Ethereum Price Eyes $2,800 Breakout as Call Options Dominate June 27 Expiry

Ethereum ETH $2 454 24h volatility: 0.9% Market cap: $295.99 B Vol. 24h: $16.02 B is drawing strong trader interest as the June 27 options expiry nears, with open interest piling up at key bullish strikes.

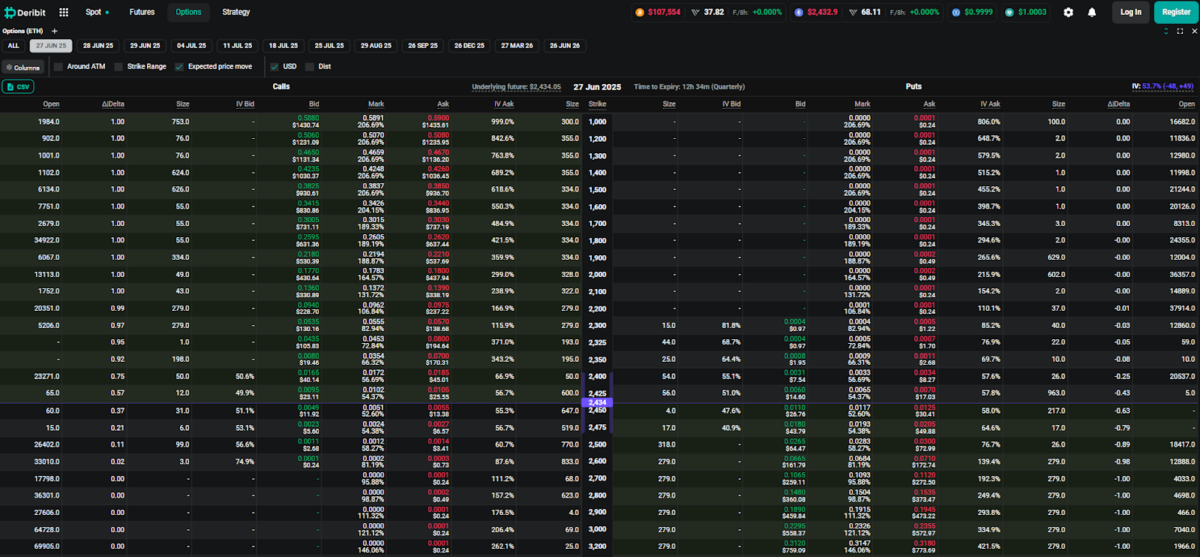

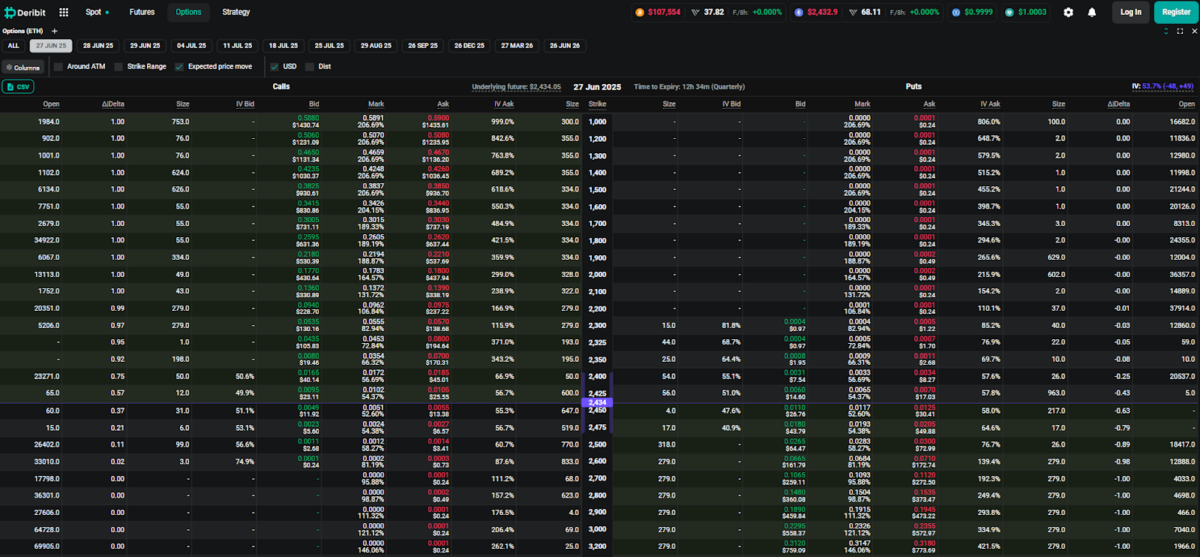

According to Deribit data, call options at the $2,500 and $2,450 levels now lead with 770 and 647 contracts, respectively, marking them as the most active bullish bets heading into expiry.

ETH option chain data | Source: Deribit

ETH price currently trades around $2,438, and the growing concentration near those levels suggests traders are positioning for a breakout. Implied volatility for at-the-money options is hovering around 47%, while the $2,500 strike carries a slightly elevated IV near 56.7%. This reflects expectations of short-term price movement and potential volatility spikes.

On the put side, open interest is thinner by comparison. The highest concentration appears at $2,425, where 665 contracts are open, and $2,450 with 217 contracts, forming a soft short-term support zone. Overall, positioning favors upside, with limited defensive hedging on the downside.

Speculative bets are also appearing at deep out-of-the-money strikes above $3,000, with some contracts showing implied volatility close to 999%.

Ethereum Eyes $2,800 After EMA Reclaim

ETHUSD price dynamics | Source: TradingView

Ethereum price recently bounced from the $2,220–$2,250 support area and reclaimed the 50-day EMA at $2,425. Price is now compressing just under the $2,520–$2,600 resistance zone – an area that repeatedly rejected upside attempts throughout May and early June.

A close above this resistance could trigger a move toward $2,800 and possibly $3,100, aligning with historical supply zones and failed breakout levels. The daily RSI is currently flat near 47, while parabolic SAR dots have flipped below price for the first time in two weeks, suggesting a transition toward bullish momentum.

Volatility is expanding into expiry, with ETH price testing the median Bollinger Band around $2,518. If price breaks cleanly on volume, the next leg could aim for $2,793 or higher in the days following the expiry.

Going to $10,000 this cycle

U heard it here first

— Crypto GEMs 📈🚀 (@cryptogems555) June 26, 2025

Snorter Heats Up As Ethereum Price Eyes Breakout

As Ethereum price coils near $2,600, meme-fueled hype is spilling into fresh launches like Snorter, which is a Solana-based trading bot project now in presale.

With over $1.3M raised and just days left, $SNORT is gaining traction fast. Early buyers get access at $0.0965, with staking perks and DeFi tools built in.

The post Ethereum Price Eyes $2,800 Breakout as Call Options Dominate June 27 Expiry appeared first on Coinspeaker.

Read More

Ethereum Price Trapped in Symmetrical Triangle as Monthly Chart Shows Bearish Double Top

Ethereum Price Eyes $2,800 Breakout as Call Options Dominate June 27 Expiry

Ethereum ETH $2 454 24h volatility: 0.9% Market cap: $295.99 B Vol. 24h: $16.02 B is drawing strong trader interest as the June 27 options expiry nears, with open interest piling up at key bullish strikes.

According to Deribit data, call options at the $2,500 and $2,450 levels now lead with 770 and 647 contracts, respectively, marking them as the most active bullish bets heading into expiry.

ETH option chain data | Source: Deribit

ETH price currently trades around $2,438, and the growing concentration near those levels suggests traders are positioning for a breakout. Implied volatility for at-the-money options is hovering around 47%, while the $2,500 strike carries a slightly elevated IV near 56.7%. This reflects expectations of short-term price movement and potential volatility spikes.

On the put side, open interest is thinner by comparison. The highest concentration appears at $2,425, where 665 contracts are open, and $2,450 with 217 contracts, forming a soft short-term support zone. Overall, positioning favors upside, with limited defensive hedging on the downside.

Speculative bets are also appearing at deep out-of-the-money strikes above $3,000, with some contracts showing implied volatility close to 999%.

Ethereum Eyes $2,800 After EMA Reclaim

ETHUSD price dynamics | Source: TradingView

Ethereum price recently bounced from the $2,220–$2,250 support area and reclaimed the 50-day EMA at $2,425. Price is now compressing just under the $2,520–$2,600 resistance zone – an area that repeatedly rejected upside attempts throughout May and early June.

A close above this resistance could trigger a move toward $2,800 and possibly $3,100, aligning with historical supply zones and failed breakout levels. The daily RSI is currently flat near 47, while parabolic SAR dots have flipped below price for the first time in two weeks, suggesting a transition toward bullish momentum.

Volatility is expanding into expiry, with ETH price testing the median Bollinger Band around $2,518. If price breaks cleanly on volume, the next leg could aim for $2,793 or higher in the days following the expiry.

Going to $10,000 this cycle

U heard it here first

— Crypto GEMs 📈🚀 (@cryptogems555) June 26, 2025

Snorter Heats Up As Ethereum Price Eyes Breakout

As Ethereum price coils near $2,600, meme-fueled hype is spilling into fresh launches like Snorter, which is a Solana-based trading bot project now in presale.

With over $1.3M raised and just days left, $SNORT is gaining traction fast. Early buyers get access at $0.0965, with staking perks and DeFi tools built in.

The post Ethereum Price Eyes $2,800 Breakout as Call Options Dominate June 27 Expiry appeared first on Coinspeaker.

Read More