Litecoin and Hedera ETFs Edge Closer as Canary Files Final Amendments

- Canary Capital amended filings for Litecoin (LTCC) and Hedera (HBR) spot ETFs, a final step before SEC review.

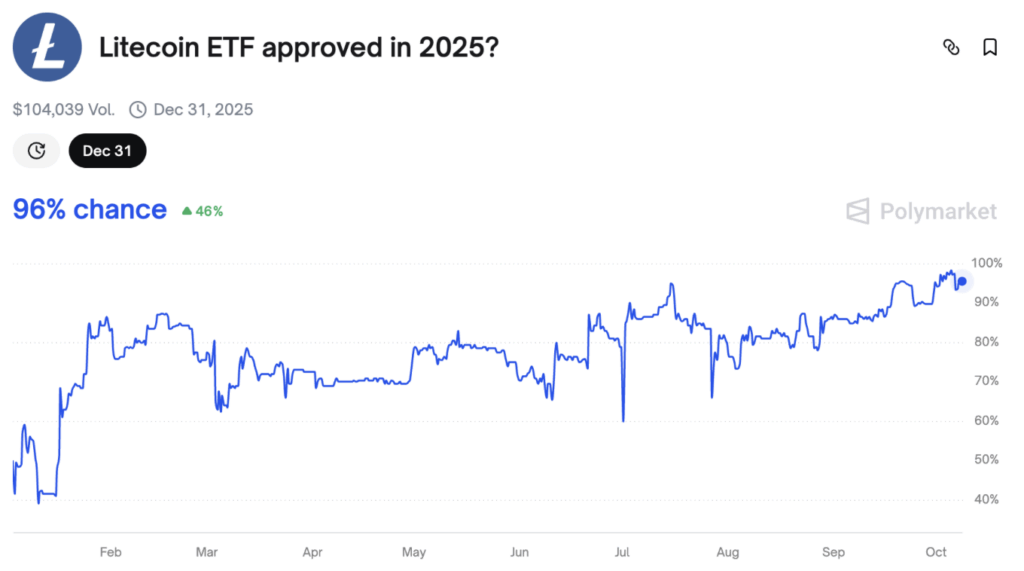

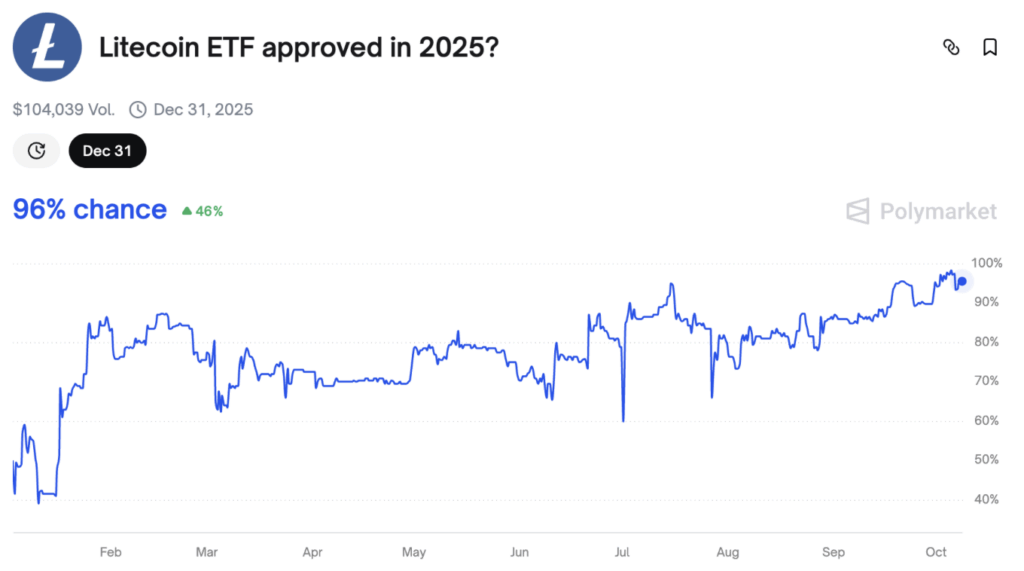

- Polymarket odds show a 96% chance of approval by year-end, fueling bullish sentiment.

- Historical Q4 returns and a bullish chart setup could position LTC for a strong rally into 2026.

Asset manager Canary Capital has stirred fresh excitement after amending its S-1 filings for proposed Litecoin (LTC)and Hedera (HBAR) spot ETFs. Bloomberg’s ETF analysts noted that these tweaks often represent the final housekeeping before the SEC delivers its verdict. If approval lands, it could flip the script for Litecoin in particular, which has spent October bouncing between rallies and pullbacks.

A green light from the SEC wouldn’t just be symbolic—it could open the gates for institutional inflows and fuel the next leg of Litecoin’s price action. Investors are already speculating that this decision could be the spark that ignites LTC’s Q4 rally.

Will 2025 Finally See a Litecoin ETF?

The amendments, filed on October 7, 2025, included a management fee of 0.95% for both ETFs. While higher than most Bitcoin spot ETFs, analysts like Eric Balchunas stressed that fees like this are standard for niche or early-stage products. “If flows come in, other issuers will Terrordome that sht with cheaper funds,” he joked, hinting at competitive pressure if demand explodes.

Canary also revealed proposed ticker symbols: LTCC for the Litecoin ETF and HBR for Hedera. According to Balchunas and colleague James Seyffart, the inclusion of fees and tickers usually signals a filing is entering its final phase. Timing, however, may be complicated by the ongoing U.S. government shutdown, which could stall SEC reviews.

Even so, optimism hasn’t cooled. On prediction markets like Polymarket, traders are assigning a 96% probability that a Litecoin ETF will be approved before the end of 2025—a near-certainty in market terms.

ETF Optimism and Q4 Tailwinds Fuel Litecoin

Beyond filings, market performance has shown flickers of strength. Litecoin briefly touched a six-week high last week before easing back, holding onto a portion of its gains. As of press time, LTC trades around $115.7, down 2.55% on the day, but still supported by broader bullish setups.

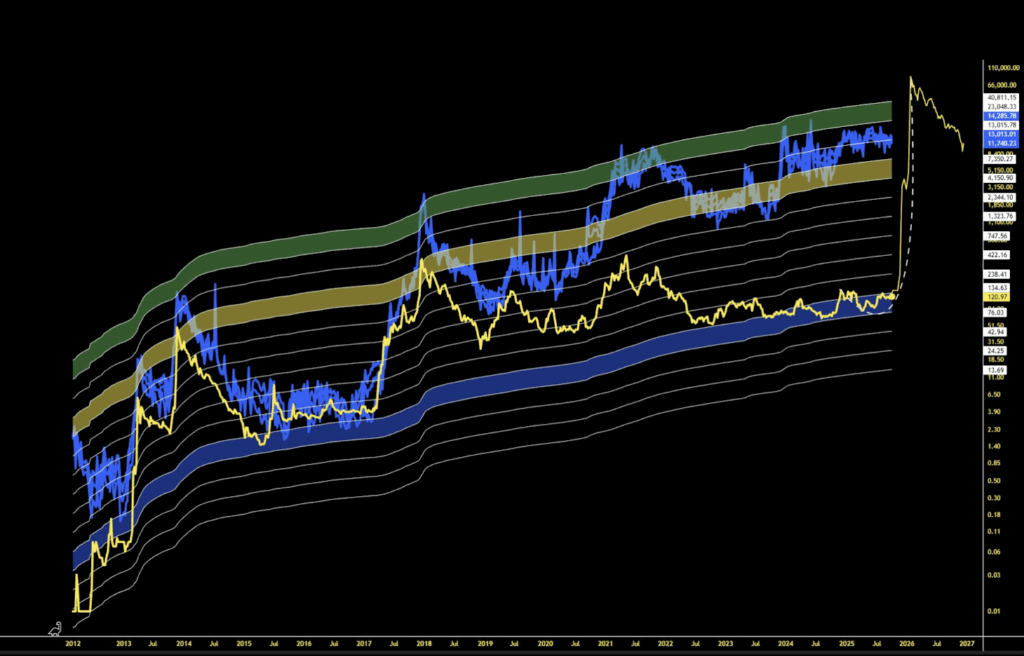

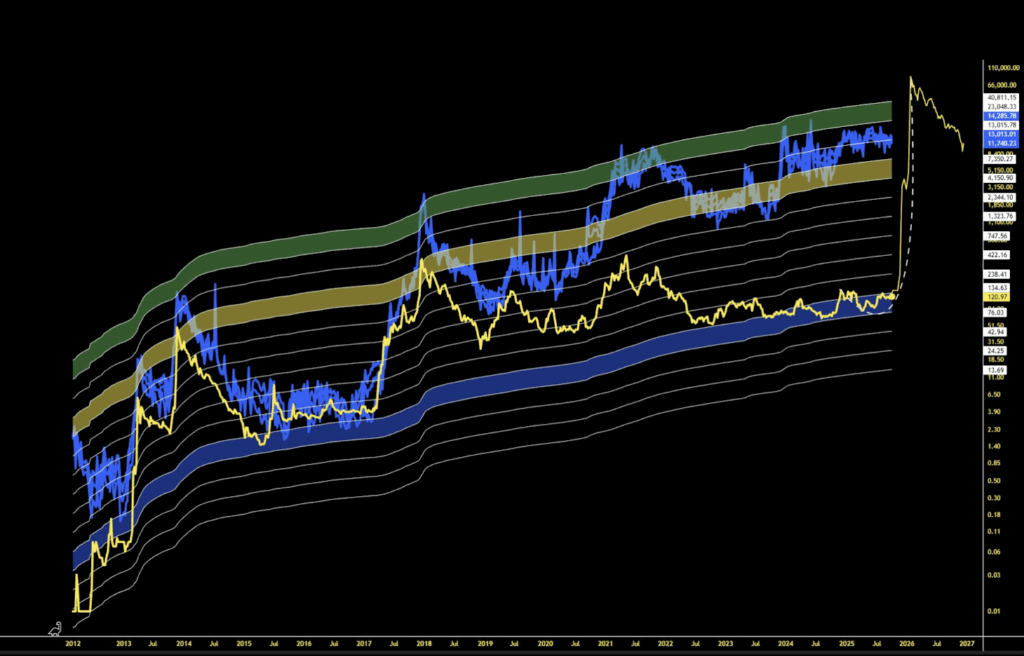

History adds weight to the optimism: Q4 has traditionally been Litecoin’s strongest stretch, with the coin closing in the red just four times over the last 12 years. November, in particular, has been explosive, averaging 148% gains. October tends to be quieter, but often lays the groundwork for bigger runs into year-end.

From a technical angle, analysts are eyeing an inverse head-and-shoulders pattern on LTC’s chart. If confirmed, this classic bullish reversal could mark the beginning of a fresh uptrend.

Outlook for Litecoin

Put together—the ETF anticipation, seasonal strength, and supportive chart patterns—Litecoin looks primed for renewed momentum into the final months of 2025. A confirmed ETF approval could act as the accelerant, while technicals and historical cycles provide the structure for a rally.

If the SEC comes through, Litecoin might be gearing up for a run that investors have been waiting on for years.

The post Litecoin and Hedera ETFs Edge Closer as Canary Files Final Amendments first appeared on BlockNews.

Litecoin and Hedera ETFs Edge Closer as Canary Files Final Amendments

- Canary Capital amended filings for Litecoin (LTCC) and Hedera (HBR) spot ETFs, a final step before SEC review.

- Polymarket odds show a 96% chance of approval by year-end, fueling bullish sentiment.

- Historical Q4 returns and a bullish chart setup could position LTC for a strong rally into 2026.

Asset manager Canary Capital has stirred fresh excitement after amending its S-1 filings for proposed Litecoin (LTC)and Hedera (HBAR) spot ETFs. Bloomberg’s ETF analysts noted that these tweaks often represent the final housekeeping before the SEC delivers its verdict. If approval lands, it could flip the script for Litecoin in particular, which has spent October bouncing between rallies and pullbacks.

A green light from the SEC wouldn’t just be symbolic—it could open the gates for institutional inflows and fuel the next leg of Litecoin’s price action. Investors are already speculating that this decision could be the spark that ignites LTC’s Q4 rally.

Will 2025 Finally See a Litecoin ETF?

The amendments, filed on October 7, 2025, included a management fee of 0.95% for both ETFs. While higher than most Bitcoin spot ETFs, analysts like Eric Balchunas stressed that fees like this are standard for niche or early-stage products. “If flows come in, other issuers will Terrordome that sht with cheaper funds,” he joked, hinting at competitive pressure if demand explodes.

Canary also revealed proposed ticker symbols: LTCC for the Litecoin ETF and HBR for Hedera. According to Balchunas and colleague James Seyffart, the inclusion of fees and tickers usually signals a filing is entering its final phase. Timing, however, may be complicated by the ongoing U.S. government shutdown, which could stall SEC reviews.

Even so, optimism hasn’t cooled. On prediction markets like Polymarket, traders are assigning a 96% probability that a Litecoin ETF will be approved before the end of 2025—a near-certainty in market terms.

ETF Optimism and Q4 Tailwinds Fuel Litecoin

Beyond filings, market performance has shown flickers of strength. Litecoin briefly touched a six-week high last week before easing back, holding onto a portion of its gains. As of press time, LTC trades around $115.7, down 2.55% on the day, but still supported by broader bullish setups.

History adds weight to the optimism: Q4 has traditionally been Litecoin’s strongest stretch, with the coin closing in the red just four times over the last 12 years. November, in particular, has been explosive, averaging 148% gains. October tends to be quieter, but often lays the groundwork for bigger runs into year-end.

From a technical angle, analysts are eyeing an inverse head-and-shoulders pattern on LTC’s chart. If confirmed, this classic bullish reversal could mark the beginning of a fresh uptrend.

Outlook for Litecoin

Put together—the ETF anticipation, seasonal strength, and supportive chart patterns—Litecoin looks primed for renewed momentum into the final months of 2025. A confirmed ETF approval could act as the accelerant, while technicals and historical cycles provide the structure for a rally.

If the SEC comes through, Litecoin might be gearing up for a run that investors have been waiting on for years.

The post Litecoin and Hedera ETFs Edge Closer as Canary Files Final Amendments first appeared on BlockNews.