Circle takes crypto security to the next level – Here is how

Circle, the leading global financial technology firm, has taken cryptocurrency security to a whole new level. The company is known for its stablecoin, USDC, which is backed 1:1 by the US dollar.

This stablecoin has proven to be a game-changer in the world of digital finance, providing users with a seamless and secure way to move funds between traditional banking systems and blockchain-based finance.

Circle says it has spent years building banking relationships, financial infrastructure, and a regulation-first approach to operating USDC and managing the reserve.

This has enabled the company to build a stablecoin that is not only trusted but also highly secure.

Circle focuses on building a secure USDC reserve

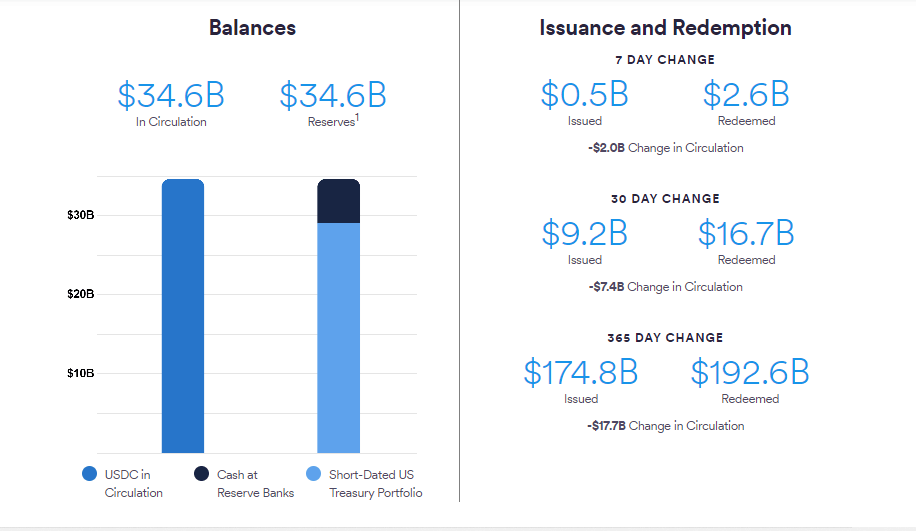

The USDC reserve is the backbone of the stablecoin, and Circle has taken great care to ensure that it is secure and transparent. The reserve is held ~80% in short-dated U.S. Treasuries and ~20% in cash deposits within the U.S. banking system.

Short-dated U.S. Treasuries are widely recognized as the most liquid assets in the world and carry the full faith and credit of the United States.

The Treasuries in the USDC reserve are held in an SEC-regulated, wholly-owned, government money fund structure. They are not subject to any lock-ups or redemption gates, and there is daily independent, third-party reporting on this portfolio, down to each individual security.

Circle also holds ~20% of the reserve in cash to satisfy the immediate liquidity needs of its customers. Following multiple recent bank failures, Circle has taken steps to reduce risk from the banking system by holding substantially all of the cash portions of the reserve at one of the world’s 30 global systemically important banks, also known as a GSIB.

These banks are widely recognized as the safest banks, with the highest capital, liquidity, and supervisory requirements in the world. The company also holds modest funds at its transaction banking partners in support of USDC liquidity operations.

Circle’s aspiration for tokenized cash

Circle has always aspired to hold the cash portion of the USDC reserve directly with the Federal Reserve, fulfilling its vision of USDC as true tokenized cash. To do so will require stablecoin legislation.

Since the company’s founding in 2013, the company has been at the forefront of calls for federal regulation of the digital asset industry, and it is optimistic that Congress will act.

The USDC reserve is held in segregated accounts for the benefit of USDC holders. By law and regulation, Circle cannot use the USDC reserve for corporate purposes.

In the unlikely case of a Circle bankruptcy, the USDC reserve would remain segregated for USDC holders and would not be part of the bankruptcy estate.

In the unlikely case of any reserve deficit, Circle stands behind USDC and its obligations to USDC holders, with all its corporate resources (current corporate cash is in excess of $800 million, and Circle is a profitable business), and with external capital if necessary.

Circle’s commitment to security, transparency, and trust has set a new standard for cryptocurrency. The company’s stablecoin, USDC, has become the go-to choice for millions of users around the world, and its success is a testament to the company’s dedication to innovation and excellence in the digital finance industry.

Circle takes crypto security to the next level – Here is how

Circle, the leading global financial technology firm, has taken cryptocurrency security to a whole new level. The company is known for its stablecoin, USDC, which is backed 1:1 by the US dollar.

This stablecoin has proven to be a game-changer in the world of digital finance, providing users with a seamless and secure way to move funds between traditional banking systems and blockchain-based finance.

Circle says it has spent years building banking relationships, financial infrastructure, and a regulation-first approach to operating USDC and managing the reserve.

This has enabled the company to build a stablecoin that is not only trusted but also highly secure.

Circle focuses on building a secure USDC reserve

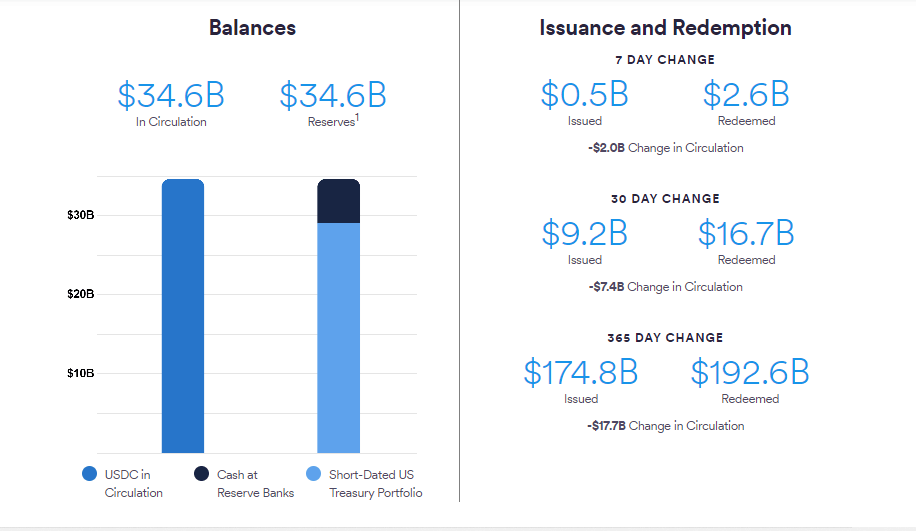

The USDC reserve is the backbone of the stablecoin, and Circle has taken great care to ensure that it is secure and transparent. The reserve is held ~80% in short-dated U.S. Treasuries and ~20% in cash deposits within the U.S. banking system.

Short-dated U.S. Treasuries are widely recognized as the most liquid assets in the world and carry the full faith and credit of the United States.

The Treasuries in the USDC reserve are held in an SEC-regulated, wholly-owned, government money fund structure. They are not subject to any lock-ups or redemption gates, and there is daily independent, third-party reporting on this portfolio, down to each individual security.

Circle also holds ~20% of the reserve in cash to satisfy the immediate liquidity needs of its customers. Following multiple recent bank failures, Circle has taken steps to reduce risk from the banking system by holding substantially all of the cash portions of the reserve at one of the world’s 30 global systemically important banks, also known as a GSIB.

These banks are widely recognized as the safest banks, with the highest capital, liquidity, and supervisory requirements in the world. The company also holds modest funds at its transaction banking partners in support of USDC liquidity operations.

Circle’s aspiration for tokenized cash

Circle has always aspired to hold the cash portion of the USDC reserve directly with the Federal Reserve, fulfilling its vision of USDC as true tokenized cash. To do so will require stablecoin legislation.

Since the company’s founding in 2013, the company has been at the forefront of calls for federal regulation of the digital asset industry, and it is optimistic that Congress will act.

The USDC reserve is held in segregated accounts for the benefit of USDC holders. By law and regulation, Circle cannot use the USDC reserve for corporate purposes.

In the unlikely case of a Circle bankruptcy, the USDC reserve would remain segregated for USDC holders and would not be part of the bankruptcy estate.

In the unlikely case of any reserve deficit, Circle stands behind USDC and its obligations to USDC holders, with all its corporate resources (current corporate cash is in excess of $800 million, and Circle is a profitable business), and with external capital if necessary.

Circle’s commitment to security, transparency, and trust has set a new standard for cryptocurrency. The company’s stablecoin, USDC, has become the go-to choice for millions of users around the world, and its success is a testament to the company’s dedication to innovation and excellence in the digital finance industry.