Crypto Weekly Report: In-Depth Insights on Blockchain, Bitcoin, Altcoins, ETFs and More

The post Crypto Weekly Report: In-Depth Insights on Blockchain, Bitcoin, Altcoins, ETFs and More appeared first on Coinpedia Fintech News

1. Breaking News This Week

- Fed Interest Rate

Traders anticipate a March start for Federal Reserve interest rate cuts, but uncertainty lingers after stronger-than-expected December retail sales.

- Singapore Rejects Bitcoin ETFs

The Monetary Authority of Singapore disapproves of listing Bitcoin ETFs, citing cryptocurrency’s ineligibility as assets for ETFs.

- SEC Extends Ethereum ETF Decision

The SEC extends the decision deadline for Fidelity’s spot Ethereum ETF proposal to March 5, coinciding with other Bitcoin ETF applications.

- Binance Launches in Thailand

Gulf Binance, a Binance and Gulf Innova joint venture, launches crypto exchange services in Thailand for public access.

- Accelerated SEC Timeline for Bitcoin ETF Options

SEC aims for potential approval of spot Bitcoin ETF-based options by the end of February.

- Ripple Objects to SEC Request

Ripple responds to SEC’s motion to compel, arguing it seeks irrelevant information and challenges the need for new data.

- SEC vs. Coinbase Complexity

SEC and Coinbase await a judge’s decision on whether secondary-market trades of a dozen tokens on the exchange violate securities law.

2. Blockchain Performance

In this section, we will analyse two things primarily: the top-performing blockchains based solely on their 7-day change and the top performers among the top five blockchains with the highest TVL.

2.1. Top Blockchain Performers by 7-Day Change

| Blockchain | 7-Day Change (in %) |

| Mode | +357% |

| Viction | +185% |

| PulseChain | +120% |

| ICP | +109% |

| DogeChain | +59.50% |

Among the top blockchain performers by 7-day change, Mode takes the lead with an impressive +357%, followed by Viction at +185%. PulseChain demonstrates a notable +120%, while ICP and DogeChain show positive trends with +109% and +59.50%, respectively.

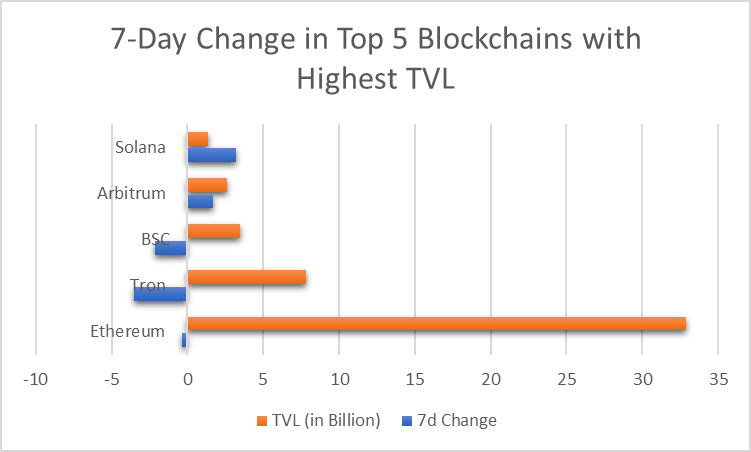

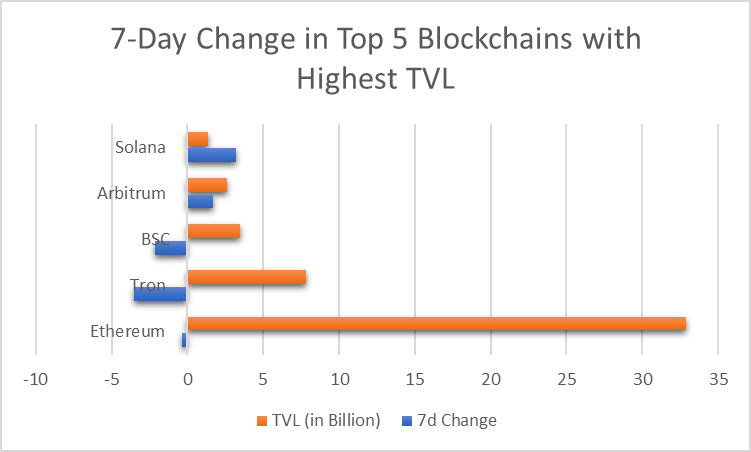

2.2. Top Performers: 7-Day Change in Top 5 Blockchains with Highest TVL

| Blockchain | 7d Change | TVL (in Billion) |

| Ethereum | -0.35% | $32.884b |

| Tron | -3.49% | $7.827b |

| BSC | -2.11% | $3.476b |

| Arbitrum | +1.67% | $2.631b |

| Solana | +3.19% | $1.362b |

In the realm of top-performing blochains by 7-day change and highest TVL, Ethereum maintains stability with a slight decrease of -0.35%, boasting a substantial $32.884 billion TVL. Solana shows robust growth at +3.19%, securing a $1.362 billion TVL. Other contenders like Arbitrum, Tron, and BSC exhibit varying 7-day changes, ranging from -3.49% to +3.19%.

3. Crypto Market Analysis

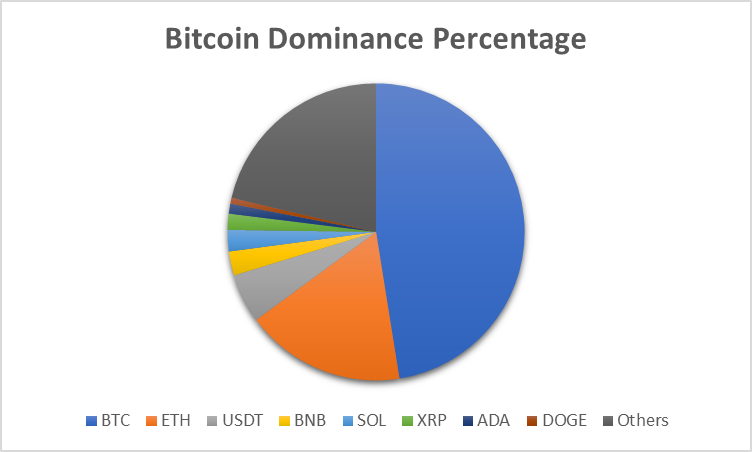

3.1. Bitcoin Price and Dominance

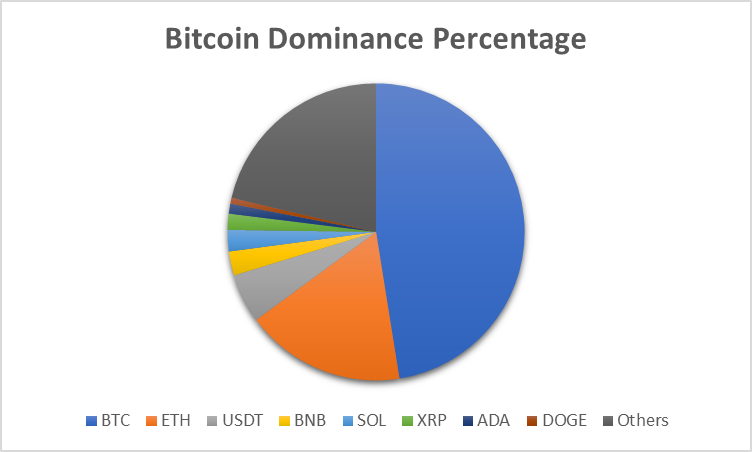

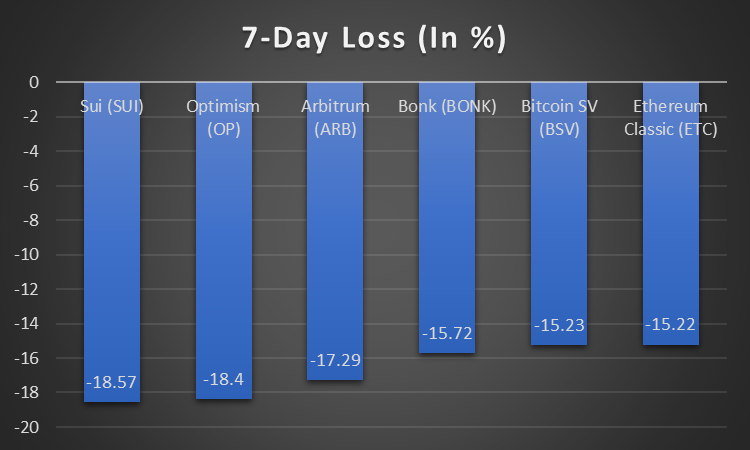

| Cryptocurrency | Price | Market Cap | Dominance Percentage | 7d- Change in Market Cap |

| BTC | $41,517.05 | $814,183,398,032 | 47.6% | -3.7% |

| ETH | $2,472.54 | $297,227,466,946 | 17.47% | -3.1% |

| USDT | $0.993 | $94,931,461,114 | 5.36% | -0.0% |

| BNB | $312.61 | $48,091,288,144 | 2.63% | +4.5% |

| SOL | $91.56 | $39,659,679,333 | 2.33% | -1.2% |

| XRP | $0.5464 | $29,726,797,725 | 1.76% | -4.8% |

| ADA | $0.5104 | $17,911,980,946 | 1.09% | -6.9% |

| DOGE | $0.078 | $11,222,007,173 | 0.65% | -2.7% |

| Others | 21.34% |

Bitcoin (BTC) leads with a price of $41,517.05, commanding a substantial market cap of $814.18 billion and a dominance percentage of 47.6%. Its 7-day change in market cap is a negative index of -3.7. Ethereum (ETH) follows with a price of $2,472.54, a market cap of $297.23 billion, and a 7-day change in market cap of -3.1%. Binance Coin (BNB) stands out with a positive 7-day change of +4.5%, priced at $312.61, and a market cap of $48.09 billion.

3.2. Top Gainers & Losers of the Week in Crypto Market

Here is the list of top gainers and top losers of the week in the cryptocurrency market. The analysis is made using the 7-day Gain and 7-day Lose indexes.

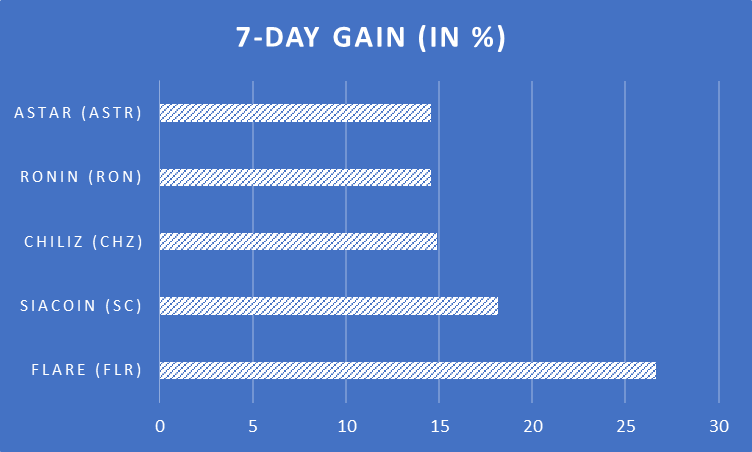

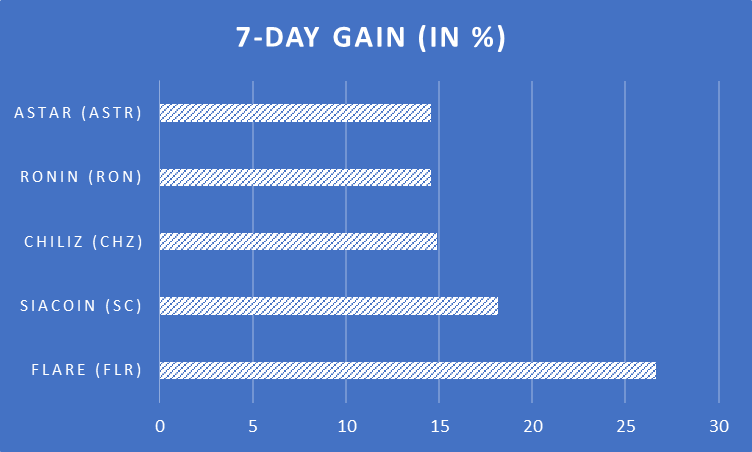

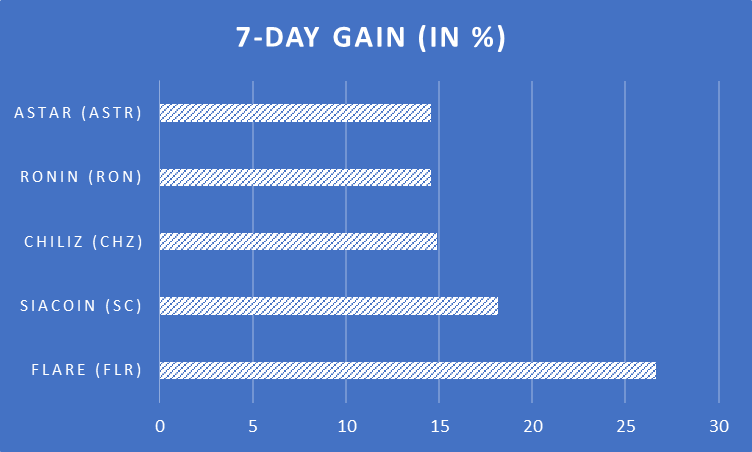

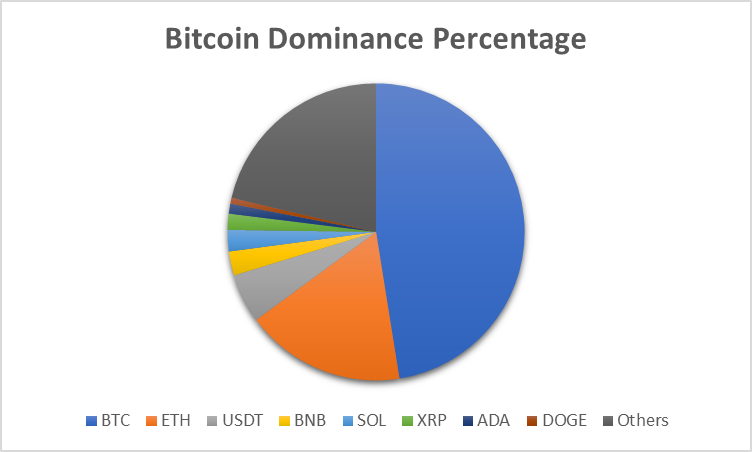

3.2.1. Top Gainers of the Week in Crypto

| Cryptocurrency | Price | 7-Day Gain |

| Flare (FLR) | $0.02213 | 26.62% |

| Siacoin (SC) | $0.01095 | 18.13% |

| Chiliz (CHZ) | $0.09643 | 14.87% |

| Ronin (RON) | $2.10 | 14.57% |

| Astar (ASTR) | $0.174 | 14.56% |

This week’s top gainers in the crypto space include Flare (FLR) with a 7-day gain of 26.62%, Siacoin (SC) at $0.01095 with an 18.13% increase, Chiliz (CHZ) at $0.09643 showcasing a 14.87% gain, Ronin (RON) with a 14.57% increase at $2.10, and Astar (ASTR) at $0.174 with a 14.56% gain.

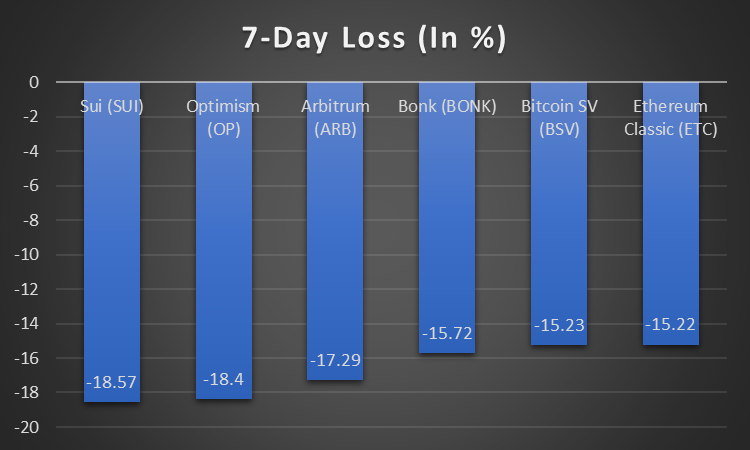

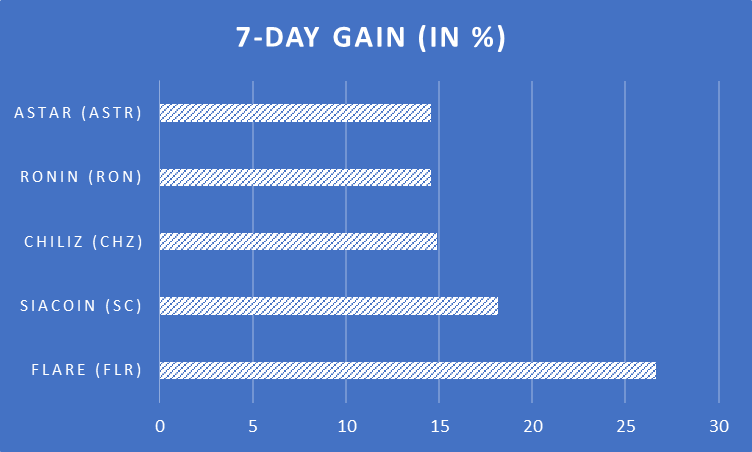

3.2.2. Top Losers of the Week in Crypto

| Cryptocurrency | Price | 7-Day Loss |

| Sui (SUI) | $1.08 | -18.57% |

| Optimism (OP) | $3.13 | -18.40% |

| Arbitrum (ARB) | $1.79 | -17.29% |

| Bonk (BONK) | $0.00001133 | -15.72% |

| Bitcoin SV (BSV) | $71.57 | -15.23% |

| Ethereum Classic (ETC) | $24.69 | -15.22% |

This week’s top losers in the cryptocurrency market are led by Sui (SUI) with a 7-day loss of -18.57%, followed closely by Optimism (OP) at $3.13 with an -18.40% decrease. Arbitrum (ARB), Bonk (BONK), Bitcoin SV (BSV), and Ethereum Classic (ETC) also experienced losses ranging from -15.22% to -17.29%, indicating a challenging week for these assets.

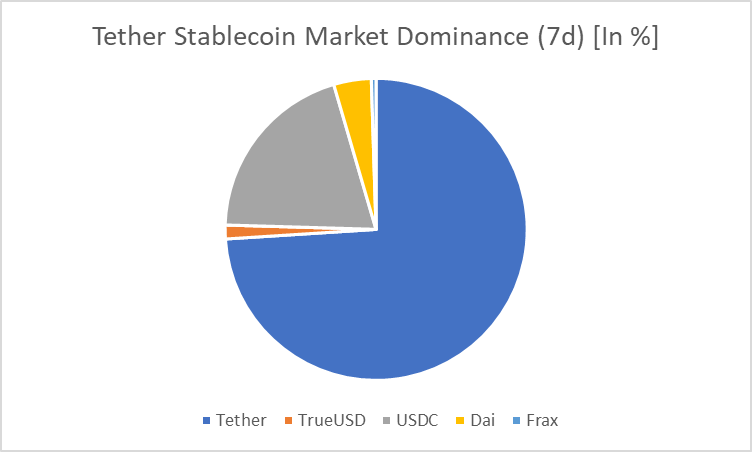

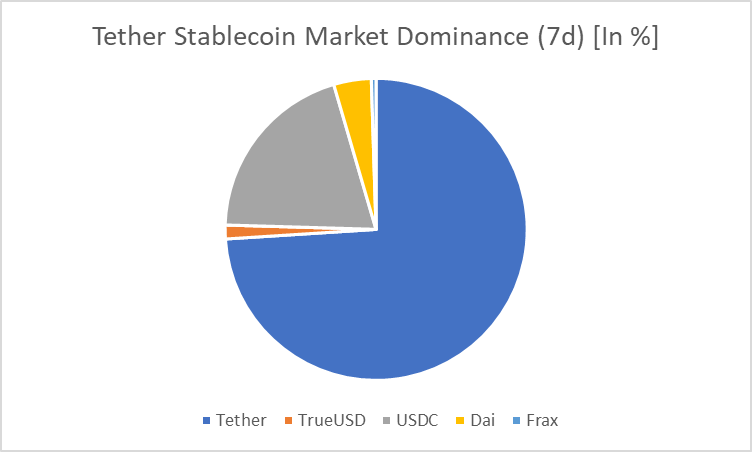

3.3. Stablecoin Weekly Analysis

| Stablecoin | Market Capitalisation (7d) | Market Dominance (7d) [in %] | Trading Volume (7d) |

| Tether | $94,967,646,331 | 72.25% | $45,051,204,444 |

| TrueUSD | $1,876,926,357 | 1.44% | $128,811,385 |

| USDC | $25,524,310,090 | 19.54% | $7,508,298,350 |

| Dai | $5,166,646,630 | 3.93% | $157,000,259 |

| Frax | $648,627,425 | 0.49% | $11,020,426 |

In the week’s stablecoin performance analysis, Tether (USDT) stands out with a commanding trading volume of $45.05 billion, emphasising its widespread utility. Tether also holds the highest market capitalisation at $94.97 billion, securing a dominant 72.25% market share. USDC follows closely with a notable trading volume of $7.51 billion and a substantial market capitalization of $25.52 billion, commanding a 19.54% market dominance.

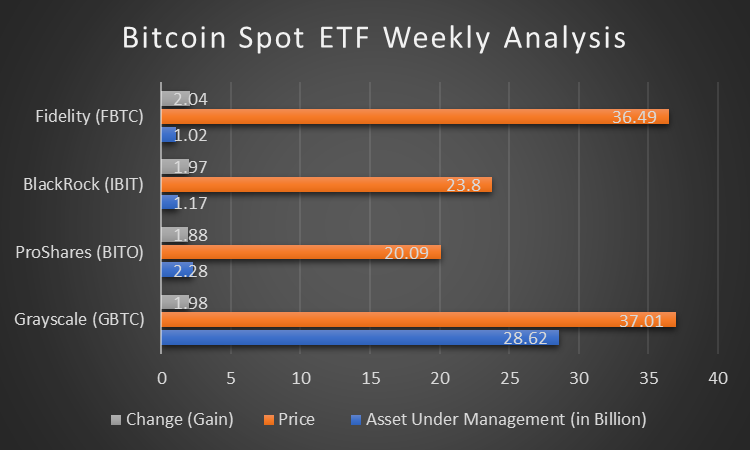

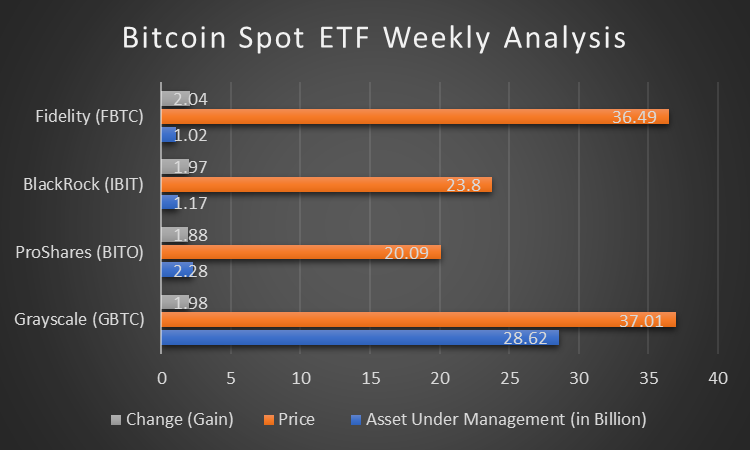

4. Bitcoin Spot ETF Weekly Analysis

| Bitcoin Spot ETFs | Asset Under Management (in Billion) | Price | Change (Gain) |

| Grayscale (GBTC) | $28.62B | $37.01 | +1.98% |

| ProShares (BITO) | $2.28B | $20.09 | +1.88% |

| BlackRock (IBIT) | $1.17B | $23.80 | +1.97% |

| Fidelity (FBTC) | $1.02B | $36.49 | +2.04% |

In this week’s Bitcoin Spot ETF analysis, Grayscale (GBTC) leads with $28.62 billion in Assets Under Management and a price of $37.01. Notably, Fidelity (FBTC) displays a remarkable 2.04% gain, with $1.02 billion AUM and a $36.49 price. ProShares (BITO) and BlackRock (IBIT) also show positive changes at 1.88% and 1.97%, respectively. This reflects a dynamic week, with Fidelity standing out for its impressive gain in value.

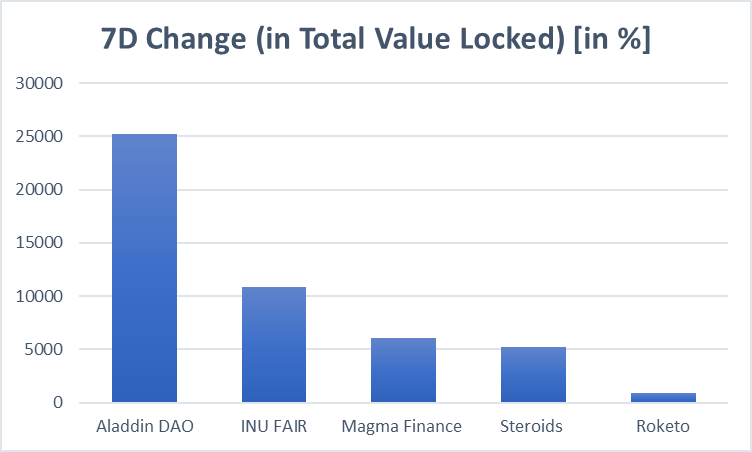

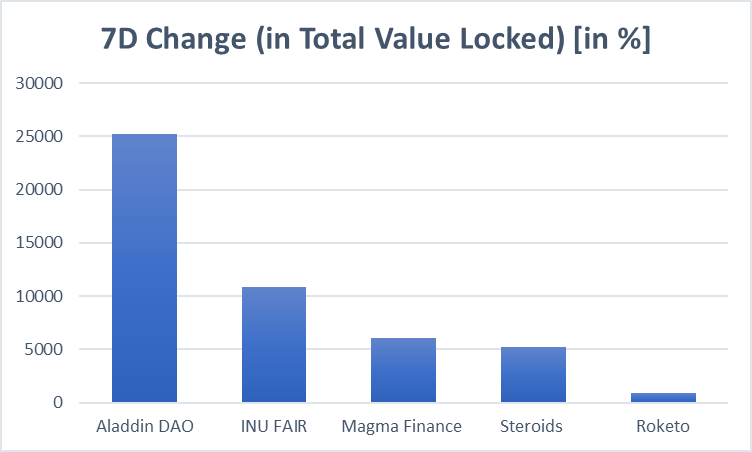

5. DeFi Market Weekly Status Analysis

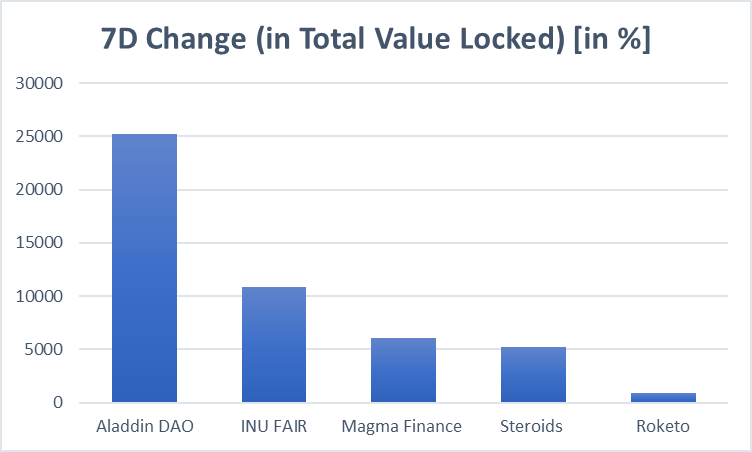

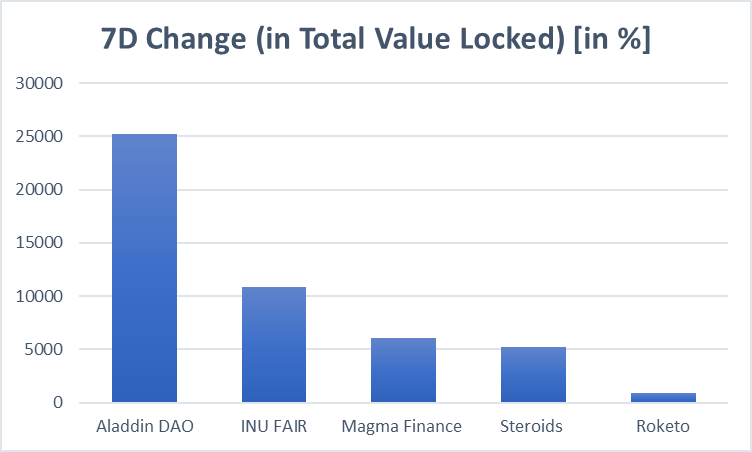

| DeFi Protocols | 7d Change (in Total Value Locked) [in %] |

| Aladdin DAO | +25212% |

| INU FAIR | +10852% |

| Magma Finance | +6066% |

| Steroids | +5204% |

| Roketo | +851% |

In this week’s DeFi market analysis, impressive growth is observed in Total Volume Locked (TVL) across various protocols. Aladdin DAO leads with a remarkable +25212% 7-day change, followed by INU FAIR at +10852%, Magma Finance at +6.66%, Steroids at +5204%, and Roketo at +851%.

6. NFT Marketplace: A Basic Weekly Analysis

| NFT Marketplaces | 7-day Rolling Volume | 7-day Rolling Trade | Volume Change | Market Share (based on 1-day Volume) |

| Blur | 34705.91 | 42920 | +11.91% | 54.19% |

| Blur Aggregator | 19661.24 | 23917 | +35.32% | 17.83% |

| Opensea | 10870.06 | 35894 | -6.81% | 15.45% |

| Cryptopunks | 2470.67 | 36 | +57.37% | 7.89% |

| Gem | 1931.81 | 7354 | -11.34% | 1.84% |

In this week’s basic analysis of NFT marketplace, notable trends emerge. Blur and Blur Aggregator show substantial volume increases of +11.91% and +35.32%, respectively, with market shares of 54.19% and 17.83%, In contrast, Opensea experiences a -6.81% volume change but maintains a significant market share of 15.45%. Cryptopunks exhibit a remarkable +57.37% volume change, claiming a 7.89% market share. Gem, however, sees a 11.34% volume change, holding a 1.84% market share.

6.1. Top NFT Collectible Sales this Week

| NFT Collectibles | Price (in USD) |

| CryptoPunk #6912 | $475,676.56 |

| CryptoPunk #4506 | $349,195.00 |

| Art Blocks #78000643 | $243,379.25 |

| Azuki #5889 | $236,049.33 |

| CryptoPunks #6889 | $227,976,52 |

In this week’s NFT collectible sales, notable transactions include CryptoPunk #6912 at $475,676.56, followed by CryptoPunk #4506 at $349,195.00. Art Blocks #78000643 secured a significant value of $243,379.25, while Azuki #5889 and CryptoPunks #6889 fetched prices of $236,049.33 and $227,976.52, respectively.

Crypto Weekly Report: In-Depth Insights on Blockchain, Bitcoin, Altcoins, ETFs and More

The post Crypto Weekly Report: In-Depth Insights on Blockchain, Bitcoin, Altcoins, ETFs and More appeared first on Coinpedia Fintech News

1. Breaking News This Week

- Fed Interest Rate

Traders anticipate a March start for Federal Reserve interest rate cuts, but uncertainty lingers after stronger-than-expected December retail sales.

- Singapore Rejects Bitcoin ETFs

The Monetary Authority of Singapore disapproves of listing Bitcoin ETFs, citing cryptocurrency’s ineligibility as assets for ETFs.

- SEC Extends Ethereum ETF Decision

The SEC extends the decision deadline for Fidelity’s spot Ethereum ETF proposal to March 5, coinciding with other Bitcoin ETF applications.

- Binance Launches in Thailand

Gulf Binance, a Binance and Gulf Innova joint venture, launches crypto exchange services in Thailand for public access.

- Accelerated SEC Timeline for Bitcoin ETF Options

SEC aims for potential approval of spot Bitcoin ETF-based options by the end of February.

- Ripple Objects to SEC Request

Ripple responds to SEC’s motion to compel, arguing it seeks irrelevant information and challenges the need for new data.

- SEC vs. Coinbase Complexity

SEC and Coinbase await a judge’s decision on whether secondary-market trades of a dozen tokens on the exchange violate securities law.

2. Blockchain Performance

In this section, we will analyse two things primarily: the top-performing blockchains based solely on their 7-day change and the top performers among the top five blockchains with the highest TVL.

2.1. Top Blockchain Performers by 7-Day Change

| Blockchain | 7-Day Change (in %) |

| Mode | +357% |

| Viction | +185% |

| PulseChain | +120% |

| ICP | +109% |

| DogeChain | +59.50% |

Among the top blockchain performers by 7-day change, Mode takes the lead with an impressive +357%, followed by Viction at +185%. PulseChain demonstrates a notable +120%, while ICP and DogeChain show positive trends with +109% and +59.50%, respectively.

2.2. Top Performers: 7-Day Change in Top 5 Blockchains with Highest TVL

| Blockchain | 7d Change | TVL (in Billion) |

| Ethereum | -0.35% | $32.884b |

| Tron | -3.49% | $7.827b |

| BSC | -2.11% | $3.476b |

| Arbitrum | +1.67% | $2.631b |

| Solana | +3.19% | $1.362b |

In the realm of top-performing blochains by 7-day change and highest TVL, Ethereum maintains stability with a slight decrease of -0.35%, boasting a substantial $32.884 billion TVL. Solana shows robust growth at +3.19%, securing a $1.362 billion TVL. Other contenders like Arbitrum, Tron, and BSC exhibit varying 7-day changes, ranging from -3.49% to +3.19%.

3. Crypto Market Analysis

3.1. Bitcoin Price and Dominance

| Cryptocurrency | Price | Market Cap | Dominance Percentage | 7d- Change in Market Cap |

| BTC | $41,517.05 | $814,183,398,032 | 47.6% | -3.7% |

| ETH | $2,472.54 | $297,227,466,946 | 17.47% | -3.1% |

| USDT | $0.993 | $94,931,461,114 | 5.36% | -0.0% |

| BNB | $312.61 | $48,091,288,144 | 2.63% | +4.5% |

| SOL | $91.56 | $39,659,679,333 | 2.33% | -1.2% |

| XRP | $0.5464 | $29,726,797,725 | 1.76% | -4.8% |

| ADA | $0.5104 | $17,911,980,946 | 1.09% | -6.9% |

| DOGE | $0.078 | $11,222,007,173 | 0.65% | -2.7% |

| Others | 21.34% |

Bitcoin (BTC) leads with a price of $41,517.05, commanding a substantial market cap of $814.18 billion and a dominance percentage of 47.6%. Its 7-day change in market cap is a negative index of -3.7. Ethereum (ETH) follows with a price of $2,472.54, a market cap of $297.23 billion, and a 7-day change in market cap of -3.1%. Binance Coin (BNB) stands out with a positive 7-day change of +4.5%, priced at $312.61, and a market cap of $48.09 billion.

3.2. Top Gainers & Losers of the Week in Crypto Market

Here is the list of top gainers and top losers of the week in the cryptocurrency market. The analysis is made using the 7-day Gain and 7-day Lose indexes.

3.2.1. Top Gainers of the Week in Crypto

| Cryptocurrency | Price | 7-Day Gain |

| Flare (FLR) | $0.02213 | 26.62% |

| Siacoin (SC) | $0.01095 | 18.13% |

| Chiliz (CHZ) | $0.09643 | 14.87% |

| Ronin (RON) | $2.10 | 14.57% |

| Astar (ASTR) | $0.174 | 14.56% |

This week’s top gainers in the crypto space include Flare (FLR) with a 7-day gain of 26.62%, Siacoin (SC) at $0.01095 with an 18.13% increase, Chiliz (CHZ) at $0.09643 showcasing a 14.87% gain, Ronin (RON) with a 14.57% increase at $2.10, and Astar (ASTR) at $0.174 with a 14.56% gain.

3.2.2. Top Losers of the Week in Crypto

| Cryptocurrency | Price | 7-Day Loss |

| Sui (SUI) | $1.08 | -18.57% |

| Optimism (OP) | $3.13 | -18.40% |

| Arbitrum (ARB) | $1.79 | -17.29% |

| Bonk (BONK) | $0.00001133 | -15.72% |

| Bitcoin SV (BSV) | $71.57 | -15.23% |

| Ethereum Classic (ETC) | $24.69 | -15.22% |

This week’s top losers in the cryptocurrency market are led by Sui (SUI) with a 7-day loss of -18.57%, followed closely by Optimism (OP) at $3.13 with an -18.40% decrease. Arbitrum (ARB), Bonk (BONK), Bitcoin SV (BSV), and Ethereum Classic (ETC) also experienced losses ranging from -15.22% to -17.29%, indicating a challenging week for these assets.

3.3. Stablecoin Weekly Analysis

| Stablecoin | Market Capitalisation (7d) | Market Dominance (7d) [in %] | Trading Volume (7d) |

| Tether | $94,967,646,331 | 72.25% | $45,051,204,444 |

| TrueUSD | $1,876,926,357 | 1.44% | $128,811,385 |

| USDC | $25,524,310,090 | 19.54% | $7,508,298,350 |

| Dai | $5,166,646,630 | 3.93% | $157,000,259 |

| Frax | $648,627,425 | 0.49% | $11,020,426 |

In the week’s stablecoin performance analysis, Tether (USDT) stands out with a commanding trading volume of $45.05 billion, emphasising its widespread utility. Tether also holds the highest market capitalisation at $94.97 billion, securing a dominant 72.25% market share. USDC follows closely with a notable trading volume of $7.51 billion and a substantial market capitalization of $25.52 billion, commanding a 19.54% market dominance.

4. Bitcoin Spot ETF Weekly Analysis

| Bitcoin Spot ETFs | Asset Under Management (in Billion) | Price | Change (Gain) |

| Grayscale (GBTC) | $28.62B | $37.01 | +1.98% |

| ProShares (BITO) | $2.28B | $20.09 | +1.88% |

| BlackRock (IBIT) | $1.17B | $23.80 | +1.97% |

| Fidelity (FBTC) | $1.02B | $36.49 | +2.04% |

In this week’s Bitcoin Spot ETF analysis, Grayscale (GBTC) leads with $28.62 billion in Assets Under Management and a price of $37.01. Notably, Fidelity (FBTC) displays a remarkable 2.04% gain, with $1.02 billion AUM and a $36.49 price. ProShares (BITO) and BlackRock (IBIT) also show positive changes at 1.88% and 1.97%, respectively. This reflects a dynamic week, with Fidelity standing out for its impressive gain in value.

5. DeFi Market Weekly Status Analysis

| DeFi Protocols | 7d Change (in Total Value Locked) [in %] |

| Aladdin DAO | +25212% |

| INU FAIR | +10852% |

| Magma Finance | +6066% |

| Steroids | +5204% |

| Roketo | +851% |

In this week’s DeFi market analysis, impressive growth is observed in Total Volume Locked (TVL) across various protocols. Aladdin DAO leads with a remarkable +25212% 7-day change, followed by INU FAIR at +10852%, Magma Finance at +6.66%, Steroids at +5204%, and Roketo at +851%.

6. NFT Marketplace: A Basic Weekly Analysis

| NFT Marketplaces | 7-day Rolling Volume | 7-day Rolling Trade | Volume Change | Market Share (based on 1-day Volume) |

| Blur | 34705.91 | 42920 | +11.91% | 54.19% |

| Blur Aggregator | 19661.24 | 23917 | +35.32% | 17.83% |

| Opensea | 10870.06 | 35894 | -6.81% | 15.45% |

| Cryptopunks | 2470.67 | 36 | +57.37% | 7.89% |

| Gem | 1931.81 | 7354 | -11.34% | 1.84% |

In this week’s basic analysis of NFT marketplace, notable trends emerge. Blur and Blur Aggregator show substantial volume increases of +11.91% and +35.32%, respectively, with market shares of 54.19% and 17.83%, In contrast, Opensea experiences a -6.81% volume change but maintains a significant market share of 15.45%. Cryptopunks exhibit a remarkable +57.37% volume change, claiming a 7.89% market share. Gem, however, sees a 11.34% volume change, holding a 1.84% market share.

6.1. Top NFT Collectible Sales this Week

| NFT Collectibles | Price (in USD) |

| CryptoPunk #6912 | $475,676.56 |

| CryptoPunk #4506 | $349,195.00 |

| Art Blocks #78000643 | $243,379.25 |

| Azuki #5889 | $236,049.33 |

| CryptoPunks #6889 | $227,976,52 |

In this week’s NFT collectible sales, notable transactions include CryptoPunk #6912 at $475,676.56, followed by CryptoPunk #4506 at $349,195.00. Art Blocks #78000643 secured a significant value of $243,379.25, while Azuki #5889 and CryptoPunks #6889 fetched prices of $236,049.33 and $227,976.52, respectively.