Mantra Token’s 90% Drop: Reckless Liquidations or Insider Trading?

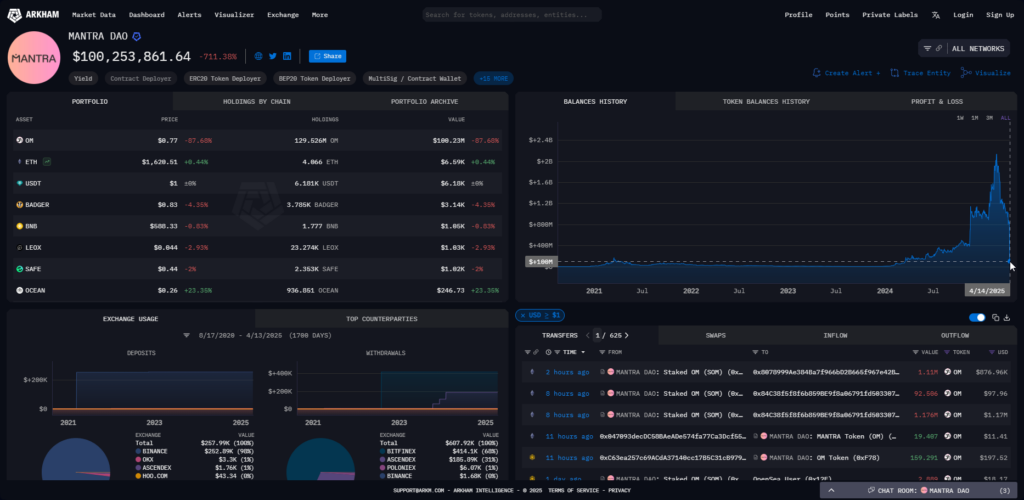

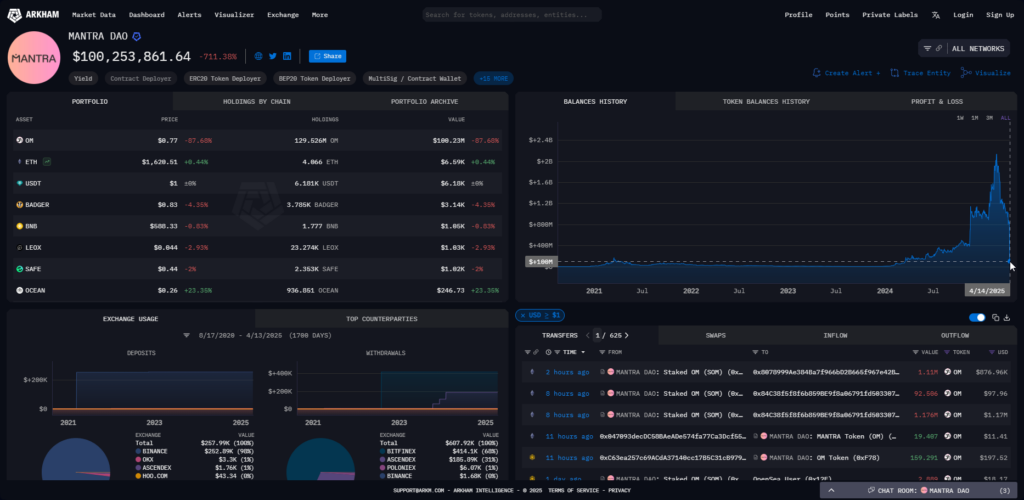

The Mantra token crash has just shocked the crypto community as the OM token plunged over 90% in a single hour on Sunday, and right now investors are still reeling from the impact. The token, which was trading at nearly $6, suddenly dropped to below $0.4, and this has really raised some serious questions about cryptocurrency market volatility, as well as potential liquidation risks and also possible insider trading accusations.

Also Read: Nvidia (NVDA) Citi Cuts Price Target to $150: Here’s Why

Is Mantra Token’s 90% Drop A Result Of Market Volatility Or Insider Influence?

This dramatic Mantra token crash happened during a period of low liquidity on Sunday evening UTC, which was actually early morning in Asia, and this timing has certainly added fuel to the speculation about market manipulation. At the moment, project representatives are trying to address the growing concerns about cryptocurrency market volatility and the integrity of the project.

John Patrick Mullin, Mantra’s co-founder, stated:

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders. The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice.”

Sherpas, OMies, and broader crypto community,

— JP Mullin (

First off, the team and I greatly appreciate the support that we have received over the past several hours, which we believe is a testament to the strong support MANTRA has among its investors and community.

We have determined that…,

) (@jp_mullin888) April 13, 2025

Exchange Actions Trigger Massive Selloff

The official MANTRA account also shared their position on X, formerly known as Twitter:

“MANTRA community – we want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project. One thing we want to be clear on: this was not our team.”

Basically, forced liquidations tend to happen when leveraged positions fall below certain maintenance requirements, and then automatic selling is triggered, which can further accelerate price declines. This recent Mantra token crash is, in many ways, a perfect example of the extreme liquidation risks that can exist in crypto trading.

MANTRA community – we want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project. One thing we want to be clear on: this was not our team. We are looking into it and will share more details…

— MANTRA | Tokenizing RWAs (@MANTRA_Chain) April 13, 2025

Also Read: Amazon (AMZN) AWS Revenue Hits $108B as AI Gets ‘Triple-Digit’ Growth

Financial Impact and Market Response

According to the available data, the crash has apparently wiped out an estimated $10 billion in market cap, with the OM token falling to as low as $0.37 before somewhat stabilizing around $0.8. And this kind of extreme cryptocurrency market volatility has definitely raised some legitimate concerns about potential insider trading.

Hank Huang, CEO of Kronos Research, told Decrypt:

“Incidents like this test investor confidence and raise a critical question about how to ensure tokenized assets can be made safer for mainstream adoption.”

Team Rejects Insider Trading Claims

With rumors circulating about a possible “rug pull,” the Mantra team has firmly rejected all insider trading allegations. As of today, the Mantra token crash has essentially become something of a case study in the challenges of maintaining crypto investment security.

John Patrick Mullin emphasized:

“To be clear, this dislocation was not caused by the team, the MANTRA Chain Association, its core advisors, or MANTRA’s investors selling tokens. Tokens remain locked and subject to the published vesting periods.”

Also Read: Cardano Reverses 14% Drop: Where Will ADA Go Next?

This crash is probably one of the steepest single-day declines we’ve seen this year, and it really highlights both the liquidation risks and also the crypto investment security concerns that many investors have. And for Mantra, which is actually a key player in the RWA tokenization sector, rebuilding investor trust now presents a pretty significant challenge following this devastating Mantra token crash.

Mantra Token’s 90% Drop: Reckless Liquidations or Insider Trading?

The Mantra token crash has just shocked the crypto community as the OM token plunged over 90% in a single hour on Sunday, and right now investors are still reeling from the impact. The token, which was trading at nearly $6, suddenly dropped to below $0.4, and this has really raised some serious questions about cryptocurrency market volatility, as well as potential liquidation risks and also possible insider trading accusations.

Also Read: Nvidia (NVDA) Citi Cuts Price Target to $150: Here’s Why

Is Mantra Token’s 90% Drop A Result Of Market Volatility Or Insider Influence?

This dramatic Mantra token crash happened during a period of low liquidity on Sunday evening UTC, which was actually early morning in Asia, and this timing has certainly added fuel to the speculation about market manipulation. At the moment, project representatives are trying to address the growing concerns about cryptocurrency market volatility and the integrity of the project.

John Patrick Mullin, Mantra’s co-founder, stated:

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders. The timing and depth of the crash suggest that a very sudden closure of account positions was initiated without sufficient warning or notice.”

Sherpas, OMies, and broader crypto community,

— JP Mullin (

First off, the team and I greatly appreciate the support that we have received over the past several hours, which we believe is a testament to the strong support MANTRA has among its investors and community.

We have determined that…,

) (@jp_mullin888) April 13, 2025

Exchange Actions Trigger Massive Selloff

The official MANTRA account also shared their position on X, formerly known as Twitter:

“MANTRA community – we want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project. One thing we want to be clear on: this was not our team.”

Basically, forced liquidations tend to happen when leveraged positions fall below certain maintenance requirements, and then automatic selling is triggered, which can further accelerate price declines. This recent Mantra token crash is, in many ways, a perfect example of the extreme liquidation risks that can exist in crypto trading.

MANTRA community – we want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project. One thing we want to be clear on: this was not our team. We are looking into it and will share more details…

— MANTRA | Tokenizing RWAs (@MANTRA_Chain) April 13, 2025

Also Read: Amazon (AMZN) AWS Revenue Hits $108B as AI Gets ‘Triple-Digit’ Growth

Financial Impact and Market Response

According to the available data, the crash has apparently wiped out an estimated $10 billion in market cap, with the OM token falling to as low as $0.37 before somewhat stabilizing around $0.8. And this kind of extreme cryptocurrency market volatility has definitely raised some legitimate concerns about potential insider trading.

Hank Huang, CEO of Kronos Research, told Decrypt:

“Incidents like this test investor confidence and raise a critical question about how to ensure tokenized assets can be made safer for mainstream adoption.”

Team Rejects Insider Trading Claims

With rumors circulating about a possible “rug pull,” the Mantra team has firmly rejected all insider trading allegations. As of today, the Mantra token crash has essentially become something of a case study in the challenges of maintaining crypto investment security.

John Patrick Mullin emphasized:

“To be clear, this dislocation was not caused by the team, the MANTRA Chain Association, its core advisors, or MANTRA’s investors selling tokens. Tokens remain locked and subject to the published vesting periods.”

Also Read: Cardano Reverses 14% Drop: Where Will ADA Go Next?

This crash is probably one of the steepest single-day declines we’ve seen this year, and it really highlights both the liquidation risks and also the crypto investment security concerns that many investors have. And for Mantra, which is actually a key player in the RWA tokenization sector, rebuilding investor trust now presents a pretty significant challenge following this devastating Mantra token crash.