European trading hours lead global Bitcoin surge in 2024’s first quarter

Quick Take

Bitcoin has experienced a remarkable first quarter in 2024, as reported by Coinglass, with the digital asset surging by an impressive 64% over the quarter and by 13% in March alone.

This surge marks the seventh consecutive month of gains for Bitcoin. The introduction of spot Bitcoin ETFs in the United States has played a significant role, attracting over $12 billion in net inflows.

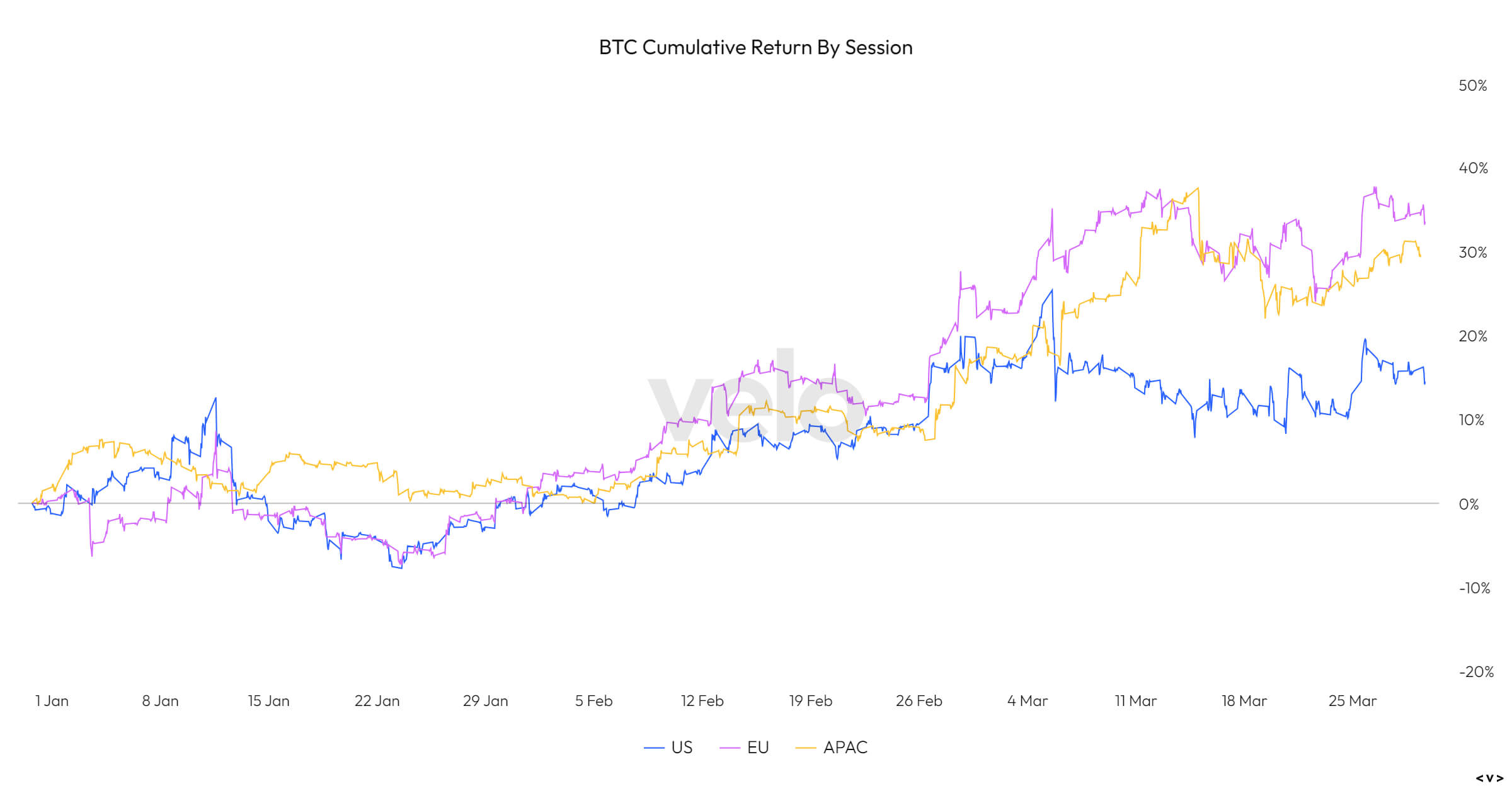

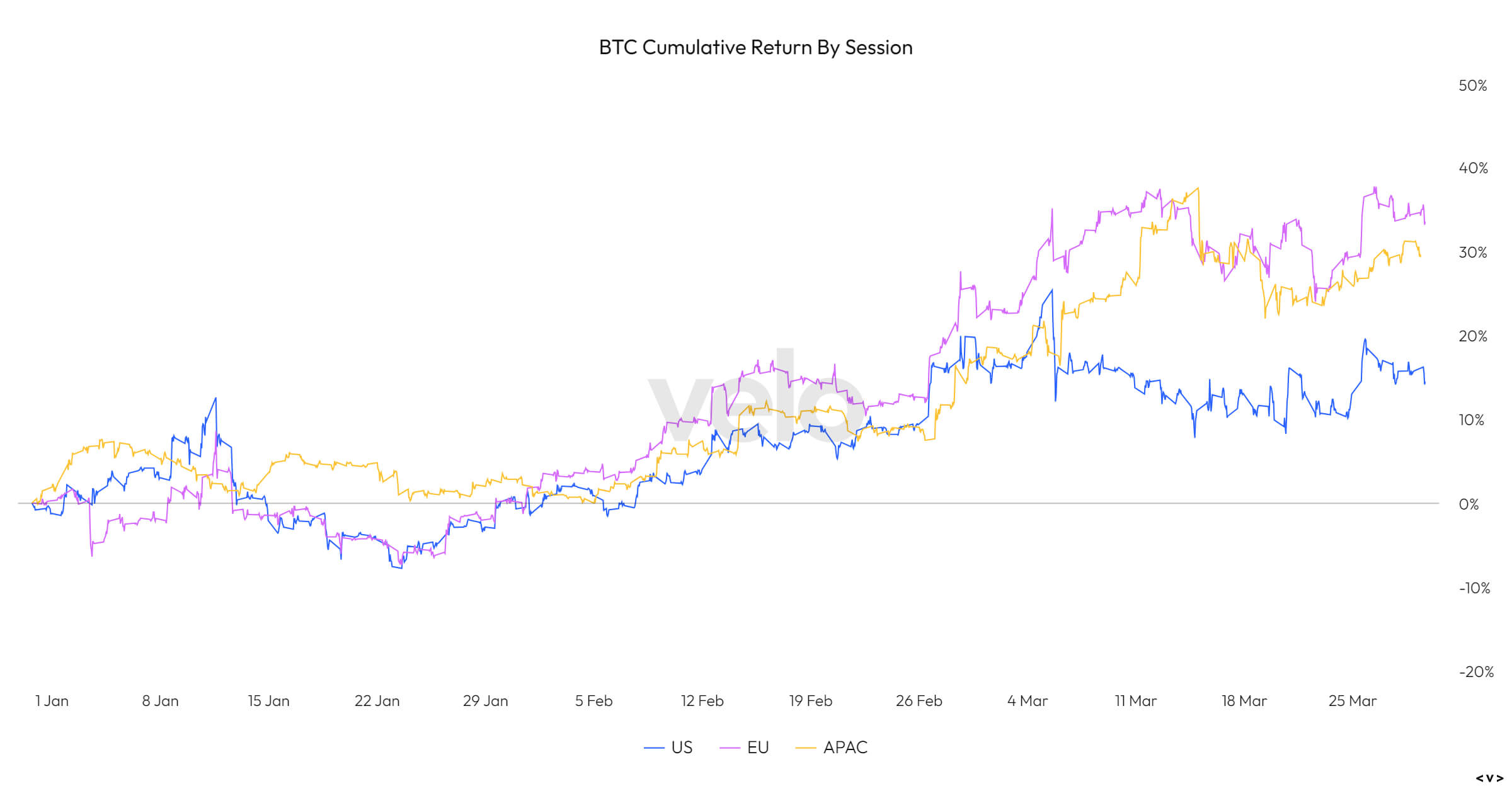

Furthermore, analysis of session data from Velo Data indicates that European trading hours have surpassed both the US and Asia in performance year-to-date. European sessions have seen a 34% increase compared to 30% for Asia and 14% for the US.

Notably, there was a significant spike on March 25, coinciding with the announcement by the London Stock Exchange (LSE) of the launch dates for Bitcoin and Ethereum Exchange Traded Notes (ETNs).

Looking ahead, a number of anticipated bullish events, such as the Bitcoin halving, the launches of LSE ETNs, and the potential introduction of Hong Kong ETFs, are expected to provide further impetus to Bitcoin’s momentum.

The post European trading hours lead global Bitcoin surge in 2024’s first quarter appeared first on CryptoSlate.

European trading hours lead global Bitcoin surge in 2024’s first quarter

Quick Take

Bitcoin has experienced a remarkable first quarter in 2024, as reported by Coinglass, with the digital asset surging by an impressive 64% over the quarter and by 13% in March alone.

This surge marks the seventh consecutive month of gains for Bitcoin. The introduction of spot Bitcoin ETFs in the United States has played a significant role, attracting over $12 billion in net inflows.

Furthermore, analysis of session data from Velo Data indicates that European trading hours have surpassed both the US and Asia in performance year-to-date. European sessions have seen a 34% increase compared to 30% for Asia and 14% for the US.

Notably, there was a significant spike on March 25, coinciding with the announcement by the London Stock Exchange (LSE) of the launch dates for Bitcoin and Ethereum Exchange Traded Notes (ETNs).

Looking ahead, a number of anticipated bullish events, such as the Bitcoin halving, the launches of LSE ETNs, and the potential introduction of Hong Kong ETFs, are expected to provide further impetus to Bitcoin’s momentum.

The post European trading hours lead global Bitcoin surge in 2024’s first quarter appeared first on CryptoSlate.