Ethereum Shock: $113K Gas Fee Spree Leads to Crypto Catastrophe

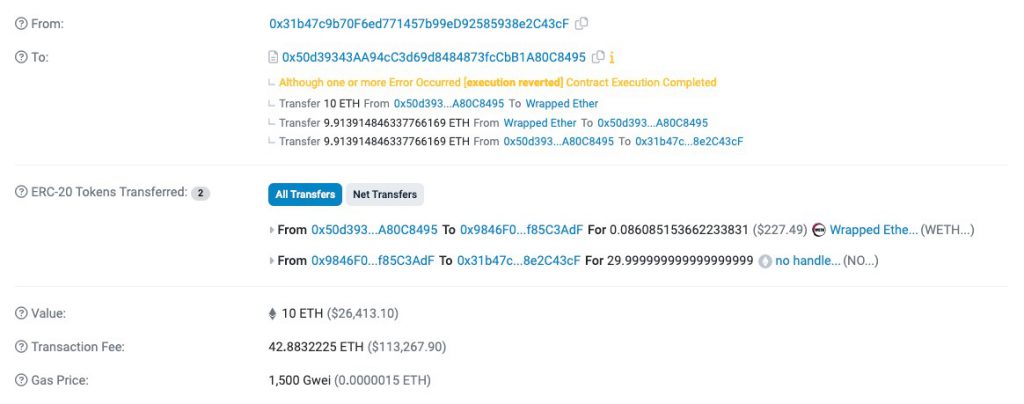

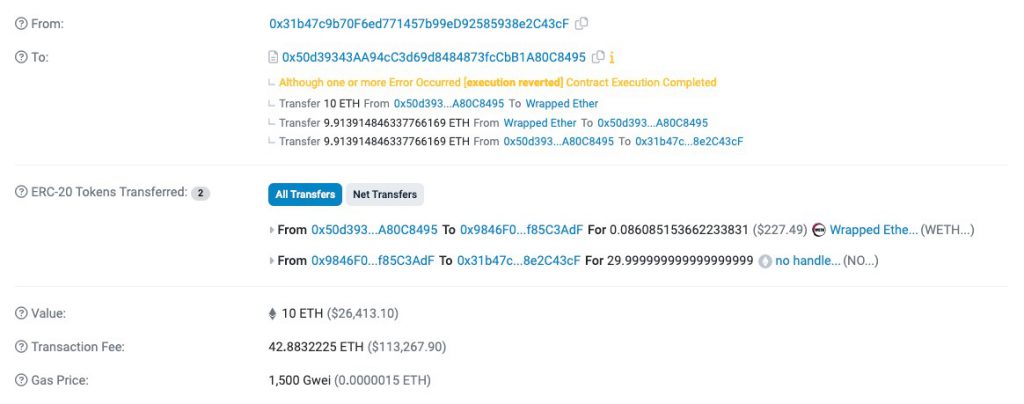

Following Ethereum’s Merge, hopes were high among investors for a reduction in gas fees on the network. However, recent events have highlighted that hefty transaction fees are still a significant issue for users. In a noteworthy incident on Feb. 13, a single transaction on the Ethereum network incurred a massive 42.88 ETH gas fee, amounting to approximately $113,531. This incident echoes the frenzy of a bull run.

Rug Pull Scam

A crypto user made headlines after spending a staggering $113,000 in gas fees to secure $26,000 worth of a newly launched token. Unfortunately, the token turned out to be a “rug pull” scam, losing value within just 35 minutes of purchase.

According to Etherscan data, a wallet address interacted with a smart contract address on Feb.13, transferring 10 ETH (valued at around $26,000) to the contract. The smart contract then swapped it for 30 No Handle (NO) tokens, which were later deposited into another wallet address.

Also Read: What is the Ethereum (ETH) Burn Address?

Hefty Gas Fees and Disaster

While substantial gas fees are often viewed as a bullish indicator, this gamble ended disastrously. The price of the NO token soared before crashing back to near-zero within minutes, leaving the user “rugged.” This incident underscores the risks associated with investing in speculative tokens. The NO token, deemed “high risk” by analysts, plummeted shortly after launch, posing significant dangers to investors.

The emergence of ERC-404 tokens, which aim to merge ERC-721 NFTs with ERC-20 tokens, comes with inherent risks, as demonstrated by this unfortunate outcome.

Transaction Fees and Ethereum

Also Read: Ethereum Breaks Crucial Resistance; Will ETH Hit $3,000?

Transaction fees are an essential aspect of blockchain networks, with Ethereum known for its high gas fees. These fees fluctuate based on usage and demand dynamics, contributing to their recent increase. While the allure of quick gains in the cryptocurrency market is tempting, investors should exercise caution and conduct thorough research. The $113,000 gas fee debacle serves as a stark reminder of the risks involved in speculative ventures without proper due diligence.

Read More

Is Ethereum Back In Business? Morningstar Candlestick Pattern Tells A Story

Ethereum Shock: $113K Gas Fee Spree Leads to Crypto Catastrophe

Following Ethereum’s Merge, hopes were high among investors for a reduction in gas fees on the network. However, recent events have highlighted that hefty transaction fees are still a significant issue for users. In a noteworthy incident on Feb. 13, a single transaction on the Ethereum network incurred a massive 42.88 ETH gas fee, amounting to approximately $113,531. This incident echoes the frenzy of a bull run.

Rug Pull Scam

A crypto user made headlines after spending a staggering $113,000 in gas fees to secure $26,000 worth of a newly launched token. Unfortunately, the token turned out to be a “rug pull” scam, losing value within just 35 minutes of purchase.

According to Etherscan data, a wallet address interacted with a smart contract address on Feb.13, transferring 10 ETH (valued at around $26,000) to the contract. The smart contract then swapped it for 30 No Handle (NO) tokens, which were later deposited into another wallet address.

Also Read: What is the Ethereum (ETH) Burn Address?

Hefty Gas Fees and Disaster

While substantial gas fees are often viewed as a bullish indicator, this gamble ended disastrously. The price of the NO token soared before crashing back to near-zero within minutes, leaving the user “rugged.” This incident underscores the risks associated with investing in speculative tokens. The NO token, deemed “high risk” by analysts, plummeted shortly after launch, posing significant dangers to investors.

The emergence of ERC-404 tokens, which aim to merge ERC-721 NFTs with ERC-20 tokens, comes with inherent risks, as demonstrated by this unfortunate outcome.

Transaction Fees and Ethereum

Also Read: Ethereum Breaks Crucial Resistance; Will ETH Hit $3,000?

Transaction fees are an essential aspect of blockchain networks, with Ethereum known for its high gas fees. These fees fluctuate based on usage and demand dynamics, contributing to their recent increase. While the allure of quick gains in the cryptocurrency market is tempting, investors should exercise caution and conduct thorough research. The $113,000 gas fee debacle serves as a stark reminder of the risks involved in speculative ventures without proper due diligence.

Read More