Chia founder alludes to Finney, Sassaman collab as Nick Szabo leads Polymarket bets for HBO Satoshi doc

Share:

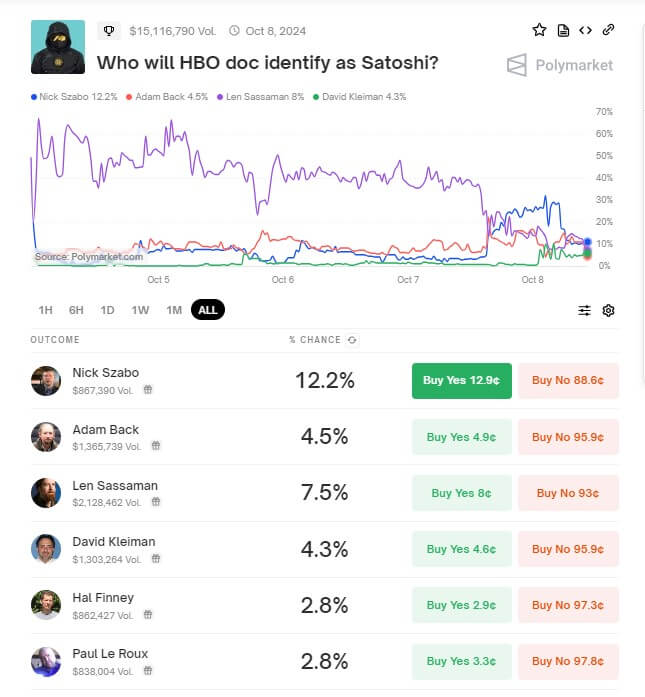

Crypto bettors on blockchain-based prediction platform Polymarket are actively trading on the outcome of HBO’s upcoming documentary that claims to reveal the identity of Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

According to the platform’s data, the market “Who will HBO doc identify as Satoshi?” has quickly become one of Polymarket’s top 10 most-traded markets for the month.

Despite being live for less than a week, daily trade volume has already reached $2.5 million, attracting 1,778 users as of Oct. 7, based on figures from Dune Analytics.

In addition, Polymarket’s data indicates that significant bets are being placed, with the pool amassing more than $15 million in wagers.

However, as speculation intensifies about the documentary’s claims, crypto bettors remain divided about who will be identified as Bitcoin’s elusive creator.

The platform’s data shows that bettors are focusing on several key figures, including Nick Szabo, Len Sassaman, Adam Back, David Kleiman, and Hal Finney. Each of these individuals has notable odds of being revealed as Nakamoto.

The HBO documentary is scheduled to air on Oct. 9 at 2:00 A.M. UTC.

Sassaman’s odds fall below 10%

When the market opened on Oct. 4, Len Sassaman led with odds as high as 68%. At the time, many bettors pointed to his cryptographic expertise, use of British English, and connections to the late Hal Finney, an early Bitcoin user and another potential Satoshi candidate.

In addition, Sassaman’s work on privacy technologies, which closely mirror Bitcoin’s design, further fueled these speculations.

However, his odds have since plunged following comments by the documentary’s director, Cullen Hoback, suggesting that Satoshi Nakamoto may still be alive. Due to this, some bettors ruled out Sassaman, who passed away in 2011.

Sassaman’s widow, Meredith Patterson, also reportedly revealed that HBO never contacted her for the documentary, adding to the skepticism. His close friend, former roommate, and creator of Chia, Bram Cohen, further cast doubt, stating that Sassaman lacked the technical skills to develop Bitcoin. However, in a recent podcast, he alluded to the possibility of Satoshi being a collaboration between Finney and Sassaman, stating Finney had the technical ability and Sassman the writing skills.

Despite this, some bettors still consider Sassaman a potential candidate, though his odds have now fallen below 10%.

Szabo takes the lead

While Sassaman’s odds have diminished, many bettors now believe Satoshi could be Nick Szabo, an American computer scientist.

Szabo, who developed the Bitcoin precursor BitGold, currently holds 13.2% of the betting odds. BitGold never officially launched, but many see it as an influential precursor to Bitcoin. Its design included peer-to-peer networking, proof-of-work mining, and cryptography—concepts later incorporated into Bitcoin.

This connection often places Szabo at the center of discussions about Satoshi Nakamoto. However, Szabo has consistently denied being the mysterious creator of Bitcoin.

The post Chia founder alludes to Finney, Sassaman collab as Nick Szabo leads Polymarket bets for HBO Satoshi doc appeared first on CryptoSlate.

Read More

Chia founder alludes to Finney, Sassaman collab as Nick Szabo leads Polymarket bets for HBO Satoshi doc

Share:

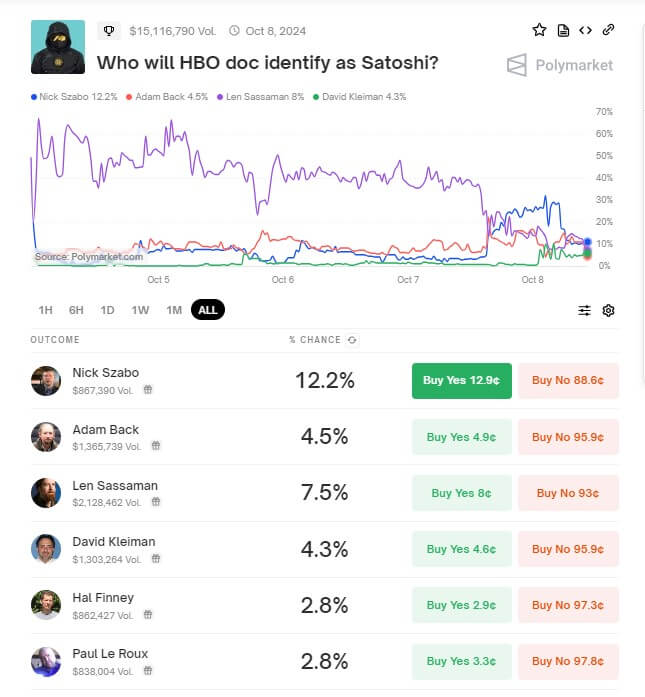

Crypto bettors on blockchain-based prediction platform Polymarket are actively trading on the outcome of HBO’s upcoming documentary that claims to reveal the identity of Bitcoin’s pseudonymous creator, Satoshi Nakamoto.

According to the platform’s data, the market “Who will HBO doc identify as Satoshi?” has quickly become one of Polymarket’s top 10 most-traded markets for the month.

Despite being live for less than a week, daily trade volume has already reached $2.5 million, attracting 1,778 users as of Oct. 7, based on figures from Dune Analytics.

In addition, Polymarket’s data indicates that significant bets are being placed, with the pool amassing more than $15 million in wagers.

However, as speculation intensifies about the documentary’s claims, crypto bettors remain divided about who will be identified as Bitcoin’s elusive creator.

The platform’s data shows that bettors are focusing on several key figures, including Nick Szabo, Len Sassaman, Adam Back, David Kleiman, and Hal Finney. Each of these individuals has notable odds of being revealed as Nakamoto.

The HBO documentary is scheduled to air on Oct. 9 at 2:00 A.M. UTC.

Sassaman’s odds fall below 10%

When the market opened on Oct. 4, Len Sassaman led with odds as high as 68%. At the time, many bettors pointed to his cryptographic expertise, use of British English, and connections to the late Hal Finney, an early Bitcoin user and another potential Satoshi candidate.

In addition, Sassaman’s work on privacy technologies, which closely mirror Bitcoin’s design, further fueled these speculations.

However, his odds have since plunged following comments by the documentary’s director, Cullen Hoback, suggesting that Satoshi Nakamoto may still be alive. Due to this, some bettors ruled out Sassaman, who passed away in 2011.

Sassaman’s widow, Meredith Patterson, also reportedly revealed that HBO never contacted her for the documentary, adding to the skepticism. His close friend, former roommate, and creator of Chia, Bram Cohen, further cast doubt, stating that Sassaman lacked the technical skills to develop Bitcoin. However, in a recent podcast, he alluded to the possibility of Satoshi being a collaboration between Finney and Sassaman, stating Finney had the technical ability and Sassman the writing skills.

Despite this, some bettors still consider Sassaman a potential candidate, though his odds have now fallen below 10%.

Szabo takes the lead

While Sassaman’s odds have diminished, many bettors now believe Satoshi could be Nick Szabo, an American computer scientist.

Szabo, who developed the Bitcoin precursor BitGold, currently holds 13.2% of the betting odds. BitGold never officially launched, but many see it as an influential precursor to Bitcoin. Its design included peer-to-peer networking, proof-of-work mining, and cryptography—concepts later incorporated into Bitcoin.

This connection often places Szabo at the center of discussions about Satoshi Nakamoto. However, Szabo has consistently denied being the mysterious creator of Bitcoin.

The post Chia founder alludes to Finney, Sassaman collab as Nick Szabo leads Polymarket bets for HBO Satoshi doc appeared first on CryptoSlate.

Read More