December Fed Rate Cut: Why Traders See Less Than 50% Chance

Share:

BitcoinWorld

December Fed Rate Cut: Why Traders See Less Than 50% Chance

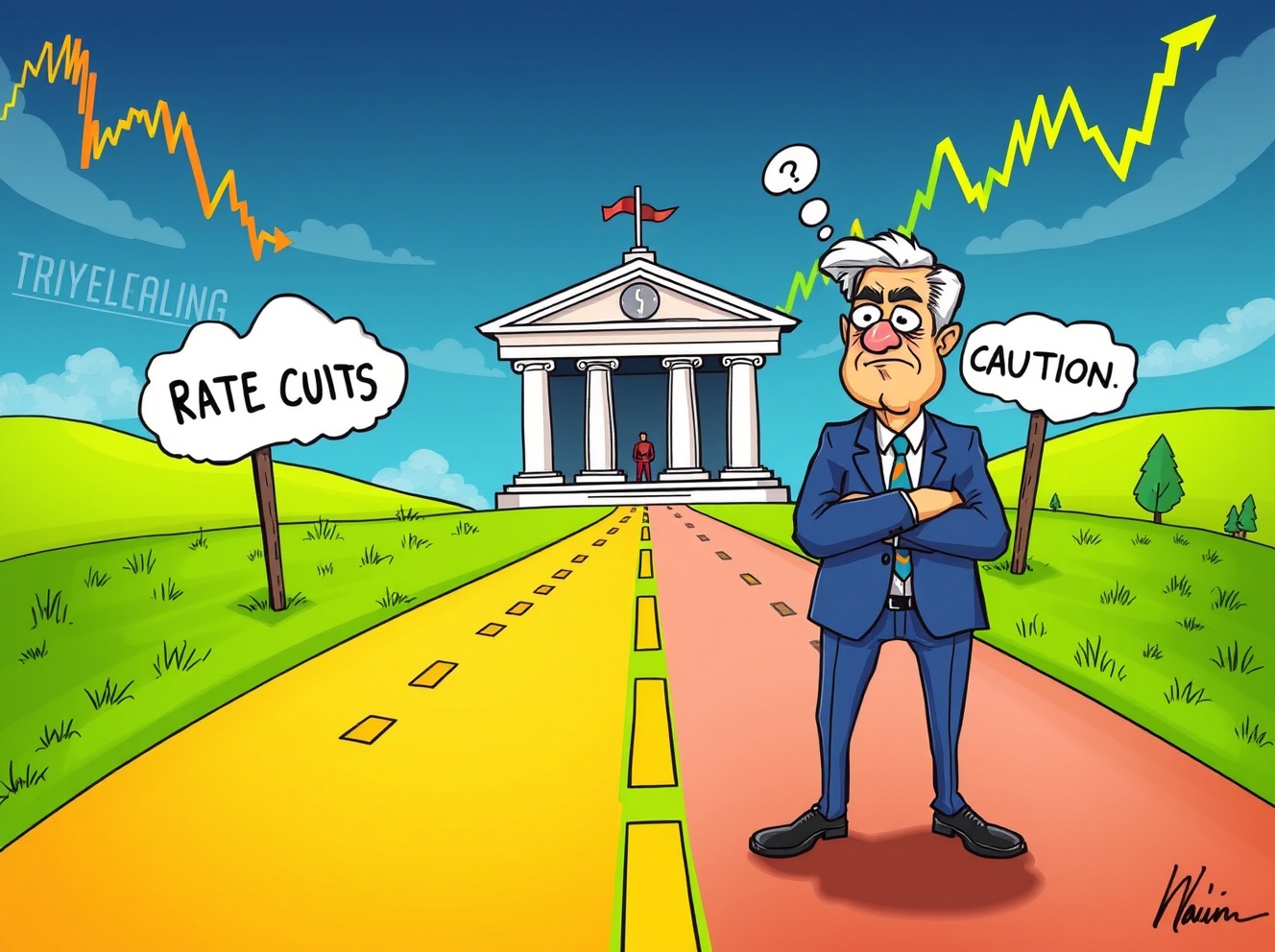

Are you wondering how market expectations for a December Fed rate cut could affect your investments? Recent data shows traders price in less than 50% chance of a December Fed rate cut, signaling a shift in economic outlook that every investor should understand. This development, reported by Walter Bloomberg based on CME trader activity, highlights the cautious stance on monetary policy as we approach the end of the year.

What Does a Less Than 50% Chance of a December Fed Rate Cut Mean?

When traders price in less than 50% chance of a December Fed rate cut, it reflects their collective assessment of economic conditions. Essentially, they believe the Federal Reserve is unlikely to lower interest rates in December due to factors like inflation trends and employment data. This probability is derived from futures contracts on the CME Group’s FedWatch tool, which aggregates market sentiment. Therefore, a lower probability suggests that traders expect the Fed to maintain or even tighten policy, impacting everything from stock prices to cryptocurrency volatility. For instance, if rates stay high, borrowing costs rise, which can dampen economic growth and investor enthusiasm.

Key Factors Influencing the December Fed Rate Cut Odds

Several elements contribute to why traders are skeptical about a December Fed rate cut. Let’s break them down into simple points:

- Inflation Data: Persistent inflation above the Fed’s 2% target makes rate cuts less likely, as the central bank aims to control price stability.

- Employment Strength: A robust job market reduces the urgency for stimulus, supporting higher rates for longer.

- Global Economic Conditions: International events, such as trade tensions or geopolitical risks, can influence the Fed’s decisions.

- Market Volatility: Recent fluctuations in stocks and bonds signal uncertainty, leading traders to adjust their expectations for a December Fed rate cut.

Moreover, the Fed’s previous statements emphasize data dependency, meaning they will wait for clear signs of economic softening before acting. As a result, the current odds highlight a wait-and-see approach that could shape your investment moves.

How Can You Navigate This Uncertainty Around the December Fed Rate Cut?

Facing a low probability of a December Fed rate cut requires strategic thinking. First, diversify your portfolio to include assets that perform well in higher-rate environments, such as certain bonds or defensive stocks. Second, stay updated on economic indicators like CPI reports and Fed meetings, as these can quickly change the odds. Finally, consider consulting financial experts to tailor your approach. By understanding why traders price in less than 50% chance of a December Fed rate cut, you can make informed decisions that protect and grow your wealth in shifting markets.

Conclusion: Stay Ahead of the Curve on the December Fed Rate Cut

In summary, the market’s view on the December Fed rate cut underscores a broader theme of caution in today’s economy. With traders pricing in less than 50% chance, it’s clear that optimism for easing monetary policy is fading. This insight empowers you to anticipate market movements and adjust your strategies accordingly. Remember, knowledge is your best tool in navigating financial uncertainties.

Frequently Asked Questions

Why is the probability of a December Fed rate cut below 50%?

Traders base this on economic data like inflation and employment, which suggest the Fed may hold rates steady to combat price pressures.

How does the December Fed rate cut affect cryptocurrency markets?

Higher interest rates can reduce liquidity and risk appetite, potentially leading to lower crypto prices as investors seek safer assets.

What tools do traders use to predict Fed rate cuts?

They rely on the CME FedWatch Tool, which analyzes futures contracts to gauge market expectations for Federal Reserve actions.

Can the odds of a December Fed rate change quickly?

Yes, new economic reports or Fed announcements can shift probabilities rapidly, so it’s important to monitor updates regularly.

Should I change my investment strategy based on this probability?

While it’s a factor, diversify and focus on long-term goals rather than reacting to short-term market sentiments.

Where can I find reliable updates on the December Fed rate cut?

Follow reputable financial news sources and the Federal Reserve’s official communications for accurate information.

If you found this analysis helpful, share it on social media to help others stay informed about the December Fed rate cut and its market implications!

To learn more about the latest economic trends, explore our article on key developments shaping interest rates and future market dynamics.

This post December Fed Rate Cut: Why Traders See Less Than 50% Chance first appeared on BitcoinWorld.

December Fed Rate Cut: Why Traders See Less Than 50% Chance

Share:

BitcoinWorld

December Fed Rate Cut: Why Traders See Less Than 50% Chance

Are you wondering how market expectations for a December Fed rate cut could affect your investments? Recent data shows traders price in less than 50% chance of a December Fed rate cut, signaling a shift in economic outlook that every investor should understand. This development, reported by Walter Bloomberg based on CME trader activity, highlights the cautious stance on monetary policy as we approach the end of the year.

What Does a Less Than 50% Chance of a December Fed Rate Cut Mean?

When traders price in less than 50% chance of a December Fed rate cut, it reflects their collective assessment of economic conditions. Essentially, they believe the Federal Reserve is unlikely to lower interest rates in December due to factors like inflation trends and employment data. This probability is derived from futures contracts on the CME Group’s FedWatch tool, which aggregates market sentiment. Therefore, a lower probability suggests that traders expect the Fed to maintain or even tighten policy, impacting everything from stock prices to cryptocurrency volatility. For instance, if rates stay high, borrowing costs rise, which can dampen economic growth and investor enthusiasm.

Key Factors Influencing the December Fed Rate Cut Odds

Several elements contribute to why traders are skeptical about a December Fed rate cut. Let’s break them down into simple points:

- Inflation Data: Persistent inflation above the Fed’s 2% target makes rate cuts less likely, as the central bank aims to control price stability.

- Employment Strength: A robust job market reduces the urgency for stimulus, supporting higher rates for longer.

- Global Economic Conditions: International events, such as trade tensions or geopolitical risks, can influence the Fed’s decisions.

- Market Volatility: Recent fluctuations in stocks and bonds signal uncertainty, leading traders to adjust their expectations for a December Fed rate cut.

Moreover, the Fed’s previous statements emphasize data dependency, meaning they will wait for clear signs of economic softening before acting. As a result, the current odds highlight a wait-and-see approach that could shape your investment moves.

How Can You Navigate This Uncertainty Around the December Fed Rate Cut?

Facing a low probability of a December Fed rate cut requires strategic thinking. First, diversify your portfolio to include assets that perform well in higher-rate environments, such as certain bonds or defensive stocks. Second, stay updated on economic indicators like CPI reports and Fed meetings, as these can quickly change the odds. Finally, consider consulting financial experts to tailor your approach. By understanding why traders price in less than 50% chance of a December Fed rate cut, you can make informed decisions that protect and grow your wealth in shifting markets.

Conclusion: Stay Ahead of the Curve on the December Fed Rate Cut

In summary, the market’s view on the December Fed rate cut underscores a broader theme of caution in today’s economy. With traders pricing in less than 50% chance, it’s clear that optimism for easing monetary policy is fading. This insight empowers you to anticipate market movements and adjust your strategies accordingly. Remember, knowledge is your best tool in navigating financial uncertainties.

Frequently Asked Questions

Why is the probability of a December Fed rate cut below 50%?

Traders base this on economic data like inflation and employment, which suggest the Fed may hold rates steady to combat price pressures.

How does the December Fed rate cut affect cryptocurrency markets?

Higher interest rates can reduce liquidity and risk appetite, potentially leading to lower crypto prices as investors seek safer assets.

What tools do traders use to predict Fed rate cuts?

They rely on the CME FedWatch Tool, which analyzes futures contracts to gauge market expectations for Federal Reserve actions.

Can the odds of a December Fed rate change quickly?

Yes, new economic reports or Fed announcements can shift probabilities rapidly, so it’s important to monitor updates regularly.

Should I change my investment strategy based on this probability?

While it’s a factor, diversify and focus on long-term goals rather than reacting to short-term market sentiments.

Where can I find reliable updates on the December Fed rate cut?

Follow reputable financial news sources and the Federal Reserve’s official communications for accurate information.

If you found this analysis helpful, share it on social media to help others stay informed about the December Fed rate cut and its market implications!

To learn more about the latest economic trends, explore our article on key developments shaping interest rates and future market dynamics.

This post December Fed Rate Cut: Why Traders See Less Than 50% Chance first appeared on BitcoinWorld.