Bitcoin Price Prediction: New ATH Confirmed — Here’s Where BTC Could Be Headed Next

Bitcoin (BTC) has hit a new all time high of $111,087, up 3% in a day and finally breaking above the long held resistance zone of $108,000. The daily close above the highs is a big deal for the crypto markets. BTC is now in a rising channel since April, with higher highs and higher lows.

Technically the breakout is strong. MACD has just given a bullish crossover and the 50 day EMA ($96,956) is rising, the long term trend is strong.

If BTC holds above $113,369, we may see the next resistance levels at $117,141 and $120,913. But price is at the top of the channel so a pullback to $108,000 could be a healthy reset and a second chance long.

Regulation Boosts Investor Confidence

Beyond the charts, Bitcoin’s breakout is being driven by big regulatory tailwinds. In Texas, the state lawmakers approved Senate Bill 21, allowing the state to create a Bitcoin reserve.

Once signed into law, Texas will be the second US state after New Hampshire to hold crypto on its balance sheet, a big step in legitimizing Bitcoin as a treasury asset.

Hong Kong also passed landmark legislation to regulate fiat-referenced stablecoins (FRS), including licensing, AML compliance and reserve management.

This tighter framework will attract institutional capital and solidify Bitcoin as a regulated and strategic hedge in global finance.

These policy changes reduce uncertainty and mean crypto is becoming part of the mainstream financial infrastructure – key for long term adoption and capital inflow.

Macro Tailwinds Fuel Bullish Outlook for Bitcoin

Bitcoin’s rally comes as traditional markets are getting nervous. A disappointing US Treasury auction pushed 20 year bond yields above 5.1%, 10 year and 30 year yields are also spiking.

This bond market chaos is driving investors to Bitcoin as a macro hedge. Geopolitical tensions – tariffs and currency concerns – are also eroding faith in fiat systems.

According to Caroline Bowler of BTC Markets, institutional investors are “reallocating to digital assets”, a trend that is being seen with over $27 billion in BTC inflows since early May.1.1 billion long and leveraged, one trader is all in. ETF flows and whales are buying, $160,000 is no longer a moonshot.

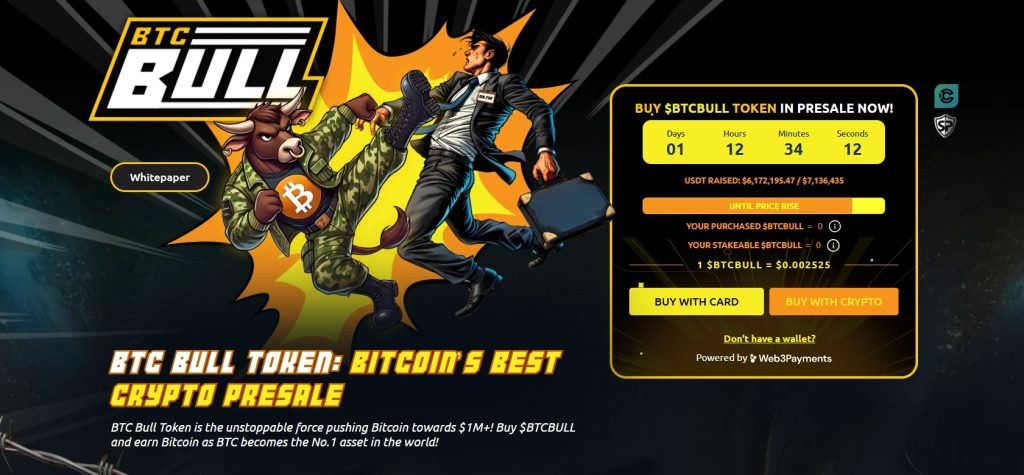

BTC Bull Token Nears $7.14M Cap as 71% Staking Yield Fuels FOMO

As Bitcoin hovers near $111K, attention is rapidly turning to high-upside altcoins — and BTC Bull Token ($BTCBULL) is stealing the spotlight. With $6.17 million raised out of its $7.14 million cap, momentum is accelerating as the next presale price jump closes in fast.

What sets BTCBULL apart is its unique rewards model — token holders receive Bitcoin airdrops directly tied to BTC’s price rallies. The higher Bitcoin climbs, the more BTC gets distributed — with presale buyers receiving priority rewards over post-launch DEX investors.

Key Stats:

- USDT Raised: $6,172,195.39 / $7,136,435

- Token Price: $0.002525

- Staking Pool: 1.47B BTCBULL

- Yield: ~71% APY

Built-in scarcity adds even more firepower: every time Bitcoin rises by $50K, BTC Bull triggers a token burn, reducing supply and increasing upside potential for long-term holders.

Meanwhile, staking is turning heads. BTCBULL offers a whopping ~71% APY on its Ethereum-based staking pool (currently holding 1.47B BTCBULL), with no lockups or withdrawal fees. That means passive yield — with full liquidity.

The post Bitcoin Price Prediction: New ATH Confirmed — Here’s Where BTC Could Be Headed Next appeared first on Cryptonews.

Bitcoin Price Prediction: New ATH Confirmed — Here’s Where BTC Could Be Headed Next

Bitcoin (BTC) has hit a new all time high of $111,087, up 3% in a day and finally breaking above the long held resistance zone of $108,000. The daily close above the highs is a big deal for the crypto markets. BTC is now in a rising channel since April, with higher highs and higher lows.

Technically the breakout is strong. MACD has just given a bullish crossover and the 50 day EMA ($96,956) is rising, the long term trend is strong.

If BTC holds above $113,369, we may see the next resistance levels at $117,141 and $120,913. But price is at the top of the channel so a pullback to $108,000 could be a healthy reset and a second chance long.

Regulation Boosts Investor Confidence

Beyond the charts, Bitcoin’s breakout is being driven by big regulatory tailwinds. In Texas, the state lawmakers approved Senate Bill 21, allowing the state to create a Bitcoin reserve.

Once signed into law, Texas will be the second US state after New Hampshire to hold crypto on its balance sheet, a big step in legitimizing Bitcoin as a treasury asset.

Hong Kong also passed landmark legislation to regulate fiat-referenced stablecoins (FRS), including licensing, AML compliance and reserve management.

This tighter framework will attract institutional capital and solidify Bitcoin as a regulated and strategic hedge in global finance.

These policy changes reduce uncertainty and mean crypto is becoming part of the mainstream financial infrastructure – key for long term adoption and capital inflow.

Macro Tailwinds Fuel Bullish Outlook for Bitcoin

Bitcoin’s rally comes as traditional markets are getting nervous. A disappointing US Treasury auction pushed 20 year bond yields above 5.1%, 10 year and 30 year yields are also spiking.

This bond market chaos is driving investors to Bitcoin as a macro hedge. Geopolitical tensions – tariffs and currency concerns – are also eroding faith in fiat systems.

According to Caroline Bowler of BTC Markets, institutional investors are “reallocating to digital assets”, a trend that is being seen with over $27 billion in BTC inflows since early May.1.1 billion long and leveraged, one trader is all in. ETF flows and whales are buying, $160,000 is no longer a moonshot.

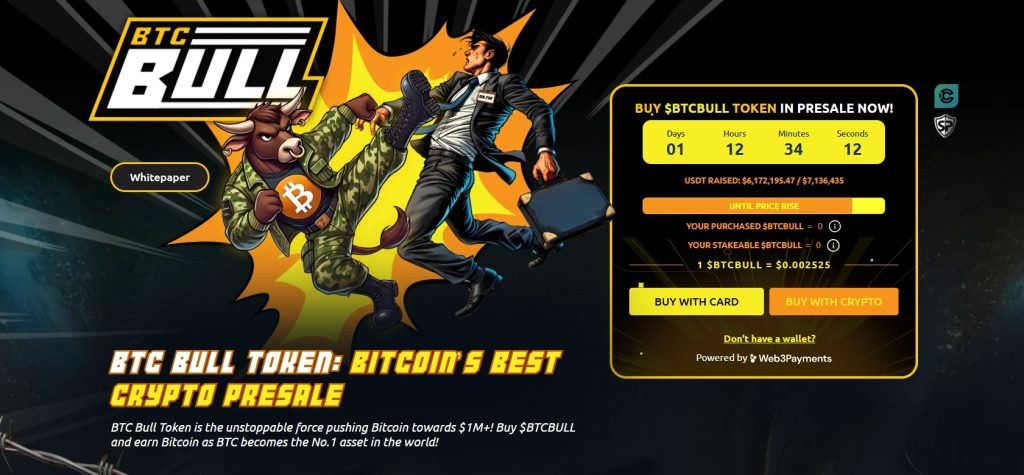

BTC Bull Token Nears $7.14M Cap as 71% Staking Yield Fuels FOMO

As Bitcoin hovers near $111K, attention is rapidly turning to high-upside altcoins — and BTC Bull Token ($BTCBULL) is stealing the spotlight. With $6.17 million raised out of its $7.14 million cap, momentum is accelerating as the next presale price jump closes in fast.

What sets BTCBULL apart is its unique rewards model — token holders receive Bitcoin airdrops directly tied to BTC’s price rallies. The higher Bitcoin climbs, the more BTC gets distributed — with presale buyers receiving priority rewards over post-launch DEX investors.

Key Stats:

- USDT Raised: $6,172,195.39 / $7,136,435

- Token Price: $0.002525

- Staking Pool: 1.47B BTCBULL

- Yield: ~71% APY

Built-in scarcity adds even more firepower: every time Bitcoin rises by $50K, BTC Bull triggers a token burn, reducing supply and increasing upside potential for long-term holders.

Meanwhile, staking is turning heads. BTCBULL offers a whopping ~71% APY on its Ethereum-based staking pool (currently holding 1.47B BTCBULL), with no lockups or withdrawal fees. That means passive yield — with full liquidity.

The post Bitcoin Price Prediction: New ATH Confirmed — Here’s Where BTC Could Be Headed Next appeared first on Cryptonews.

The Texas House has officially passed the Strategic Bitcoin Reserve Bill (SB21).

The Texas House has officially passed the Strategic Bitcoin Reserve Bill (SB21). $110K BITCOIN HAS ENTERED THE CHAT

$110K BITCOIN HAS ENTERED THE CHAT  (@BitgetPH)

(@BitgetPH)