How did Argentina’s president Javier Milei pull off the largest crypto rug pull in history?

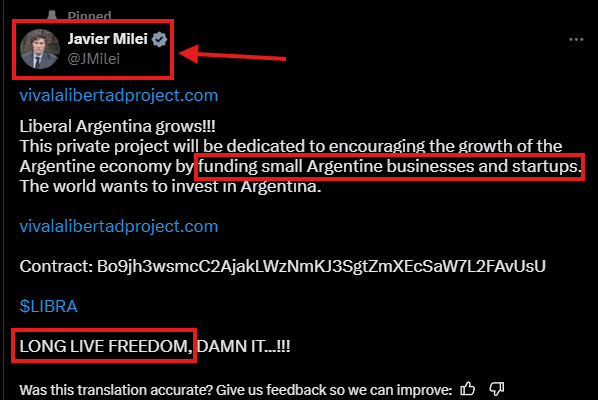

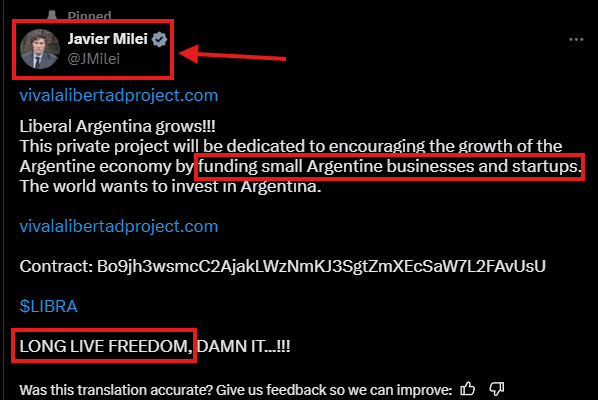

Argentina’s president Javier Milei literally wiped out the meme coin market in just five hours today, and might have incinerated his reputation along with it. Let’s start from the beginning. At exactly 10:01 PM UTC, Javier made a post on X announcing that $LIBRA was launching to “boost Argentina’s economy.”

Of course people weren’t sure if he was serious. Some thought his X account got hacked. Others assumed it was another political stunt. But then, many Argentine politicians confirmed it was real, so as per usual, retail traders dove in headfirst. Within minutes, $LIBRA hit a $4.6 billion market cap.

The whole thing was ridiculous, as meme coins tend to be. There was no whitepaper, no tokenomics, no investor protections, just a basic, terrible-looking website that linked to a Google Form. The pitch on the website’s landing page was, and I quote, “Funding small projects to boost Argentina’s economy.” But the reality turned out to be a blatant liquidity trap.

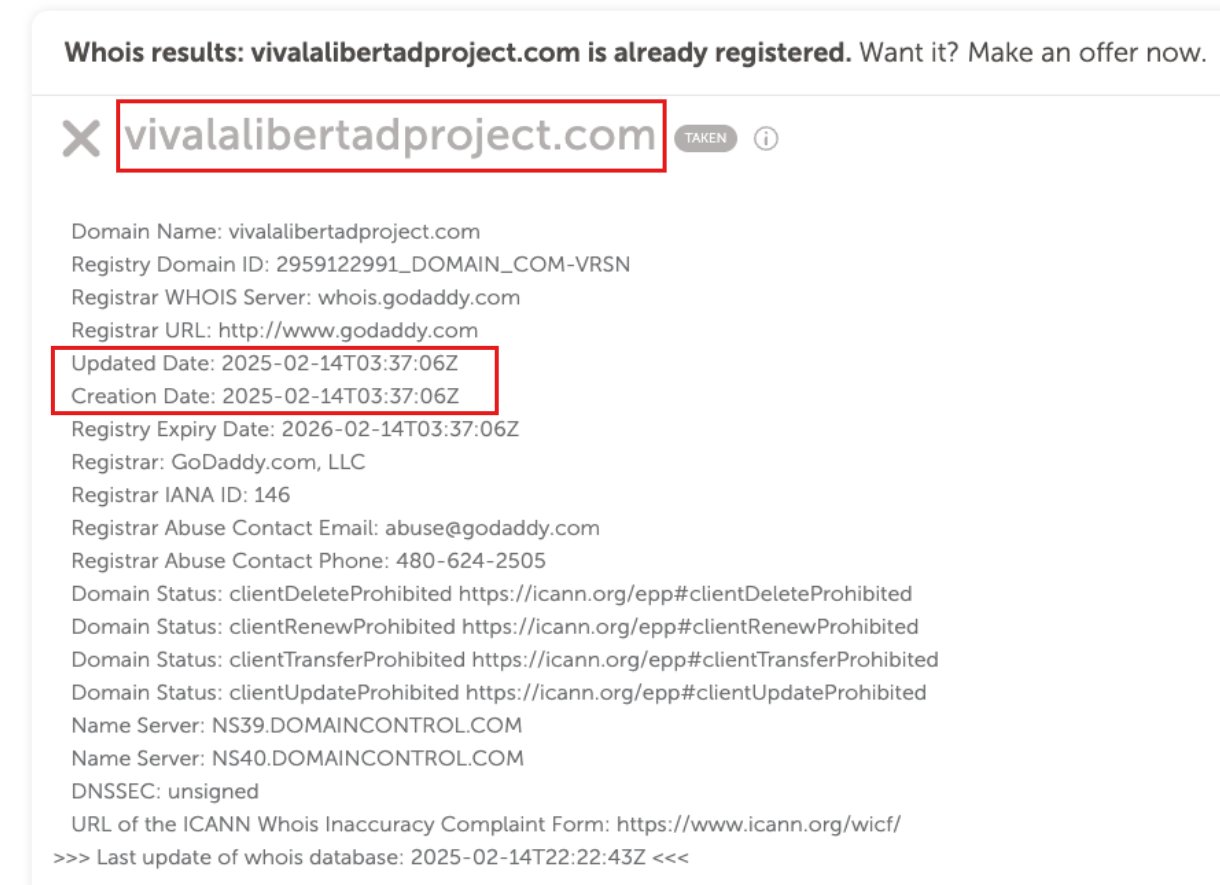

On-chain data showed the domain was registered hours before launch. No public owner. One-year registration. Multiple restricted domain statuses. Everything about this screamed cash grab.

By the time people started asking questions, it was already too late. Insiders had drained $87.4 million within three hours, according to data from Bubblemaps. 82% of the supply sat in a single cluster.

And then, the real dumping began.

Insiders cashed out as retail traders took the hit

At 10:40 PM UTC, $LIBRA hit its all-time high, and immediately, multiple large holders liquidated millions in minutes, with some pulling in $4 million+ each before the market even caught on. By press time, $LIBRA has fallen below $600,000 in market cap, meaning $4.59 billion is now gone. Yeesh!

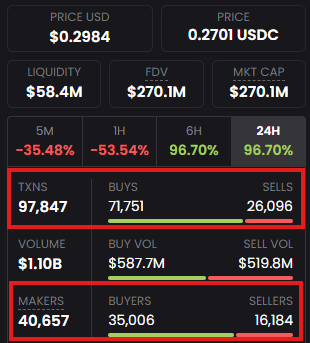

The selling was so aggressive that only 27% of transactions were actual sales. That means for every insider dumping millions, there were two retail traders panic-buying the dip. More than $1.1 billion in volume was traded, but by then, the only ones making money were the ones who got in before the public knew what hit them.

Javier deleted his announcement tweet and tried to distance himself. Speaking in Spanish via a post on X, he said:

“A few hours ago I posted a tweet, as I have so many other times, supporting a supposed private enterprise with which I obviously have no connection whatsoever. I was not aware of the details of the project and after having become aware of it I decided not to continue spreading the word (that is why I deleted the tweet). To the filthy rats of the political caste who want to take advantage of this situation to do harm, I want to say that every day they confirm how vile politicians are, and they increase our conviction to kick them in the ass.”

The fallout didn’t stop with $LIBRA. Trump’s infamous meme coin, $TRUMP, lost $500 million in market cap overnight. The entire meme coin market bled out over $6 billion in the aftermath. More than 50,000 wallets held $LIBRA before the collapse, and most of them are worthless as of press time.

On-chain analysts started digging into the wallets behind the biggest dumps. That’s when things got even darker.

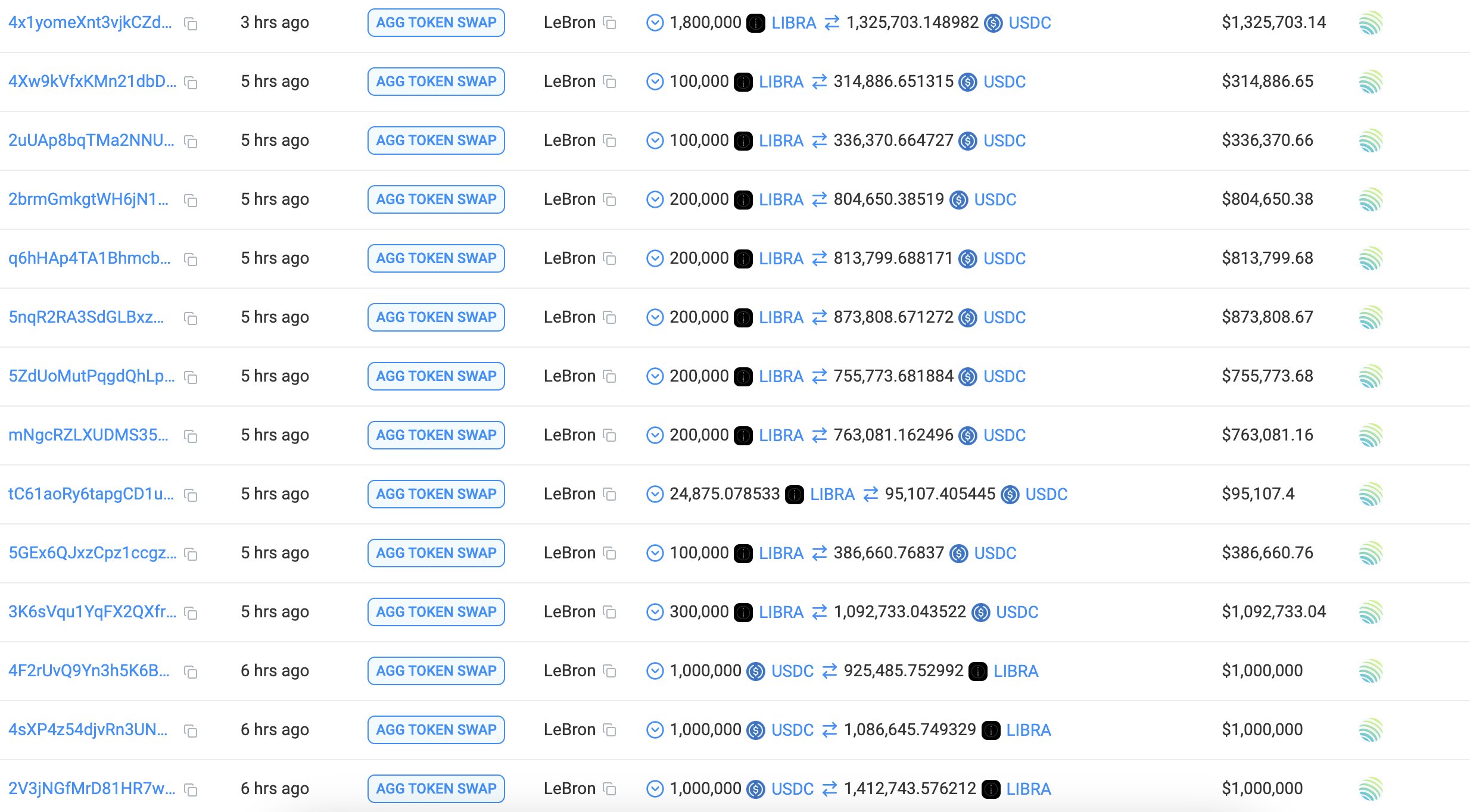

A notorious trader known as LeBron made $4.56 million in a single day from $LIBRA alone, according to data from Lookonchain. His wallet history goes like this: $8.9 million from $MELANIA, $3.2 million from $TRUMP, and $1 million from $HARRYBOLZ.

His $LIBRA play was textbook. He bought 128.8 million tokens for $4,807.19 at an average price of $0.037 per token. Once the price surged, he offloaded in chunks, pocketing a multimillion-dollar return hours before the crash wiped everyone else out.

Crypto Twitter calls out the scam—and the people behind it

Traders weren’t quiet. Crypto Twitter exploded with accusations. One guy said, “This is how the CIA funds itself now. Meme coins are their bread and butter. Stay away from anything unverified and able to be rugged. PERIOD.”

“Can we stop calling these rug pulls? Because by calling it that we are suggesting that it was unexpected,” another user said.

One trader who was particularly furious posted that: “How the f*ck you ret*rds trust a nigga that look like Willy Wonka on a 5-day fenty bender? Y’all deserve to file for Chapter 7 bankruptcy. I don’t think it’s a good idea that presidents of countries launch meme coins.”

Meanwhile, Solana investor Darky said, “Unpopular take but I think $LIBRA was what we needed to finish this meme coin shit meta. Every meme trader has been liquidated. Let the smart money move into alts and AI coins finally.”

That wasn’t all. Moonshot listed $LIBRA before the launch and delisted it right after insiders dumped $100 million. Kelsier Venture, the company allegedly tied to $LIBRA’s creation, was linked to Arunkumar Sugadevan, a notorious Indian serial rug puller. His on-chain footprint connected him to $MELANIA, $ENRON, and OG.Fun—all of which had similar pump-and-dump histories, according to this one investor who said he and his friend lost over $2 million in $LIBRA.

TRON founder Justin Sun also spoke out. Commenting under Javier’s post, Justin said:

“I have great respect for President Milei. I believe that he should take some responsibility in this matter, urging the culprits to return the funds to the victims and assume the corresponding legal responsibilities. Protecting investors is a very serious legal duty, and we must take it seriously.”

Javier built his entire political career on fighting corruption and government abuse. Now, his name is directly tied to the biggest meme coin rug pull in history.

One trader called it out: “Javier made his whole campaign about stopping corruption and people abusing the government to drain resources. Then, once in power, he uses his political position to launch a token for his own personal benefit, to likely make 9 figs.”

Others compared his “I had no idea” defense to previous celebrity rug pulls, especially after rap star Kanye West exposed an influencer a week ago. One user said:

“Kanye posted an offer he refused. He promotes a rug pull. Then says his account was hacked after the rug. We saw the exact same play by Dean Norris. The same thing is done here ‘oops wasn’t me.’ Assange did it too. Rugged $55m from the DAO and blanked the community after.”

The real question? Who was actually behind $LIBRA? And will anyone ever be held accountable?

Cryptopolitan Academy: How to Write a Web3 Resume That Lands Interviews - FREE Cheat Sheet

How did Argentina’s president Javier Milei pull off the largest crypto rug pull in history?

Argentina’s president Javier Milei literally wiped out the meme coin market in just five hours today, and might have incinerated his reputation along with it. Let’s start from the beginning. At exactly 10:01 PM UTC, Javier made a post on X announcing that $LIBRA was launching to “boost Argentina’s economy.”

Of course people weren’t sure if he was serious. Some thought his X account got hacked. Others assumed it was another political stunt. But then, many Argentine politicians confirmed it was real, so as per usual, retail traders dove in headfirst. Within minutes, $LIBRA hit a $4.6 billion market cap.

The whole thing was ridiculous, as meme coins tend to be. There was no whitepaper, no tokenomics, no investor protections, just a basic, terrible-looking website that linked to a Google Form. The pitch on the website’s landing page was, and I quote, “Funding small projects to boost Argentina’s economy.” But the reality turned out to be a blatant liquidity trap.

On-chain data showed the domain was registered hours before launch. No public owner. One-year registration. Multiple restricted domain statuses. Everything about this screamed cash grab.

By the time people started asking questions, it was already too late. Insiders had drained $87.4 million within three hours, according to data from Bubblemaps. 82% of the supply sat in a single cluster.

And then, the real dumping began.

Insiders cashed out as retail traders took the hit

At 10:40 PM UTC, $LIBRA hit its all-time high, and immediately, multiple large holders liquidated millions in minutes, with some pulling in $4 million+ each before the market even caught on. By press time, $LIBRA has fallen below $600,000 in market cap, meaning $4.59 billion is now gone. Yeesh!

The selling was so aggressive that only 27% of transactions were actual sales. That means for every insider dumping millions, there were two retail traders panic-buying the dip. More than $1.1 billion in volume was traded, but by then, the only ones making money were the ones who got in before the public knew what hit them.

Javier deleted his announcement tweet and tried to distance himself. Speaking in Spanish via a post on X, he said:

“A few hours ago I posted a tweet, as I have so many other times, supporting a supposed private enterprise with which I obviously have no connection whatsoever. I was not aware of the details of the project and after having become aware of it I decided not to continue spreading the word (that is why I deleted the tweet). To the filthy rats of the political caste who want to take advantage of this situation to do harm, I want to say that every day they confirm how vile politicians are, and they increase our conviction to kick them in the ass.”

The fallout didn’t stop with $LIBRA. Trump’s infamous meme coin, $TRUMP, lost $500 million in market cap overnight. The entire meme coin market bled out over $6 billion in the aftermath. More than 50,000 wallets held $LIBRA before the collapse, and most of them are worthless as of press time.

On-chain analysts started digging into the wallets behind the biggest dumps. That’s when things got even darker.

A notorious trader known as LeBron made $4.56 million in a single day from $LIBRA alone, according to data from Lookonchain. His wallet history goes like this: $8.9 million from $MELANIA, $3.2 million from $TRUMP, and $1 million from $HARRYBOLZ.

His $LIBRA play was textbook. He bought 128.8 million tokens for $4,807.19 at an average price of $0.037 per token. Once the price surged, he offloaded in chunks, pocketing a multimillion-dollar return hours before the crash wiped everyone else out.

Crypto Twitter calls out the scam—and the people behind it

Traders weren’t quiet. Crypto Twitter exploded with accusations. One guy said, “This is how the CIA funds itself now. Meme coins are their bread and butter. Stay away from anything unverified and able to be rugged. PERIOD.”

“Can we stop calling these rug pulls? Because by calling it that we are suggesting that it was unexpected,” another user said.

One trader who was particularly furious posted that: “How the f*ck you ret*rds trust a nigga that look like Willy Wonka on a 5-day fenty bender? Y’all deserve to file for Chapter 7 bankruptcy. I don’t think it’s a good idea that presidents of countries launch meme coins.”

Meanwhile, Solana investor Darky said, “Unpopular take but I think $LIBRA was what we needed to finish this meme coin shit meta. Every meme trader has been liquidated. Let the smart money move into alts and AI coins finally.”

That wasn’t all. Moonshot listed $LIBRA before the launch and delisted it right after insiders dumped $100 million. Kelsier Venture, the company allegedly tied to $LIBRA’s creation, was linked to Arunkumar Sugadevan, a notorious Indian serial rug puller. His on-chain footprint connected him to $MELANIA, $ENRON, and OG.Fun—all of which had similar pump-and-dump histories, according to this one investor who said he and his friend lost over $2 million in $LIBRA.

TRON founder Justin Sun also spoke out. Commenting under Javier’s post, Justin said:

“I have great respect for President Milei. I believe that he should take some responsibility in this matter, urging the culprits to return the funds to the victims and assume the corresponding legal responsibilities. Protecting investors is a very serious legal duty, and we must take it seriously.”

Javier built his entire political career on fighting corruption and government abuse. Now, his name is directly tied to the biggest meme coin rug pull in history.

One trader called it out: “Javier made his whole campaign about stopping corruption and people abusing the government to drain resources. Then, once in power, he uses his political position to launch a token for his own personal benefit, to likely make 9 figs.”

Others compared his “I had no idea” defense to previous celebrity rug pulls, especially after rap star Kanye West exposed an influencer a week ago. One user said:

“Kanye posted an offer he refused. He promotes a rug pull. Then says his account was hacked after the rug. We saw the exact same play by Dean Norris. The same thing is done here ‘oops wasn’t me.’ Assange did it too. Rugged $55m from the DAO and blanked the community after.”

The real question? Who was actually behind $LIBRA? And will anyone ever be held accountable?

Cryptopolitan Academy: How to Write a Web3 Resume That Lands Interviews - FREE Cheat Sheet