Stocks and Dollar Crash Together—History Says ‘Tread Carefully’ in This Rare Situation

Share:

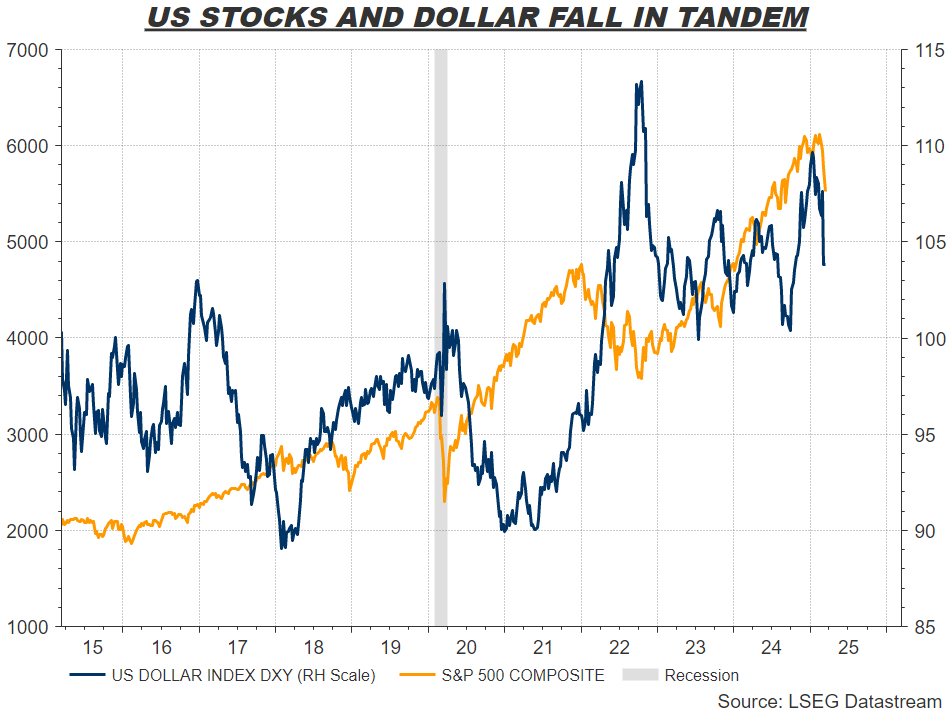

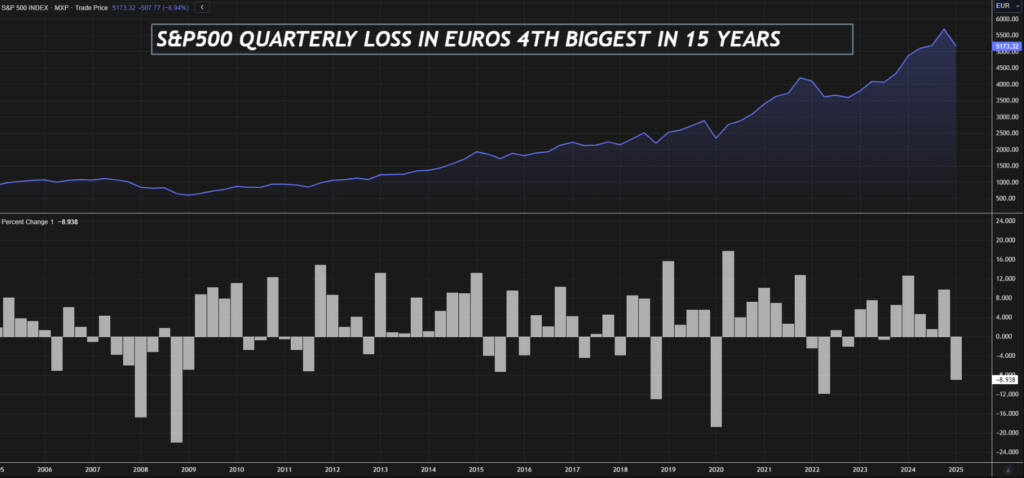

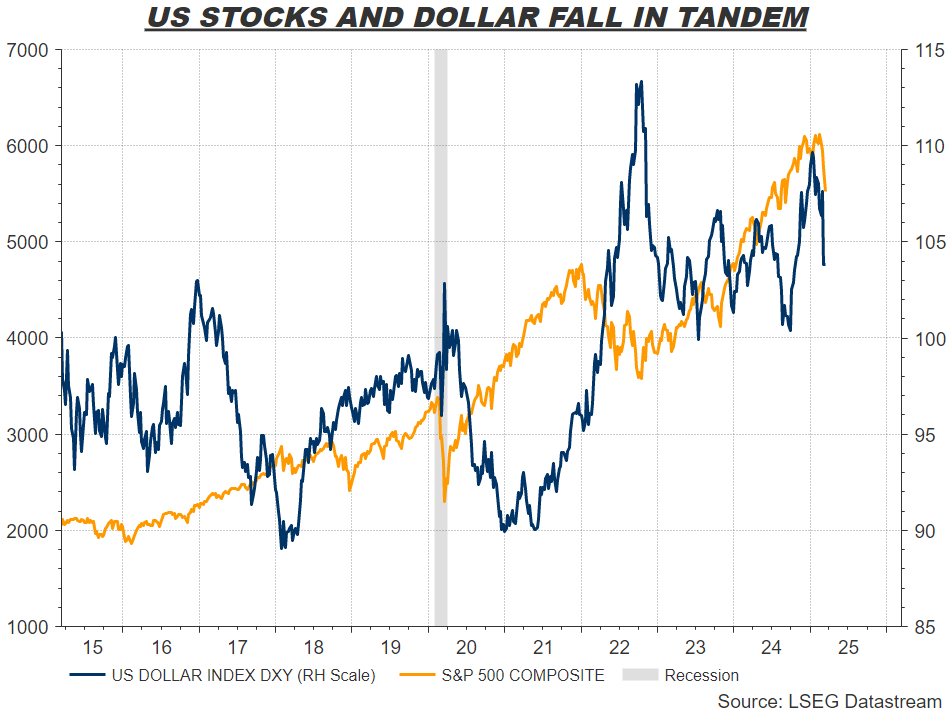

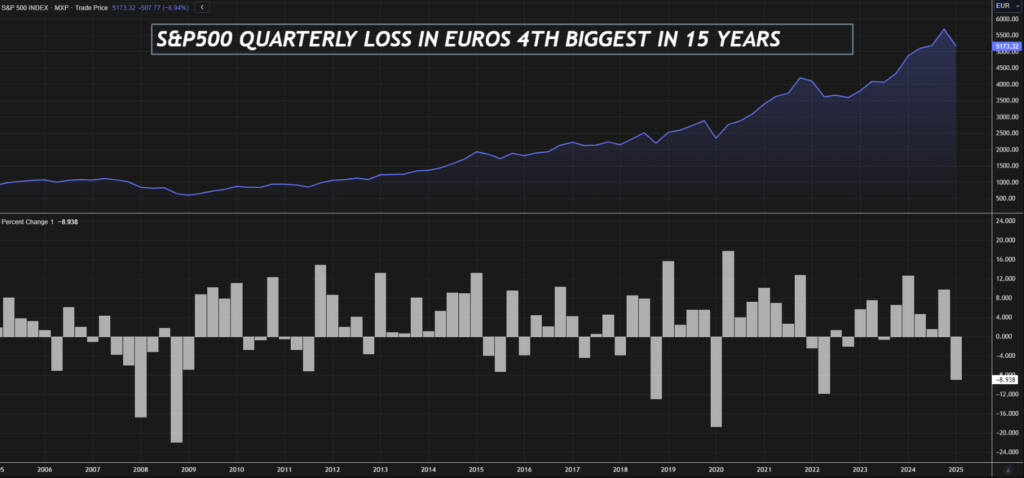

Stocks and dollar declines are happening simultaneously right now, creating a rare and concerning market situation that signals deeper economic uncertainty. This uncommon correlation between these typically divergent assets has triggered warnings from several analysts who note that historical precedents for such moves are actually quite limited but also quite concerning. The S&P 500 has fallen about 7.96% over the past three months, while the ICE U.S. Dollar Index has also declined by around 8.99% during the same period.

Dean Christians, senior research analyst at SentimenTrader, stated:

“Equity investors may want to wait for a more favorable entry point.”

Also Read: XRP Price Prediction: 25% Drop in XRP as Euro Stablecoin Hits XRP Ledger

What Falling Stocks and Dollar Signal About Economic Uncertainty

The simultaneous decline of stocks and the dollar represents a breakdown in traditional asset correlation patterns that many investors rely on. When both the dollar and stocks fall together, it often precedes continued market instability and additional economic uncertainty.

Safe Haven Assets During Market Turmoil

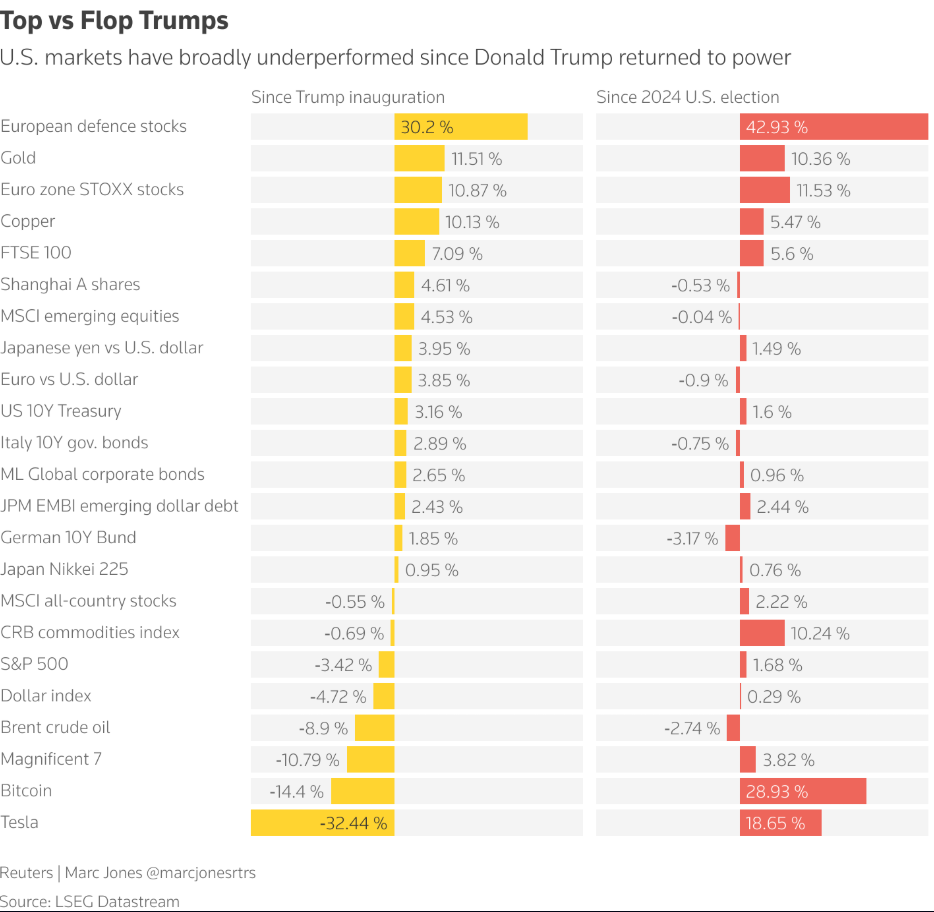

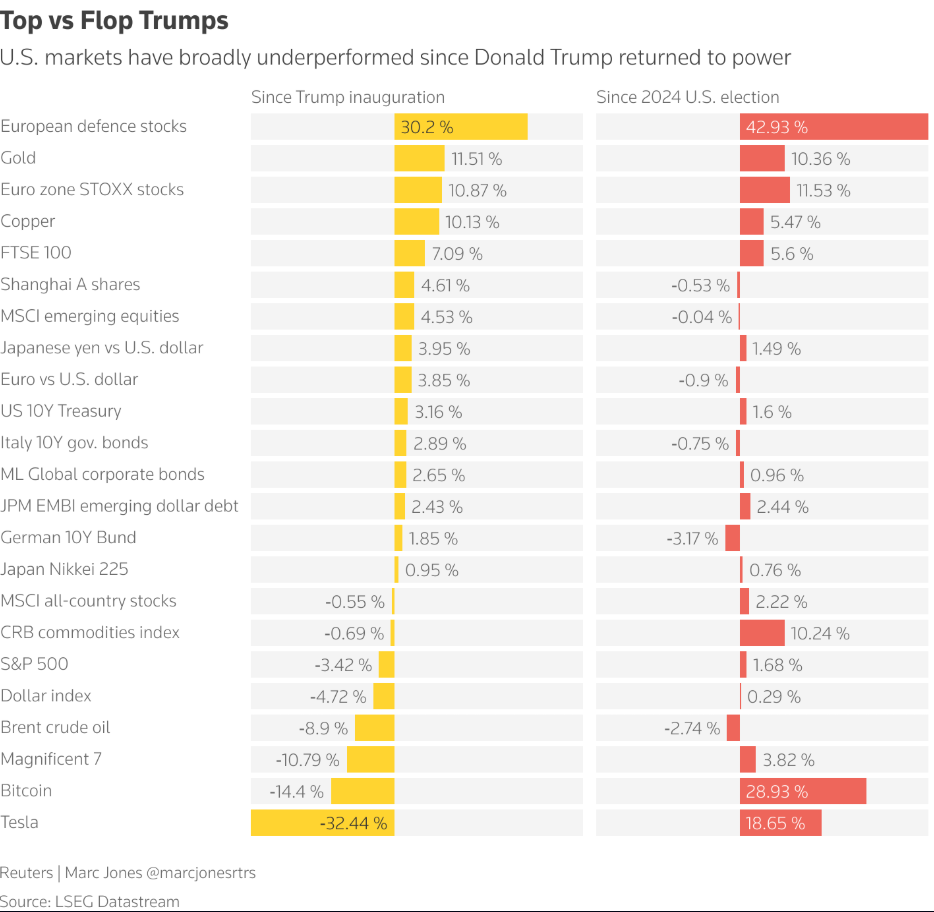

As stocks and the dollar lose their protective status, alternative safe haven assets are currently gaining favor among investors. Gold has risen approximately 11.51% since Trump’s inauguration, demonstrating its enduring role during periods of economic uncertainty and market stress.

Christians noted:

“When both stocks and the dollar decline simultaneously, it typically signals a fundamental reassessment of U.S. economic prospects.”

Also Read: Pi Coin April 2025: Price to Jump 230% This Month? $2 Peak In Sight

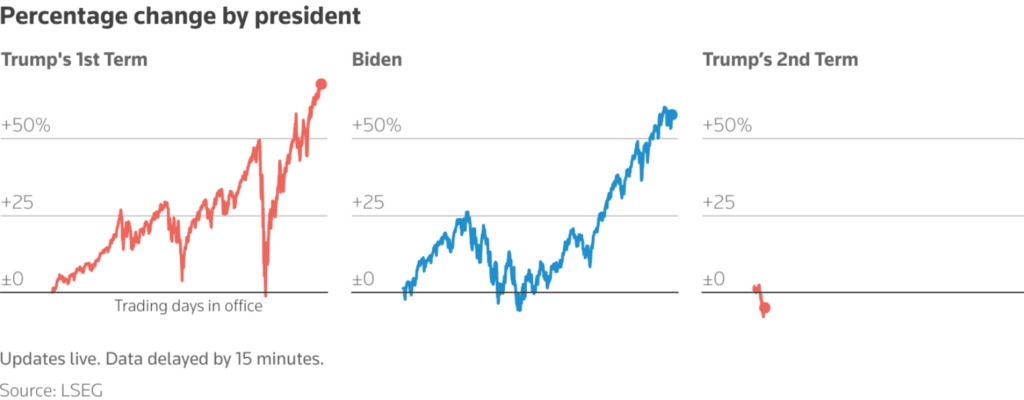

Political Impact on Stocks and Dollar

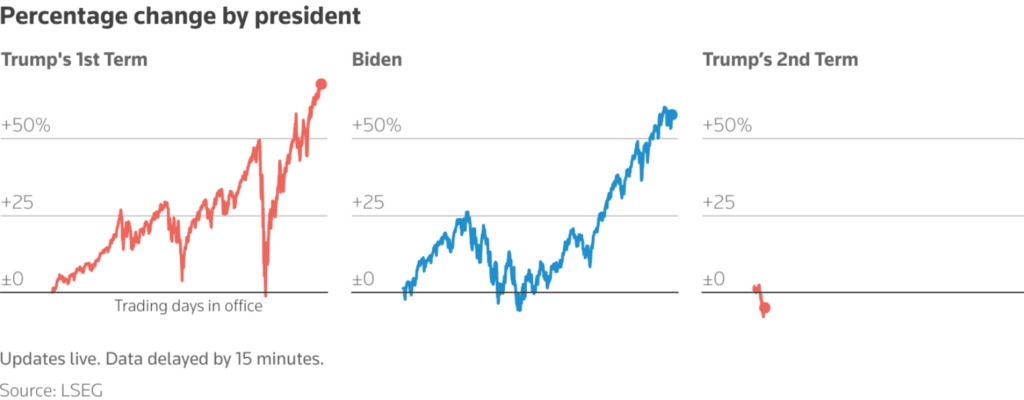

Recent market data shows that U.S. stocks and the dollar have generally underperformed since President Trump returned to office. The dollar index has declined about 4.72% since the inauguration while showing only minimal growth after the election, as well.

Investment Strategies During Market Downturn

The rare correlation between falling stocks and the dollar requires investors to rethink their portfolio strategies right now. Traditional asset correlation patterns typically relied upon for diversification just aren’t working as effectively during this unusual market downturn.

Christians emphasized:

“The historical data, while limited, suggests investors should stay on their toes when both stocks and the dollar’s retreat in tandem.”

Also Read: Shiba Inu Vs. Dogecoin: Which Can Turn $1000 To $1 Million First?

As economic uncertainty continues to persist, both stocks and the greenback movements will likely be heavily influenced by upcoming economic data releases and also by Federal Reserve communications in the coming weeks.

Stocks and Dollar Crash Together—History Says ‘Tread Carefully’ in This Rare Situation

Share:

Stocks and dollar declines are happening simultaneously right now, creating a rare and concerning market situation that signals deeper economic uncertainty. This uncommon correlation between these typically divergent assets has triggered warnings from several analysts who note that historical precedents for such moves are actually quite limited but also quite concerning. The S&P 500 has fallen about 7.96% over the past three months, while the ICE U.S. Dollar Index has also declined by around 8.99% during the same period.

Dean Christians, senior research analyst at SentimenTrader, stated:

“Equity investors may want to wait for a more favorable entry point.”

Also Read: XRP Price Prediction: 25% Drop in XRP as Euro Stablecoin Hits XRP Ledger

What Falling Stocks and Dollar Signal About Economic Uncertainty

The simultaneous decline of stocks and the dollar represents a breakdown in traditional asset correlation patterns that many investors rely on. When both the dollar and stocks fall together, it often precedes continued market instability and additional economic uncertainty.

Safe Haven Assets During Market Turmoil

As stocks and the dollar lose their protective status, alternative safe haven assets are currently gaining favor among investors. Gold has risen approximately 11.51% since Trump’s inauguration, demonstrating its enduring role during periods of economic uncertainty and market stress.

Christians noted:

“When both stocks and the dollar decline simultaneously, it typically signals a fundamental reassessment of U.S. economic prospects.”

Also Read: Pi Coin April 2025: Price to Jump 230% This Month? $2 Peak In Sight

Political Impact on Stocks and Dollar

Recent market data shows that U.S. stocks and the dollar have generally underperformed since President Trump returned to office. The dollar index has declined about 4.72% since the inauguration while showing only minimal growth after the election, as well.

Investment Strategies During Market Downturn

The rare correlation between falling stocks and the dollar requires investors to rethink their portfolio strategies right now. Traditional asset correlation patterns typically relied upon for diversification just aren’t working as effectively during this unusual market downturn.

Christians emphasized:

“The historical data, while limited, suggests investors should stay on their toes when both stocks and the dollar’s retreat in tandem.”

Also Read: Shiba Inu Vs. Dogecoin: Which Can Turn $1000 To $1 Million First?

As economic uncertainty continues to persist, both stocks and the greenback movements will likely be heavily influenced by upcoming economic data releases and also by Federal Reserve communications in the coming weeks.