SOL Price Targets $250 Resistance — Can Bulls Overcome Pressure?

- Solana price trades at $235, just 6% shy of the critical $250 resistance level.

- Long-term holders are selling at a six-month high, signaling short-term pressure.

- If SOL defends $232 support, momentum could drive a breakout toward $250.

Solana’s rally has carried it right up toward the big $250 mark, a level traders have been watching closely. It’s not just a round number; it’s a psychological line that often acts as either a springboard or a ceiling. But just as SOL inches closer, cracks are showing in its support base.

Long-Term Holders Are Cashing Out

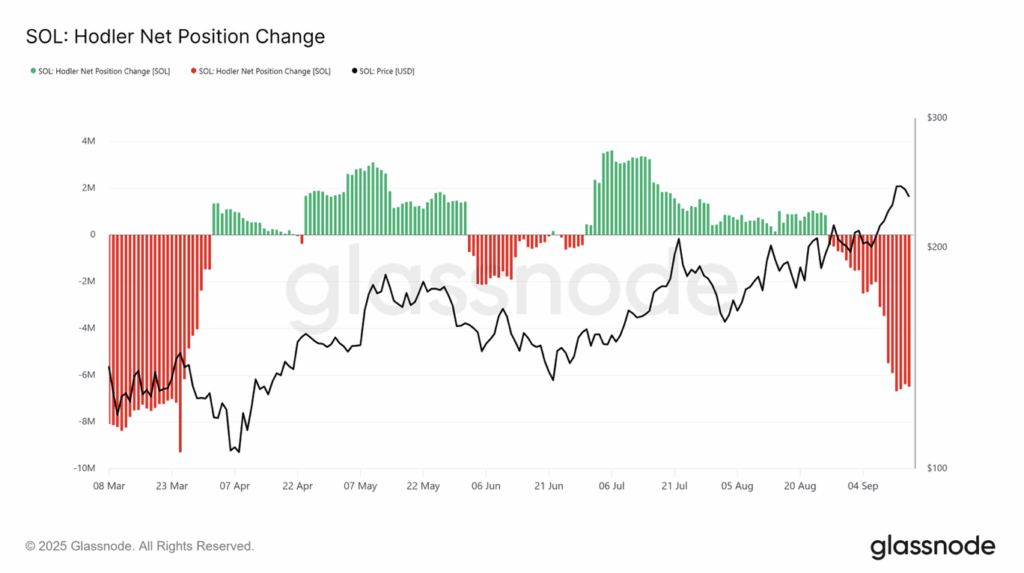

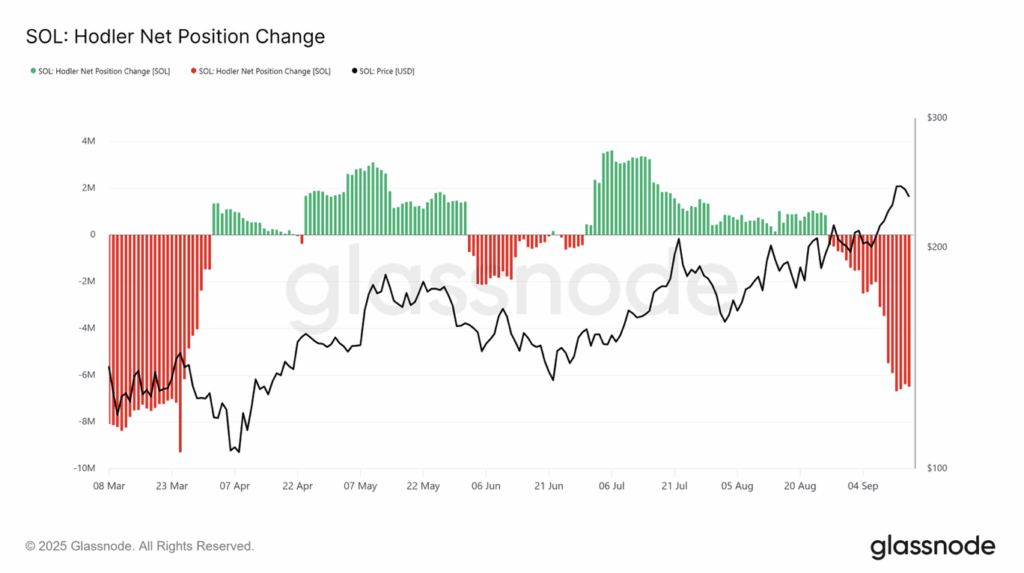

Fresh data from Glassnode shows that Solana’s long-term holders have started unloading their bags. These are the investors who usually keep price trends steady — their buying often fuels recoveries, while their selling tends to shake confidence. Right now, the net position change is at a six-month high for selling, a signal that belief may be fading a little. If this trend stretches on, it could slow down Solana’s momentum and stall the push to $250.

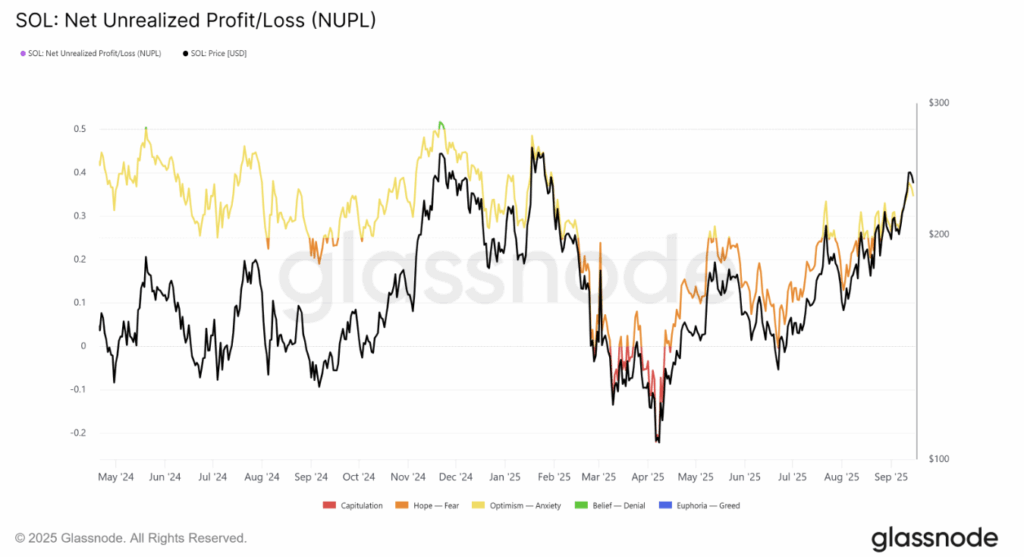

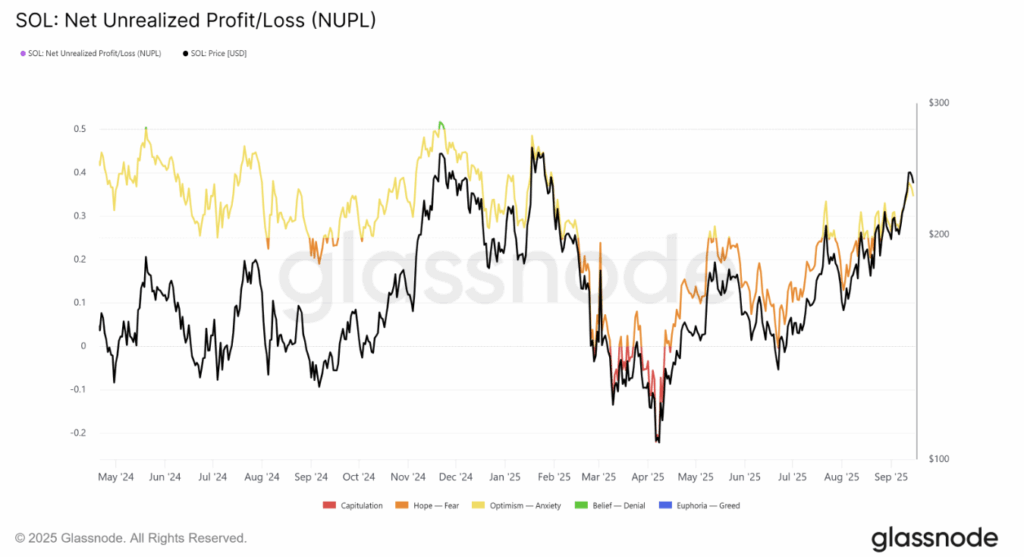

At the same time, Solana’s NUPL (Net Unrealized Profit/Loss) still points to room for growth. Historically, when NUPL climbs toward the 0.5 “Belief–Denial” threshold, markets often flip and corrections arrive. That means Solana might still squeeze in short-term gains before the next big cooldown.

SOL Price Analysis: Key Levels to Watch

As of now, SOL trades around $235 — roughly 6% below the $250 milestone. Over the weekend, it tried but failed to breach the mark, yet it’s still holding above $232 support. If bullish sentiment kicks back in, Solana could rebound from $232, retest $242 resistance, and maybe even push on to $250. But there’s a catch: long-term holder selling needs to ease, otherwise buyers will be fighting an uphill battle.

On the flip side, if those big holders ramp up their exits, the $232 floor may crack. In that case, Solana could slip back toward $221, which would put a dent in the near-term bullish setup and reset market expectations.

Bottom Line

Solana’s path to $250 is alive, but it’s also fragile. The network’s fundamentals are strong, but trader psychology and holder behavior are now in the spotlight. If sellers keep pressing, momentum could fade fast. But if the market holds its ground at current support levels, the door to $250 — and maybe higher — stays wide open.

The post SOL Price Targets $250 Resistance — Can Bulls Overcome Pressure? first appeared on BlockNews.

SOL Price Targets $250 Resistance — Can Bulls Overcome Pressure?

- Solana price trades at $235, just 6% shy of the critical $250 resistance level.

- Long-term holders are selling at a six-month high, signaling short-term pressure.

- If SOL defends $232 support, momentum could drive a breakout toward $250.

Solana’s rally has carried it right up toward the big $250 mark, a level traders have been watching closely. It’s not just a round number; it’s a psychological line that often acts as either a springboard or a ceiling. But just as SOL inches closer, cracks are showing in its support base.

Long-Term Holders Are Cashing Out

Fresh data from Glassnode shows that Solana’s long-term holders have started unloading their bags. These are the investors who usually keep price trends steady — their buying often fuels recoveries, while their selling tends to shake confidence. Right now, the net position change is at a six-month high for selling, a signal that belief may be fading a little. If this trend stretches on, it could slow down Solana’s momentum and stall the push to $250.

At the same time, Solana’s NUPL (Net Unrealized Profit/Loss) still points to room for growth. Historically, when NUPL climbs toward the 0.5 “Belief–Denial” threshold, markets often flip and corrections arrive. That means Solana might still squeeze in short-term gains before the next big cooldown.

SOL Price Analysis: Key Levels to Watch

As of now, SOL trades around $235 — roughly 6% below the $250 milestone. Over the weekend, it tried but failed to breach the mark, yet it’s still holding above $232 support. If bullish sentiment kicks back in, Solana could rebound from $232, retest $242 resistance, and maybe even push on to $250. But there’s a catch: long-term holder selling needs to ease, otherwise buyers will be fighting an uphill battle.

On the flip side, if those big holders ramp up their exits, the $232 floor may crack. In that case, Solana could slip back toward $221, which would put a dent in the near-term bullish setup and reset market expectations.

Bottom Line

Solana’s path to $250 is alive, but it’s also fragile. The network’s fundamentals are strong, but trader psychology and holder behavior are now in the spotlight. If sellers keep pressing, momentum could fade fast. But if the market holds its ground at current support levels, the door to $250 — and maybe higher — stays wide open.

The post SOL Price Targets $250 Resistance — Can Bulls Overcome Pressure? first appeared on BlockNews.