USDC crosses $16 trillion in volume, driven by Solana’s market share

Circle’s USD Coin (USDC) stablecoin has crossed the $16 trillion mark in total cumulative volume.

While this number falls short of traditional financial powerhouses like Visa, which processed over $12 trillion in payments just last year, it highlights the remarkable growth of stablecoins. Despite their relatively short existence, stablecoins have quickly established themselves as key players in the global financial market.

Stablecoins play an essential role in the crypto ecosystem. They facilitate the smooth transfer of funds, support seamless trading between tokens, and enable payments, especially for cross-border transactions.

Launched in 2018, USDC is the second-largest stablecoin by market capitalization, with $34.6 billion currently in circulation. Circle has strategically positioned USDC as a more regulatory-compliant stablecoin, differentiating it from competitors like USDT.

This approach has contributed to USDC’s dominance in transactions this year, surpassing Tether’s USDT despite having a smaller circulating supply. According to Artemis, USDC now accounts for roughly 50% of the total stablecoin transaction volume.

Solana fuelling USDC’s growth

USDC’s transaction volume is primarily driven by the Solana blockchain, which holds more than three-quarters of the stablecoin market share. Data from DeFiLlama indicates that USDC makes up about 65% of Solana’s $3.98 billion stablecoin supply.

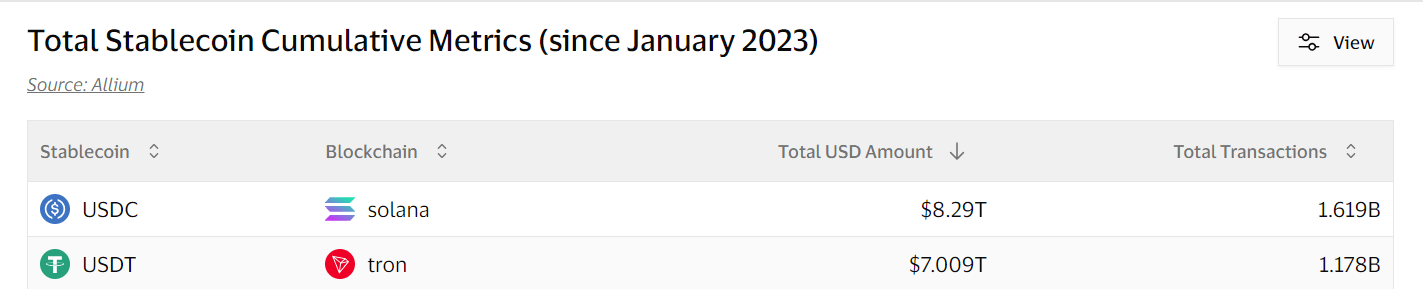

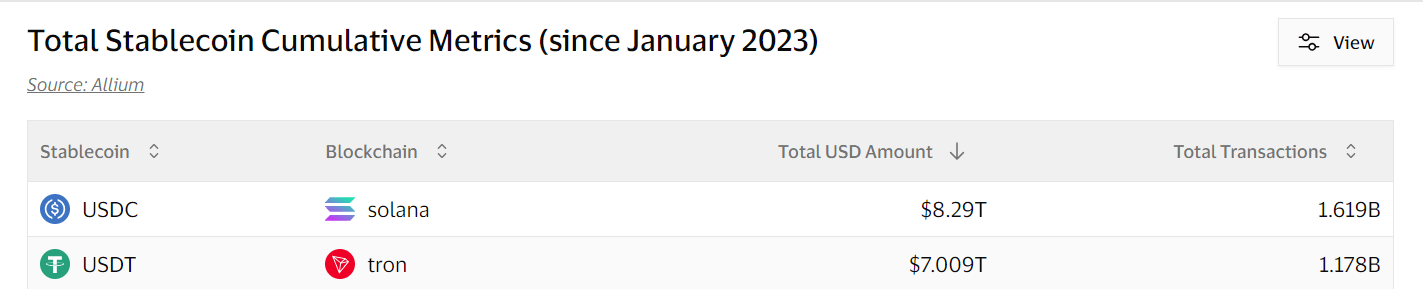

A stablecoin dashboard created by Visa Inc., in collaboration with Allium Labs, shows that USDC’s transaction volume on Solana has soared to approximately $8.29 trillion since the beginning of last year. Its nearest rival, USDT on TRON, saw a volume of $7 trillion during the same timeframe.

This growth isn’t surprising, given Solana’s popularity for its speed and lower transaction costs, which have attracted interest from traditional financial players like PayPal.

The recent surge in memecoin trading and DeFi activities on Solana has further propelled its rise. Over the past few months, the market has even seen instances when trading activity on Solana surpassed Ethereum’s.

The post USDC crosses $16 trillion in volume, driven by Solana’s market share appeared first on CryptoSlate.

USDC crosses $16 trillion in volume, driven by Solana’s market share

Circle’s USD Coin (USDC) stablecoin has crossed the $16 trillion mark in total cumulative volume.

While this number falls short of traditional financial powerhouses like Visa, which processed over $12 trillion in payments just last year, it highlights the remarkable growth of stablecoins. Despite their relatively short existence, stablecoins have quickly established themselves as key players in the global financial market.

Stablecoins play an essential role in the crypto ecosystem. They facilitate the smooth transfer of funds, support seamless trading between tokens, and enable payments, especially for cross-border transactions.

Launched in 2018, USDC is the second-largest stablecoin by market capitalization, with $34.6 billion currently in circulation. Circle has strategically positioned USDC as a more regulatory-compliant stablecoin, differentiating it from competitors like USDT.

This approach has contributed to USDC’s dominance in transactions this year, surpassing Tether’s USDT despite having a smaller circulating supply. According to Artemis, USDC now accounts for roughly 50% of the total stablecoin transaction volume.

Solana fuelling USDC’s growth

USDC’s transaction volume is primarily driven by the Solana blockchain, which holds more than three-quarters of the stablecoin market share. Data from DeFiLlama indicates that USDC makes up about 65% of Solana’s $3.98 billion stablecoin supply.

A stablecoin dashboard created by Visa Inc., in collaboration with Allium Labs, shows that USDC’s transaction volume on Solana has soared to approximately $8.29 trillion since the beginning of last year. Its nearest rival, USDT on TRON, saw a volume of $7 trillion during the same timeframe.

This growth isn’t surprising, given Solana’s popularity for its speed and lower transaction costs, which have attracted interest from traditional financial players like PayPal.

The recent surge in memecoin trading and DeFi activities on Solana has further propelled its rise. Over the past few months, the market has even seen instances when trading activity on Solana surpassed Ethereum’s.

The post USDC crosses $16 trillion in volume, driven by Solana’s market share appeared first on CryptoSlate.