2025 Crypto Fundraising Recap: Structural Shifts in Web3 Venture Capital

2025 Web3 Investment Cycle: Fewer Deals, Larger Checks

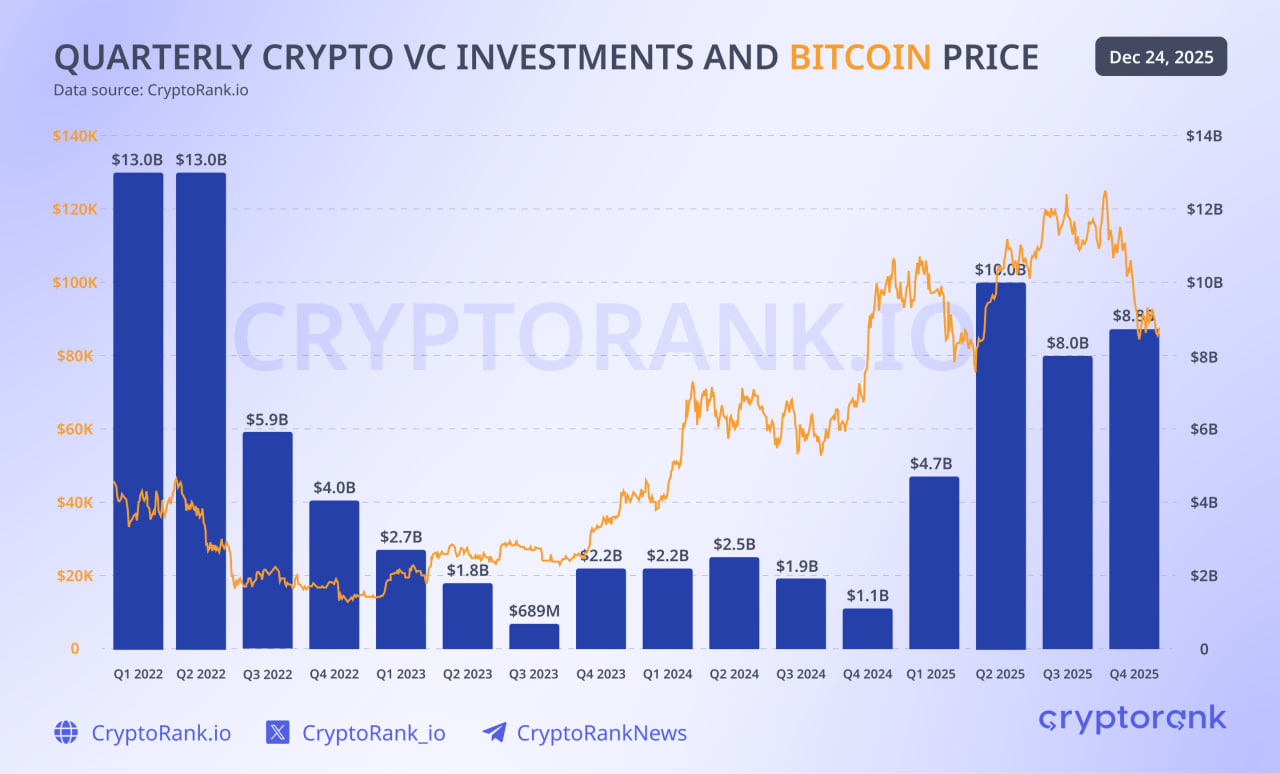

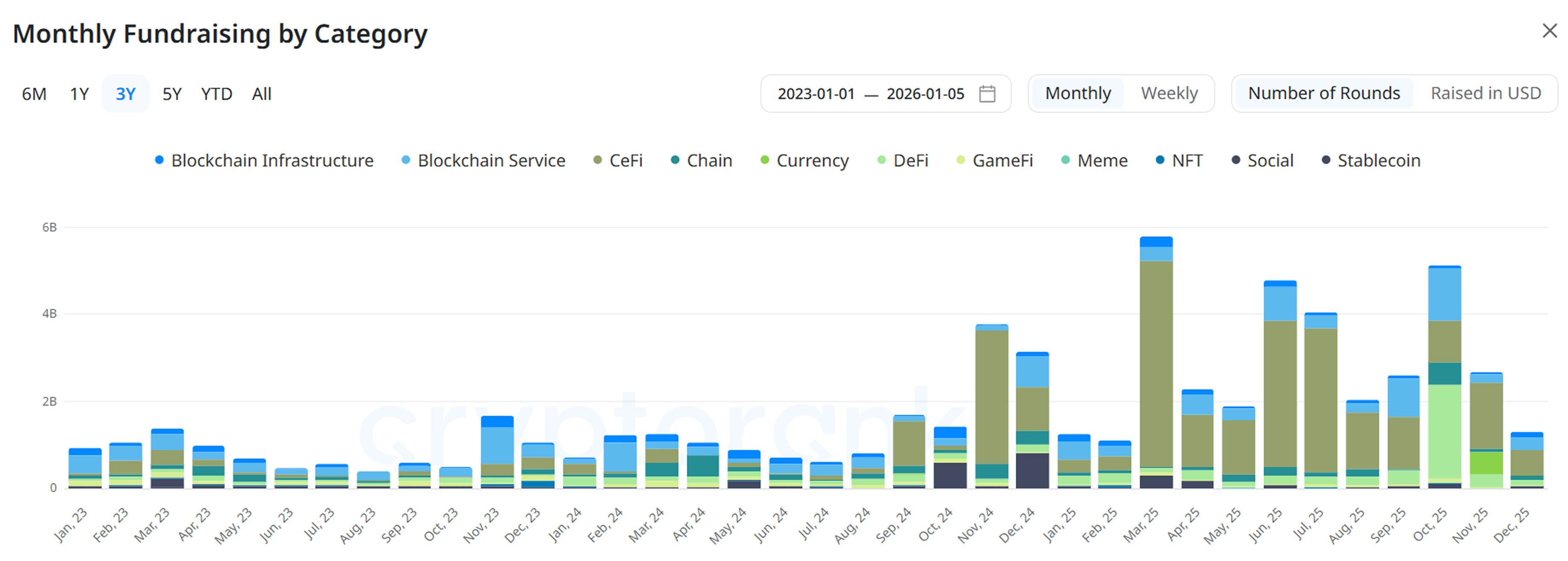

In 2025, capital invested in the Web3 sector increased significantly compared with the previous two years. Notably, despite Bitcoin’s price recovering in 2023 and returning to prior highs in 2024, venture fundraising accelerated meaningfully only in 2025.

Data source: CryptoRank API

The surge in Web3 investment coincided with the election of Donald Trump as the 47th President of the United States. His return to office introduced a markedly more favorable regulatory environment for the crypto sector, reflected in initiatives such as the GENIUS Act, Clarity Act, and Anti-CBDC Act, alongside the SEC’s withdrawal from multiple enforcement actions and explicit commitments to position the US as a global hub for the crypto industry.

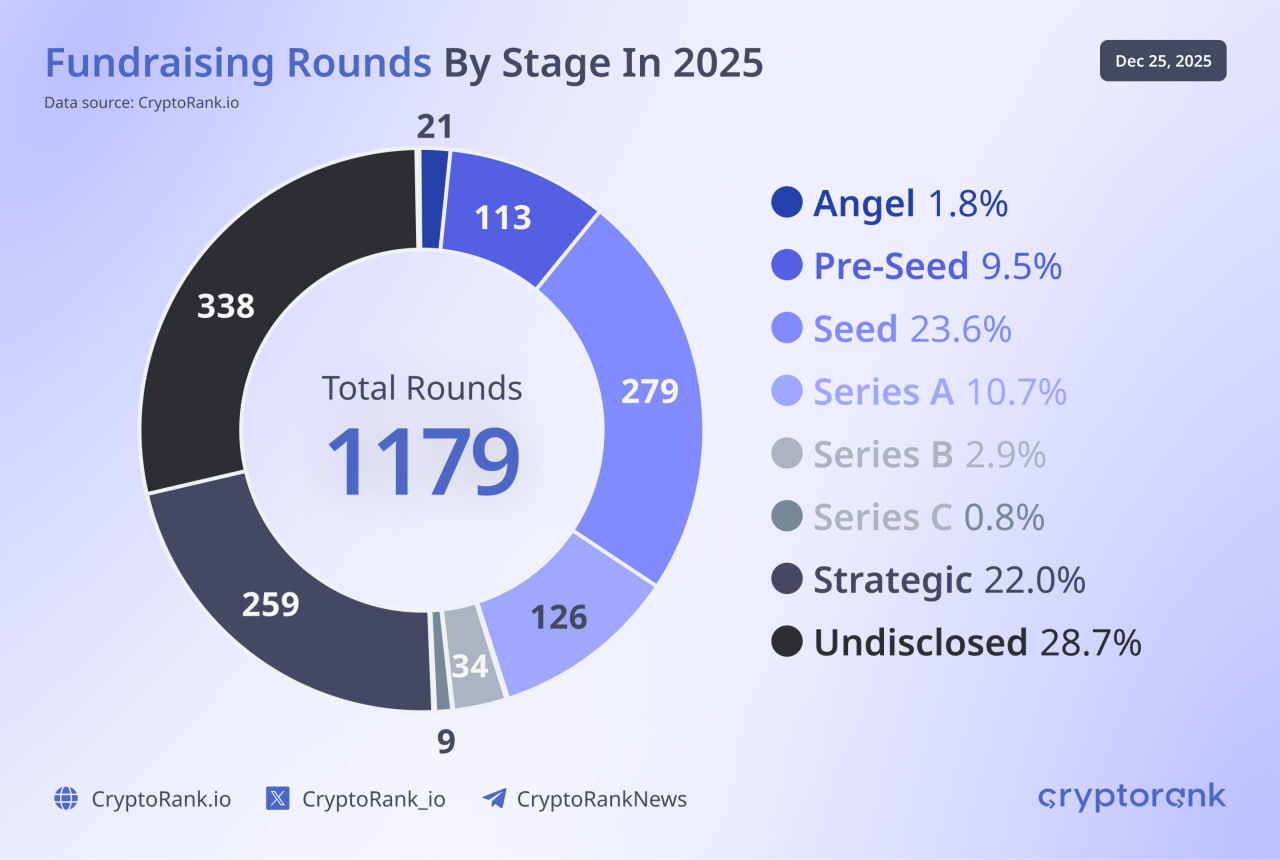

In 2025, a total of 1,179 Web3 VC deals were closed, representing a 29.6% decline year-over-year, according to our 2024 Crypto Fundraising Recap. Deal activity was also 2–3x lower than during 2021–2022, despite total capital invested reaching comparable levels.

Data source: CryptoRank API

This, however, does not mean that individual projects raised more capital on average than in earlier years, as several outsized late-stage financings in 2025 disproportionately inflated total investment figures and distorted aggregate averages.

Data obtained by API

The current market trajectory follows the natural maturation of an emerging sector. During the 2021–2022 fundraising boom, Web3 was flooded with startups racing to capture newly forming markets. While a small number introduced genuine innovation, many others were near-identical replicas targeting the same opportunities. In that phase, venture capital followed a classic spray-and-pray approach, backing multiple teams within the same niche rather than selecting clear winners. VCs were not investing in individual projects, but underwriting entire niches.

Why Most Tokens Fail to Hold Value Post-TGE

As the market became more saturated and structured, the bar for new entrants rose materially. In 2025, investors increasingly prioritized revenue generation and viable unit economics, as purely speculative token-based models without underlying cash flows largely lost their appeal.

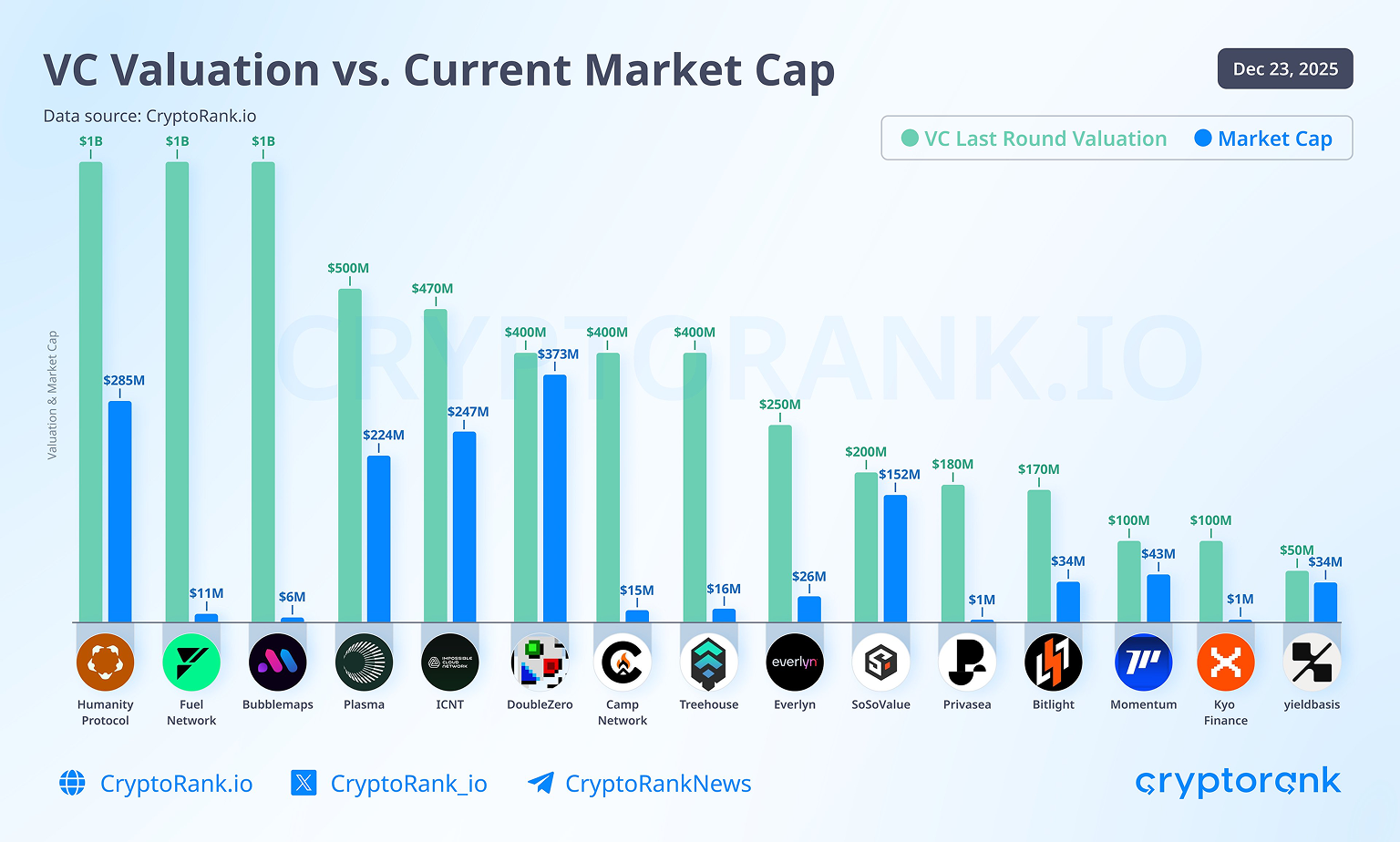

Our research shows that only 12% of token sales are currently trading above their TGE price. This weak performance is driven by two structural factors. First, many projects fail to generate sustainable revenue through the value of their products. Second, even when revenue exists, teams are often unable to link it to the token in a direct, value-accretive way.

As the market matures, principles that govern traditional finance increasingly apply to the Web3 sector. Most tokens fail to deliver tangible financial value to holders, leading retail investors to become markedly more selective and increasingly reluctant to allocate capital to altcoins.

Data obtained by API

This dynamic has triggered a chain reaction in which the market capitalization of many projects now sits below their prior VC valuations. Such a market structure has forced venture funds to adopt an even more selective investment approach, accelerating the shift away from the “spray-and-pray” strategy of earlier cycles toward concentrated allocations in late-stage rounds, where projects have already demonstrated real traction.

Data obtained by API

The End of Trust-Based Fundraising in Web3

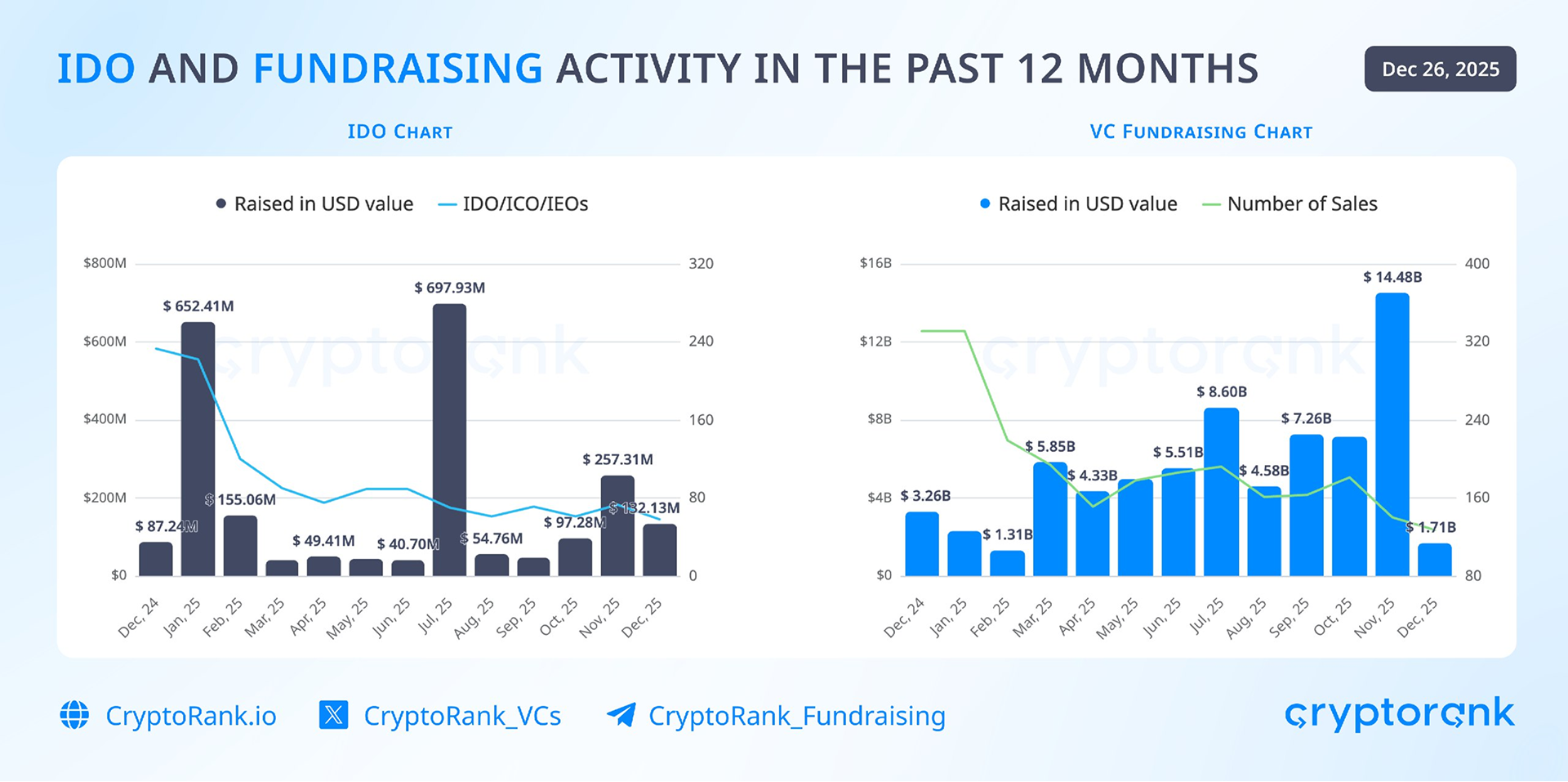

Another consequence of weak token sale performance is the continued decline of IDO fundraising relative to venture capital. While IDO volumes are not at their absolute lows, the ratio of IDO to VC fundraising has fallen to its lowest level on record and shows no meaningful recovery, even as VC investment rebounds.

Data source: CryptoRank API

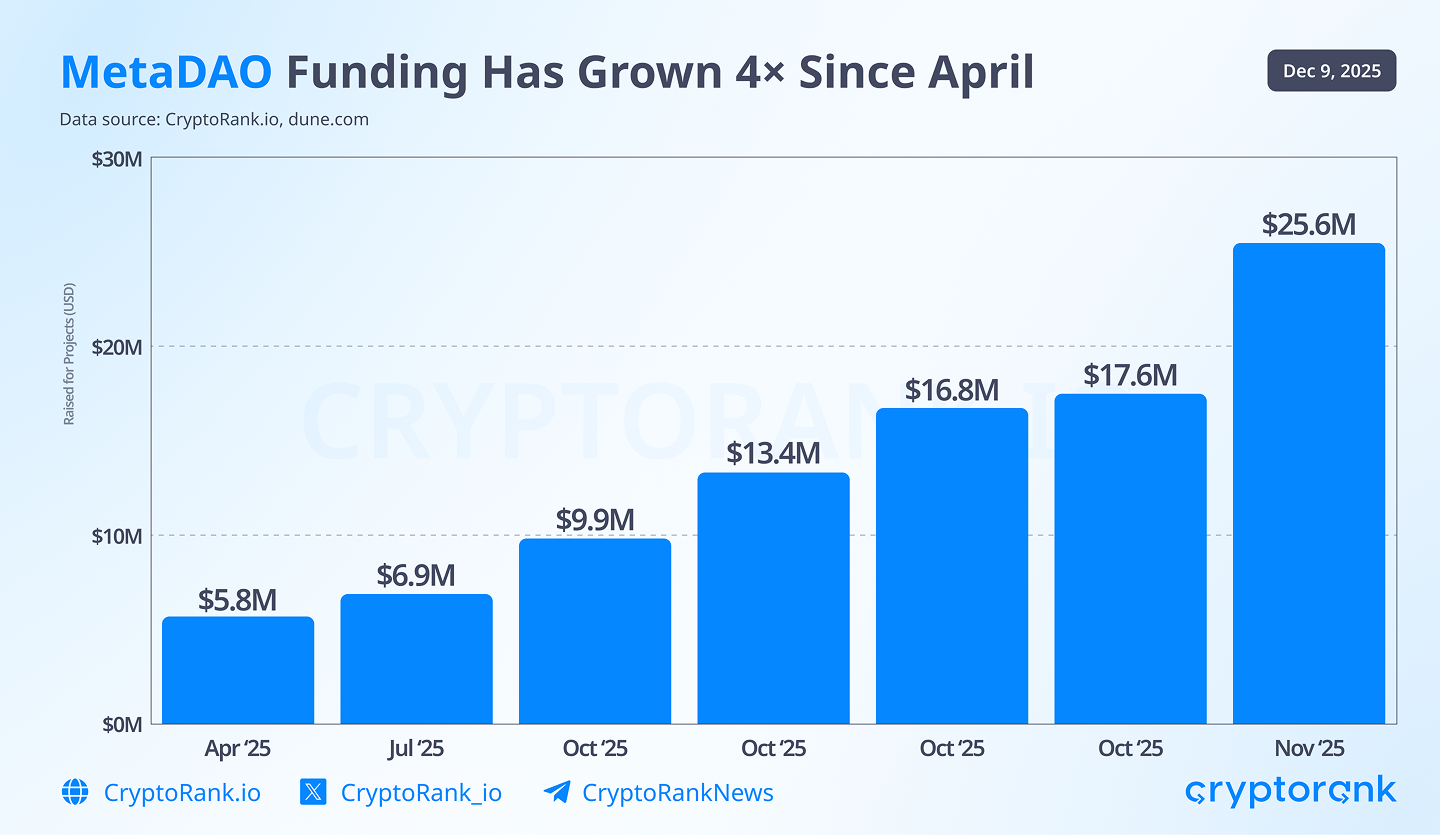

One notable exception is MetaDAO, which achieved a significantly higher token sale success rate and, as a result, gradually increased its fundraising volumes throughout 2025. MetaDAO’s outperformance is driven by its structural design: contributed USDC remains locked in an on-chain treasury, capital deployment is governed by futarchy-based markets rather than token-holder voting, and teams cannot access funds without market approval. Additionally, rewards unlock only after predefined price milestones (2x, 4x, 8x), materially reducing rug risk and enforcing long-term incentive alignment.

Data source: CryptoRank API

The model is delivering measurable outcomes. UMBRA is up approximately 7x, META has gained over 3x, and demand for new launches continues to build across finance Paystream, privacy ZKLSOL, and AI Loyal. Venture interest has followed: a recent $9.9 million OTC purchase was made by Variant, 6MV, and Paradigm. As a result, MetaDAO is evolving beyond a launchpad into an on-chain capital allocator, where markets systematically filter weak projects and concentrate capital into the strongest ones.

The case of MetaDAO shows that the IDO model can still work in 2025, but only if it is fundamentally redesigned. Stronger incentives for teams and on-chain protection of investor capital are now essential, while speculation and trust-based models are no longer enough.

Web3 Niches with Proven Product–Market Fit in 2025

Some Web3 niches stand out in 2025 due to proven business models and sustained user demand. Three segments, in particular, continue to dominate VC interest: prediction markets, perpetuals, and CeFi. Below, we examine why these areas remain especially attractive to investors.

Prediction Market

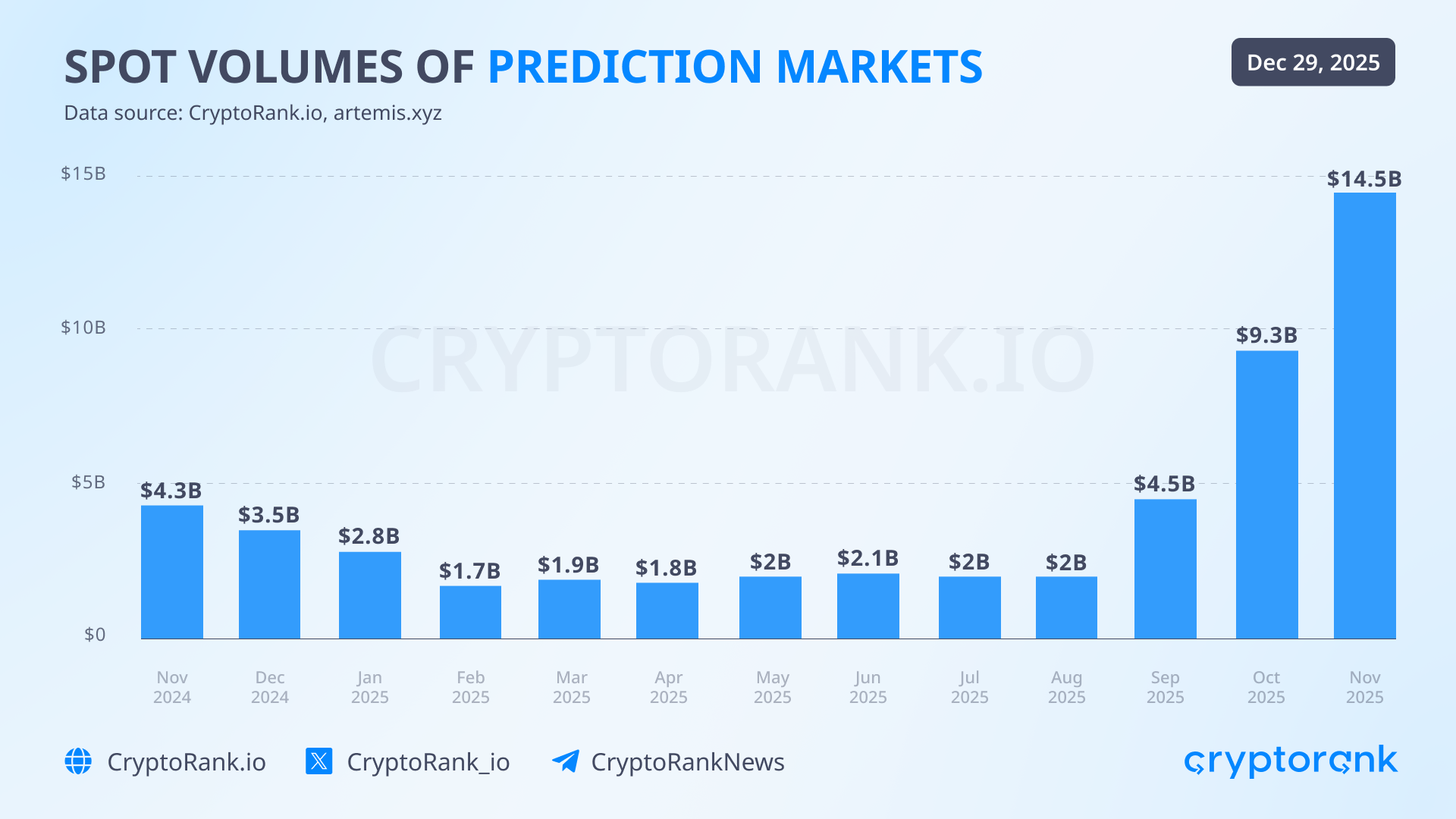

Prediction markets attracted a substantial amount of venture capital in 2025. While the sector has existed for more than eight years, it remained largely overlooked by both users and investors until recently.

The catalyst was the breakout success of Polymarket during the US presidential election cycle. Presidential elections consistently generate outsized engagement for betting platforms, and the highly polarized nature of the past election amplified attention further, driving a surge in speculative activity across prediction markets.

Users were actively searching for a reliable betting platform as traditional betting markets suffer from centralization risks, including censorship and opaque practices, especially among offshore platforms operating outside clear regulation. This is where blockchain-native solutions proved their advantage: censorship resistance and transparent settlement. Polymarket met this demand by offering a platform that was not only credible and trust-minimized, but also intuitive for non-crypto users, with a wide range of accessible prediction markets.

Polymarket gained strong user adoption, and importantly, engagement persisted even after the US presidential election concluded. A meaningful share of users continued to actively use the platform beyond the election cycle, signaling retention rather than one-off speculative interest.

This success drew renewed attention from other players in the sector. Kalshi pivoted toward deeper crypto integration and raised $1 billion at an $11 billion valuation in its latest funding round, led by Sequoia Capital and CapitalG, with participation from Andreessen Horowitz (a16z crypto), Paradigm, and others.

Alongside incumbents, new entrants also emerged and successfully attracted venture funding, including Opinion Labs, Limitless, and several other prediction-focused platforms.

Polymarket further cemented its position by raising $2 billion at a $9 billion valuation in its latest funding round, led by Intercontinental Exchange, the parent company of the New York Stock Exchange.

Perpetuals

Another niche that gained significant traction in 2025 had existed for years but only attracted sustained venture interest after its business model was clearly validated. The success of Hyperliquid served as the inflection point, demonstrating the viability of the model and triggering a renewed wave of fundraising activity across the sector.

Hyperliquid rapidly became one of the leading Web3 projects by revenue, triggering an aggressive competitive response across the perpetuals market. Its performance sparked a race among rival protocols seeking exposure to this highly profitable segment. Competing projects such as Aster, Lighter, and Avantis attracted VC funding and strategic backing from partners aiming to capture market share in the perpetuals space.

Although the perpetuals market had existed for years, it was the demonstrated success of Hyperliquid, validated by real business metrics, that triggered the surge of VC interest in perpetuals protocols. This again reinforces a broader pattern: only niches that prove their economic viability attract sustained venture capital inflows.

CeFi

CeFi represents a broader niche encompassing multiple business models and use cases, but 2025 marked a standout year for the segment in terms of total capital raised. The underlying drivers mirror those seen in prediction markets and perpetuals: clear, well-understood business models and proven, recurring revenue streams.

Data source: CryptoRank API

Historically, CeFi projects have operated with stronger business models, largely because most of them do not rely on token issuance. Instead, CeFi platforms monetize through traditional revenue streams such as trading fees, spreads, and services. As the Web3 market has become increasingly revenue-driven and focused on established, later-stage projects, this structure has turned into a clear competitive advantage.

Moreover, CeFi increasingly acts as a gateway into the Web3 ecosystem, addressing a far broader audience than internally focused, crypto-native projects. As regulatory clarity around crypto improves, venture capital has shown growing interest in CeFi platforms that onboard non-crypto users, positioning them as scalable entry points into the broader Web3 economy.

More specifically, segments such as RWAs, exchanges, payments, DATs, and custody solutions attracted substantial fundraising in 2025, not only from traditional Web3 venture firms, but increasingly from established TradFi financial institutions.

Digital Asset Treasuries: A New Capital Formation Layer

One of the more notable new phenomena in crypto fundraising is the rise of digital asset treasuries. Rather than directly funding early-stage projects, these vehicles generate incremental demand for established protocols by acquiring their tokens on the open market, effectively supporting liquidity and valuation for existing ecosystems.

This dynamic further strengthens late-stage fundraising cycles, as token purchases increasingly occur through structured OTC transactions rather than open-market buying. In most cases, these deals involve project teams or strategic partners directly, allowing large positions to change hands without exerting downward pressure on the token’s market price.

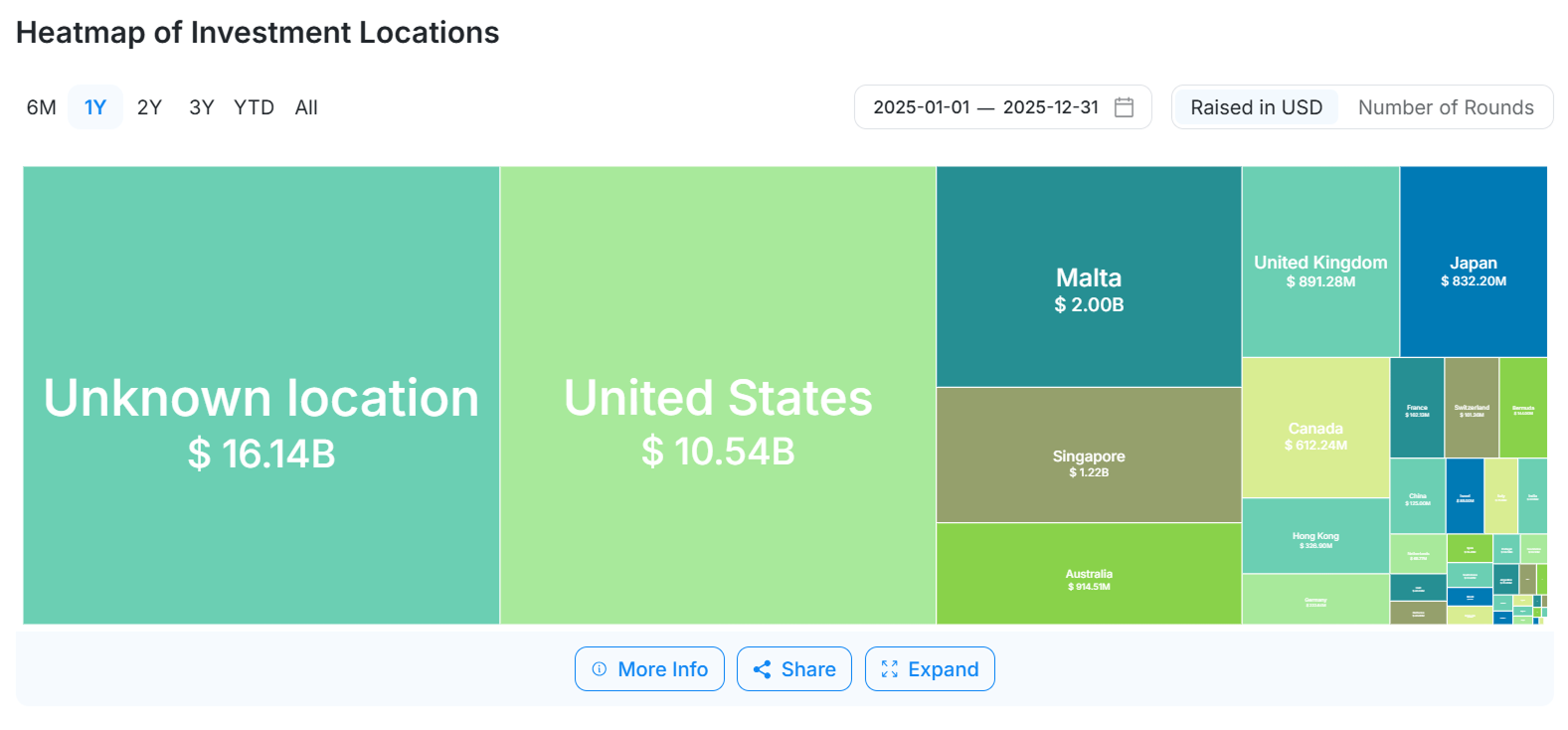

The United States Consolidates Its Position as the Global Crypto Hub

In 2025, President Trump publicly declared his intention to position the United States as the global center of the crypto industry. In reality, the US had already been in that position for years, consistently leading global crypto fundraising even before the statement was made. Nonetheless, Trump’s actions materially reshaped the crypto landscape. They accelerated the rise of digital asset treasuries, paved the way for Circle’s IPO, and boosted demand for stablecoins, ultimately increasing indirect demand for U.S. Treasury bills.

Data source: CryptoRank API

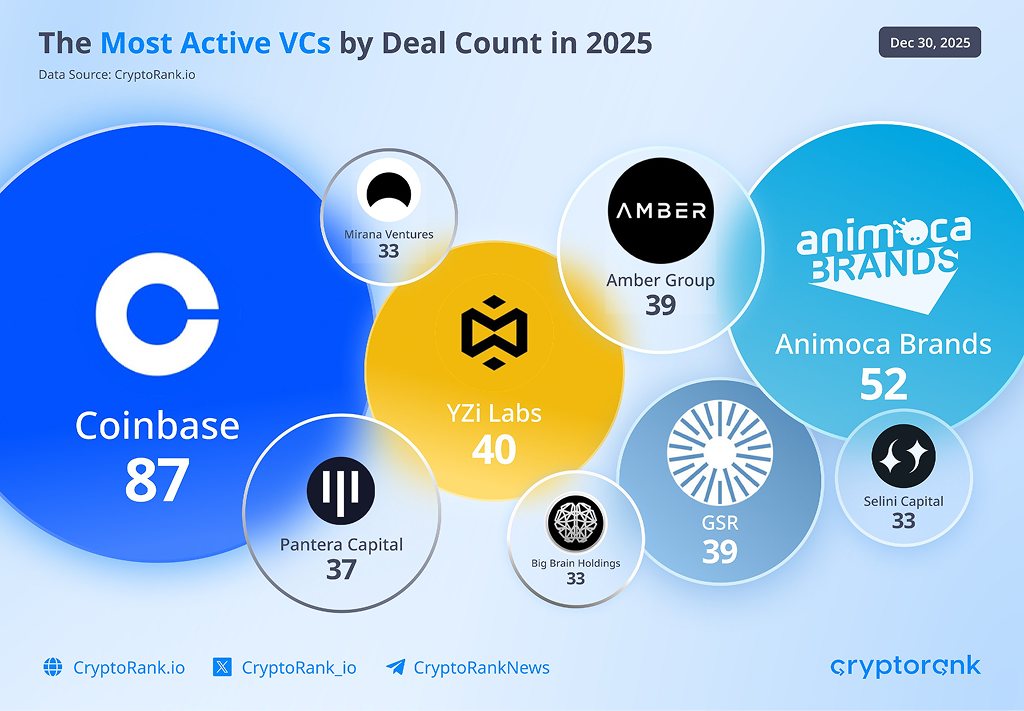

Coinbase Ventures, the venture arm of the Coinbase exchange, became the most active venture firm by number of deals in 2025, signaling increased fundraising activity among US-oriented venture funds.

Data obtained by API

Overall, the US remains the global hub of the crypto industry, hosting the largest share of capital and the highest number of projects. Ongoing legislative efforts are laying a strong foundation for further industry development in 2026.

Outlook for 2026

Continued market maturation will push crypto projects toward greater economic efficiency, with the ability to generate sustainable cash flow playing an increasingly important role. Venture capital is prepared to deploy capital rapidly and at scale into proven niches, competing for exposure to revenue-driven markets.

CeFi may emerge as one of the most attractive niches in 2026, driven by its outward-facing market orientation beyond the crypto-native audience, clearer regulatory frameworks, and inherently revenue-focused business models.

In summary, founders should shift their focus from idealistic narratives to pragmatic, revenue-centric fundamentals if they aim to build successful products in 2026.