Luxembourg Becomes First Eurozone Nation to Invest in Bitcoin Through Sovereign Wealth Fund

Luxembourg’s Intergenerational Sovereign Wealth Fund (FSIL) has become the first state-level fund in the Eurozone to invest in Bitcoin, allocating 1% of its holdings to Bitcoin exchange-traded funds (ETFs).

Bob Kieffer, Luxembourg’s Director of the Treasury and Secretary General, announced the move in an October 8 LinkedIn post.

Kieffer noted that Finance Minister Gilles Roth had revealed the decision earlier during the presentation of the 2026 Budget at the Chambre des Députés, Luxembourg’s legislature.

“Under the revised framework, the FSIL will continue to invest in equity and debt markets, while now also being authorized to allocate up to 15% of its assets to alternative investments,” Kieffer explained.

These include private equity, real estate, and crypto assets.

Conservative or Bold? Inside Luxembourg’s 1% Bitcoin Allocation

To minimize operational risks, the fund’s Bitcoin exposure will be managed through regulated ETFs rather than direct holdings.

With total assets under management of approximately €764 million (about $888 million) as of June 30, the 1% allocation puts roughly $9 million into Bitcoin ETFs.

Kieffer addressed the mixed reactions to the move, acknowledging that opinions vary on both timing and scale.

“Some might argue that we’re committing too little too late; others will point out the volatility and speculative nature of the investment,” he wrote.

However, he stressed that the FSIL management board views the 1% allocation as a sensible balance between innovation and stability.

The decision, according to Kieffer, reflects confidence in Bitcoin’s long-term potential while staying consistent with the fund’s conservative investment approach.

Luxembourg Flagged Crypto as High-Risk—Then Invested Anyway

The announcement may surprise those familiar with Luxembourg’s traditionally cautious stance toward cryptocurrencies.

It follows earlier reports from late May indicating that the country’s 2025 National Risk Assessment had classified crypto-related businesses as high-risk for money laundering.

The report noted that Virtual Asset Service Providers (VASPs) often operate in decentralized environments, which complicates oversight and makes tracing illicit financial activities more challenging.

Yet Luxembourg continues to attract major crypto players seeking regulatory approval.

In May, Bitstamp, one of the world’s longest-running cryptocurrency exchanges, secured its Crypto Asset Service Provider (CASP) license from Luxembourg regulators under the European Union’s Markets in Crypto-Assets (MiCA) framework.

In January, UK-based Standard Chartered announced plans to establish a Luxembourg-based entity as its regulatory hub for crypto and digital asset custody services across the European Union.

Coinbase has also expanded its European presence, obtaining a license under the EU’s MiCA regulatory framework through Luxembourg’s financial regulator, solidifying the nation’s position as a compliant hub for digital assets.

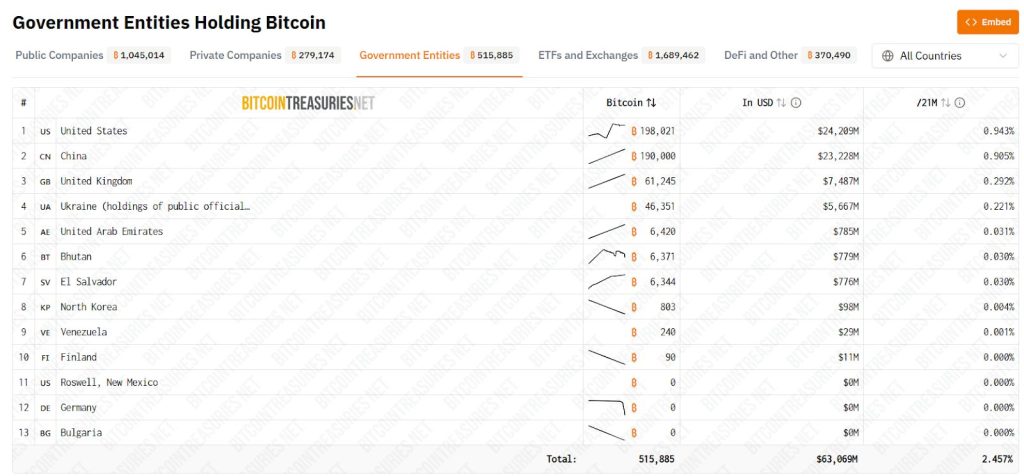

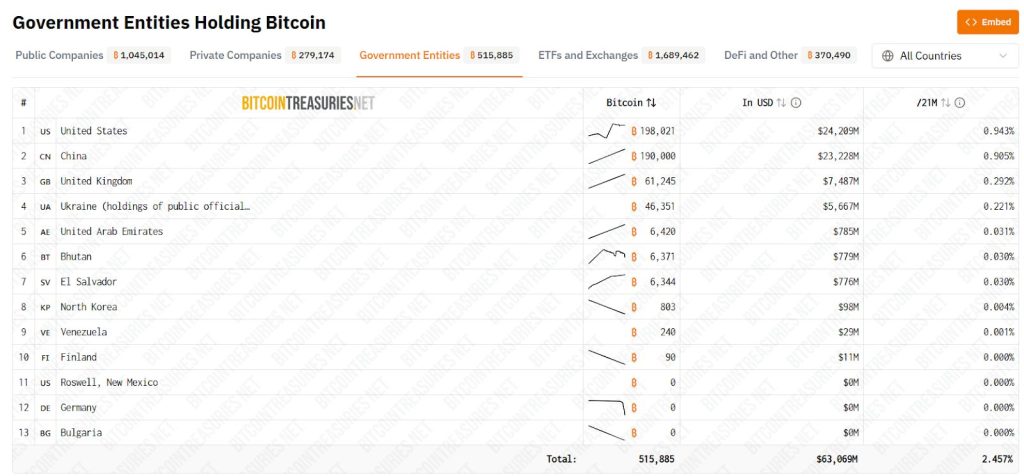

Breaking Down National Bitcoin Holdings Around the World

Data from Bitcoin Treasuries shows that, beyond Europe, nation-states and government entities collectively hold about 515,885 Bitcoin, valued at roughly $63 billion, representing around 2.46% of Bitcoin’s total supply.

The United States leads with 198,021 BTC worth approximately $24.2 billion, followed by China with 190,000 BTC valued at $23.2 billion, much of it seized through enforcement actions despite China’s restrictive crypto policies.

The United Kingdom ranks third with 61,245 BTC (around $7.5 billion), while Ukraine holds 46,351 BTC valued at $5.7 billion, reflecting its reliance on crypto donations amid ongoing conflict and its progressive approach to digital assets.

El Salvador remains the only country to have adopted Bitcoin as legal tender, holding 6,344 BTC worth $776 million, making it a global outlier in crypto-based monetary policy.

Both the United Arab Emirates and Bhutan hold more than 6,000 BTC each, showing a trend among both resource-rich and emerging nations to treat Bitcoin as a strategic reserve asset.

Several countries, including Finland, Roswell in New Mexico, Germany, and Bulgaria, now have zero or minimal holdings after liquidating their positions.

The post Luxembourg Becomes First Eurozone Nation to Invest in Bitcoin Through Sovereign Wealth Fund appeared first on Cryptonews.

Luxembourg Becomes First Eurozone Nation to Invest in Bitcoin Through Sovereign Wealth Fund

Luxembourg’s Intergenerational Sovereign Wealth Fund (FSIL) has become the first state-level fund in the Eurozone to invest in Bitcoin, allocating 1% of its holdings to Bitcoin exchange-traded funds (ETFs).

Bob Kieffer, Luxembourg’s Director of the Treasury and Secretary General, announced the move in an October 8 LinkedIn post.

Kieffer noted that Finance Minister Gilles Roth had revealed the decision earlier during the presentation of the 2026 Budget at the Chambre des Députés, Luxembourg’s legislature.

“Under the revised framework, the FSIL will continue to invest in equity and debt markets, while now also being authorized to allocate up to 15% of its assets to alternative investments,” Kieffer explained.

These include private equity, real estate, and crypto assets.

Conservative or Bold? Inside Luxembourg’s 1% Bitcoin Allocation

To minimize operational risks, the fund’s Bitcoin exposure will be managed through regulated ETFs rather than direct holdings.

With total assets under management of approximately €764 million (about $888 million) as of June 30, the 1% allocation puts roughly $9 million into Bitcoin ETFs.

Kieffer addressed the mixed reactions to the move, acknowledging that opinions vary on both timing and scale.

“Some might argue that we’re committing too little too late; others will point out the volatility and speculative nature of the investment,” he wrote.

However, he stressed that the FSIL management board views the 1% allocation as a sensible balance between innovation and stability.

The decision, according to Kieffer, reflects confidence in Bitcoin’s long-term potential while staying consistent with the fund’s conservative investment approach.

Luxembourg Flagged Crypto as High-Risk—Then Invested Anyway

The announcement may surprise those familiar with Luxembourg’s traditionally cautious stance toward cryptocurrencies.

It follows earlier reports from late May indicating that the country’s 2025 National Risk Assessment had classified crypto-related businesses as high-risk for money laundering.

The report noted that Virtual Asset Service Providers (VASPs) often operate in decentralized environments, which complicates oversight and makes tracing illicit financial activities more challenging.

Yet Luxembourg continues to attract major crypto players seeking regulatory approval.

In May, Bitstamp, one of the world’s longest-running cryptocurrency exchanges, secured its Crypto Asset Service Provider (CASP) license from Luxembourg regulators under the European Union’s Markets in Crypto-Assets (MiCA) framework.

In January, UK-based Standard Chartered announced plans to establish a Luxembourg-based entity as its regulatory hub for crypto and digital asset custody services across the European Union.

Coinbase has also expanded its European presence, obtaining a license under the EU’s MiCA regulatory framework through Luxembourg’s financial regulator, solidifying the nation’s position as a compliant hub for digital assets.

Breaking Down National Bitcoin Holdings Around the World

Data from Bitcoin Treasuries shows that, beyond Europe, nation-states and government entities collectively hold about 515,885 Bitcoin, valued at roughly $63 billion, representing around 2.46% of Bitcoin’s total supply.

The United States leads with 198,021 BTC worth approximately $24.2 billion, followed by China with 190,000 BTC valued at $23.2 billion, much of it seized through enforcement actions despite China’s restrictive crypto policies.

The United Kingdom ranks third with 61,245 BTC (around $7.5 billion), while Ukraine holds 46,351 BTC valued at $5.7 billion, reflecting its reliance on crypto donations amid ongoing conflict and its progressive approach to digital assets.

El Salvador remains the only country to have adopted Bitcoin as legal tender, holding 6,344 BTC worth $776 million, making it a global outlier in crypto-based monetary policy.

Both the United Arab Emirates and Bhutan hold more than 6,000 BTC each, showing a trend among both resource-rich and emerging nations to treat Bitcoin as a strategic reserve asset.

Several countries, including Finland, Roswell in New Mexico, Germany, and Bulgaria, now have zero or minimal holdings after liquidating their positions.

The post Luxembourg Becomes First Eurozone Nation to Invest in Bitcoin Through Sovereign Wealth Fund appeared first on Cryptonews.

Bhutan government moves $23.73M Bitcoin to Binance perfectly timing

Bhutan government moves $23.73M Bitcoin to Binance perfectly timing