Prediction Markets: Polymarket vs Kalshi

Prediction Markets: Polymarket vs Kalshi

October became a record month for the prediction market sector. The total trading volume reached $8.5 billion, surpassing last November’s figures – the month of the U.S. presidential elections. The number of traders also peaked at 478K, while the prediction market narrative dominated X in terms of mindshare.

The main battle is ongoing between two leaders: Polymarket and Kalshi. Let’s take a closer look at the key developments for each.

Polymarket

In October, Polymarket raised $2 billion at a $9 billion valuation from Intercontinental Exchange (ICE), the parent company of the NYSE. The project is now focused on returning to the U.S., which would grant access to the largest market and eliminate Kalshi’s main advantage. There’s a 90% probability of Polymarket’s return by the end of the year.

Another major announcement was the upcoming launch of the POLY token in 2026, along with a planned airdrop for traders. Following the news, activity on the platform increased by more than 20%.

Kalshi

In October, the project also announced a new funding round – $300 million at a $5 billion valuation. The lead investors were Sequoia Capital and Andreessen Horowitz. In total, Kalshi has raised $565 million to date.

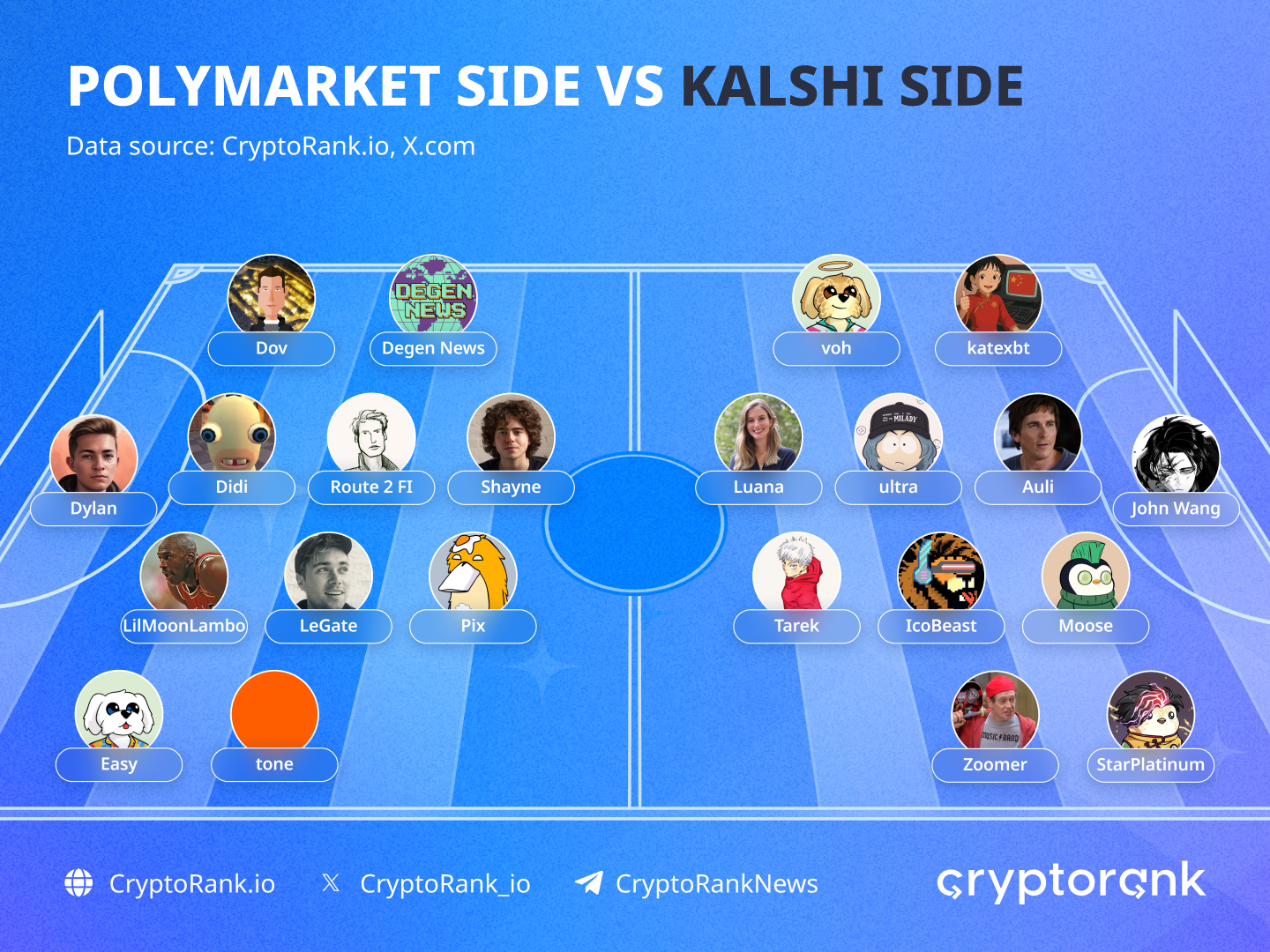

The partnership with Robinhood opened access to thousands of new users. Traders can now place bets on NFL and college football games directly within the broker’s app. Currently, about 90% of Kalshi’s prediction volume comes from sports markets. To expand its presence in other categories, primarily crypto, Kalshi has partnered with several big X influencers, like John Wang, ICO Beast, 0xUltra, and others.

Stats Comparison

Let’s break down the numbers. In October, Kalshi surpassed Polymarket in trading volume – $4.4 billion versus $4.1 billion. The gap is relatively small compared to September, when Kalshi was the clear leader with $2.9 billion against $1.6 billion.

As mentioned earlier, the majority of Kalshi’s volume comes from sports, while Polymarket’s activity is more diversified across sports, politics, and culture.

Kalshi also leads in transaction count – 16 million vs 12 million. As of November 12, the open interest stands at $216 million for Polymarket and $297 million for Kalshi.

Among other players, it’s worth highlighting Opinion Labs – a project backed by YZi Labs. They launched a points system and announced future rewards for active traders. Last week, the platform opened access to all users, though market liquidity remains quite low, so if you are going to trade here, do it cautiously.

Wrapping Up

The competition is intensifying, as is overall attention to the sector. Polymarket and Opinion have both confirmed airdrop plans for users. Considering Polymarket’s latest raise and valuation, the POLY’s market cap can be high, meaning the airdrop size might also be significant.

Opinion is being developed as an attempt by the BNB ecosystem to capture part of the attention and liquidity in this sector. The recent example of Aster showed that YZi Labs knows how to promote its projects, suggesting the airdrop could be quite rewarding as well. Kalshi, on the other hand, is a highly regulated project, and the possibility of future rewards there is considered low.

You can find airdrop guides for Polymarket and Opinion on CryptoRank.

Andreessen Horowitz (a16z crypto)

Andreessen Horowitz (a16z crypto) Sequoia Capital

Sequoia Capital