Bitcoin vs. Gold Debate Persists, Fidelity Expert Weighs In

Bitcoin [BTC] has been dubbed “digital gold” for various reasons. From its limited supply and store-of-value properties to being a hedge against inflation, the asset has made quite a lot of noise. Despite being so similar to gold, there has been some debate about which asset is a superior financial instrument. While some prefer the safety that gold provides as a traditional investment tool, others intend to explore the volatile waters of Bitcoin.

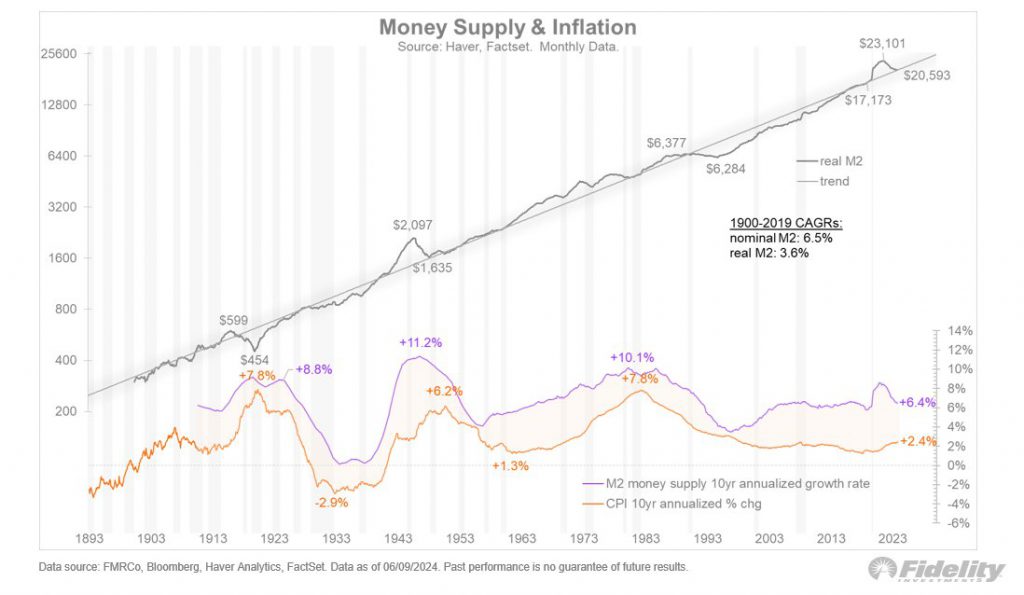

Amidst this backdrop, the Director of Global Macro at Fidelity, Jurrien Timmer, decided to share his insights. Timmer identifies both assets as hedges against fiscal supremacy. He pointed out that in the existing state of the government, the value of money can be manipulated while raising the money supply.

While this seems plausible, there is a considerable risk of inflation if the government continues to raise the money supply. For instance, during the COVID-19 outbreak, actual money saw a dramatic increase. However, the Federal Reserve’s measures reversed this trend.

Also Read: Donald Trump Touts Bitcoin Mining As Final Defence Against CBDC

Bitcoin and Gold

In order to address this, both Bitcoin and gold need to consolidate their status as stores of value. He said,

“My sense is that for the store of value argument to really accelerate, we will need to see sustained above-trend growth in the monetary aggregates. So far, we have not seen that, with the massive spike in real M2 during the pandemic quickly reversing under the weight of a restrictive Fed. That tells me that gold and Bitcoin are a play on something that may happen but hasn’t happened yet.“

Timmer further adds that cryptocurrency or Bitcoin, is exponential gold as opposed to a digital imitation of gold. He believes this is due to its money and network technology.

Also Read: Bitcoin Whale Returns, Turns $30M Into $535M In 5 years

However, the decentralized nature and immunity against government interference make Bitcoin stand out as a prominent mode of investment when compared to gold. At press time, BTC was trading at $67,829.20 following a $67,836 with a 1.48% daily surge.

Bitcoin vs. Gold Debate Persists, Fidelity Expert Weighs In

Bitcoin [BTC] has been dubbed “digital gold” for various reasons. From its limited supply and store-of-value properties to being a hedge against inflation, the asset has made quite a lot of noise. Despite being so similar to gold, there has been some debate about which asset is a superior financial instrument. While some prefer the safety that gold provides as a traditional investment tool, others intend to explore the volatile waters of Bitcoin.

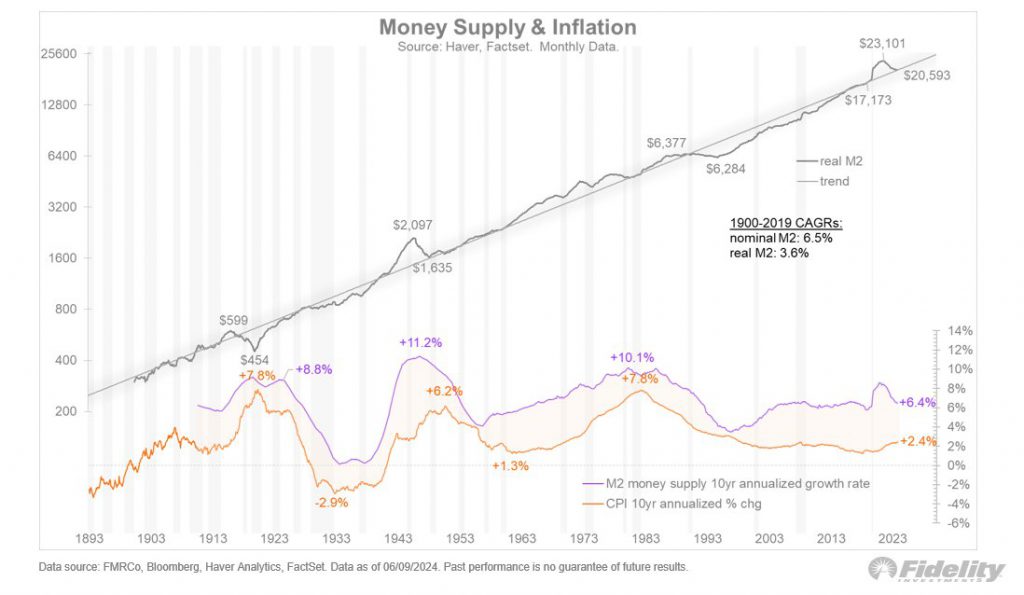

Amidst this backdrop, the Director of Global Macro at Fidelity, Jurrien Timmer, decided to share his insights. Timmer identifies both assets as hedges against fiscal supremacy. He pointed out that in the existing state of the government, the value of money can be manipulated while raising the money supply.

While this seems plausible, there is a considerable risk of inflation if the government continues to raise the money supply. For instance, during the COVID-19 outbreak, actual money saw a dramatic increase. However, the Federal Reserve’s measures reversed this trend.

Also Read: Donald Trump Touts Bitcoin Mining As Final Defence Against CBDC

Bitcoin and Gold

In order to address this, both Bitcoin and gold need to consolidate their status as stores of value. He said,

“My sense is that for the store of value argument to really accelerate, we will need to see sustained above-trend growth in the monetary aggregates. So far, we have not seen that, with the massive spike in real M2 during the pandemic quickly reversing under the weight of a restrictive Fed. That tells me that gold and Bitcoin are a play on something that may happen but hasn’t happened yet.“

Timmer further adds that cryptocurrency or Bitcoin, is exponential gold as opposed to a digital imitation of gold. He believes this is due to its money and network technology.

Also Read: Bitcoin Whale Returns, Turns $30M Into $535M In 5 years

However, the decentralized nature and immunity against government interference make Bitcoin stand out as a prominent mode of investment when compared to gold. At press time, BTC was trading at $67,829.20 following a $67,836 with a 1.48% daily surge.