Rumors Circulate of Bitcoin ETF Approval Tomorrow, How Could the BTC Price and Bitcoin Minetrix React?

Rumors are swirling that the long-awaited approval of a spot Bitcoin exchange-traded fund (ETF) in the US could finally arrive as soon as tomorrow.

If true, this regulatory green light could have a massive effect on Bitcoin’s price, with some analysts predicting a surge to new all-time highs.

But beyond Bitcoin itself, some BTC-related tokens could also soar higher thanks to the wave of investor inflows that a spot crypto ETF could unlock.

Bitcoin ETF Frenzy Ramps Up as Approval Rumors Emerge

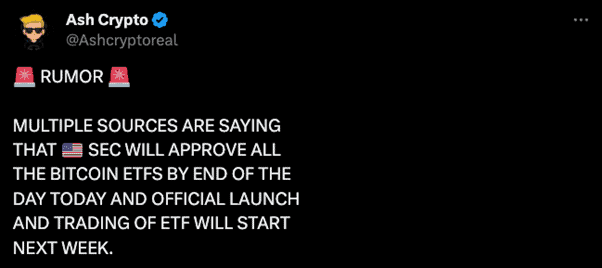

Anticipation for the SEC to approve a spot Bitcoin ETF has reached fever pitch, with speculation that one of these funds could be given the nod within 24 hours.

Fueling the rumors, Grayscale’s chief legal officer tweeted cryptically about “filling out some forms,” while a TechCrunch reporter cited insider sources expecting ETF approvals imminently.

The hashtag #BTCETF trended wildly on social media platforms, with the Bitcoin price surging almost 5% due to the buzz.

However, some analysts have cooled prospects of an immediate ETF approval, given procedural constraints like public comment periods.

Most expect the pivotal SEC decisions to come between January 8 and January 10, once the final regulatory filings are submitted.

With powerhouses like BlackRock, Valkyrie, and Fidelity vying for a spot crypto ETF, the race is finally nearing its conclusion.

An approval would unlock billions of new institutional and retail capital, bringing it into Bitcoin and the crypto market more generally.

Massive BTC Price Predictions from Analysts Amid Imminent ETF Hopes

An SEC green light is widely believed to ignite a Bitcoin rally due to the increased demand it would bring.

Some analysts forecast Bitcoin reaching as high as $75,000 if its largest remaining regulatory barrier was to fall.

Analyst Mark Mobius predicted $60,000 by year’s end, citing heightened interest from traders worldwide.

Bit Mining’s chief economist, Youwei Yang, set a target range of $25,000 to $75,000 for 2024 based on formal ETF inflows and constrained supply from the upcoming halving event.

However, not all reactions are bullish – some traders could “sell the news” if the long-speculated approval finally comes.

Selling the news refers to traders selling an asset after a widely-anticipated event occurs, on the assumption that the asset has already priced in the expected impact.

So, in this case, some traders may believe that Bitcoin’s current price already reflects expectations of an SEC approval for a Bitcoin ETF.

If that approval finally comes, those traders could decide to take profits by selling BTC – pushing the coin’s price down.

Limited-Time Bitcoin Minetrix Presale Offers BTC Mining Innovation & Derivative ETF Exposure

While Bitcoin itself stands to benefit most directly from ETF approval, some related crypto tokens branded after BTC could ride the wave of hype and investor inflows.

Coins that offer derivative exposure to Bitcoin mining or leverage its brand have surged previously during BTC bull runs.

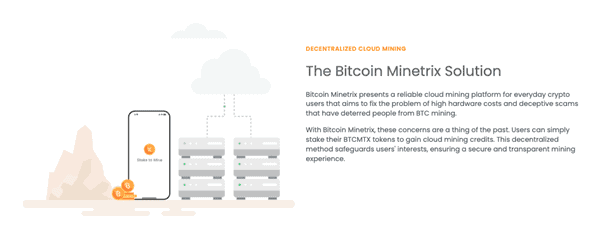

One new coin being touted to grow if a spot BTC ETF is approved is Bitcoin Minetrix (BTCMTX), which has attracted substantial interest for its “Stake-to-Mine” mechanism.

This mechanism lets users earn BTC mining yields simply by staking the native BTCMTX token.

Through this setup, Bitcoin Minetrix aims to simplify BTC mining for a mainstream audience, removing barriers to entry like expensive hardware.

Underpinning the project’s technology is a comprehensive audit from Coinsult, helping boost safety and transparency.

Speculation is growing around Bitcoin Minetrix’s potential, given that its staking rewards significantly outpace the industry average.

Additionally, Bitcoin Minetrix appeals to environmentally-conscious investors by utilizing cloud infrastructure rather than a traditional mining setup.

As the crypto community awaits the SEC’s final decision on a spot BTC ETF, Bitcoin Minetrix represents an intriguing derivative play with its own unique features.

The project’s presale has now raised over $7.5 million in funding, and early investors can buy BTCMTX tokens for just $0.0126 for a limited time.

Visit Bitcoin Minetrix Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Rumors Circulate of Bitcoin ETF Approval Tomorrow, How Could the BTC Price and Bitcoin Minetrix React? appeared first on CryptoPotato.

Rumors Circulate of Bitcoin ETF Approval Tomorrow, How Could the BTC Price and Bitcoin Minetrix React?

Rumors are swirling that the long-awaited approval of a spot Bitcoin exchange-traded fund (ETF) in the US could finally arrive as soon as tomorrow.

If true, this regulatory green light could have a massive effect on Bitcoin’s price, with some analysts predicting a surge to new all-time highs.

But beyond Bitcoin itself, some BTC-related tokens could also soar higher thanks to the wave of investor inflows that a spot crypto ETF could unlock.

Bitcoin ETF Frenzy Ramps Up as Approval Rumors Emerge

Anticipation for the SEC to approve a spot Bitcoin ETF has reached fever pitch, with speculation that one of these funds could be given the nod within 24 hours.

Fueling the rumors, Grayscale’s chief legal officer tweeted cryptically about “filling out some forms,” while a TechCrunch reporter cited insider sources expecting ETF approvals imminently.

The hashtag #BTCETF trended wildly on social media platforms, with the Bitcoin price surging almost 5% due to the buzz.

However, some analysts have cooled prospects of an immediate ETF approval, given procedural constraints like public comment periods.

Most expect the pivotal SEC decisions to come between January 8 and January 10, once the final regulatory filings are submitted.

With powerhouses like BlackRock, Valkyrie, and Fidelity vying for a spot crypto ETF, the race is finally nearing its conclusion.

An approval would unlock billions of new institutional and retail capital, bringing it into Bitcoin and the crypto market more generally.

Massive BTC Price Predictions from Analysts Amid Imminent ETF Hopes

An SEC green light is widely believed to ignite a Bitcoin rally due to the increased demand it would bring.

Some analysts forecast Bitcoin reaching as high as $75,000 if its largest remaining regulatory barrier was to fall.

Analyst Mark Mobius predicted $60,000 by year’s end, citing heightened interest from traders worldwide.

Bit Mining’s chief economist, Youwei Yang, set a target range of $25,000 to $75,000 for 2024 based on formal ETF inflows and constrained supply from the upcoming halving event.

However, not all reactions are bullish – some traders could “sell the news” if the long-speculated approval finally comes.

Selling the news refers to traders selling an asset after a widely-anticipated event occurs, on the assumption that the asset has already priced in the expected impact.

So, in this case, some traders may believe that Bitcoin’s current price already reflects expectations of an SEC approval for a Bitcoin ETF.

If that approval finally comes, those traders could decide to take profits by selling BTC – pushing the coin’s price down.

Limited-Time Bitcoin Minetrix Presale Offers BTC Mining Innovation & Derivative ETF Exposure

While Bitcoin itself stands to benefit most directly from ETF approval, some related crypto tokens branded after BTC could ride the wave of hype and investor inflows.

Coins that offer derivative exposure to Bitcoin mining or leverage its brand have surged previously during BTC bull runs.

One new coin being touted to grow if a spot BTC ETF is approved is Bitcoin Minetrix (BTCMTX), which has attracted substantial interest for its “Stake-to-Mine” mechanism.

This mechanism lets users earn BTC mining yields simply by staking the native BTCMTX token.

Through this setup, Bitcoin Minetrix aims to simplify BTC mining for a mainstream audience, removing barriers to entry like expensive hardware.

Underpinning the project’s technology is a comprehensive audit from Coinsult, helping boost safety and transparency.

Speculation is growing around Bitcoin Minetrix’s potential, given that its staking rewards significantly outpace the industry average.

Additionally, Bitcoin Minetrix appeals to environmentally-conscious investors by utilizing cloud infrastructure rather than a traditional mining setup.

As the crypto community awaits the SEC’s final decision on a spot BTC ETF, Bitcoin Minetrix represents an intriguing derivative play with its own unique features.

The project’s presale has now raised over $7.5 million in funding, and early investors can buy BTCMTX tokens for just $0.0126 for a limited time.

Visit Bitcoin Minetrix Presale

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

The post Rumors Circulate of Bitcoin ETF Approval Tomorrow, How Could the BTC Price and Bitcoin Minetrix React? appeared first on CryptoPotato.