ETH Wipes $10B in Leverage but FOMO Keeps Bulls Alive

- Ethereum wiped $10B in leverage in three days as open interest tumbled.

- MVRV ratio at 2.10 signals overheating, echoing past local tops.

- Despite sell-offs, ETH shows resilience, with FOMO likely to drive the next breakout.

Ethereum is sitting in a tense zone around $4,500, caught between traders’ FOMO and the weight of profit-taking. The past few days have been messy—open interest fell almost 7% in one session, and in just three days nearly $10 billion in leverage vanished from the market. It looks like a textbook deleveraging event after ETH ran a bit too hot.

MVRV Screams Overheated

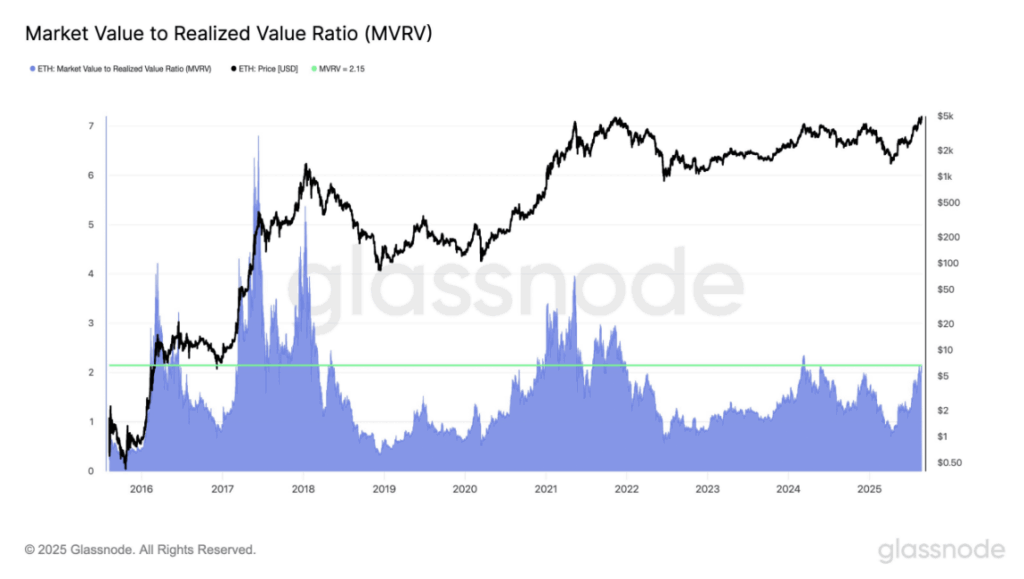

Adding to the jitters, Ethereum’s Market Value to Realized Value (MVRV) ratio touched 2.10 right as the coin brushed against its $4.9k all-time high. Every time this ratio has spiked in the past, ETH has stumbled. Back in March 2024, for example, MVRV hit 2.35 and the price promptly fell off a cliff—dropping more than 50% in just seven weeks before smart money scooped up the dip.

That same pattern might be starting again. The 10% slide on August 25, from a $4,800 open, wasn’t just random noise. It was ETH’s overheated metrics catching up, signaling a short-term top before a potential reset.

FOMO Keeps ETH in the Game

Still, Ethereum refuses to break. This August, MVRV jumped above 2.10 not once but twice. After the first spike near $4,790, ETH sold off hard, dipping close to $4,000. But within days, the asset flipped back with a new high, touching $4.9k. That kind of resilience shows that even after heavy liquidations, the structure is intact, and buyers are still stepping in.

Now, with another MVRV spike above 2.10 on August 22 and the $10 billion wipeout behind us, the market might have the setup for a higher leg. Short-term fear and profit-taking could continue, but FOMO is clearly fueling momentum, and ETH looks primed to test new levels once the dust settles.

The post ETH Wipes $10B in Leverage but FOMO Keeps Bulls Alive first appeared on BlockNews.

ETH Wipes $10B in Leverage but FOMO Keeps Bulls Alive

- Ethereum wiped $10B in leverage in three days as open interest tumbled.

- MVRV ratio at 2.10 signals overheating, echoing past local tops.

- Despite sell-offs, ETH shows resilience, with FOMO likely to drive the next breakout.

Ethereum is sitting in a tense zone around $4,500, caught between traders’ FOMO and the weight of profit-taking. The past few days have been messy—open interest fell almost 7% in one session, and in just three days nearly $10 billion in leverage vanished from the market. It looks like a textbook deleveraging event after ETH ran a bit too hot.

MVRV Screams Overheated

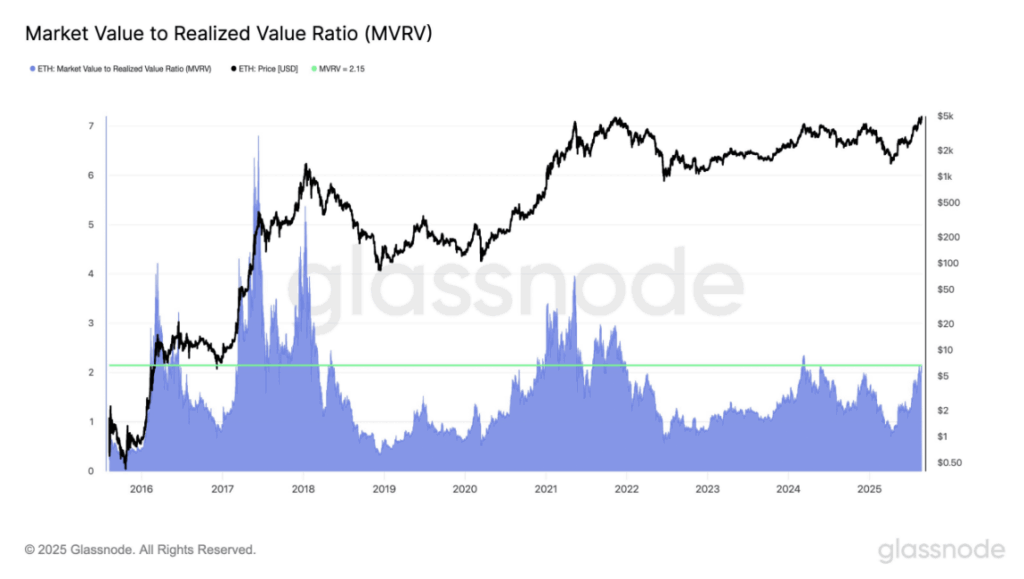

Adding to the jitters, Ethereum’s Market Value to Realized Value (MVRV) ratio touched 2.10 right as the coin brushed against its $4.9k all-time high. Every time this ratio has spiked in the past, ETH has stumbled. Back in March 2024, for example, MVRV hit 2.35 and the price promptly fell off a cliff—dropping more than 50% in just seven weeks before smart money scooped up the dip.

That same pattern might be starting again. The 10% slide on August 25, from a $4,800 open, wasn’t just random noise. It was ETH’s overheated metrics catching up, signaling a short-term top before a potential reset.

FOMO Keeps ETH in the Game

Still, Ethereum refuses to break. This August, MVRV jumped above 2.10 not once but twice. After the first spike near $4,790, ETH sold off hard, dipping close to $4,000. But within days, the asset flipped back with a new high, touching $4.9k. That kind of resilience shows that even after heavy liquidations, the structure is intact, and buyers are still stepping in.

Now, with another MVRV spike above 2.10 on August 22 and the $10 billion wipeout behind us, the market might have the setup for a higher leg. Short-term fear and profit-taking could continue, but FOMO is clearly fueling momentum, and ETH looks primed to test new levels once the dust settles.

The post ETH Wipes $10B in Leverage but FOMO Keeps Bulls Alive first appeared on BlockNews.