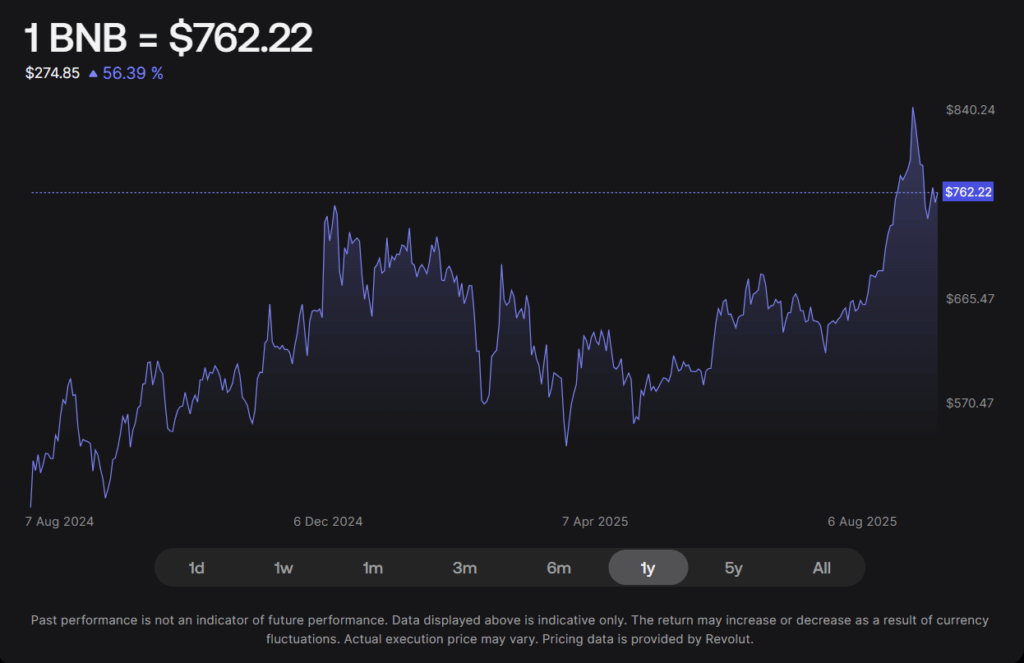

BNB Holds Strong After Testing $750 Support

- BNB rebounded from a $746 low to near $760 after strong buying volume signaled robust support.

- Corporate treasury purchases and Binance platform upgrades are bolstering investor confidence.

- BNB’s modest 10% drawdown from all-time highs outperforms most exchange tokens, keeping its technical trend intact.

BNB has rebounded from a sharp intraday drop to $746.29, where heavy buying volume—over 105,000 tokens traded—helped establish a firm support base. The token is now hovering near $760, showing resilience despite broader market weakness from geopolitical tensions and macroeconomic uncertainty. This recovery reflects strong demand at key price levels, particularly from both retail traders and corporate buyers.

Corporate Accumulation Boosts Stability

Several companies, including CEA Industries, Windtree Therapeutics, and Nano Labs, have recently added BNB to their treasuries, underscoring growing institutional interest. Binance has also strengthened its platform with a new web version of its wallet and expanded bitcoin options offerings. These moves appear to be reinforcing confidence in BNB’s long-term position in the exchange token market.

Outperforming the Exchange Token Sector

Compared to other exchange tokens that are still 30–60% off their highs, BNB’s 10% pullback from its $861 peak positions it among the sector’s most stable assets, alongside LEO. BNB currently commands an 81.4% dominance of the exchange token market capitalization, according to CryptoQuant data, further highlighting its leading role.

Technical Momentum Building

From its $746 low, BNB has been forming a pattern of higher lows, signaling improving sentiment and buying momentum. Two volume-backed bounces have reinforced this bullish shift, with price now consolidating near $760. If this pattern holds, a push toward the $770–$780 resistance zone could follow, provided market conditions remain supportive.

The post BNB Holds Strong After Testing $750 Support first appeared on BlockNews.

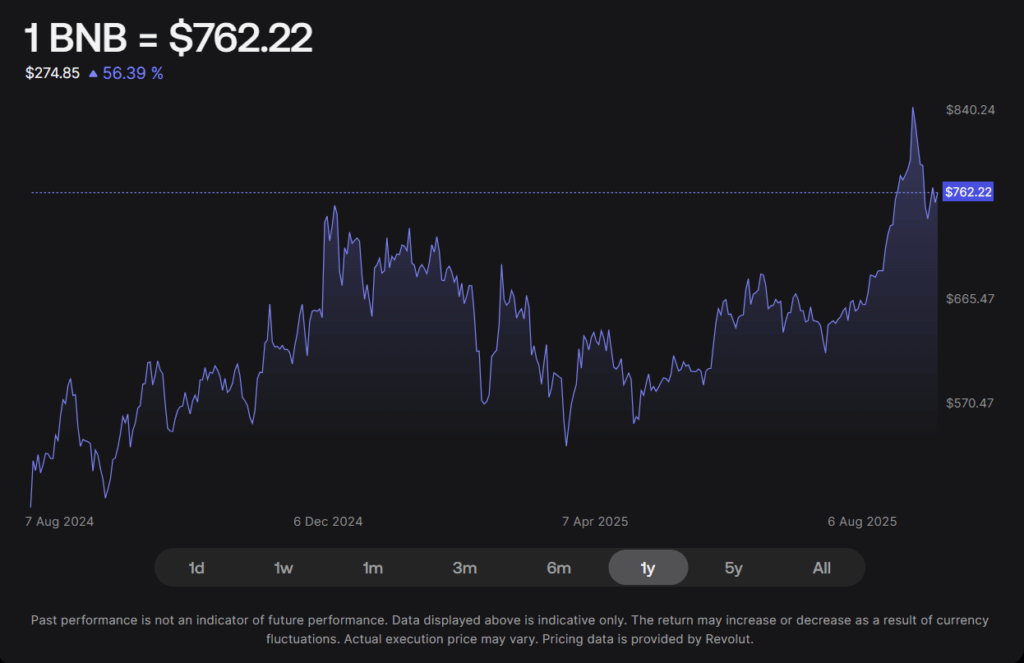

BNB Holds Strong After Testing $750 Support

- BNB rebounded from a $746 low to near $760 after strong buying volume signaled robust support.

- Corporate treasury purchases and Binance platform upgrades are bolstering investor confidence.

- BNB’s modest 10% drawdown from all-time highs outperforms most exchange tokens, keeping its technical trend intact.

BNB has rebounded from a sharp intraday drop to $746.29, where heavy buying volume—over 105,000 tokens traded—helped establish a firm support base. The token is now hovering near $760, showing resilience despite broader market weakness from geopolitical tensions and macroeconomic uncertainty. This recovery reflects strong demand at key price levels, particularly from both retail traders and corporate buyers.

Corporate Accumulation Boosts Stability

Several companies, including CEA Industries, Windtree Therapeutics, and Nano Labs, have recently added BNB to their treasuries, underscoring growing institutional interest. Binance has also strengthened its platform with a new web version of its wallet and expanded bitcoin options offerings. These moves appear to be reinforcing confidence in BNB’s long-term position in the exchange token market.

Outperforming the Exchange Token Sector

Compared to other exchange tokens that are still 30–60% off their highs, BNB’s 10% pullback from its $861 peak positions it among the sector’s most stable assets, alongside LEO. BNB currently commands an 81.4% dominance of the exchange token market capitalization, according to CryptoQuant data, further highlighting its leading role.

Technical Momentum Building

From its $746 low, BNB has been forming a pattern of higher lows, signaling improving sentiment and buying momentum. Two volume-backed bounces have reinforced this bullish shift, with price now consolidating near $760. If this pattern holds, a push toward the $770–$780 resistance zone could follow, provided market conditions remain supportive.

The post BNB Holds Strong After Testing $750 Support first appeared on BlockNews.