Apple Stock Dips 5% & Losing Most Valuable Title After Shipping iPhones to US

Apple stock dips 5% as trade tensions continue to escalate, creating some pretty significant market volatility. The tech giant has also just lost its coveted position as the world’s most valuable company while they’re making strategic moves to ship iPhones to the US ahead of those new tariffs that are coming into effect.

Also Read: Shiba Inu for Retirement: How Much Fresh SHIB Did You Need for $2M Now?

How Apple’s 5% Dip and iPhone Supply Chain Issues Impact Stock Volatility

Market Value Drops Amid Tariff Concerns

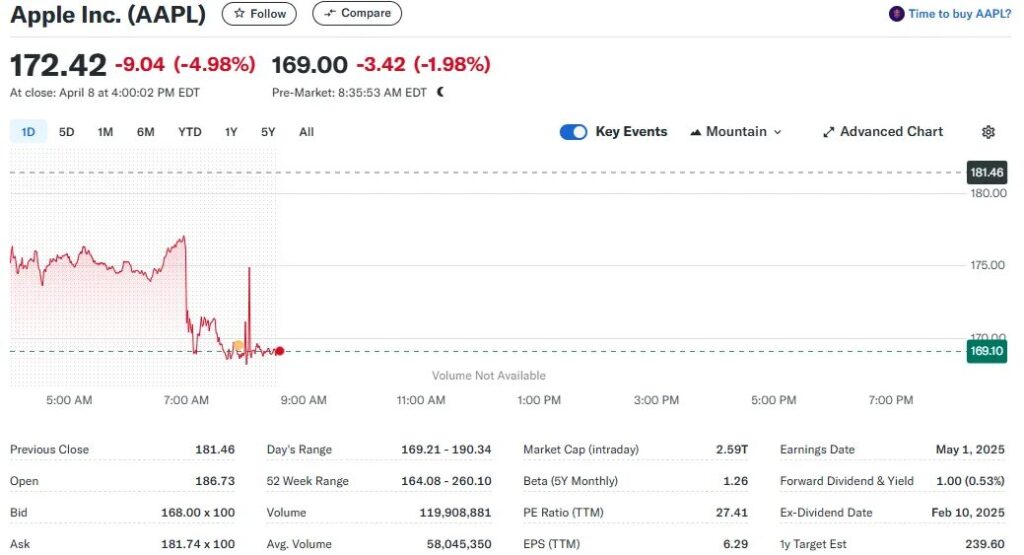

Apple stock dips 5%, actually pushing the iPhone maker’s market cap to less than $2.6 trillion, while Microsoft reached about $2.65 trillion at the time of writing. This decline happens as Apple deals with all sorts of challenges related to iPhone supply chain issues and is essentially losing most valuable title in the process.

Apple’s shares have, in fact, lost over a fifth of their value since President Trump announced those tariff increases. This whole Apple stock dips 5% situation has basically contributed to erasing nearly $775 billion from the company’s market value – an amount that exceeds Tesla’s entire market cap.

Strategic Shipping Ahead of Tariffs

To manage the ongoing Apple market volatility, the company transported five planes full of iPhones and other products to the US in late March. A senior Indian official confirmed these urgent shipments to The Times of India.

Also Read: $2K in XRP by 2028? Here’s What One Top Bank Says You’ll Earn

Products were pretty much rushed from manufacturing hubs in both India and China to stock US warehouses before the April 5 deadline. This kind of demonstrates how current iPhone supply chain issues are really shaping the company’s strategy right now.

India’s Strategic Manufacturing Advantage

The new tariff structure creates additional Apple market volatility but also presents a significant advantage for Indian operations. With the US imposing 26% tariffs on Indian exports versus a much steeper 54% on Chinese goods, Apple gains an approximate 28 percentage point cost advantage by manufacturing in India.

Apple shipping iPhones to US from India makes strategic sense as the country already dominates smartphone exports to America, valued at nearly $9 billion in recent reports. This shift highlights how Apple losing most valuable title coincides with some major manufacturing strategy adjustments.

Comparative Tech Stock Performance

Among major tech stocks, this Apple stock dips 5% situation represents the worst performance in the sector. Tesla has declined about 21.5% since the tariff announcement, while other tech giants such as Amazon, Nvidia, and Meta have experienced drops between 12-13%. Microsoft and Alphabet have fared slightly better with declines of 7.7% and 7.2%, respectively.

Also Read: China Announces Additional 84% Tariff on US Goods

Future Outlook

The current stockpiling strategy has bought Apple some time, but long-term implications of Apple shipping iPhones to US remain somewhat uncertain. With US warehouses now stocked for several months, Apple has gained valuable time to assess how global tariff structures will shape its next strategic moves.

Apple stock dips 5% and ongoing iPhone supply chain issues remain serious concerns as investors continue to watch the company’s rather heavy reliance on Chinese manufacturing amid persistent Apple market volatility and losing most valuable title to Microsoft.

Apple Stock Dips 5% & Losing Most Valuable Title After Shipping iPhones to US

Apple stock dips 5% as trade tensions continue to escalate, creating some pretty significant market volatility. The tech giant has also just lost its coveted position as the world’s most valuable company while they’re making strategic moves to ship iPhones to the US ahead of those new tariffs that are coming into effect.

Also Read: Shiba Inu for Retirement: How Much Fresh SHIB Did You Need for $2M Now?

How Apple’s 5% Dip and iPhone Supply Chain Issues Impact Stock Volatility

Market Value Drops Amid Tariff Concerns

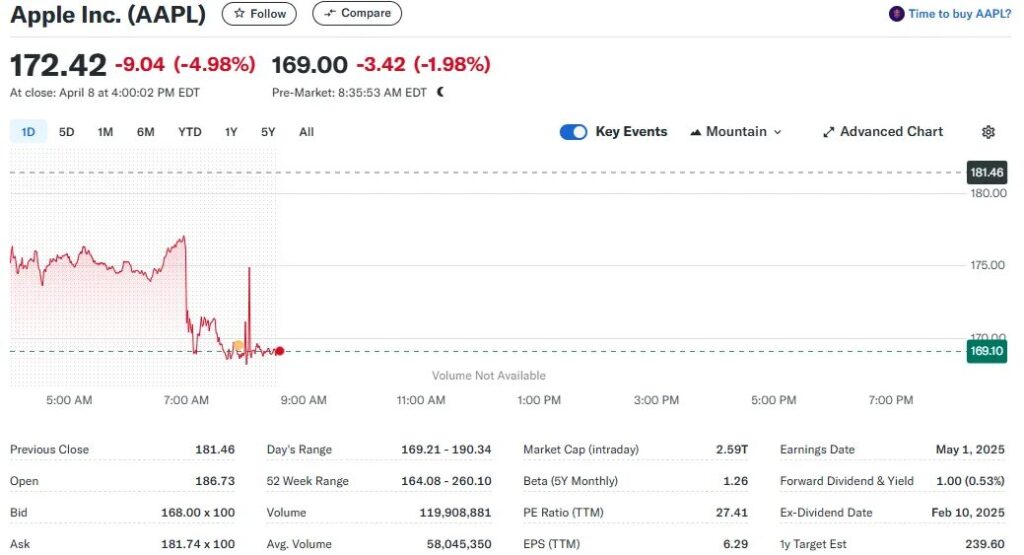

Apple stock dips 5%, actually pushing the iPhone maker’s market cap to less than $2.6 trillion, while Microsoft reached about $2.65 trillion at the time of writing. This decline happens as Apple deals with all sorts of challenges related to iPhone supply chain issues and is essentially losing most valuable title in the process.

Apple’s shares have, in fact, lost over a fifth of their value since President Trump announced those tariff increases. This whole Apple stock dips 5% situation has basically contributed to erasing nearly $775 billion from the company’s market value – an amount that exceeds Tesla’s entire market cap.

Strategic Shipping Ahead of Tariffs

To manage the ongoing Apple market volatility, the company transported five planes full of iPhones and other products to the US in late March. A senior Indian official confirmed these urgent shipments to The Times of India.

Also Read: $2K in XRP by 2028? Here’s What One Top Bank Says You’ll Earn

Products were pretty much rushed from manufacturing hubs in both India and China to stock US warehouses before the April 5 deadline. This kind of demonstrates how current iPhone supply chain issues are really shaping the company’s strategy right now.

India’s Strategic Manufacturing Advantage

The new tariff structure creates additional Apple market volatility but also presents a significant advantage for Indian operations. With the US imposing 26% tariffs on Indian exports versus a much steeper 54% on Chinese goods, Apple gains an approximate 28 percentage point cost advantage by manufacturing in India.

Apple shipping iPhones to US from India makes strategic sense as the country already dominates smartphone exports to America, valued at nearly $9 billion in recent reports. This shift highlights how Apple losing most valuable title coincides with some major manufacturing strategy adjustments.

Comparative Tech Stock Performance

Among major tech stocks, this Apple stock dips 5% situation represents the worst performance in the sector. Tesla has declined about 21.5% since the tariff announcement, while other tech giants such as Amazon, Nvidia, and Meta have experienced drops between 12-13%. Microsoft and Alphabet have fared slightly better with declines of 7.7% and 7.2%, respectively.

Also Read: China Announces Additional 84% Tariff on US Goods

Future Outlook

The current stockpiling strategy has bought Apple some time, but long-term implications of Apple shipping iPhones to US remain somewhat uncertain. With US warehouses now stocked for several months, Apple has gained valuable time to assess how global tariff structures will shape its next strategic moves.

Apple stock dips 5% and ongoing iPhone supply chain issues remain serious concerns as investors continue to watch the company’s rather heavy reliance on Chinese manufacturing amid persistent Apple market volatility and losing most valuable title to Microsoft.