Bitcoin Price Prediction – If Bitcoin Breaks This Level, Expect a Fast Move to New All-Time Highs

This week, Bitcoin (BTC/USD) surged to $108,182, briefly breaching a key resistance level that now holds the potential to trigger a new wave of bullish momentum.

At the moment, BTC is trading around $107,300, the cryptocurrency is up nearly 10% in just three days, driven by a combination of short liquidation, technical breakouts, and easing geopolitical tensions in the Middle East.

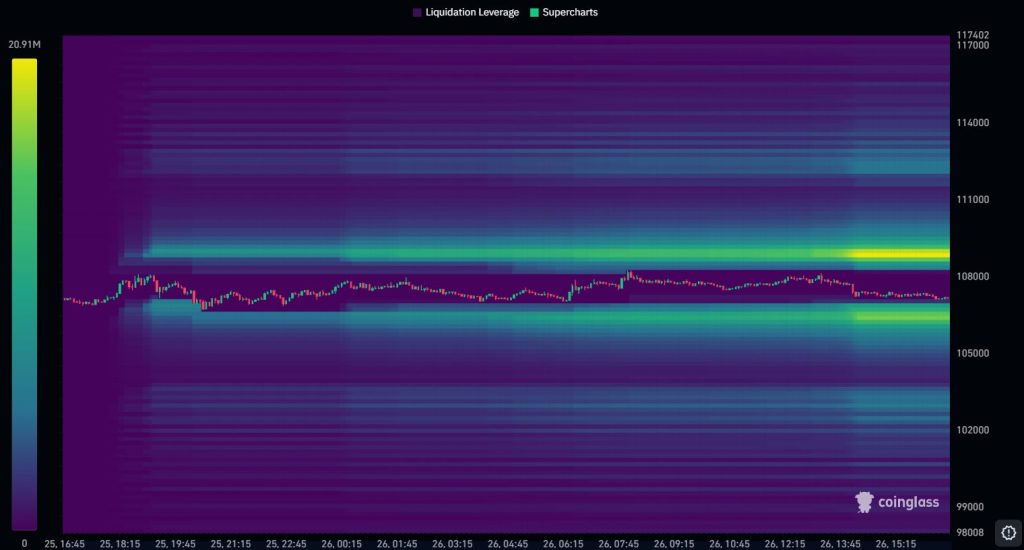

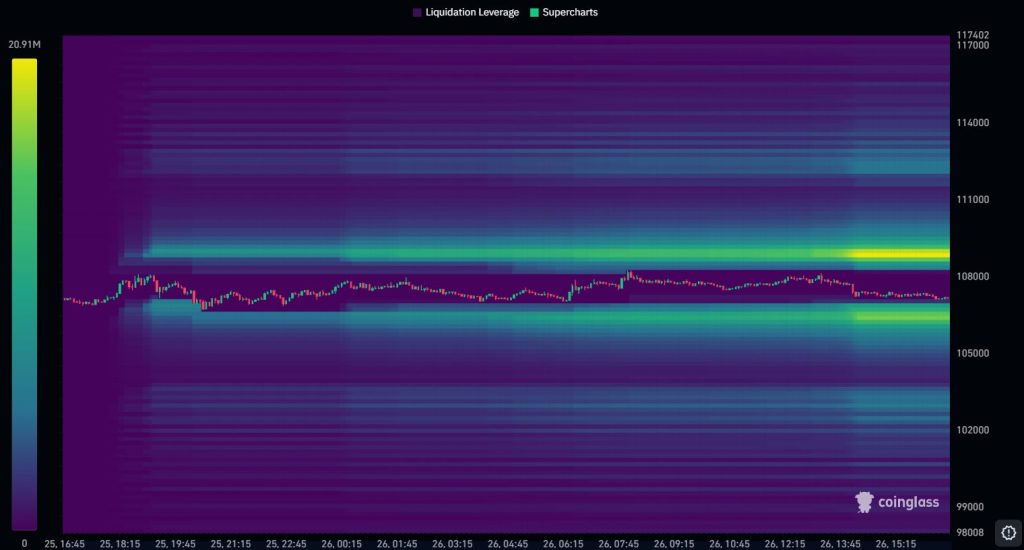

Traders widely anticipated the move past $108K. The level represented a significant liquidity zone, and its breach forced aggressive short positions to unwind.

Data from CoinGlass confirms that this rally absorbed much of the high-leverage short interest built around recent price consolidation, effectively clearing the path for a potential breakout toward higher resistance levels.

Popular analysts, such as Matthew Hyland, describe the current environment as “bulls in control,” while others, like the Titan of Crypto, highlight a recent breakout above the Ichimoku Cloud, signaling further upside potential.

Technical models now indicate $110,448 and $111,944 as potential upside targets, provided BTC can maintain its traction above $108,251.

Bitcoin (BTC/USD) Technical Setup Signals Possible Acceleration

From a charting perspective, the Bitcoin price prediction appears bullish after BTC recently formed a three-bar bullish pattern, similar to a modified “three white soldiers” setup, indicating strong buyer commitment.

However, price action is stalling just below a long-standing descending trendline, suggesting that $108,251 remains a critical inflection point.

- Support levels: $106,237 (Fib 0.236), $105,081 (50-EMA), and $103,984 (Fib 0.5)

- Resistance targets: $110,448 and $111,944

- MACD status: Bullish crossover, but histogram momentum flattening

- Candlestick signal: Spinning top forming under trendline, indicating potential hesitation

If BTC closes above $108,251 with high volume, we could see a quick move to $111K. If not, we could see a short-term pullback to $105,000-$103,900.

Macro Outlook: Russia is Back in Focus

Middle East tensions have eased, but geopolitical risk remains. Market sentiment has shifted back to Eastern Europe as tensions between NATO and Russia escalate. According to QCP Capital, the risk premium on global assets is evolving from a short-term hedge to a long-term assumption.

The S&P 500 and Nasdaq experienced a slight bounce, a temporary calm, but macroeconomic uncertainty remains a headwind. For BTC, any increase in global volatility, especially from traditional markets, could bring in safe-haven flows into crypto assets.

However, BTC’s structure remains bullish. With on-chain data indicating lower realized profits and technical indicators suggesting a continuation, the path to new all-time highs remains open if $ 108,000 holds.

Conclusion: BTC is at a crossroads. A close above $108,251 could signal a quick move to $111K and beyond. If not, we could see a pullback to key support zones. Traders are watching – this level will define the next move.

BTC Bull Token Nears $8.4M Hard Cap as Presale Enters Final Hours

With Bitcoin trading near $105,000, investor focus is shifting toward BTC Bull Token ($BTCBULL), a rising altcoin that is nearly fully allocated during its presale. As of today, the project has raised $7,438,492.88 of its $8,397,441 target, leaving under $1 million to be raised before the token price moves to the next tier.

Currently priced at $0.00258, early buyers have a limited time to enter before the subsequent price increase takes effect.

Bitcoin-Linked Tokenomics and Burn Mechanism

BTCBULL ties its value directly to Bitcoin’s price through two smart systems:

- BTC Airdrops: Distributed to holders, with priority for presale participants.

- Supply Burns: Triggered automatically when BTC rises in $50,000 increments.

- APY: 55% annually

- Lockups: None

- Liquidity: Immediate

- Total Pool: 1,925,149,417 BTCBULL

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income. With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.

The post Bitcoin Price Prediction – If Bitcoin Breaks This Level, Expect a Fast Move to New All-Time Highs appeared first on Cryptonews.

Bitcoin Price Prediction – If Bitcoin Breaks This Level, Expect a Fast Move to New All-Time Highs

This week, Bitcoin (BTC/USD) surged to $108,182, briefly breaching a key resistance level that now holds the potential to trigger a new wave of bullish momentum.

At the moment, BTC is trading around $107,300, the cryptocurrency is up nearly 10% in just three days, driven by a combination of short liquidation, technical breakouts, and easing geopolitical tensions in the Middle East.

Traders widely anticipated the move past $108K. The level represented a significant liquidity zone, and its breach forced aggressive short positions to unwind.

Data from CoinGlass confirms that this rally absorbed much of the high-leverage short interest built around recent price consolidation, effectively clearing the path for a potential breakout toward higher resistance levels.

Popular analysts, such as Matthew Hyland, describe the current environment as “bulls in control,” while others, like the Titan of Crypto, highlight a recent breakout above the Ichimoku Cloud, signaling further upside potential.

Technical models now indicate $110,448 and $111,944 as potential upside targets, provided BTC can maintain its traction above $108,251.

Bitcoin (BTC/USD) Technical Setup Signals Possible Acceleration

From a charting perspective, the Bitcoin price prediction appears bullish after BTC recently formed a three-bar bullish pattern, similar to a modified “three white soldiers” setup, indicating strong buyer commitment.

However, price action is stalling just below a long-standing descending trendline, suggesting that $108,251 remains a critical inflection point.

- Support levels: $106,237 (Fib 0.236), $105,081 (50-EMA), and $103,984 (Fib 0.5)

- Resistance targets: $110,448 and $111,944

- MACD status: Bullish crossover, but histogram momentum flattening

- Candlestick signal: Spinning top forming under trendline, indicating potential hesitation

If BTC closes above $108,251 with high volume, we could see a quick move to $111K. If not, we could see a short-term pullback to $105,000-$103,900.

Macro Outlook: Russia is Back in Focus

Middle East tensions have eased, but geopolitical risk remains. Market sentiment has shifted back to Eastern Europe as tensions between NATO and Russia escalate. According to QCP Capital, the risk premium on global assets is evolving from a short-term hedge to a long-term assumption.

The S&P 500 and Nasdaq experienced a slight bounce, a temporary calm, but macroeconomic uncertainty remains a headwind. For BTC, any increase in global volatility, especially from traditional markets, could bring in safe-haven flows into crypto assets.

However, BTC’s structure remains bullish. With on-chain data indicating lower realized profits and technical indicators suggesting a continuation, the path to new all-time highs remains open if $ 108,000 holds.

Conclusion: BTC is at a crossroads. A close above $108,251 could signal a quick move to $111K and beyond. If not, we could see a pullback to key support zones. Traders are watching – this level will define the next move.

BTC Bull Token Nears $8.4M Hard Cap as Presale Enters Final Hours

With Bitcoin trading near $105,000, investor focus is shifting toward BTC Bull Token ($BTCBULL), a rising altcoin that is nearly fully allocated during its presale. As of today, the project has raised $7,438,492.88 of its $8,397,441 target, leaving under $1 million to be raised before the token price moves to the next tier.

Currently priced at $0.00258, early buyers have a limited time to enter before the subsequent price increase takes effect.

Bitcoin-Linked Tokenomics and Burn Mechanism

BTCBULL ties its value directly to Bitcoin’s price through two smart systems:

- BTC Airdrops: Distributed to holders, with priority for presale participants.

- Supply Burns: Triggered automatically when BTC rises in $50,000 increments.

- APY: 55% annually

- Lockups: None

- Liquidity: Immediate

- Total Pool: 1,925,149,417 BTCBULL

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income. With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.

The post Bitcoin Price Prediction – If Bitcoin Breaks This Level, Expect a Fast Move to New All-Time Highs appeared first on Cryptonews.