Retail Investors Returning? Analyst Says Number of New Bitcoin Addresses Soaring Amid Choppy Conditions

A widely followed crypto analyst says that crypto retail investors may be returning as the number of new Bitcoin (BTC) addresses rises in spite of choppy market conditions.

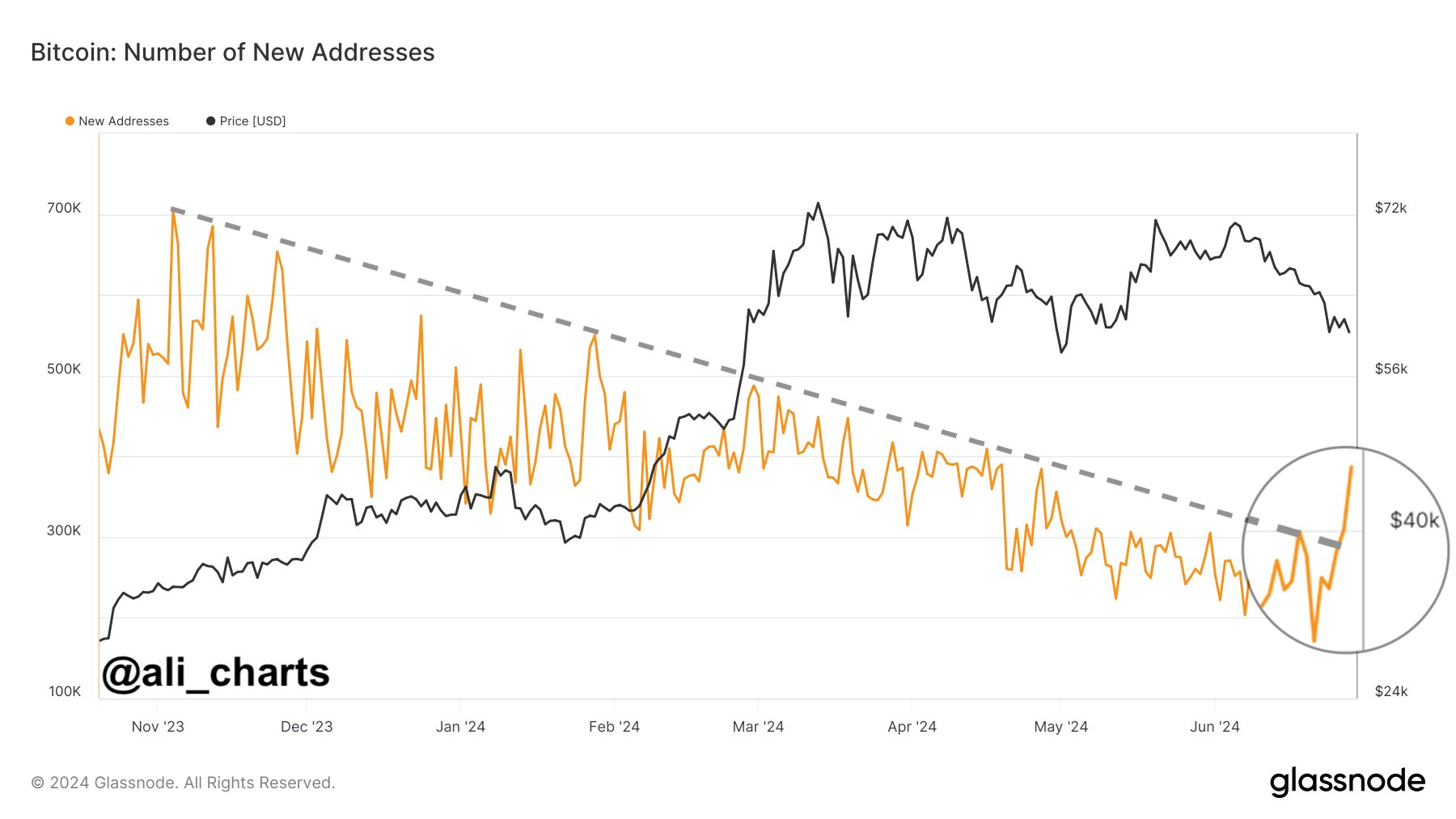

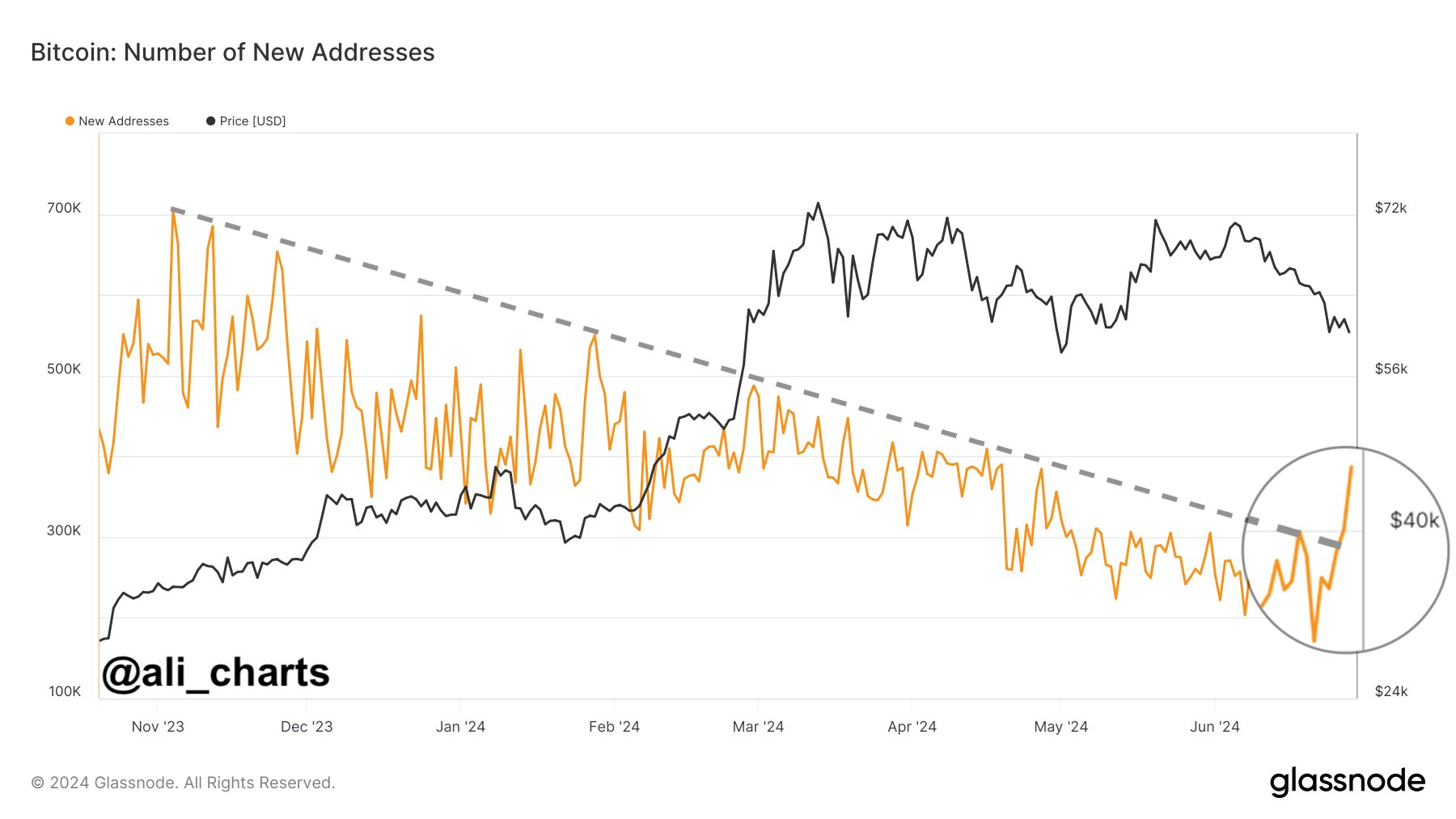

In a new strategy session, crypto trader Ali Martinez shares a chart with his 66,000 followers on the social media platform X showing that the count of new addresses on the BTC blockchain has broken a downtrend line.

“Retail Bitcoin investors are making a comeback! The number of new BTC addresses on the network surged to 352,124, marking the highest level since April.”

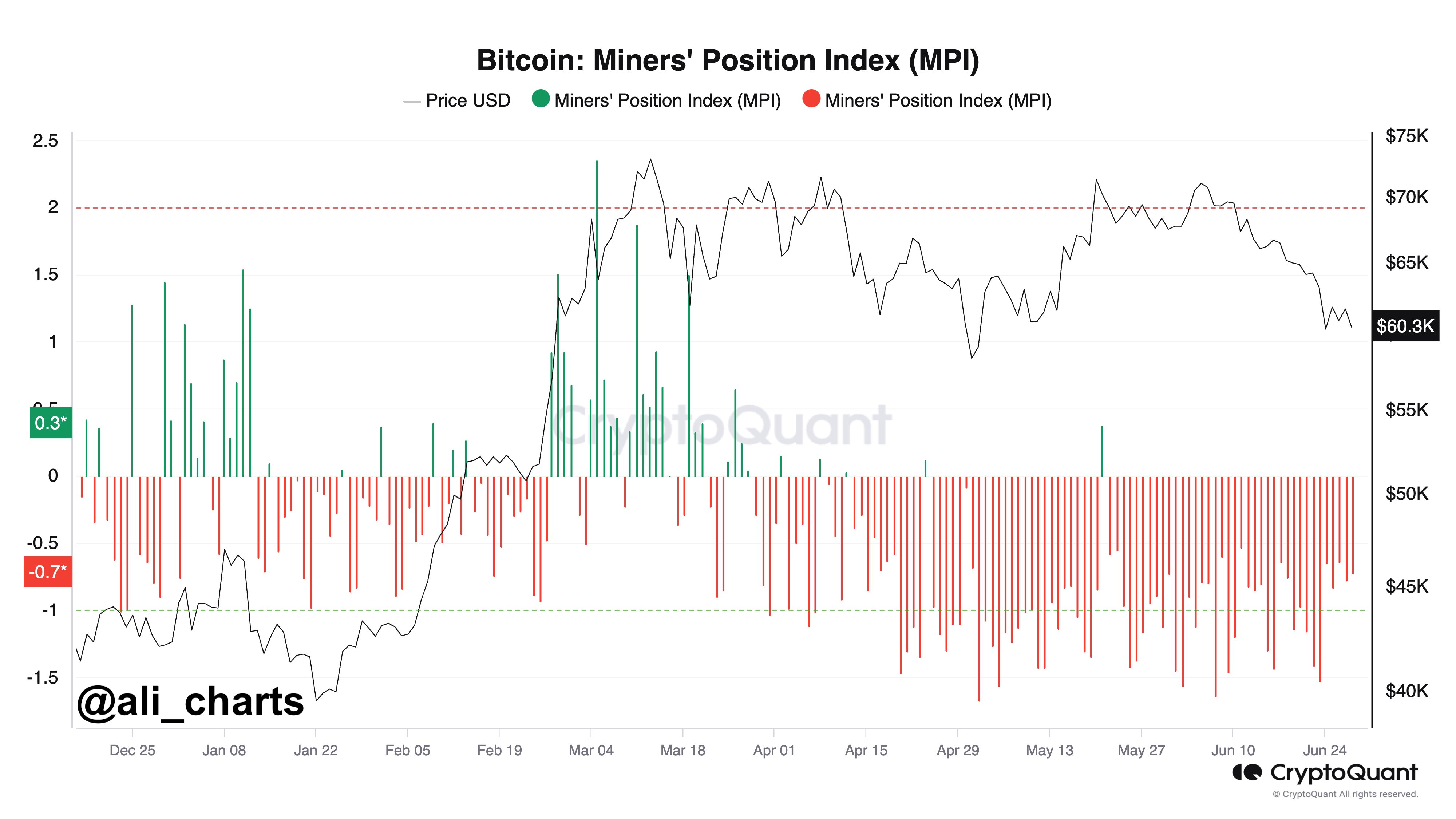

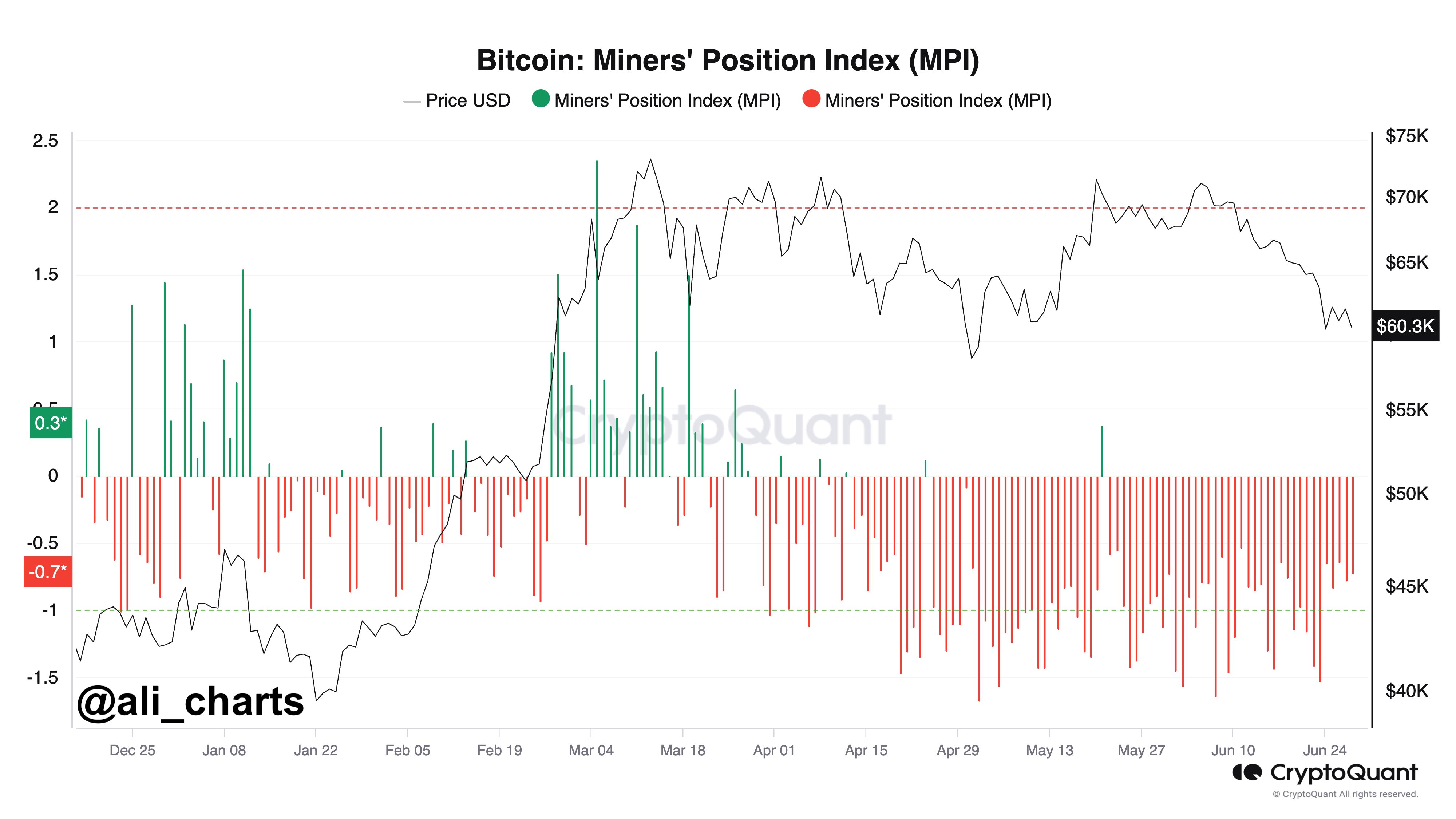

Martinez goes on to note that miners of the top crypto asset by market cap are capitulating their positions, which is generally seen as a precursor to a Bitcoin bull market.

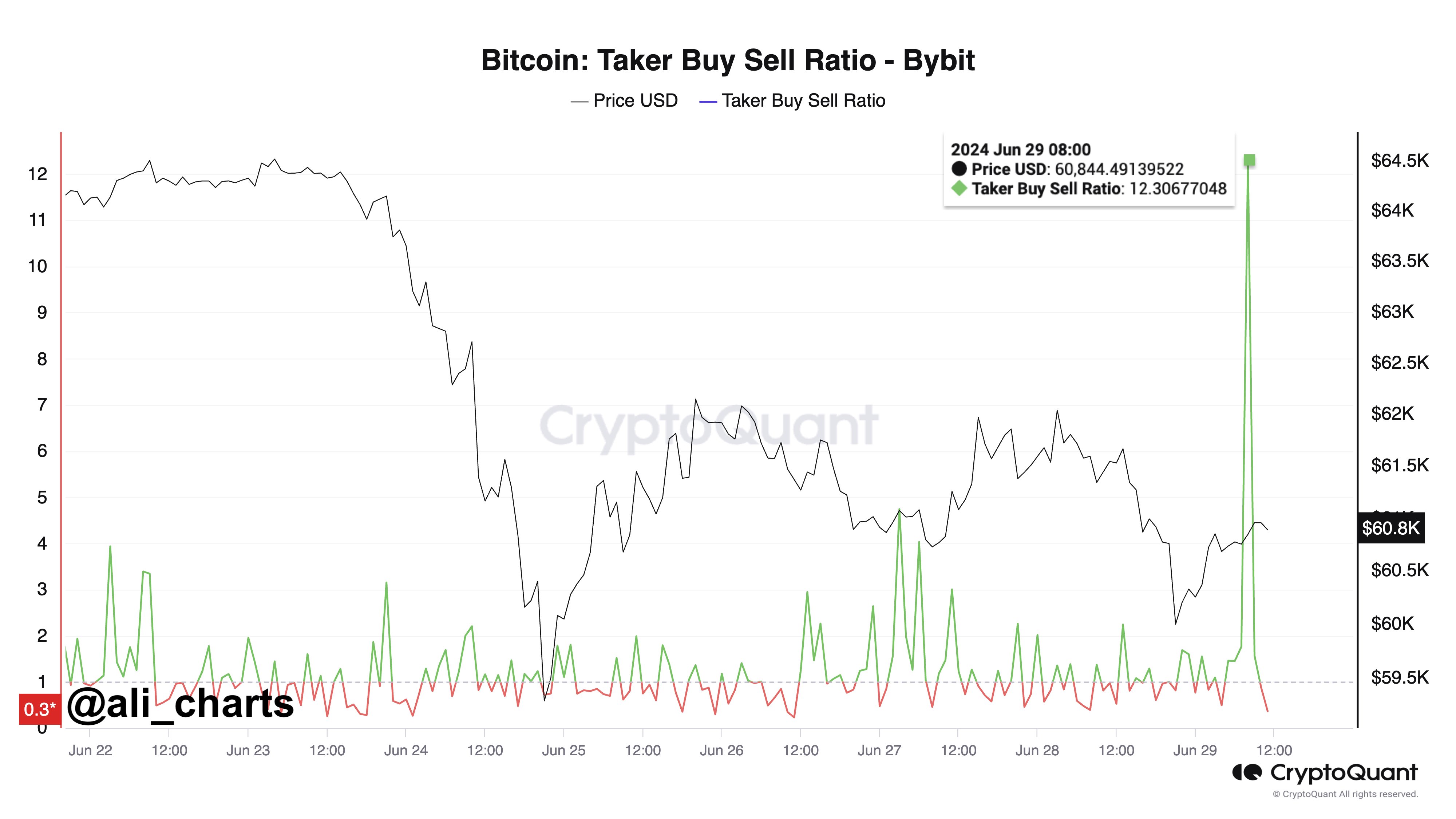

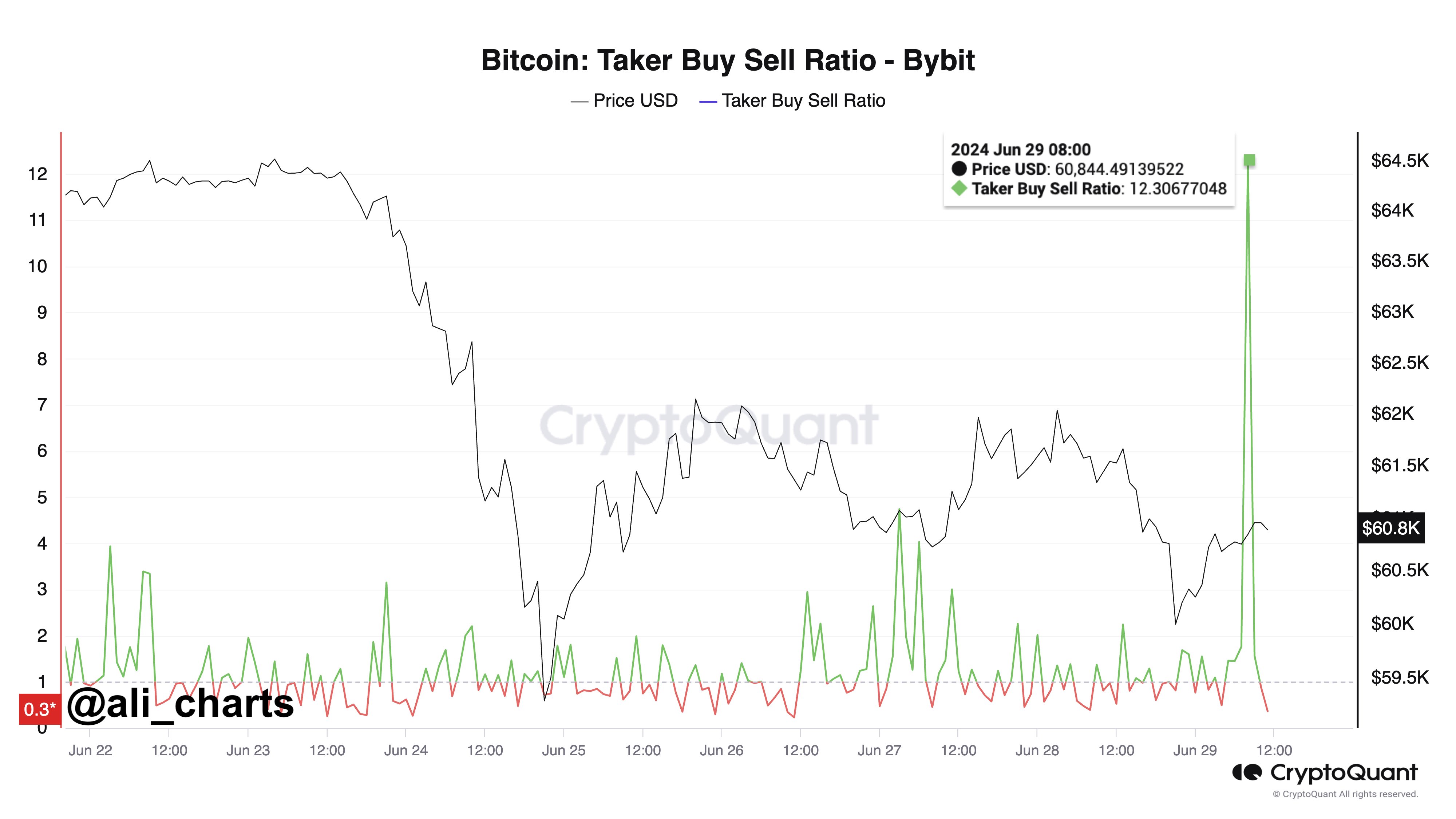

The trader concludes his analysis by noting that an entity on the crypto exchange Bybit is gobbling up the crypto king during its latest price dip as evidenced by one indicator.

“Someone at Bybit is buying the Bitcoin dip, evident from the recent spike in BTC taker buy/sell ratio!”

Martinez’s chart indicates that the Taker buy/sell ratio – or the ratio between the long and short volumes in the derivatives market – for BTC is at 12.306. Values over 1 suggests that BTC bulls are placing long positions at market price.

Bitcoin is trading for $63,331 at time of writing, an over 4% increase during the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Retail Investors Returning? Analyst Says Number of New Bitcoin Addresses Soaring Amid Choppy Conditions appeared first on The Daily Hodl.

Retail Investors Returning? Analyst Says Number of New Bitcoin Addresses Soaring Amid Choppy Conditions

A widely followed crypto analyst says that crypto retail investors may be returning as the number of new Bitcoin (BTC) addresses rises in spite of choppy market conditions.

In a new strategy session, crypto trader Ali Martinez shares a chart with his 66,000 followers on the social media platform X showing that the count of new addresses on the BTC blockchain has broken a downtrend line.

“Retail Bitcoin investors are making a comeback! The number of new BTC addresses on the network surged to 352,124, marking the highest level since April.”

Martinez goes on to note that miners of the top crypto asset by market cap are capitulating their positions, which is generally seen as a precursor to a Bitcoin bull market.

The trader concludes his analysis by noting that an entity on the crypto exchange Bybit is gobbling up the crypto king during its latest price dip as evidenced by one indicator.

“Someone at Bybit is buying the Bitcoin dip, evident from the recent spike in BTC taker buy/sell ratio!”

Martinez’s chart indicates that the Taker buy/sell ratio – or the ratio between the long and short volumes in the derivatives market – for BTC is at 12.306. Values over 1 suggests that BTC bulls are placing long positions at market price.

Bitcoin is trading for $63,331 at time of writing, an over 4% increase during the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Retail Investors Returning? Analyst Says Number of New Bitcoin Addresses Soaring Amid Choppy Conditions appeared first on The Daily Hodl.