Bitcoin Buyers Dominate On Binance As CVD Confirmation Nears 0.9, Signaling $130K Target Zone

Following a new all-time high (ATH) of $126,199 on Binance, Bitcoin (BTC) is now consolidating in the low $120,000 range. Latest exchange data – such as Cumulative Volume Delta (CVD) Confirmation Score – suggests that BTC is benefitting from strong underlying demand.

CVD Confirmation Shows Strong Demand For Bitcoin

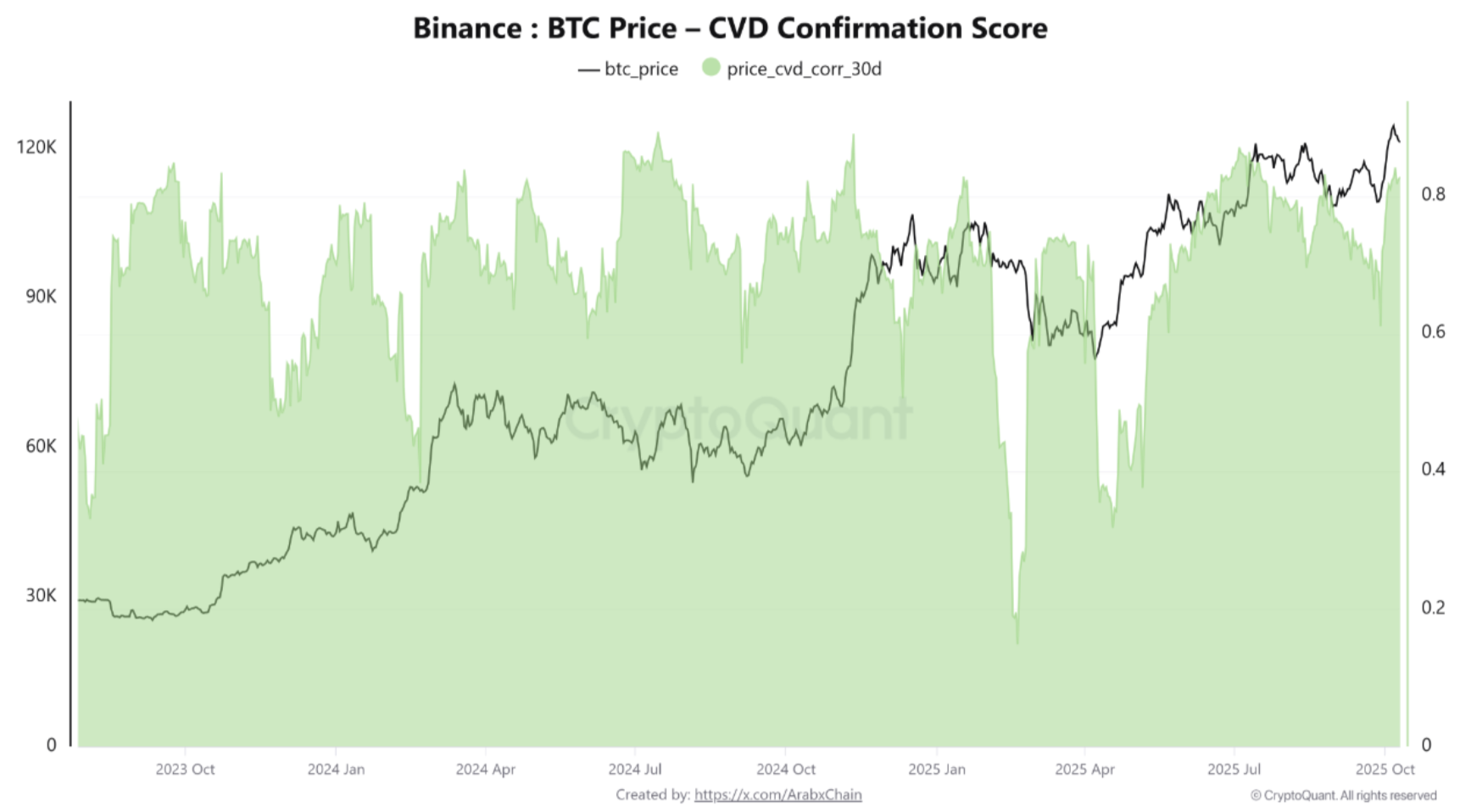

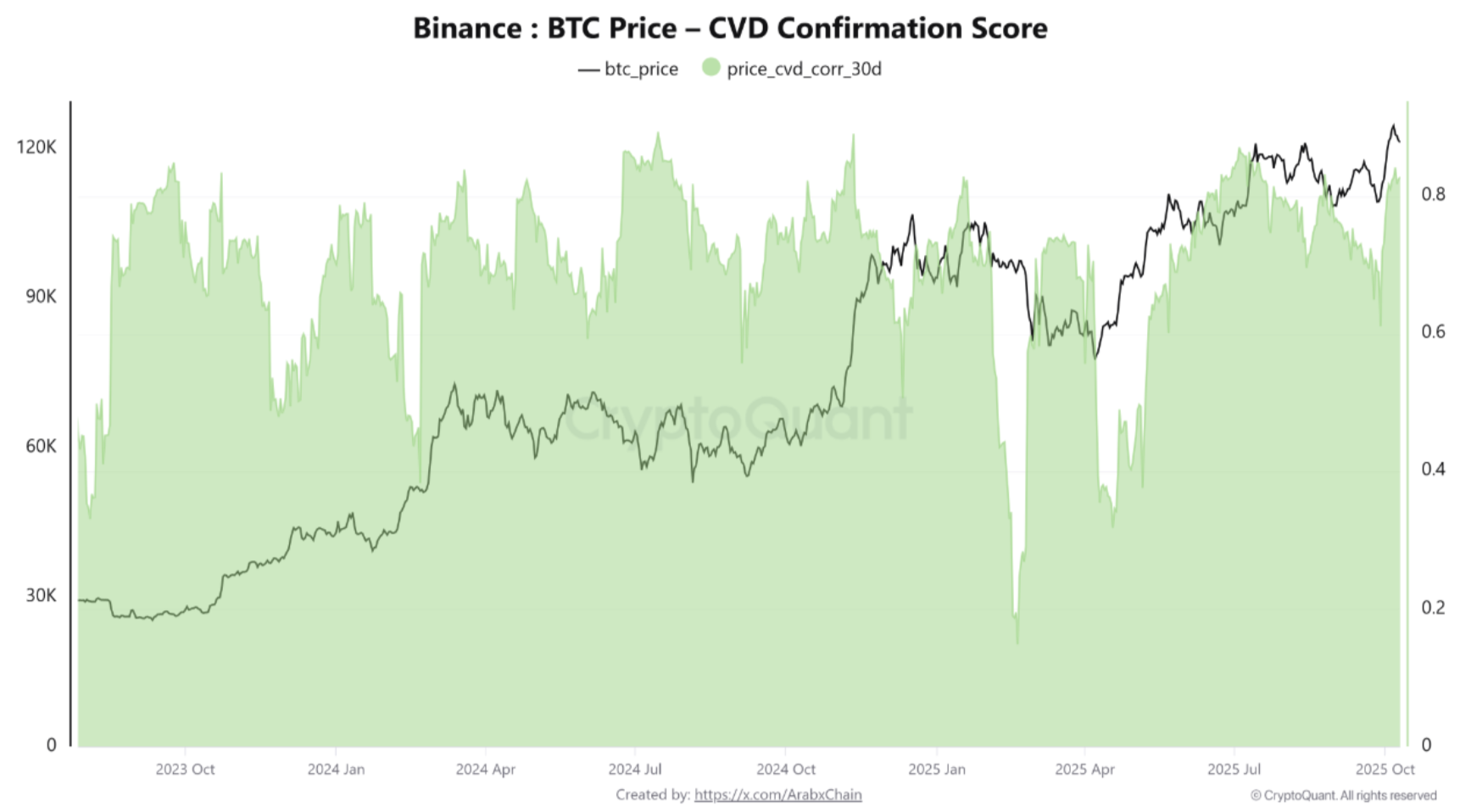

According to a CryptoQuant Quicktake post by contributor Arab Chain, Bitcoin’s CVD Confirmation Score – a 30-day rolling correlation between Bitcoin’s price and the CVD – is suggesting a strong resynchronization of the trend.

For the uninitiated, the CVD Confirmation Score measures the 30-day correlation between Bitcoin’s price and the CVD, which tracks the net difference between taker buy and sell volumes on exchanges. A high score (above 0.7) indicates that price increases are backed by real buying pressure, while a low or negative score suggests weak or speculative momentum.

Latest data from Binance shows that the CVD Confirmation Score currently hovers around 0.8 to 0.9, indicating that the current price surge is largely driven by genuine taker buying rather than a technical bounce or a short squeeze.

Past data also suggests that whenever this data point has remained about 0.7 for an extended period, price corrections tend to be relatively shallow and short-lived. This is because new liquidity in the market quickly absorbs any incoming supply of BTC.

The CryptoQuant analyst remarked that if the CVD Confirmation Score continues to hover above 0.7 – coupled with a decisive breakout above the $124,000 – $126,000 resistance zone – then it could be on its way to a potential target of as high as $135,000.

However, any negative divergence with BTC price rising and CVD Confirmation Score dropping below 0.4 should be seen as a warning sign, as it increases the likelihood of distribution or liquidation pressure.

Conversely, the $112,000 – $115,000 and $108,000 – $110,000 stand out as strong support levels for BTC. At these price levels, the CVD Confirmation Score should remain steady to ensure the uptrend remains intact. Arab Chain added:

The underlying trend is bullish and supported by real inflows on Binance, the highest-volume exchange globally. Monitor three confirmation signals: CVD Confirmation stays high, open interest remains moderate, and funding does not become excessive. Any clear imbalance across these metrics will be the first warning of a momentum shift.

Is BTC Due For A Correction?

While bulls are hoping for an extended rally for BTC, some analysts aren’t quite convinced about the digital asset surging to new highs in the near term. For instance, crypto analyst ZVN recently stated that BTC may witness a pullback before its next surge to $150,000.

Similarly, fellow crypto analyst Dick Dandy recently predicted that BTC may witness a massive 60% price correction, falling all the way down to $43,900. At press time, BTC trades at $118,791, down 1.8% in the past 24 hours.

Bitcoin Buyers Dominate On Binance As CVD Confirmation Nears 0.9, Signaling $130K Target Zone

Following a new all-time high (ATH) of $126,199 on Binance, Bitcoin (BTC) is now consolidating in the low $120,000 range. Latest exchange data – such as Cumulative Volume Delta (CVD) Confirmation Score – suggests that BTC is benefitting from strong underlying demand.

CVD Confirmation Shows Strong Demand For Bitcoin

According to a CryptoQuant Quicktake post by contributor Arab Chain, Bitcoin’s CVD Confirmation Score – a 30-day rolling correlation between Bitcoin’s price and the CVD – is suggesting a strong resynchronization of the trend.

For the uninitiated, the CVD Confirmation Score measures the 30-day correlation between Bitcoin’s price and the CVD, which tracks the net difference between taker buy and sell volumes on exchanges. A high score (above 0.7) indicates that price increases are backed by real buying pressure, while a low or negative score suggests weak or speculative momentum.

Latest data from Binance shows that the CVD Confirmation Score currently hovers around 0.8 to 0.9, indicating that the current price surge is largely driven by genuine taker buying rather than a technical bounce or a short squeeze.

Past data also suggests that whenever this data point has remained about 0.7 for an extended period, price corrections tend to be relatively shallow and short-lived. This is because new liquidity in the market quickly absorbs any incoming supply of BTC.

The CryptoQuant analyst remarked that if the CVD Confirmation Score continues to hover above 0.7 – coupled with a decisive breakout above the $124,000 – $126,000 resistance zone – then it could be on its way to a potential target of as high as $135,000.

However, any negative divergence with BTC price rising and CVD Confirmation Score dropping below 0.4 should be seen as a warning sign, as it increases the likelihood of distribution or liquidation pressure.

Conversely, the $112,000 – $115,000 and $108,000 – $110,000 stand out as strong support levels for BTC. At these price levels, the CVD Confirmation Score should remain steady to ensure the uptrend remains intact. Arab Chain added:

The underlying trend is bullish and supported by real inflows on Binance, the highest-volume exchange globally. Monitor three confirmation signals: CVD Confirmation stays high, open interest remains moderate, and funding does not become excessive. Any clear imbalance across these metrics will be the first warning of a momentum shift.

Is BTC Due For A Correction?

While bulls are hoping for an extended rally for BTC, some analysts aren’t quite convinced about the digital asset surging to new highs in the near term. For instance, crypto analyst ZVN recently stated that BTC may witness a pullback before its next surge to $150,000.

Similarly, fellow crypto analyst Dick Dandy recently predicted that BTC may witness a massive 60% price correction, falling all the way down to $43,900. At press time, BTC trades at $118,791, down 1.8% in the past 24 hours.