Strategy Acquires 196 BTC for $22.1M, Boosting Holdings to 640K BTC

Billionaire Michael Saylor once again shows no signs of slowing down. Strategy has further cemented its reputation as the world’s largest corporate Bitcoin holder with a fresh purchase.

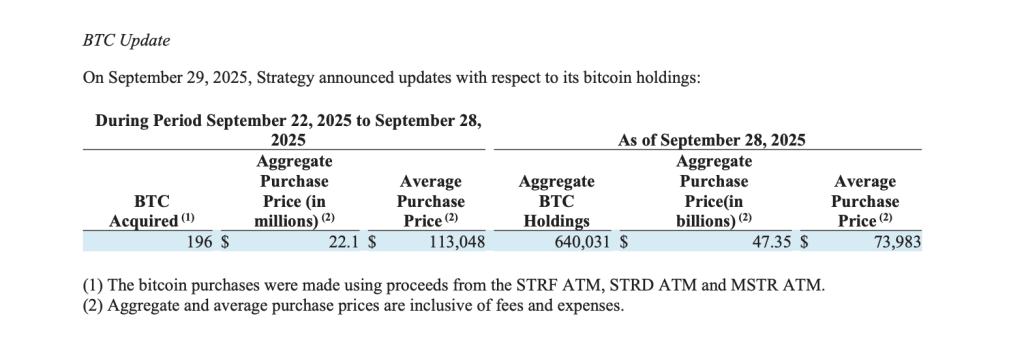

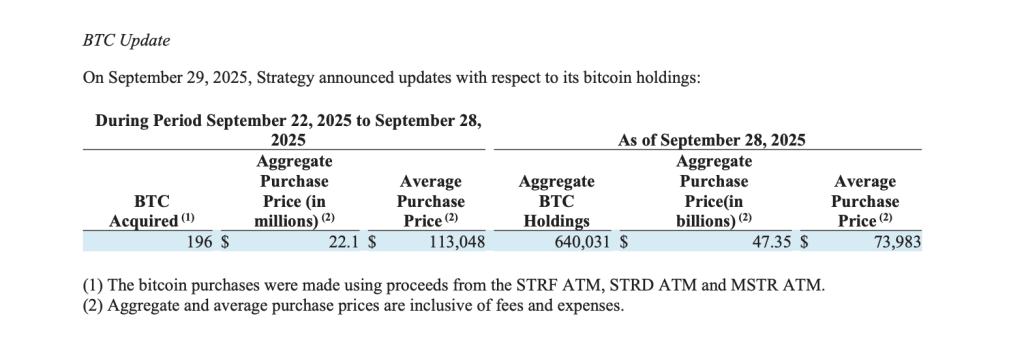

Strategy expanded its position as the largest corporate holder of Bitcoin. Between September 22 and September 28, 2025, the firm acquired 196 BTC for approximately $22.1 million at an average price of $113,048 per coin, according to its latest filing.

The company’s total Bitcoin holdings now stand at 640,031 BTC, acquired for an aggregate purchase price of about $47.35 billion, with an average cost of $73,983 per coin.

This latest purchase shows Strategy’s continued commitment to Bitcoin despite record-high valuations. By acquiring BTC above $113,000, the firm is not only averaging up its overall cost basis but also signaling confidence in the long-term trajectory of the digital asset.

Corporate Treasury Diversification at Scale

Strategy’s accumulation strategy has placed it in a league of its own among corporate treasuries. With holdings worth more than $47 billion, the company’s Bitcoin position surpasses the gold reserves of many nation-states.

This move is part of a broader trend where companies are increasingly exploring digital assets as treasury alternatives, particularly amid inflationary pressures, volatile interest rates, and currency risks.

By steadily increasing its Bitcoin reserves, Strategy has positioned itself as both a market leader and a case study in how corporations can diversify beyond traditional assets.

The firm’s purchases are funded through a combination of equity offerings, convertible debt, and cash flows, illustrating how balance sheet innovation can be leveraged to support long-term crypto exposure.

Market Impact and Institutional Trends

Strategy’s aggressive acquisition program comes as institutional adoption of Bitcoin accelerates. Exchange-traded funds are drawing billions in inflows, while regulatory clarity in key markets is expanding investor confidence.

As more institutions adopt Bitcoin exposure, Strategy’s large-scale holdings serve as a benchmark for corporate engagement with digital assets.

The company’s buying activity often attracts significant attention in the crypto markets, with some analysts noting its purchases as a bullish signal. By consistently acquiring Bitcoin during both bull and bear cycles, Strategy has established itself as a stabilizing long-term participant rather than a short-term speculator.

Strategic Outlook

Michael Saylor, Strategy’s co-founder and executive chairman, remains one of Bitcoin’s most outspoken advocates, often referring to it as “digital gold.” For Saylor, Bitcoin represents not only a superior store of value compared to traditional assets but also a generational hedge against monetary debasement.

With nearly 640,000 BTC under management, Strategy wields more influence than most sovereign reserves, giving it a unique voice in the global crypto economy.

The company’s unwavering commitment to Bitcoin suggests that, for Saylor and his team, digital assets are not a speculative play—but a cornerstone of corporate strategy designed to preserve and grow shareholder value for decades to come.

The post Strategy Acquires 196 BTC for $22.1M, Boosting Holdings to 640K BTC appeared first on Cryptonews.

Strategy Acquires 196 BTC for $22.1M, Boosting Holdings to 640K BTC

Billionaire Michael Saylor once again shows no signs of slowing down. Strategy has further cemented its reputation as the world’s largest corporate Bitcoin holder with a fresh purchase.

Strategy expanded its position as the largest corporate holder of Bitcoin. Between September 22 and September 28, 2025, the firm acquired 196 BTC for approximately $22.1 million at an average price of $113,048 per coin, according to its latest filing.

The company’s total Bitcoin holdings now stand at 640,031 BTC, acquired for an aggregate purchase price of about $47.35 billion, with an average cost of $73,983 per coin.

This latest purchase shows Strategy’s continued commitment to Bitcoin despite record-high valuations. By acquiring BTC above $113,000, the firm is not only averaging up its overall cost basis but also signaling confidence in the long-term trajectory of the digital asset.

Corporate Treasury Diversification at Scale

Strategy’s accumulation strategy has placed it in a league of its own among corporate treasuries. With holdings worth more than $47 billion, the company’s Bitcoin position surpasses the gold reserves of many nation-states.

This move is part of a broader trend where companies are increasingly exploring digital assets as treasury alternatives, particularly amid inflationary pressures, volatile interest rates, and currency risks.

By steadily increasing its Bitcoin reserves, Strategy has positioned itself as both a market leader and a case study in how corporations can diversify beyond traditional assets.

The firm’s purchases are funded through a combination of equity offerings, convertible debt, and cash flows, illustrating how balance sheet innovation can be leveraged to support long-term crypto exposure.

Market Impact and Institutional Trends

Strategy’s aggressive acquisition program comes as institutional adoption of Bitcoin accelerates. Exchange-traded funds are drawing billions in inflows, while regulatory clarity in key markets is expanding investor confidence.

As more institutions adopt Bitcoin exposure, Strategy’s large-scale holdings serve as a benchmark for corporate engagement with digital assets.

The company’s buying activity often attracts significant attention in the crypto markets, with some analysts noting its purchases as a bullish signal. By consistently acquiring Bitcoin during both bull and bear cycles, Strategy has established itself as a stabilizing long-term participant rather than a short-term speculator.

Strategic Outlook

Michael Saylor, Strategy’s co-founder and executive chairman, remains one of Bitcoin’s most outspoken advocates, often referring to it as “digital gold.” For Saylor, Bitcoin represents not only a superior store of value compared to traditional assets but also a generational hedge against monetary debasement.

With nearly 640,000 BTC under management, Strategy wields more influence than most sovereign reserves, giving it a unique voice in the global crypto economy.

The company’s unwavering commitment to Bitcoin suggests that, for Saylor and his team, digital assets are not a speculative play—but a cornerstone of corporate strategy designed to preserve and grow shareholder value for decades to come.

The post Strategy Acquires 196 BTC for $22.1M, Boosting Holdings to 640K BTC appeared first on Cryptonews.