Toncoin Takes A Hit With 12% Correction After Failing To Break $4.34, More Pain?

Share:

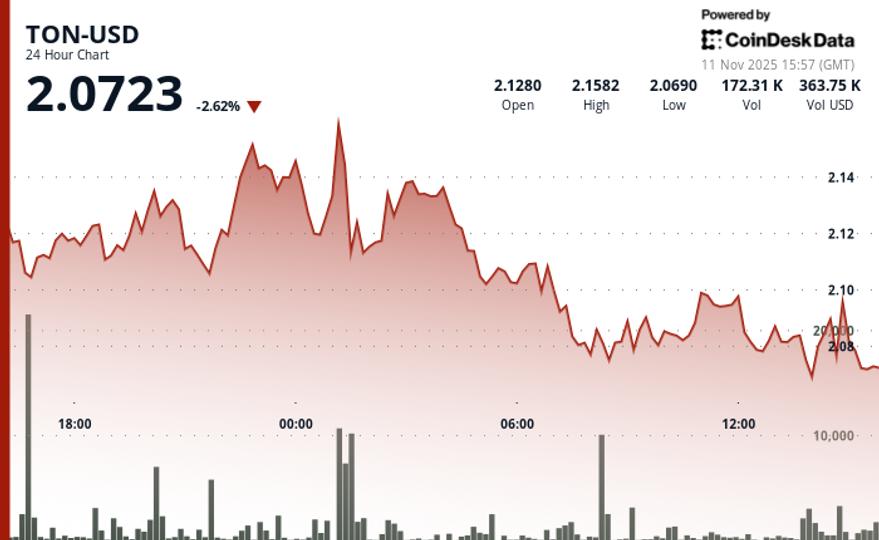

Toncoin rally has hit a roadblock, with the price slipping 12% after failing to breach the key $4.34 resistance level. The strong upward momentum that previously fueled TON’s gains lost steam as sellers aggressively defended this price zone, triggering a wave of profit-taking and increased bearish pressure.

With momentum cooling off, market participants are now watching key support levels to see if bulls can regain control. A decisive hold above crucial zones could set the stage for another breakout attempt, while continued weakness might expose Toncoin to further downside.

12% Correction: Understanding The Price Drop

Toncoin’s recent 12% correction following its failure to break through the $4.34 resistance level has raised concerns among traders and investors. To understand this price drop, it’s essential to examine the factors at play. A correction of this magnitude typically reflects a shift in market sentiment, often driven by profit-taking, a rejection at key resistance levels, or an overall weakening of bullish momentum.

After a failed breakout attempt at $4.34, the market faced a pullback, where the price retreated as sellers gained control. This is a natural response in the market when an asset struggles to sustain momentum after reaching a significant barrier. The 12% drop suggests that some traders may have begun to lock in profits after the recent rally, while others opted to exit positions as the price failed to move higher.

Additionally, broader market conditions and technical indicators have likely contributed to Toncoin’s recent 12% correction. In tandem with this, the Moving Average Convergence Divergence (MACD) indicator has shifted into a bearish crossover. The MACD’s bearish signal, coupled with the fading market sentiment, suggests that bullish pressure is weakening, which likely fueled the selling activity.

Such a correction is not unusual in volatile markets like cryptocurrency and is often viewed as a natural market reset. However, it signals a loss of immediate bullish momentum, with the price now testing the $2.36 support level. This level should be closely monitored as it will determine whether Toncoin can stabilize or if a further downside is likely.

What’s Next For Toncoin? Potential Scenarios Post-Correction

After Toncoin’s 12% correction, the key question is what lies ahead for the cryptocurrency. The price has faced a strong rejection at the $4.34 resistance level, and now, as it approaches critical support levels, several scenarios could unfold.

If Toncoin holds its ground before or at the $2.36 support level, it could signal a potential rebound, with the price stabilizing and setting up for another push toward the $4.34 resistance.

On the other hand, if the $2.36 support fails to hold, Toncoin could face a further downside, resulting in the creation of new lows. In this scenario, the market sentiment would need to shift, and Toncoin would have to demonstrate resilience to regain upward momentum.

Toncoin Takes A Hit With 12% Correction After Failing To Break $4.34, More Pain?

Share:

Toncoin rally has hit a roadblock, with the price slipping 12% after failing to breach the key $4.34 resistance level. The strong upward momentum that previously fueled TON’s gains lost steam as sellers aggressively defended this price zone, triggering a wave of profit-taking and increased bearish pressure.

With momentum cooling off, market participants are now watching key support levels to see if bulls can regain control. A decisive hold above crucial zones could set the stage for another breakout attempt, while continued weakness might expose Toncoin to further downside.

12% Correction: Understanding The Price Drop

Toncoin’s recent 12% correction following its failure to break through the $4.34 resistance level has raised concerns among traders and investors. To understand this price drop, it’s essential to examine the factors at play. A correction of this magnitude typically reflects a shift in market sentiment, often driven by profit-taking, a rejection at key resistance levels, or an overall weakening of bullish momentum.

After a failed breakout attempt at $4.34, the market faced a pullback, where the price retreated as sellers gained control. This is a natural response in the market when an asset struggles to sustain momentum after reaching a significant barrier. The 12% drop suggests that some traders may have begun to lock in profits after the recent rally, while others opted to exit positions as the price failed to move higher.

Additionally, broader market conditions and technical indicators have likely contributed to Toncoin’s recent 12% correction. In tandem with this, the Moving Average Convergence Divergence (MACD) indicator has shifted into a bearish crossover. The MACD’s bearish signal, coupled with the fading market sentiment, suggests that bullish pressure is weakening, which likely fueled the selling activity.

Such a correction is not unusual in volatile markets like cryptocurrency and is often viewed as a natural market reset. However, it signals a loss of immediate bullish momentum, with the price now testing the $2.36 support level. This level should be closely monitored as it will determine whether Toncoin can stabilize or if a further downside is likely.

What’s Next For Toncoin? Potential Scenarios Post-Correction

After Toncoin’s 12% correction, the key question is what lies ahead for the cryptocurrency. The price has faced a strong rejection at the $4.34 resistance level, and now, as it approaches critical support levels, several scenarios could unfold.

If Toncoin holds its ground before or at the $2.36 support level, it could signal a potential rebound, with the price stabilizing and setting up for another push toward the $4.34 resistance.

On the other hand, if the $2.36 support fails to hold, Toncoin could face a further downside, resulting in the creation of new lows. In this scenario, the market sentiment would need to shift, and Toncoin would have to demonstrate resilience to regain upward momentum.