8.3M BTC to Go Illiquid: Fidelity Predicts Bitcoin Supply Crunch

Bitcoin’s future supply could tighten significantly, with asset manager Fidelity forecasting that over 8.3 million BTC BTC $115 551 24h volatility: 0.5% Market cap: $2.30 T Vol. 24h: $39.79 B , roughly 42% of the circulating supply, may become “illiquid” by 2032 if current accumulation trends hold.

Fidelity’s illiquidity projection

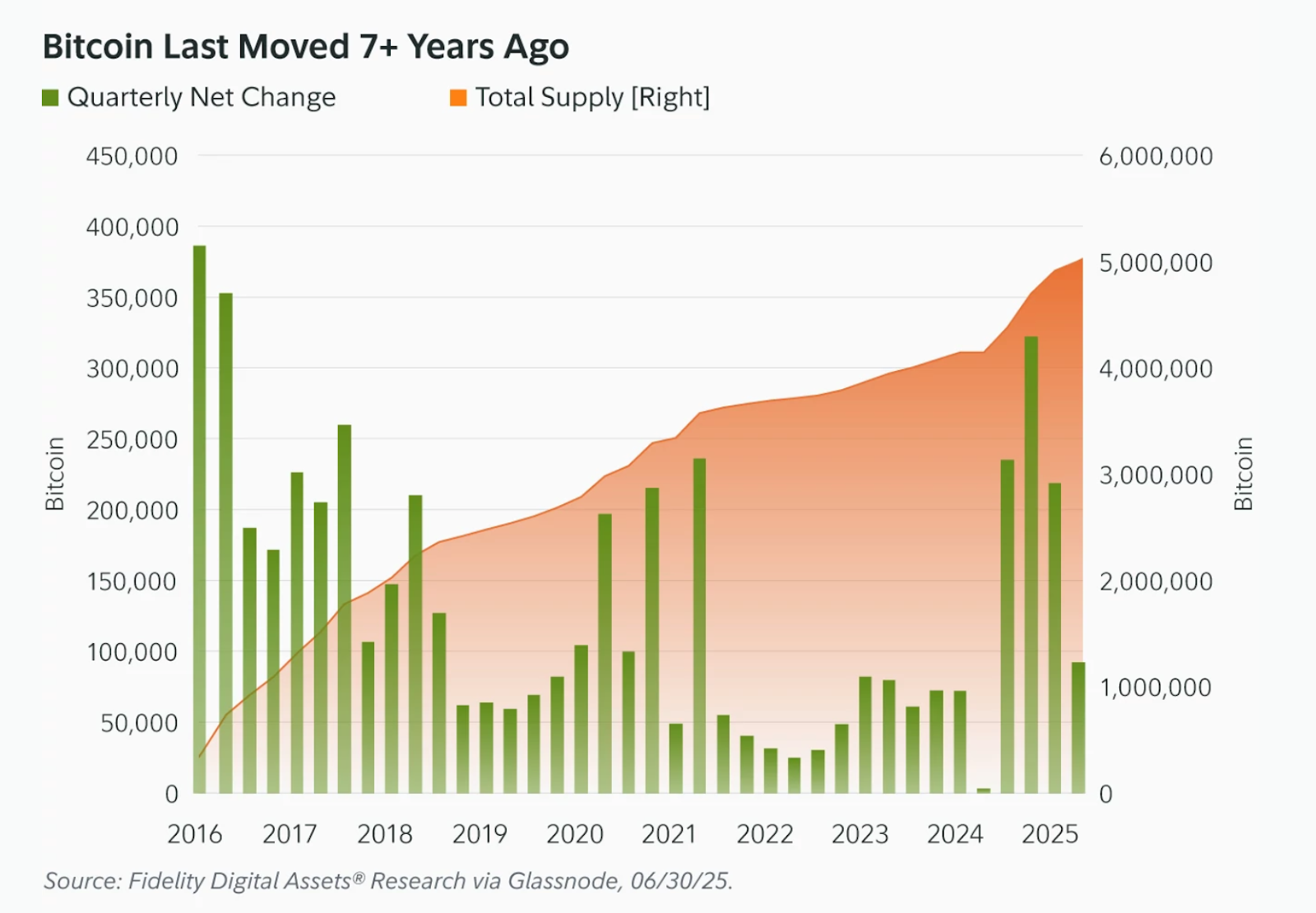

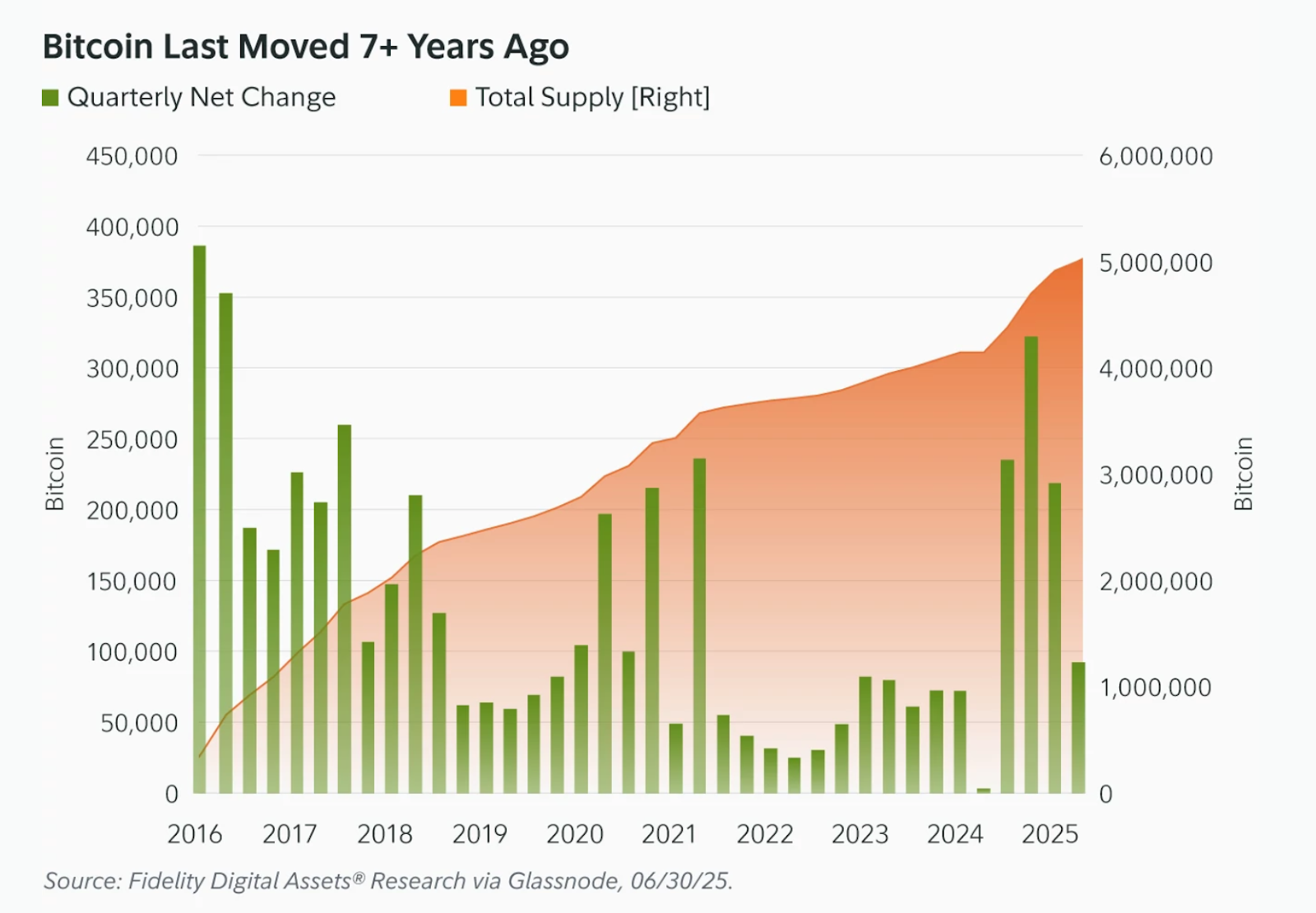

In a report released on Sept. 15, Fidelity identified two cohorts consistently locking up Bitcoin, i.e., long-term holders who haven’t moved coins in at least seven years, and publicly traded companies holding over 1,000 BTC each.

Together, these groups have steadily grown their reserves and show little inclination to sell.

Bitcoin last moved 7+ years ago | Source: Fidelity

8.3m by 2032

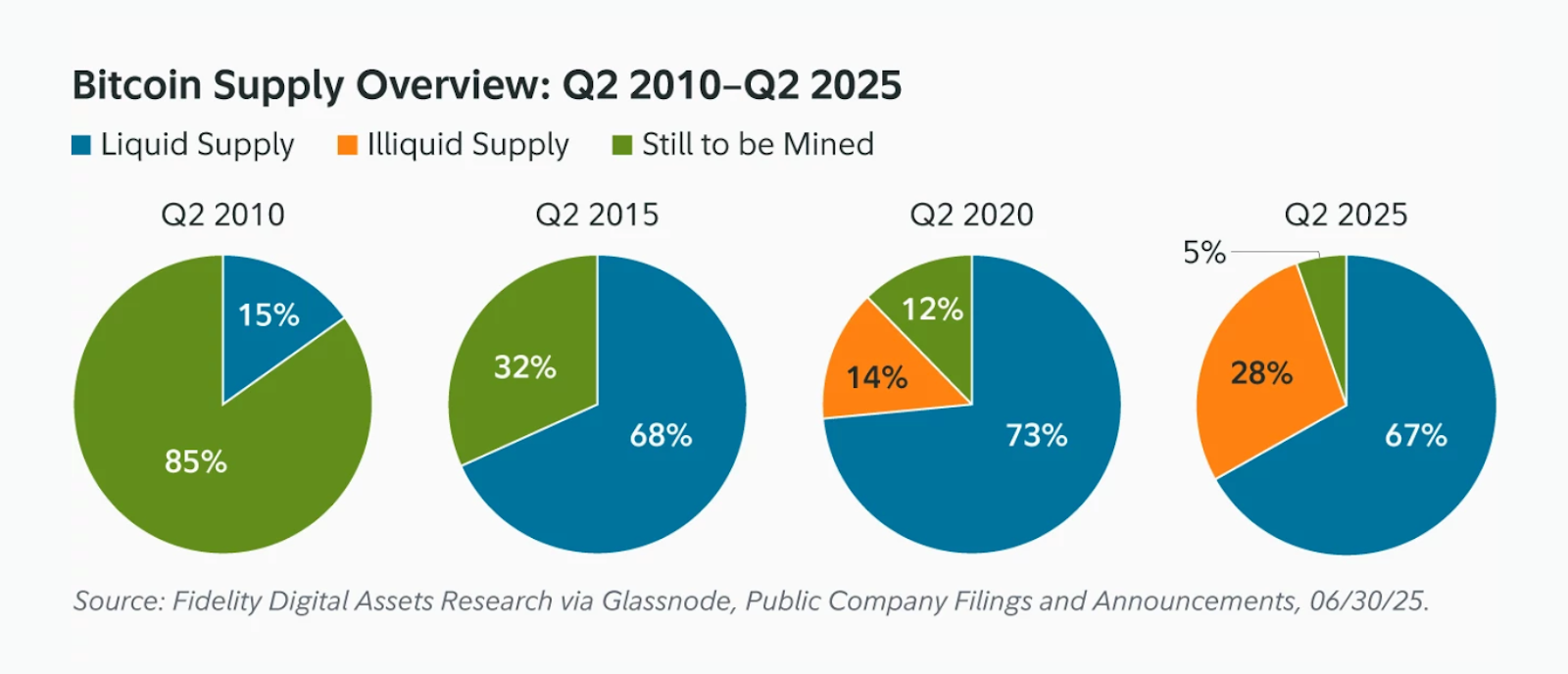

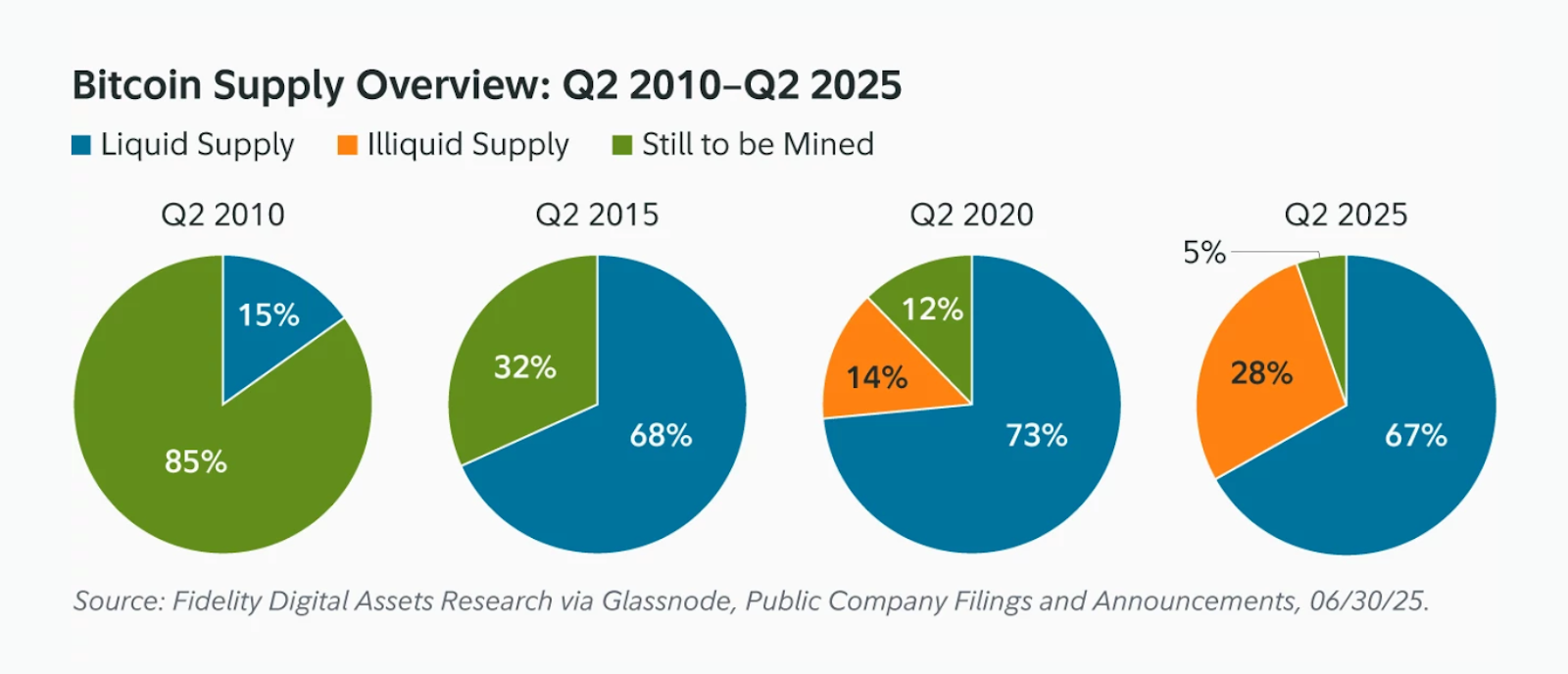

Fidelity projects that by Q2 2025, these entities will control more than six million BTC, around 28% of the total supply. By 2032, the figure could rise to 8.3 million BTC, effectively removing them from open market circulation.

Already, public companies hold nearly 1 million BTC, about 4.6% of supply, with over 105 firms participating.

Bitcoin supply overview: Q2 2010-Q2 2025 | Source: Fidelity

Notably, reduced liquid supply typically strengthens upward pressure. However, it also raises questions about concentration of ownership and the risks if whales decide to sell.

Market pressure despite long-term holding

While Fidelity’s forecast suggests long-term supply reduction, recent data paints a more volatile short-term picture.

Bitcoin whales have offloaded nearly $12.7 billion in the last 30 days, the sharpest sell-off since mid-2022, dragging BTC down 2% over the same period.

$BTC recovery has been fueled by macro momentum, ETF inflows, and futures. Yet weaker spot flows, softer funding, and profit-taking highlight emerging sell pressure, leaving sentiment improved but still fragile.

Read more in this week's Market Pulse👇https://t.co/IQspNhWM22 pic.twitter.com/YiYYoEQtbO

— glassnode (@glassnode) September 15, 2025

Glassnode’s weekly data indicates that Bitcoin’s rebound to $116,000, fueled by ETF inflows and Fed rate-cut anticipation, is facing resistance.

Overbought RSI levels, rising profit-taking, and weakening conviction in spot markets hint at fragility. Futures markets remain active, but softer funding signals waning demand for leveraged longs.

Calm risk environment ahead of fed decision

Interestingly, CryptoQuant’s Bitcoin Risk Index sits at just 23%, suggesting limited probability of sudden liquidations.

Analysts note this mirrors the September–December 2023 period of stability, though all eyes are on the Federal Reserve’s upcoming policy announcement.

Bitcoin Risk Index – the higher the value, the more dangerous the current market configuration relative to the last 3 years, with increased probability of rapid pullbacks/liquidations.

Currently, the index is at a low level of 23%, the environment is calm, probability of sharp… pic.twitter.com/RDSjxfTWVg

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 16, 2025

Looking forward, analysts like Fundstrat’s Tom Lee argue that easing US monetary policy could trigger a major rally in both Bitcoin and Ethereum in Q4, making BTC and ETH as one of the best crypto to buy in 2025.

The post 8.3M BTC to Go Illiquid: Fidelity Predicts Bitcoin Supply Crunch appeared first on Coinspeaker.

8.3M BTC to Go Illiquid: Fidelity Predicts Bitcoin Supply Crunch

Bitcoin’s future supply could tighten significantly, with asset manager Fidelity forecasting that over 8.3 million BTC BTC $115 551 24h volatility: 0.5% Market cap: $2.30 T Vol. 24h: $39.79 B , roughly 42% of the circulating supply, may become “illiquid” by 2032 if current accumulation trends hold.

Fidelity’s illiquidity projection

In a report released on Sept. 15, Fidelity identified two cohorts consistently locking up Bitcoin, i.e., long-term holders who haven’t moved coins in at least seven years, and publicly traded companies holding over 1,000 BTC each.

Together, these groups have steadily grown their reserves and show little inclination to sell.

Bitcoin last moved 7+ years ago | Source: Fidelity

8.3m by 2032

Fidelity projects that by Q2 2025, these entities will control more than six million BTC, around 28% of the total supply. By 2032, the figure could rise to 8.3 million BTC, effectively removing them from open market circulation.

Already, public companies hold nearly 1 million BTC, about 4.6% of supply, with over 105 firms participating.

Bitcoin supply overview: Q2 2010-Q2 2025 | Source: Fidelity

Notably, reduced liquid supply typically strengthens upward pressure. However, it also raises questions about concentration of ownership and the risks if whales decide to sell.

Market pressure despite long-term holding

While Fidelity’s forecast suggests long-term supply reduction, recent data paints a more volatile short-term picture.

Bitcoin whales have offloaded nearly $12.7 billion in the last 30 days, the sharpest sell-off since mid-2022, dragging BTC down 2% over the same period.

$BTC recovery has been fueled by macro momentum, ETF inflows, and futures. Yet weaker spot flows, softer funding, and profit-taking highlight emerging sell pressure, leaving sentiment improved but still fragile.

Read more in this week's Market Pulse👇https://t.co/IQspNhWM22 pic.twitter.com/YiYYoEQtbO

— glassnode (@glassnode) September 15, 2025

Glassnode’s weekly data indicates that Bitcoin’s rebound to $116,000, fueled by ETF inflows and Fed rate-cut anticipation, is facing resistance.

Overbought RSI levels, rising profit-taking, and weakening conviction in spot markets hint at fragility. Futures markets remain active, but softer funding signals waning demand for leveraged longs.

Calm risk environment ahead of fed decision

Interestingly, CryptoQuant’s Bitcoin Risk Index sits at just 23%, suggesting limited probability of sudden liquidations.

Analysts note this mirrors the September–December 2023 period of stability, though all eyes are on the Federal Reserve’s upcoming policy announcement.

Bitcoin Risk Index – the higher the value, the more dangerous the current market configuration relative to the last 3 years, with increased probability of rapid pullbacks/liquidations.

Currently, the index is at a low level of 23%, the environment is calm, probability of sharp… pic.twitter.com/RDSjxfTWVg

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 16, 2025

Looking forward, analysts like Fundstrat’s Tom Lee argue that easing US monetary policy could trigger a major rally in both Bitcoin and Ethereum in Q4, making BTC and ETH as one of the best crypto to buy in 2025.

The post 8.3M BTC to Go Illiquid: Fidelity Predicts Bitcoin Supply Crunch appeared first on Coinspeaker.