SPX6900 Price Analysis: 39% Weekly Surge Signals Bullish Momentum

- SPX6900 trades at $1.56, up nearly 39% in the last week, with $95M in daily volume.

- Analysts eye $1.85–$2.25 targets if support at $1.40–$1.45 holds.

- Historical Q3 strength and bullish sentiment suggest potential for new highs in Q4.

SPX6900 has been heating up lately, riding a wave of interest from traders who see real potential in the token. Right now, the coin is priced at $1.56, reflecting an 8.36% jump in just the past 24 hours. Over the last week, it’s surged almost 39%, a move that signals more people are paying attention. If momentum sticks, SPX could be lining itself up for even bigger moves in the near term.

Technical Indicators Show Neutral RSI, Weak MACD Crossover

The latest chart data shows SPX6900 trading at $1.56 with daily volume around $95.4 million. It’s down about 1.88% from the day’s peak, but still well within its current uptrend. The Relative Strength Index (RSI) sits at 53.2—pretty neutral, giving bulls room to push without flashing overbought signals. The MACD, though, has turned slightly bearish with a crossover, hinting that momentum may be cooling short term. Still, with the broader structure pointing upward, traders are keeping watch for continuation moves.

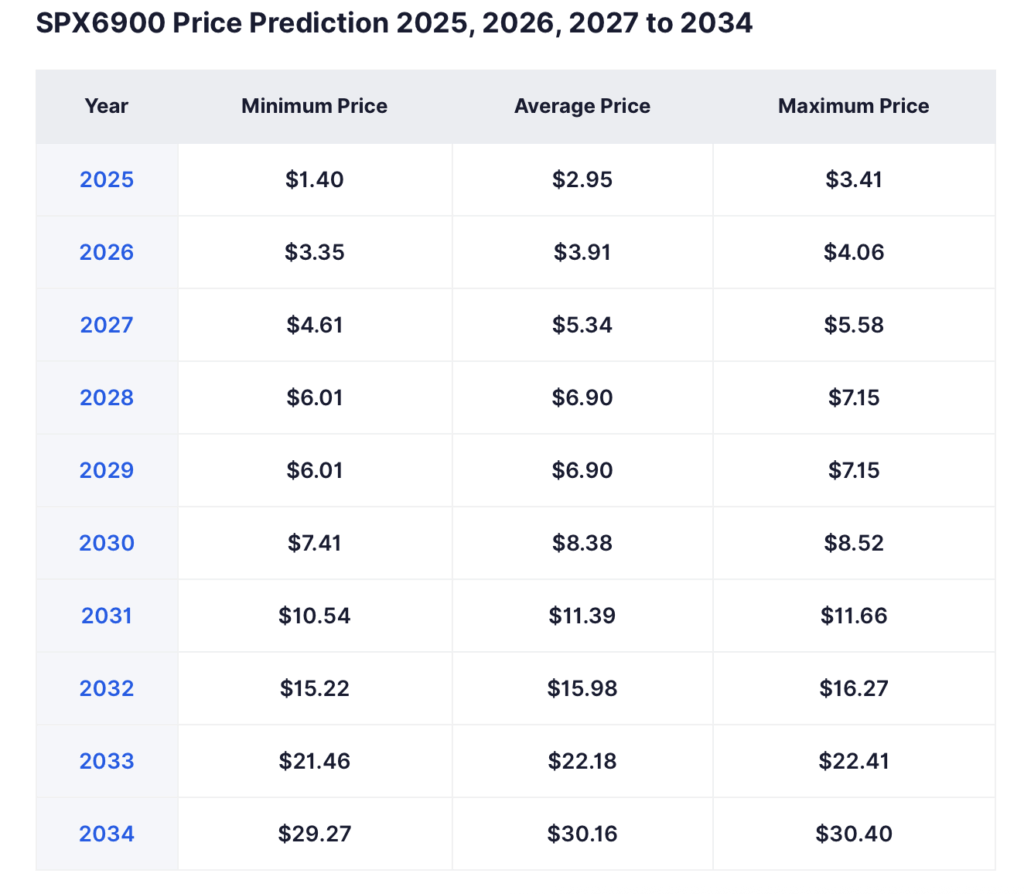

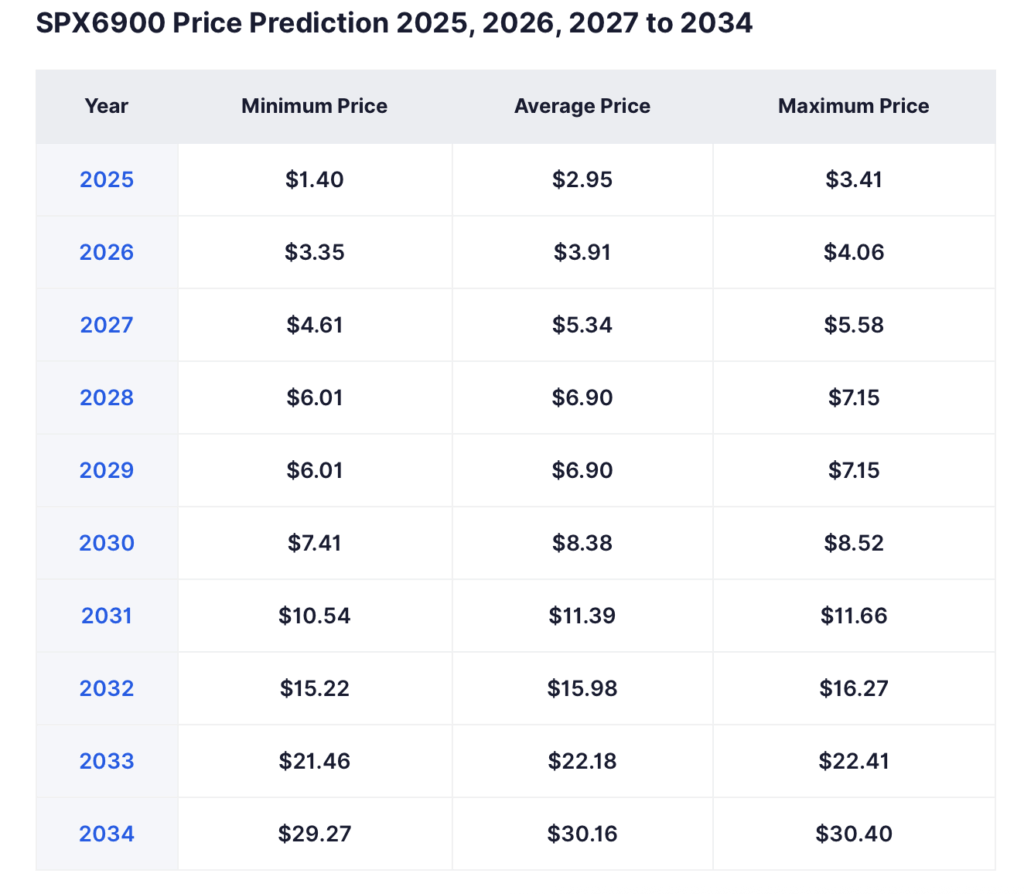

SPX6900 Price Prediction: Analysts Eye $3.41 by Year-End

DigitalCoinPrice has projected SPX6900 could reach as high as $3.41 before the year’s out, with a potential floor around $1.40. Meanwhile, on X, sentiment has been buzzing. Coinvo highlighted SPX’s “massive comeback,” noting the coin’s 32.7% surge in just 48 hours and a 60% climb over the past week. With a market cap near $1.46 billion and a circulating supply of roughly 931 million tokens, the project has managed to carve out a spot among the year’s better-performing meme coins. Technicals are still showing bullish undercurrents, giving some weight to the optimistic predictions.

Breakout Above Descending Channel Opens Path to $2.25

SPX has recently broken free from a descending channel, a shift that analysts see as a turning point in sentiment. The focus now is on the $1.40–$1.45 retest zone. If buyers defend this area, upside targets at $1.85, $1.90, and $2.25 come back into play. On the flip side, failing to hold this zone could mean a spell of sideways consolidation. Looking at historical patterns, Q3 has always been SPX’s strongest quarter—averaging over 300% returns—while Q1 typically drags. With Q4 underway and community sentiment turning bullish, many are betting on fresh highs before year-end.

The post SPX6900 Price Analysis: 39% Weekly Surge Signals Bullish Momentum first appeared on BlockNews.

SPX6900 Price Analysis: 39% Weekly Surge Signals Bullish Momentum

- SPX6900 trades at $1.56, up nearly 39% in the last week, with $95M in daily volume.

- Analysts eye $1.85–$2.25 targets if support at $1.40–$1.45 holds.

- Historical Q3 strength and bullish sentiment suggest potential for new highs in Q4.

SPX6900 has been heating up lately, riding a wave of interest from traders who see real potential in the token. Right now, the coin is priced at $1.56, reflecting an 8.36% jump in just the past 24 hours. Over the last week, it’s surged almost 39%, a move that signals more people are paying attention. If momentum sticks, SPX could be lining itself up for even bigger moves in the near term.

Technical Indicators Show Neutral RSI, Weak MACD Crossover

The latest chart data shows SPX6900 trading at $1.56 with daily volume around $95.4 million. It’s down about 1.88% from the day’s peak, but still well within its current uptrend. The Relative Strength Index (RSI) sits at 53.2—pretty neutral, giving bulls room to push without flashing overbought signals. The MACD, though, has turned slightly bearish with a crossover, hinting that momentum may be cooling short term. Still, with the broader structure pointing upward, traders are keeping watch for continuation moves.

SPX6900 Price Prediction: Analysts Eye $3.41 by Year-End

DigitalCoinPrice has projected SPX6900 could reach as high as $3.41 before the year’s out, with a potential floor around $1.40. Meanwhile, on X, sentiment has been buzzing. Coinvo highlighted SPX’s “massive comeback,” noting the coin’s 32.7% surge in just 48 hours and a 60% climb over the past week. With a market cap near $1.46 billion and a circulating supply of roughly 931 million tokens, the project has managed to carve out a spot among the year’s better-performing meme coins. Technicals are still showing bullish undercurrents, giving some weight to the optimistic predictions.

Breakout Above Descending Channel Opens Path to $2.25

SPX has recently broken free from a descending channel, a shift that analysts see as a turning point in sentiment. The focus now is on the $1.40–$1.45 retest zone. If buyers defend this area, upside targets at $1.85, $1.90, and $2.25 come back into play. On the flip side, failing to hold this zone could mean a spell of sideways consolidation. Looking at historical patterns, Q3 has always been SPX’s strongest quarter—averaging over 300% returns—while Q1 typically drags. With Q4 underway and community sentiment turning bullish, many are betting on fresh highs before year-end.

The post SPX6900 Price Analysis: 39% Weekly Surge Signals Bullish Momentum first appeared on BlockNews.