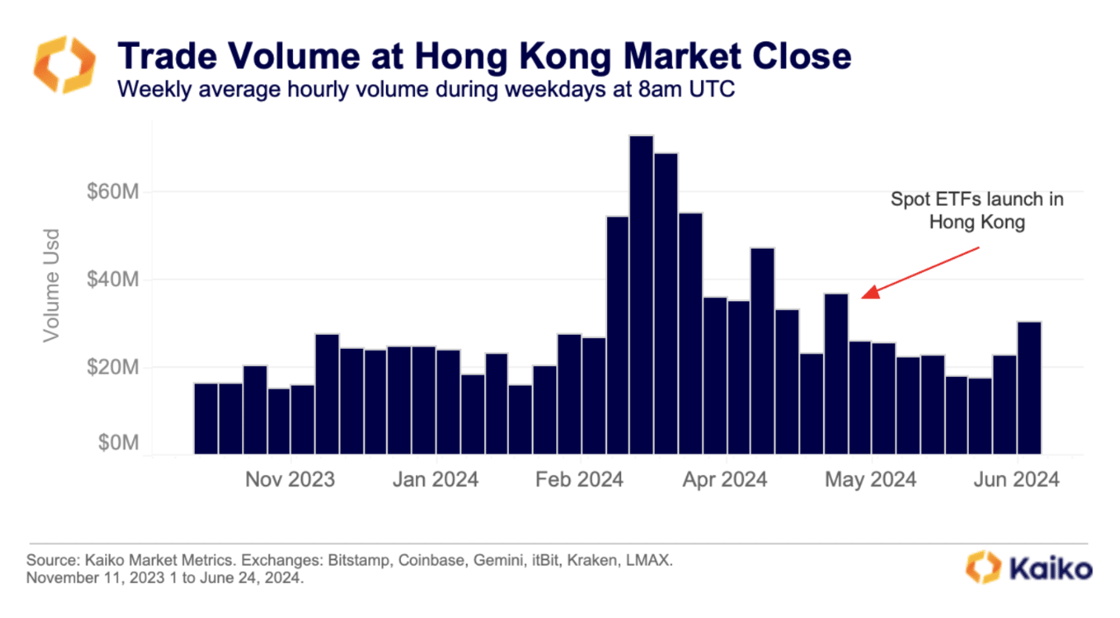

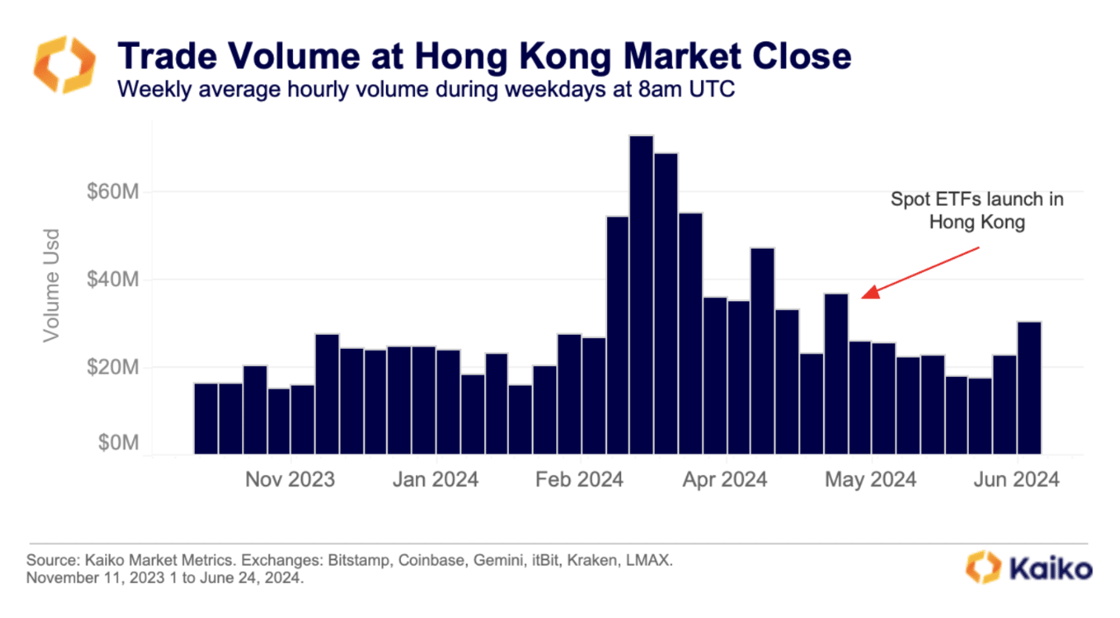

Hong Kong Bitcoin ETFs miss the mark

While the launch of spot ETFs in the U.S. has significantly impacted Bitcoin trading volumes, the recent introduction of both Bitcoin and Ethereum spot ETFs in Hong Kong in April has had a more muted effect, according to Kaiko.

Analyzing weekly data shows that average Bitcoin trading volume during the Hong Kong market close increased to $37 million the week spot BTC ETFs were launched in Hong Kong. However, this was significantly below its peak of $73 million in March.

This muted response is because Hong Kong is a much smaller market than the U.S., and the market conditions at the time of the spot BTC and ETH ETF launches in Hong Kong were different from those during the U.S. launch.

The Hong Kong funds were introduced after Bitcoin’s fourth halving, during a period of stagnant price action, and coincided with outflows from many U.S. spot BTC ETFs for the first time.

Additionally, Kaiko pointed out that market sentiment in April was more bearish than earlier in the year, with Bitcoin perpetual funding rates turning negative.

The impact of ETFs on spot Bitcoin markets has been more pronounced on U.S.-regulated exchanges.

For example, Binance, the world’s largest exchange, not regulated in the U.S., sees peak trading volumes around the U.S. market open, which then fall throughout the day.

No ETF benchmarks include Binance, as most of its Bitcoin trading volume is against stablecoins, and ETF benchmarks only consider BTC/USD prices.

“Similar to trade volume, we observe a shift in the share of BTC market depth towards US markets. The share of liquidity on US exchanges has increased to 45% since the start of the ETF-led rally in October, up from 35% a year ago.”

Kaiko

On the other hand, Coinbase, the largest exchange across all Bitcoin reference rates and a U.S.-regulated exchange, shows volumes heavily focused on the U.S. market open. These volumes increase to an average of $220 million at the close, during the benchmark fixing window.

Jai Hamid

Weekend Bitcoin trading drops to record low of 16%

Bitcoin’s weekend trading volume has plummeted to an all-time low of 16% this year. According to Kaiko, the launch of spot Bitcoin ETFs has changed BTC’s trading patterns, making them more like traditional stock trading schedules and reducing Bitcoin’s price volatility.

A quick look at Bitcoin benchmarks shows that these benchmarks provide a daily index price for one BTC in USD. They calculate their prices based on aggregated trade data from selected exchanges.

The introduction of spot Bitcoin ETFs has changed the game by increasing spot Bitcoin liquidity throughout the ETF trading day.

Liquidity providers and market makers now trade and hedge in the spot market, leading to higher spot trading volumes during the ETF benchmark fixing window.

Spot ETFs determine their net asset value (NAV) based on the fixing price, used for share creations and redemptions. To closely reflect the benchmark price, Bitcoin buying and selling for creations and redemptions must occur during the fixing window, boosting spot volumes.

Bitcoin reference rates calculate the index price using trade data received between 3 pm and 4 pm New York time. The main exchanges for this purpose are Bitstamp, Coinbase, itBit, Kraken, Gemini, and LMAX Digital. Each ETF then calculates its NAV using its benchmark index price after market close at 4 pm.

Since the approval of spot BTC ETFs, Bitcoin trade volumes have surged. Volumes rebounded in October from multi-year lows seen during the summer when signs of imminent ETF approval became evident.

This boost was driven by market optimism and a favorable macro environment for risk assets, with predictions of six U.S. rate cuts in December 2024.

“In particular, volumes during the benchmark fixing window, between 3 pm and 4 pm New York time, have improved. This changing dynamic helps to improve liquidity and price discovery in BTC markets but could also lead to increased intra-day volatility.”

Kaiko

Hong Kong Bitcoin ETFs miss the mark

While the launch of spot ETFs in the U.S. has significantly impacted Bitcoin trading volumes, the recent introduction of both Bitcoin and Ethereum spot ETFs in Hong Kong in April has had a more muted effect, according to Kaiko.

Analyzing weekly data shows that average Bitcoin trading volume during the Hong Kong market close increased to $37 million the week spot BTC ETFs were launched in Hong Kong. However, this was significantly below its peak of $73 million in March.

This muted response is because Hong Kong is a much smaller market than the U.S., and the market conditions at the time of the spot BTC and ETH ETF launches in Hong Kong were different from those during the U.S. launch.

The Hong Kong funds were introduced after Bitcoin’s fourth halving, during a period of stagnant price action, and coincided with outflows from many U.S. spot BTC ETFs for the first time.

Additionally, Kaiko pointed out that market sentiment in April was more bearish than earlier in the year, with Bitcoin perpetual funding rates turning negative.

The impact of ETFs on spot Bitcoin markets has been more pronounced on U.S.-regulated exchanges.

For example, Binance, the world’s largest exchange, not regulated in the U.S., sees peak trading volumes around the U.S. market open, which then fall throughout the day.

No ETF benchmarks include Binance, as most of its Bitcoin trading volume is against stablecoins, and ETF benchmarks only consider BTC/USD prices.

“Similar to trade volume, we observe a shift in the share of BTC market depth towards US markets. The share of liquidity on US exchanges has increased to 45% since the start of the ETF-led rally in October, up from 35% a year ago.”

Kaiko

On the other hand, Coinbase, the largest exchange across all Bitcoin reference rates and a U.S.-regulated exchange, shows volumes heavily focused on the U.S. market open. These volumes increase to an average of $220 million at the close, during the benchmark fixing window.

Jai Hamid