BlackRock Adds Bitcoin Tokens to its Holdings at Total BTC Price of Over $400M

- BlackRock has added Bitcoin tokens for a total value of $446.5 million.

- Possible rate cut and estimates by Citibank have likely led to this move.

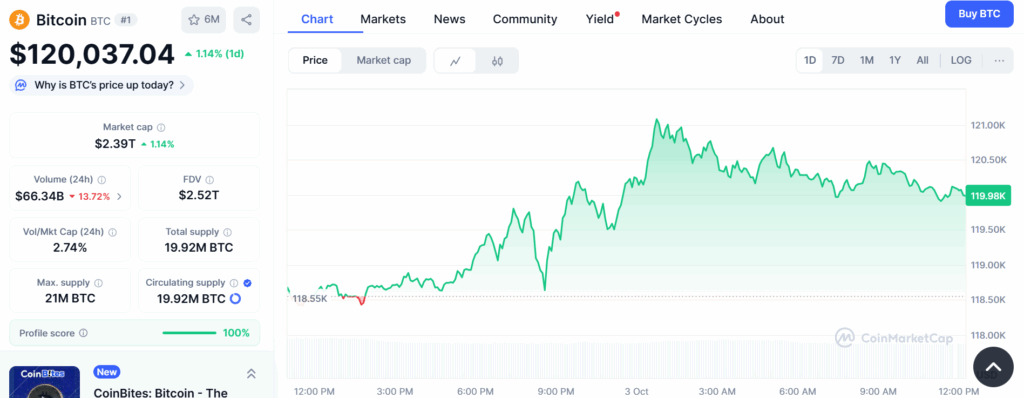

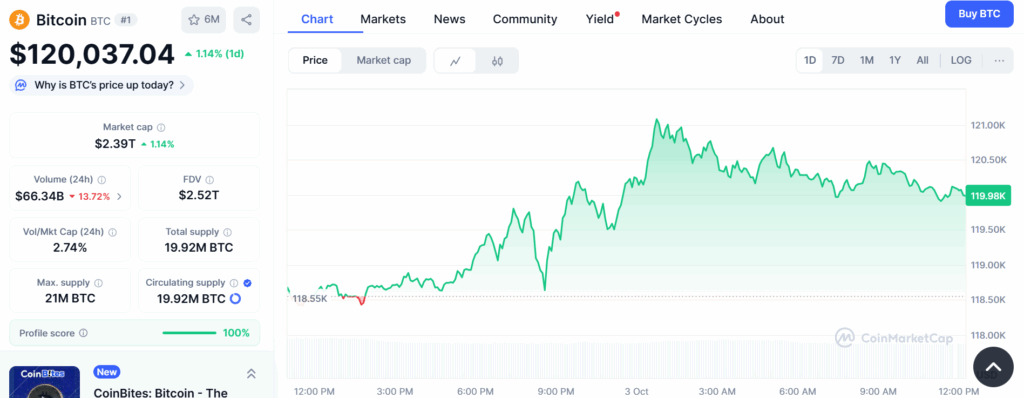

- BTC price jumped by 1.14% over the past 24 hours.

BlackRock has added Bitcoin tokens worth over $400 million to its portfolio. The move is possibly a reaction to recent reports of an upcoming rate cut and Citibank’s estimate for BTC price. BlackRock’s report underlines the market value of its holdings to more than $90 billion as of early October 2025.

Accumulation of Bitcoin Tokens by BlackRock

BlackRock has added Bitcoin tokens for a total approximate value of $446.5 million to its holdings. According to its report for IBIT, the market value of total holdings stands at $90.87 billion as of October 01, 2025. The value makes up for the total units of 773,461.25 Bitcoin tokens for the said date.

JUST IN: BlackRock buys $446.5 million worth of $BTC. pic.twitter.com/HQ1Cpsdruj

— Whale Insider (@WhaleInsider) October 3, 2025

The community has reacted to this update with one saying that BlackRock was not chasing momentum but consolidating control of supply. Another user called it a ‘loud endorsement’ of the token’s position as a store of value. Suffice it to say, BlackRock adding BTC to its holdings has sparked optimism around the token and its future within the community. This is despite some expressing slight concerns.

Possible Factors Behind BTC Holding Expansion

BlackRock added Bitcoin tokens to its portfolio earlier too. But, the recent addition comes after two crucial factors which are likely to happen. Kalshi has stated that there is an 89% chance for the US Federal Reserve to cut the rate by 25 bps. It was earlier hovering below 75%. Estimates also show that there is a 5% for the Fed to slash the lending rate by more than 5%.

Another factor that has possibly triggered BlackRock’s transaction pertains to Citibank’s statement. According to Whale Insider, Citibank has estimated that BTC price could go as high as $181,000 in the next 12 months. For reference, the Bitcoin token is currently valued at $120,037.04 with an uptick of 1.14% over the past 24 hours.

The BTC price further shows a surge of 9.57% and 8.21% in the last 7 days and 30 days, respectively. It is important to note that Kalshi and Citibank are only possible factors that could have caused a surge. They do not necessarily come up as the only or concrete factors.

BTC Price in Next Few Days

Short-term BTC price prediction estimates the token to surge by around 3.95% in the next 30 days. That would take the BBTC price to an approximate value of $125,071, amid the volatility of 2.24%. Overall sentiments are bullish, and the FGI rating is 63 points when the article is being drafted.

BTC Oscillator MACD (12, 26) is in a neutral stance. Resistance levels are within the range of $121,582 and $124,247. Support margins are calling both ends around $118,917 and $116,252.

The contents of this article are neither recommendations nor advice for crypto trading. Do thorough research and risk assessment.

Highlighted Crypto News Today:

PancakeSwap (CAKE) Bulls in Control: 30% Price Jump Coupled with a 576% Volume Explosion

Read More

Bitcoin Surges Above $123K, Nearing New Record as Bullish Q4 Sentiment Fuels Weeklong Rally

BlackRock Adds Bitcoin Tokens to its Holdings at Total BTC Price of Over $400M

- BlackRock has added Bitcoin tokens for a total value of $446.5 million.

- Possible rate cut and estimates by Citibank have likely led to this move.

- BTC price jumped by 1.14% over the past 24 hours.

BlackRock has added Bitcoin tokens worth over $400 million to its portfolio. The move is possibly a reaction to recent reports of an upcoming rate cut and Citibank’s estimate for BTC price. BlackRock’s report underlines the market value of its holdings to more than $90 billion as of early October 2025.

Accumulation of Bitcoin Tokens by BlackRock

BlackRock has added Bitcoin tokens for a total approximate value of $446.5 million to its holdings. According to its report for IBIT, the market value of total holdings stands at $90.87 billion as of October 01, 2025. The value makes up for the total units of 773,461.25 Bitcoin tokens for the said date.

JUST IN: BlackRock buys $446.5 million worth of $BTC. pic.twitter.com/HQ1Cpsdruj

— Whale Insider (@WhaleInsider) October 3, 2025

The community has reacted to this update with one saying that BlackRock was not chasing momentum but consolidating control of supply. Another user called it a ‘loud endorsement’ of the token’s position as a store of value. Suffice it to say, BlackRock adding BTC to its holdings has sparked optimism around the token and its future within the community. This is despite some expressing slight concerns.

Possible Factors Behind BTC Holding Expansion

BlackRock added Bitcoin tokens to its portfolio earlier too. But, the recent addition comes after two crucial factors which are likely to happen. Kalshi has stated that there is an 89% chance for the US Federal Reserve to cut the rate by 25 bps. It was earlier hovering below 75%. Estimates also show that there is a 5% for the Fed to slash the lending rate by more than 5%.

Another factor that has possibly triggered BlackRock’s transaction pertains to Citibank’s statement. According to Whale Insider, Citibank has estimated that BTC price could go as high as $181,000 in the next 12 months. For reference, the Bitcoin token is currently valued at $120,037.04 with an uptick of 1.14% over the past 24 hours.

The BTC price further shows a surge of 9.57% and 8.21% in the last 7 days and 30 days, respectively. It is important to note that Kalshi and Citibank are only possible factors that could have caused a surge. They do not necessarily come up as the only or concrete factors.

BTC Price in Next Few Days

Short-term BTC price prediction estimates the token to surge by around 3.95% in the next 30 days. That would take the BBTC price to an approximate value of $125,071, amid the volatility of 2.24%. Overall sentiments are bullish, and the FGI rating is 63 points when the article is being drafted.

BTC Oscillator MACD (12, 26) is in a neutral stance. Resistance levels are within the range of $121,582 and $124,247. Support margins are calling both ends around $118,917 and $116,252.

The contents of this article are neither recommendations nor advice for crypto trading. Do thorough research and risk assessment.

Highlighted Crypto News Today:

PancakeSwap (CAKE) Bulls in Control: 30% Price Jump Coupled with a 576% Volume Explosion

Read More