De-dollarization: Goldman Sachs Predicts Grim Future for U.S. Dollar

Share:

The Goldman Sachs analysis shows that de-dollarization is intensifying at this time which indicates major challenges for US currency operations due to Treasury bond prices rising while investors pull their assets from abroad. The present worldwide economic rebalancing offers indications that the United States dollar could lose its currency dominance within upcoming months.

Also Read: Here’s How Much $2,000 in Solana at Its All-Time Low Is Worth Today

De Dollarization Accelerates Amid Foreign Investment Flight, U.S. Woes

Market research from this writing period reveals an abrupt split between the United States dollar and Treasury bond values. Such an unusual pattern appears only in severe economic disruptors such as during the 2008 financial collapse.

Wall Street Giants Sound Alarm

The FX strategy team of Goldman Sachs declared:

“The recent governmental actions cause markets to question both the management framework and structural legitimacy of U.S. institutions.”

HSBC strategists noted:

Also Read: Amazon Set to Accept $XRP Payments—Ripple Price Predicted to Reach $2.10 by April 2025

“U.S. economic policy uncertainty at elevated levels creates barriers for the dollar to regain strength against other core currencies.”

The de-dollarization trend triggered Barclays to release an analysis under the provocative heading “The end of the dollar as we know it?” Recent trading shows the euro making an unexpected and significant ascent against the dollar.

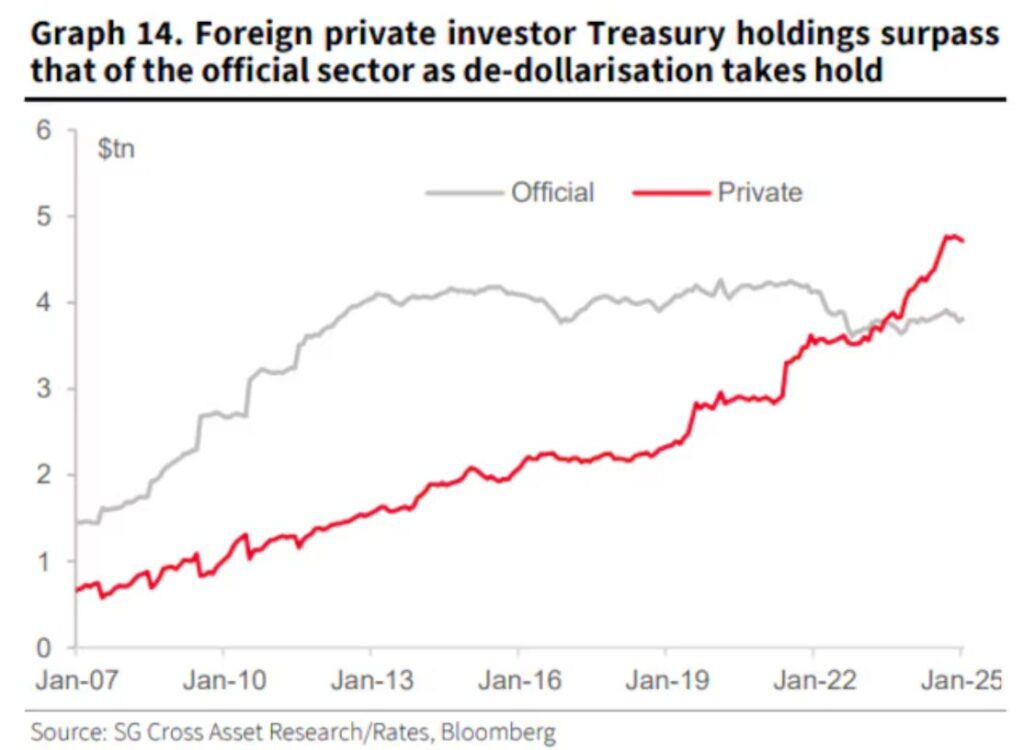

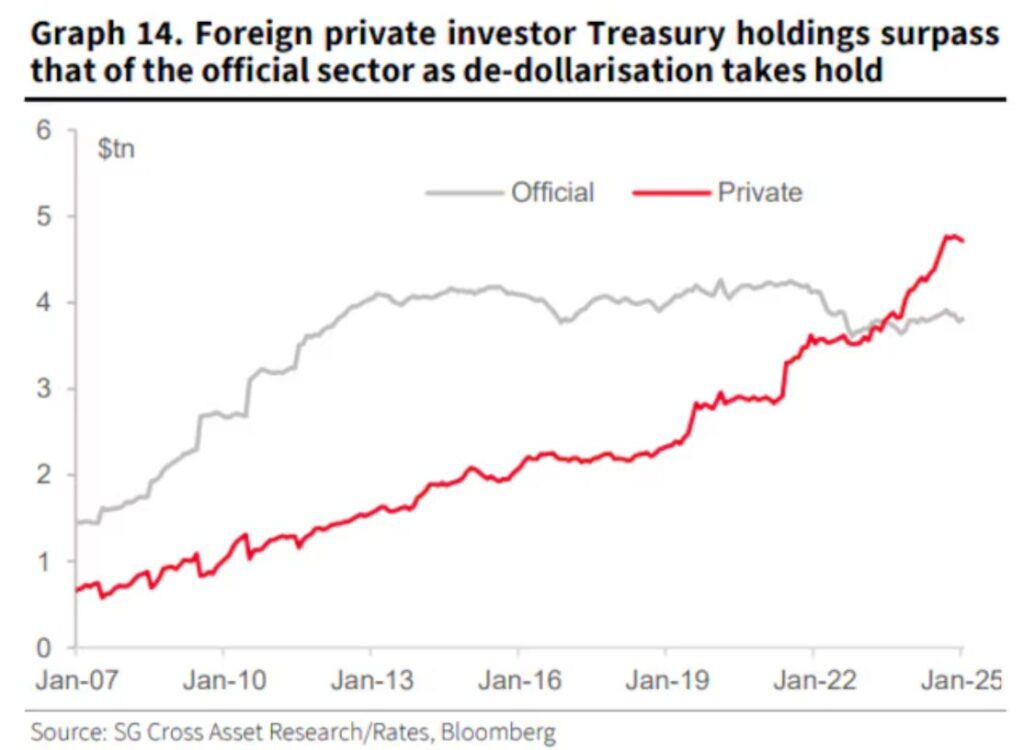

Private Investors Lead Treasury Exodus

Foreign private investors have surpassed central banks in holding US treasury securities which creates an entirely new market risk that analysts closely monitor.

The recent Treasury data indicates foreign investors owned $8.5 trillion worth of assets including $3.8 trillion from central banks and $4.7 trillion from private investment funds in January. The current ratio shows a substantial change from official sector holdings of $2 trillion a decade ago which exceeded private sector’s $2 trillion.

According to Bank of America data Japanese institutions have started withdrawing funds from long-term Treasuries.

“Treasuries received the largest foreign bond sales amount of $17.5 billion from Japanese private investors during the measurement period spanning April 4 up to the week’s end.”

Historic Market Signals For De-dollarization

The recent market movements indicated historically high levels of de-dollarization. The 30-year US Treasury yield followed the largest weekly rise since June 1982 by surging 48.5 basis points. Partial de-dollarization was apparent since the U.S. dollar declined 3% in relation to primary currencies despite being an uncommon occurrence in financial markets.

Also Read: Pi Coin Rebounds, But Will It Crash Like Mantra? Experts Weigh In

Financial assets within the United States which sustain the global financial system experienced diminished value across the preceding decades. Early signs of de-dollarization should be tracked by worldwide investors but permanency cannot be confirmed at this time.

Read More

De-dollarization: Goldman Sachs Predicts Grim Future for U.S. Dollar

Share:

The Goldman Sachs analysis shows that de-dollarization is intensifying at this time which indicates major challenges for US currency operations due to Treasury bond prices rising while investors pull their assets from abroad. The present worldwide economic rebalancing offers indications that the United States dollar could lose its currency dominance within upcoming months.

Also Read: Here’s How Much $2,000 in Solana at Its All-Time Low Is Worth Today

De Dollarization Accelerates Amid Foreign Investment Flight, U.S. Woes

Market research from this writing period reveals an abrupt split between the United States dollar and Treasury bond values. Such an unusual pattern appears only in severe economic disruptors such as during the 2008 financial collapse.

Wall Street Giants Sound Alarm

The FX strategy team of Goldman Sachs declared:

“The recent governmental actions cause markets to question both the management framework and structural legitimacy of U.S. institutions.”

HSBC strategists noted:

Also Read: Amazon Set to Accept $XRP Payments—Ripple Price Predicted to Reach $2.10 by April 2025

“U.S. economic policy uncertainty at elevated levels creates barriers for the dollar to regain strength against other core currencies.”

The de-dollarization trend triggered Barclays to release an analysis under the provocative heading “The end of the dollar as we know it?” Recent trading shows the euro making an unexpected and significant ascent against the dollar.

Private Investors Lead Treasury Exodus

Foreign private investors have surpassed central banks in holding US treasury securities which creates an entirely new market risk that analysts closely monitor.

The recent Treasury data indicates foreign investors owned $8.5 trillion worth of assets including $3.8 trillion from central banks and $4.7 trillion from private investment funds in January. The current ratio shows a substantial change from official sector holdings of $2 trillion a decade ago which exceeded private sector’s $2 trillion.

According to Bank of America data Japanese institutions have started withdrawing funds from long-term Treasuries.

“Treasuries received the largest foreign bond sales amount of $17.5 billion from Japanese private investors during the measurement period spanning April 4 up to the week’s end.”

Historic Market Signals For De-dollarization

The recent market movements indicated historically high levels of de-dollarization. The 30-year US Treasury yield followed the largest weekly rise since June 1982 by surging 48.5 basis points. Partial de-dollarization was apparent since the U.S. dollar declined 3% in relation to primary currencies despite being an uncommon occurrence in financial markets.

Also Read: Pi Coin Rebounds, But Will It Crash Like Mantra? Experts Weigh In

Financial assets within the United States which sustain the global financial system experienced diminished value across the preceding decades. Early signs of de-dollarization should be tracked by worldwide investors but permanency cannot be confirmed at this time.

Read More