Bitcoin Whales and Sharks Gobble Up $7,890,599,380 in BTC in Just Six Weeks, Says Analytics Platform – Here’s What It Means

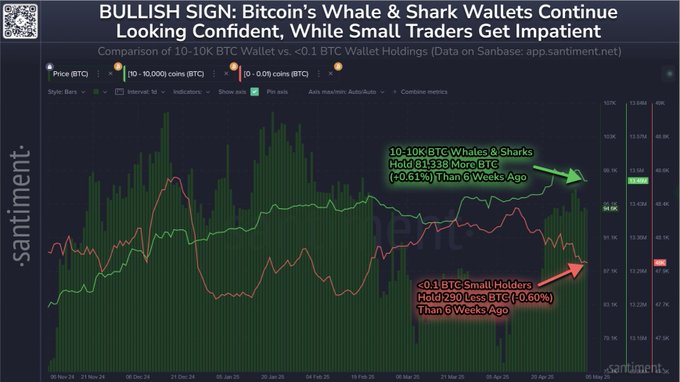

Bitcoin (BTC) whales and sharks have been on an accumulation spree over the past weeks, according to crypto analytics platform Santiment.

The analytics platform says the whales and sharks that hold between 10 to 10,000 Bitcoin have collectively added BTC worth $7.89 billion in about one and a half months.

“As May progresses, Bitcoin’s key stakeholders are mostly moving in the right direction if you’re rooting for $100,000 BTC in the near future.

Wallets with the highest correlation with crypto’s overall market health (10 – 10,000 BTC wallets) have accumulated a combined 81,338 more BTC (+0.61% of their holdings) during these past six weeks of volatility.”

According to Santiment, the accumulation by the Bitcoin investor cohorts is a bullish signal.

“When large wallets gradually accumulate in tandem with retail panic selling/selling out of boredom, it is generally a strong long-term sign of prices biding their time before another breakout.”

The crypto analytics platform further says the holdings of smaller Bitcoin wallets have fallen as the whales and sharks were accumulating.

“Meanwhile, small wallets that tend to have an inverse, lagging correlation to price (wallets with less than 0.1 BTC) have dumped 290 BTC (-0.60% of their holdings) in the past six weeks.”

Turning to Bitcoin exchange-traded funds (ETFs) inflows, Santiment says,

“…Bitcoin ETF inflow money has been sky-high since mid-April. Since April 16th, there has been $5.13 billion moved into collective BTC ETFs, pumping markets.”

Bitcoin is trading at $97,010 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Bitcoin Whales and Sharks Gobble Up $7,890,599,380 in BTC in Just Six Weeks, Says Analytics Platform – Here’s What It Means appeared first on The Daily Hodl.

Bitcoin Whales and Sharks Gobble Up $7,890,599,380 in BTC in Just Six Weeks, Says Analytics Platform – Here’s What It Means

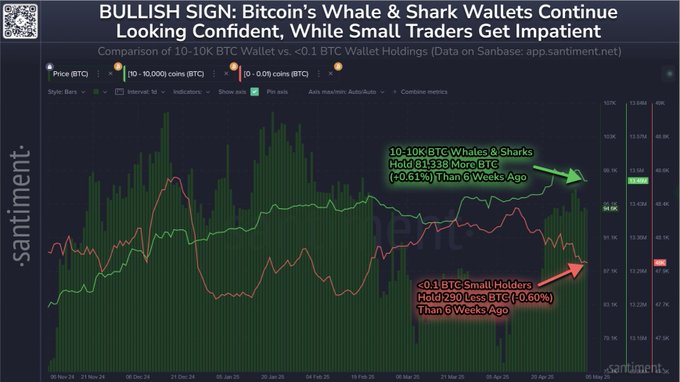

Bitcoin (BTC) whales and sharks have been on an accumulation spree over the past weeks, according to crypto analytics platform Santiment.

The analytics platform says the whales and sharks that hold between 10 to 10,000 Bitcoin have collectively added BTC worth $7.89 billion in about one and a half months.

“As May progresses, Bitcoin’s key stakeholders are mostly moving in the right direction if you’re rooting for $100,000 BTC in the near future.

Wallets with the highest correlation with crypto’s overall market health (10 – 10,000 BTC wallets) have accumulated a combined 81,338 more BTC (+0.61% of their holdings) during these past six weeks of volatility.”

According to Santiment, the accumulation by the Bitcoin investor cohorts is a bullish signal.

“When large wallets gradually accumulate in tandem with retail panic selling/selling out of boredom, it is generally a strong long-term sign of prices biding their time before another breakout.”

The crypto analytics platform further says the holdings of smaller Bitcoin wallets have fallen as the whales and sharks were accumulating.

“Meanwhile, small wallets that tend to have an inverse, lagging correlation to price (wallets with less than 0.1 BTC) have dumped 290 BTC (-0.60% of their holdings) in the past six weeks.”

Turning to Bitcoin exchange-traded funds (ETFs) inflows, Santiment says,

“…Bitcoin ETF inflow money has been sky-high since mid-April. Since April 16th, there has been $5.13 billion moved into collective BTC ETFs, pumping markets.”

Bitcoin is trading at $97,010 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Bitcoin Whales and Sharks Gobble Up $7,890,599,380 in BTC in Just Six Weeks, Says Analytics Platform – Here’s What It Means appeared first on The Daily Hodl.