Putin vs. Trump: Who’s Winning the Financial Showdown on Stocks & Commodities?

The Putin vs. Trump situation has definitely ignited a pretty serious and worrying global financial showdown that is affecting markets all around the world in ways we haven’t seen before. Right now, as we speak, Trump’s sweeping tariffs are causing stock values to tank pretty dramatically while commodity prices also continue to fluctuate wildly and unpredictably. And you know what? As this global trade war keeps getting more intense and continues escalating day by day with new announcements and counter-measures, Putin seems to be just sitting back and watching everything carefully from the sidelines, not saying too much publicly but definitely paying close attention.

And honestly, he might actually be positioned to benefit quite a bit from all of this international economic chaos that’s happening right now as Western alliances get tested and traditional trading relationships become strained. The whole thing has created this really interesting dynamic where two powerful leaders are essentially playing chess with the global economy, and regular investors are feeling the impact in their portfolios.

Also Read: 50 Countries Eye De-Dollarization & Reduce US Dollar Dependency

Trump’s Tariffs vs. Putin’s Power: Impact on Stocks and Commodities

Trump’s April 2 “Liberation Day” announcement has definitely unleashed some serious economic turmoil with a 10% baseline tariff on imports and also targeted rates up to 34% for certain specific nations. At the same time, the ongoing Putin vs. Trump dynamics are reshaping the geopolitical power structures in ways we haven’t seen in decades.

Wall Street Giants React to Putin vs. Trump

Jamie Dimon, the CEO of JPMorgan Chase, warned that: “The recent tariffs will likely increase inflation and are causing many to consider a greater probability of a recession.”

Bill Ackman, hedge fund manager, stated:

“By placing massive and disproportionate tariffs on our friends and our enemies alike and thereby launching a global economic war against the whole world at once, we are in the process of destroying confidence in our country as a trading partner.”

Also Read: De-Dollarization: 6 Global Alliances Race to Ditch the US Dollar

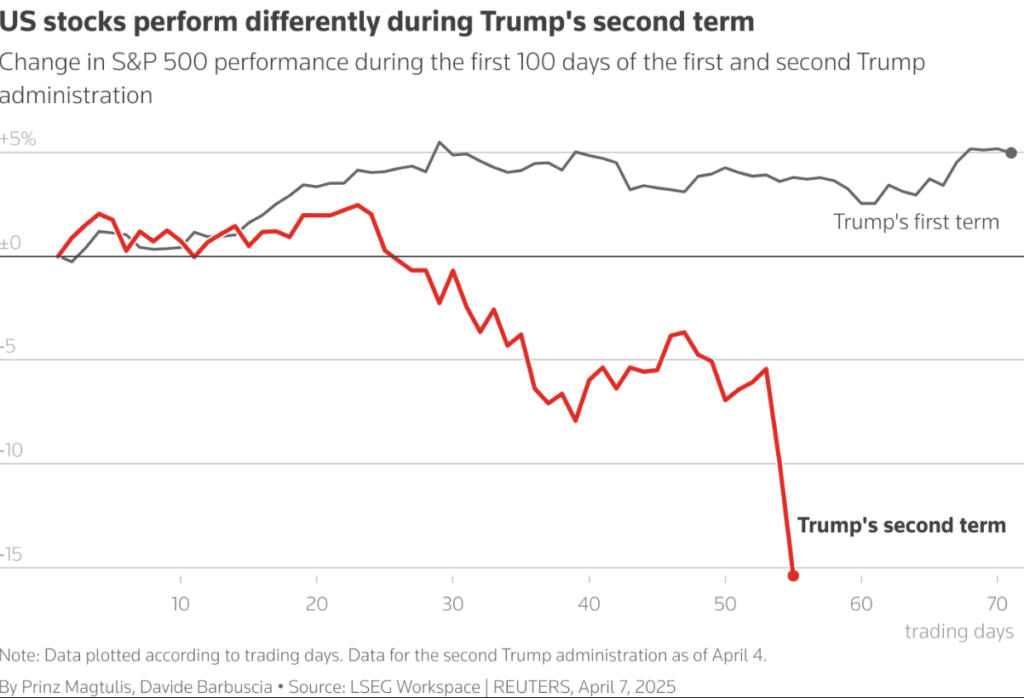

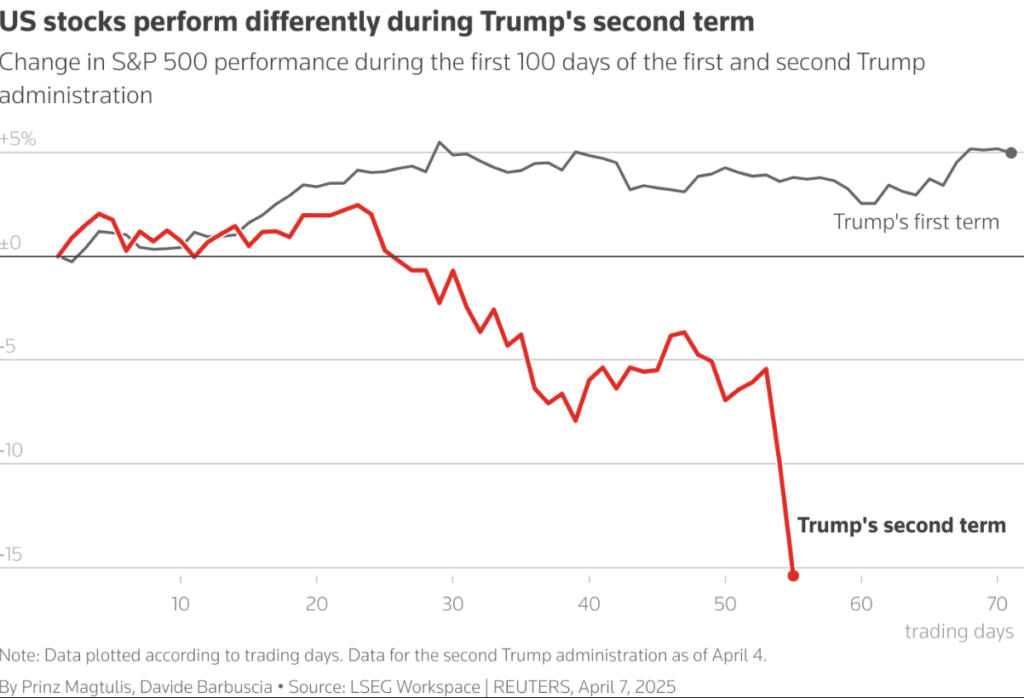

Stock Market Crash Threatens $4 Trillion

The stock market crash continues to deepen right now as Trump tariffs shake investor confidence in so many ways. Interesting timing, right? I really thought so myself.

Market experts are also pointing to some of the indicators that are also showing that this process isn’t just a temporary dip but could potentially be a more sustained downturn that might last through the summer and beyond. At the same time, retirement accounts and long-term investments are being impacted, causing concern among financial advisors who are now scrambling to adjust their clients’ strategies in response to these unprecedented market conditions.

Kristina Hooper, who works as a Chief Global Market Strategist at Invesco, said the following: “The risk of recession increases every day that these high tariffs are in force. We anticipate significant volatility and downward pressure on risk assets in the near term.”

Also Read: Trump’s Tariffs Trigger De-Dollarization – Central Banks Rush to Buy Gold at ATH!

Commodity Prices Upended in Putin vs. Trump Era

Commodity prices are facing tremendous pressure these days under the current global trade war conditions as Putin vs. Trump policies continue to reshape international trade networks.

Kathy Kriskey, Head of Alternatives Product Strategy at Invesco, said that “the reciprocal tariffs recently implemented by the Trump administration are impactful for many commodities from all three sectors: energy, metals, and agriculture.”

Russia’s Strategic View

Oleg Savchenko, a Russian lawmaker, had said on the topic: “We’ve built resilience through hardship.” Aleksei Zubets, who is a Russian economist, also stated his opinion by saying: “The world is too busy now worrying about tariffs, price hikes, and economic fallout. Ukraine has stopped being the center of attention, and for us, that’s a win.”

Also Read: De-dollarization Surges—This Major Economy Drops the U.S. Dollar

Deutsche Bank researchers warned that Trump’s tariffs represent the “biggest shock to the global trading system since the 1970s.”

The European Commission President Ursula von der Leyen announced that “we are already finalizing the first package of countermeasures in response to tariffs on steel.”

The Putin vs. Trump financial showdown is still unfolding and evolving, with pretty profound implications for global markets and international relations. It’s creating winners and losers, and honestly, it seems like we’re just at the beginning of this newest chapter in international economic relations.

Putin vs. Trump: Who’s Winning the Financial Showdown on Stocks & Commodities?

The Putin vs. Trump situation has definitely ignited a pretty serious and worrying global financial showdown that is affecting markets all around the world in ways we haven’t seen before. Right now, as we speak, Trump’s sweeping tariffs are causing stock values to tank pretty dramatically while commodity prices also continue to fluctuate wildly and unpredictably. And you know what? As this global trade war keeps getting more intense and continues escalating day by day with new announcements and counter-measures, Putin seems to be just sitting back and watching everything carefully from the sidelines, not saying too much publicly but definitely paying close attention.

And honestly, he might actually be positioned to benefit quite a bit from all of this international economic chaos that’s happening right now as Western alliances get tested and traditional trading relationships become strained. The whole thing has created this really interesting dynamic where two powerful leaders are essentially playing chess with the global economy, and regular investors are feeling the impact in their portfolios.

Also Read: 50 Countries Eye De-Dollarization & Reduce US Dollar Dependency

Trump’s Tariffs vs. Putin’s Power: Impact on Stocks and Commodities

Trump’s April 2 “Liberation Day” announcement has definitely unleashed some serious economic turmoil with a 10% baseline tariff on imports and also targeted rates up to 34% for certain specific nations. At the same time, the ongoing Putin vs. Trump dynamics are reshaping the geopolitical power structures in ways we haven’t seen in decades.

Wall Street Giants React to Putin vs. Trump

Jamie Dimon, the CEO of JPMorgan Chase, warned that: “The recent tariffs will likely increase inflation and are causing many to consider a greater probability of a recession.”

Bill Ackman, hedge fund manager, stated:

“By placing massive and disproportionate tariffs on our friends and our enemies alike and thereby launching a global economic war against the whole world at once, we are in the process of destroying confidence in our country as a trading partner.”

Also Read: De-Dollarization: 6 Global Alliances Race to Ditch the US Dollar

Stock Market Crash Threatens $4 Trillion

The stock market crash continues to deepen right now as Trump tariffs shake investor confidence in so many ways. Interesting timing, right? I really thought so myself.

Market experts are also pointing to some of the indicators that are also showing that this process isn’t just a temporary dip but could potentially be a more sustained downturn that might last through the summer and beyond. At the same time, retirement accounts and long-term investments are being impacted, causing concern among financial advisors who are now scrambling to adjust their clients’ strategies in response to these unprecedented market conditions.

Kristina Hooper, who works as a Chief Global Market Strategist at Invesco, said the following: “The risk of recession increases every day that these high tariffs are in force. We anticipate significant volatility and downward pressure on risk assets in the near term.”

Also Read: Trump’s Tariffs Trigger De-Dollarization – Central Banks Rush to Buy Gold at ATH!

Commodity Prices Upended in Putin vs. Trump Era

Commodity prices are facing tremendous pressure these days under the current global trade war conditions as Putin vs. Trump policies continue to reshape international trade networks.

Kathy Kriskey, Head of Alternatives Product Strategy at Invesco, said that “the reciprocal tariffs recently implemented by the Trump administration are impactful for many commodities from all three sectors: energy, metals, and agriculture.”

Russia’s Strategic View

Oleg Savchenko, a Russian lawmaker, had said on the topic: “We’ve built resilience through hardship.” Aleksei Zubets, who is a Russian economist, also stated his opinion by saying: “The world is too busy now worrying about tariffs, price hikes, and economic fallout. Ukraine has stopped being the center of attention, and for us, that’s a win.”

Also Read: De-dollarization Surges—This Major Economy Drops the U.S. Dollar

Deutsche Bank researchers warned that Trump’s tariffs represent the “biggest shock to the global trading system since the 1970s.”

The European Commission President Ursula von der Leyen announced that “we are already finalizing the first package of countermeasures in response to tariffs on steel.”

The Putin vs. Trump financial showdown is still unfolding and evolving, with pretty profound implications for global markets and international relations. It’s creating winners and losers, and honestly, it seems like we’re just at the beginning of this newest chapter in international economic relations.