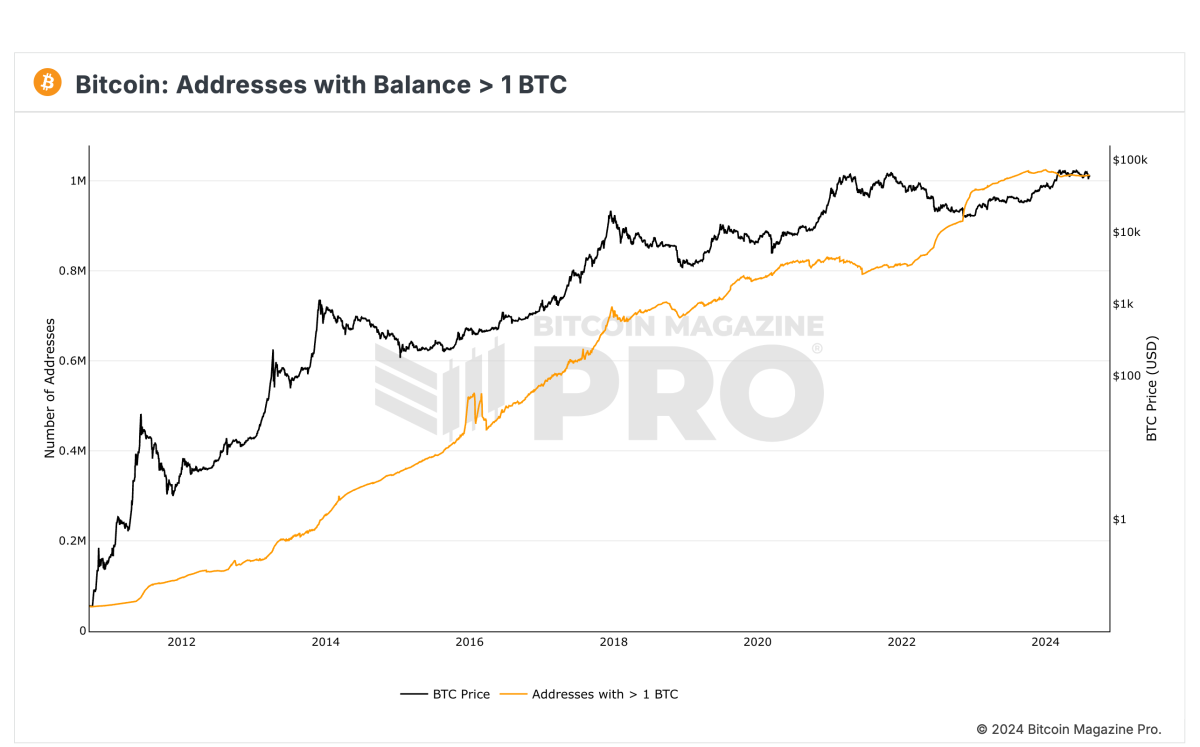

Over 1 Million Bitcoin Addresses Hold 1 BTC or More, Reflecting Strong Adoption

According to data from Bitcoin Magazine Pro, there are 1,012,650 Bitcoin addresses that contain 1 BTC or more.

This represents more than 1 million BTC potentially taken off the market and held by strong hands, a significant portion of the 21 million BTC that will ever exist. Demand continues to rise as U.S. spot Bitcoin ETFs collectively hold over 901,000 BTC, while MicroStrategy, a major corporate Bitcoin holder, owns 226,500 BTC. Additionally, MicroStrategy plans to raise $2 billion to buy more Bitcoin, further emphasizing the trend of institutions buying and holding substantial amounts of BTC, tightening the available supply as demand increases.

The number of Bitcoin addresses holding 1 BTC or more has historically lagged behind BTC's price. However, in the past two years, this trend has reversed, with the number of these addresses increasing more rapidly than Bitcoin's price. This shift signals growing adoption and reflects rising long-term confidence in Bitcoin, as more users accumulate and hold significant amounts of Bitcoin.

The rise in addresses with 1 BTC or more signifies that both retail and institutional investors are actively accumulating Bitcoin. With only 21 million BTC ever to be mined, and approximately 19 million already in circulation, the demand for Bitcoin appears to be increasing as users aim to secure their share of the limited supply.

For more detailed information, insights, and to sign up to access Bitcoin Magazine Pro's data and analytics, visit the official website here.

Over 1 Million Bitcoin Addresses Hold 1 BTC or More, Reflecting Strong Adoption

According to data from Bitcoin Magazine Pro, there are 1,012,650 Bitcoin addresses that contain 1 BTC or more.

This represents more than 1 million BTC potentially taken off the market and held by strong hands, a significant portion of the 21 million BTC that will ever exist. Demand continues to rise as U.S. spot Bitcoin ETFs collectively hold over 901,000 BTC, while MicroStrategy, a major corporate Bitcoin holder, owns 226,500 BTC. Additionally, MicroStrategy plans to raise $2 billion to buy more Bitcoin, further emphasizing the trend of institutions buying and holding substantial amounts of BTC, tightening the available supply as demand increases.

The number of Bitcoin addresses holding 1 BTC or more has historically lagged behind BTC's price. However, in the past two years, this trend has reversed, with the number of these addresses increasing more rapidly than Bitcoin's price. This shift signals growing adoption and reflects rising long-term confidence in Bitcoin, as more users accumulate and hold significant amounts of Bitcoin.

The rise in addresses with 1 BTC or more signifies that both retail and institutional investors are actively accumulating Bitcoin. With only 21 million BTC ever to be mined, and approximately 19 million already in circulation, the demand for Bitcoin appears to be increasing as users aim to secure their share of the limited supply.

For more detailed information, insights, and to sign up to access Bitcoin Magazine Pro's data and analytics, visit the official website here.