Ethereum Continues Outperforming Institutional Capital Flows As Investors Pour $1,040,000,000 Into Crypto Products: CoinShares

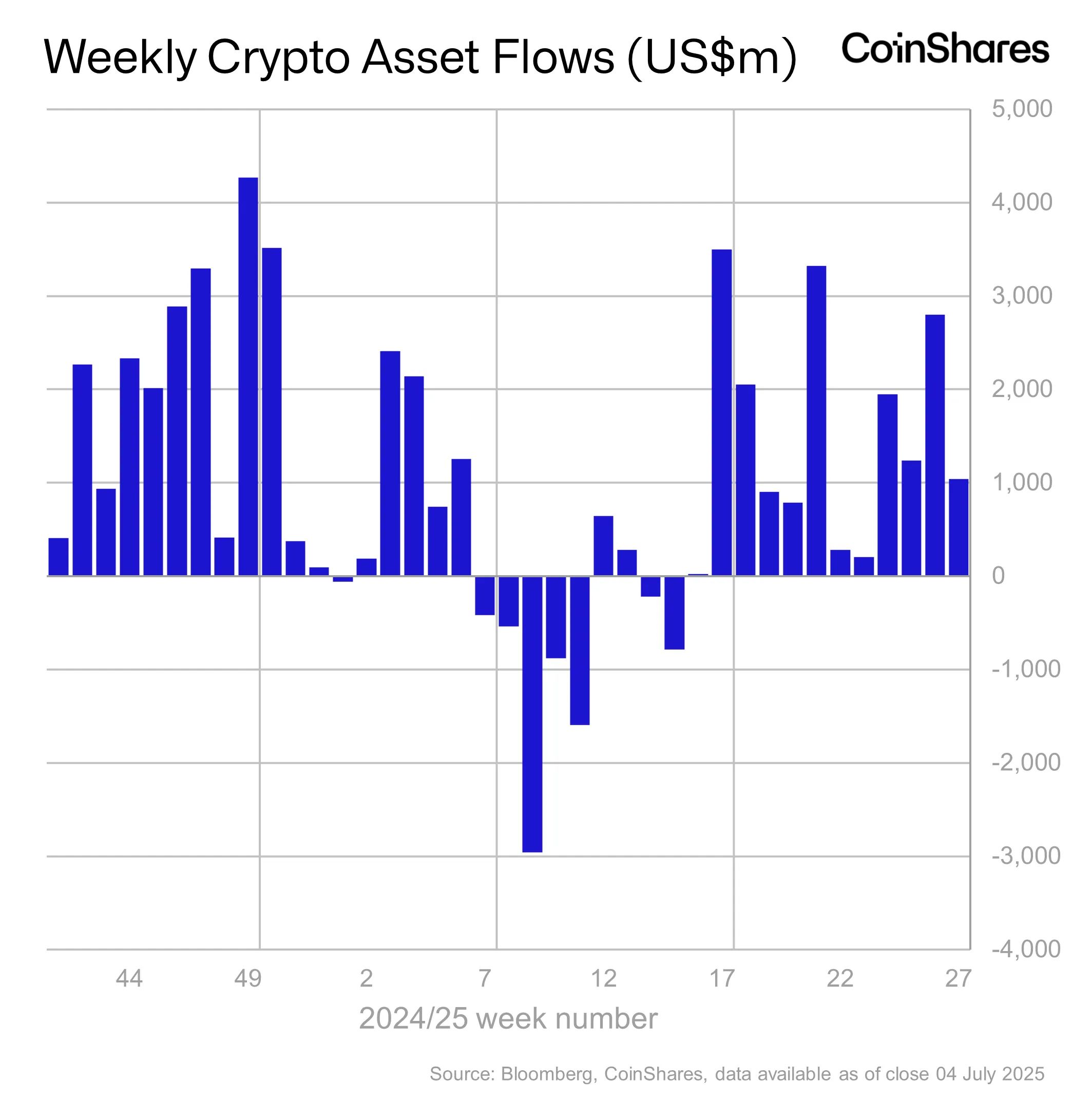

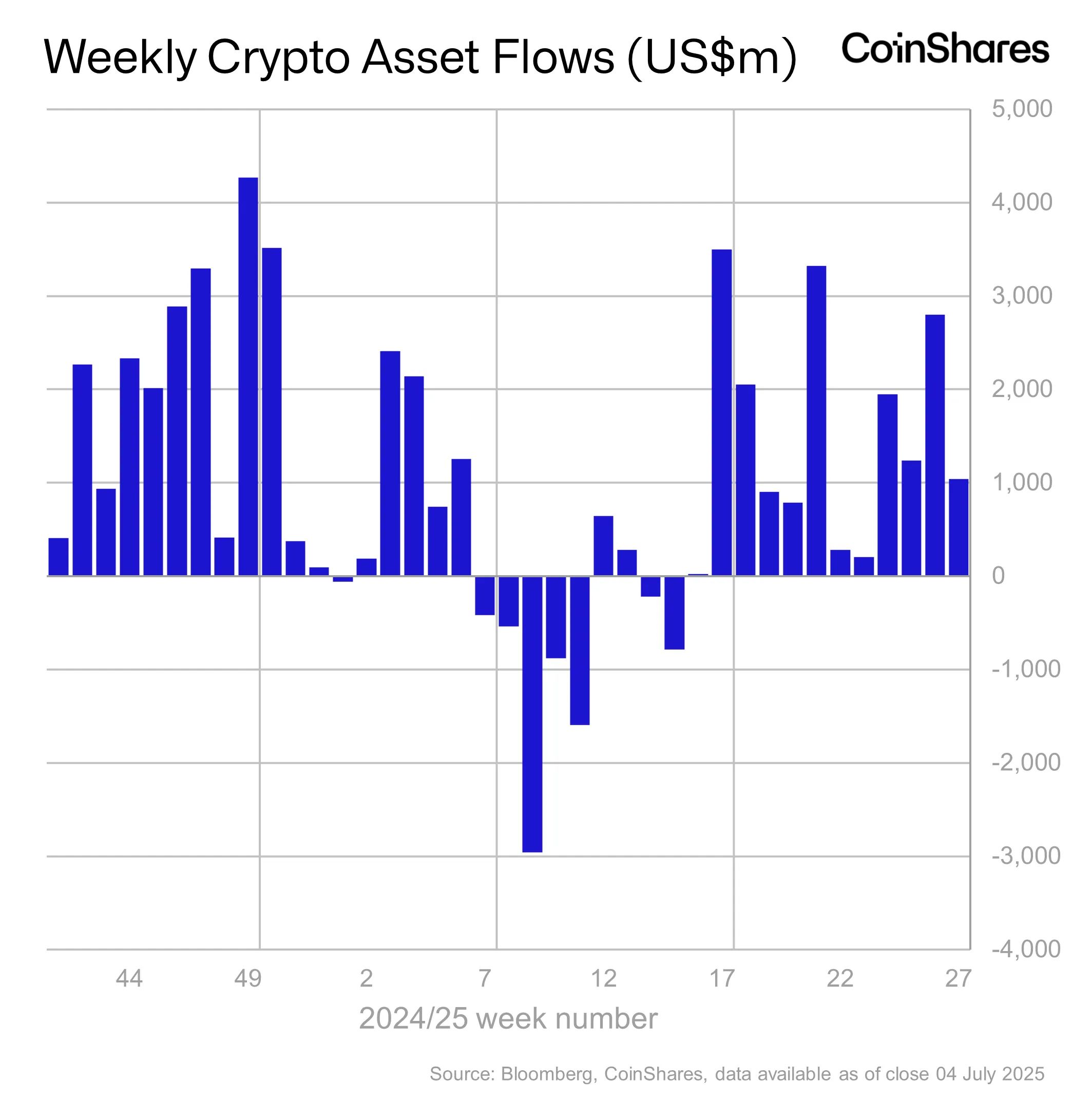

Institutional digital asset investment vehicles have enjoyed over $18 billion in inflows over the last twelve weeks, according to crypto asset management firm CoinShares.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that inflows into institutional crypto investment vehicles in the last twelve weeks have pushed assets under management (AuM) to new all-time highs.

“Digital asset investment products recorded inflows of US$1.04bn last week, marking the 12th consecutive week of inflows, which now total US$18bn. Price gains over the week pushed total assets under management (AuM) to a new all-time high of US$188bn. Trading volumes reached US$16.3bn, in line with the weekly average so far this year.”

Regionally speaking, the US led the charge with $1 billion in inflows. Switzerland and Germany also provided inflows of $33.7 million and $38.5 million. Meanwhile, Canada and Brazil saw outflows of $29.3 million and $9.7 million, respectively.

Bitcoin (BTC), as is the flagship crypto’s custom, enjoyed the biggest inflows, but this time, with a catch.

“Bitcoin investment products saw inflows of US$790m last week, marking a slowdown from the previous three weeks, which averaged US$1.5bn.

The moderation in inflows suggests that investors are becoming more cautious as Bitcoin approaches its all-time high price levels.”

Ethereum (ETH) continued its 11th consecutive week of inflows, adding $226 million in inflows last week alone in a continued outperformance of altcoins.

“On a proportional basis, weekly inflows during this run have averaged 1.6% of AuM, significantly higher than Bitcoin’s 0.8%, highlighting a notable shift in investor sentiment in favor of Ethereum.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/DM7

The post Ethereum Continues Outperforming Institutional Capital Flows As Investors Pour $1,040,000,000 Into Crypto Products: CoinShares appeared first on The Daily Hodl.

Ethereum Continues Outperforming Institutional Capital Flows As Investors Pour $1,040,000,000 Into Crypto Products: CoinShares

Institutional digital asset investment vehicles have enjoyed over $18 billion in inflows over the last twelve weeks, according to crypto asset management firm CoinShares.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that inflows into institutional crypto investment vehicles in the last twelve weeks have pushed assets under management (AuM) to new all-time highs.

“Digital asset investment products recorded inflows of US$1.04bn last week, marking the 12th consecutive week of inflows, which now total US$18bn. Price gains over the week pushed total assets under management (AuM) to a new all-time high of US$188bn. Trading volumes reached US$16.3bn, in line with the weekly average so far this year.”

Regionally speaking, the US led the charge with $1 billion in inflows. Switzerland and Germany also provided inflows of $33.7 million and $38.5 million. Meanwhile, Canada and Brazil saw outflows of $29.3 million and $9.7 million, respectively.

Bitcoin (BTC), as is the flagship crypto’s custom, enjoyed the biggest inflows, but this time, with a catch.

“Bitcoin investment products saw inflows of US$790m last week, marking a slowdown from the previous three weeks, which averaged US$1.5bn.

The moderation in inflows suggests that investors are becoming more cautious as Bitcoin approaches its all-time high price levels.”

Ethereum (ETH) continued its 11th consecutive week of inflows, adding $226 million in inflows last week alone in a continued outperformance of altcoins.

“On a proportional basis, weekly inflows during this run have averaged 1.6% of AuM, significantly higher than Bitcoin’s 0.8%, highlighting a notable shift in investor sentiment in favor of Ethereum.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/DM7

The post Ethereum Continues Outperforming Institutional Capital Flows As Investors Pour $1,040,000,000 Into Crypto Products: CoinShares appeared first on The Daily Hodl.