Missed Pendle? These Projects May Repeat Its Success

The Pendle Phenomenon

The idea behind the Pendle is not new and has originated from TradiFi in the context of the zero-coupon yield curve. Pendle's architecture allows users to tokenize the future returns of crypto assets and use them in a variety of strategies to generate additional risk-adjusted returns.

The project team managed to create a very structured yet flexible development strategy that allowed Pendle to incorporate almost all relevant market narratives into its products, including one of the most important and condemned, the EigenLayer point farming. Pendle allowed users to farm points for LRT protocols and EigenLayer with two-digit multipliers, which made the entry threshold for Restaking quite affordable.

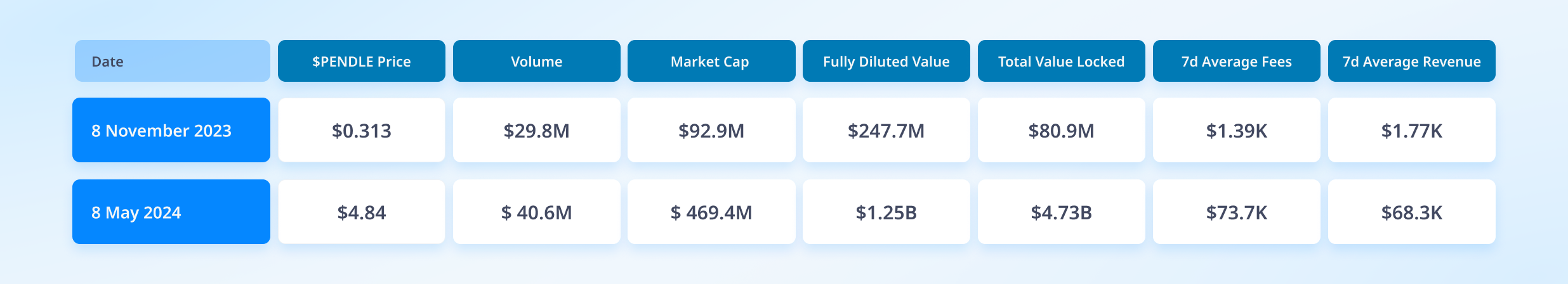

During the past 6 months, Pendle managed to achieve outstanding growth in terms of token price and financial metrics.

No doubt, innovative projects are phenomenally successful. But if you missed Pendle, that's no reason to be sad. There are other projects out there that are similar to Pendle, but with their own individuality, and they're still in the early stages. Here are three of them.

Napier

Napier is a liquidity hub for yield trading built as an extension of Curve Finance. The project provides users with versatile yield management strategies and opens the door to any other token, both fixed and floating rates, to efficiently and safely utilize liquidity flows between pools.

Project has raised $1M in Pre-Seed round with participation from B Dash Ventures, Fracton Ventures, Michael Egorov and others.

At the moment the project runs the ‘Llama Race’ campaign, where users can mint over 2 uniETH in May to earn Napier points. As usually, points will be converted to tokens through an airdrop.

IPOR

IPOR is a unified liquidity framework that brings the interest rate swap (IRS) and derivatives markets into the DeFi space, enabling interest rates on different assets to be traded.

Users can choose between fixed and floating rates, which is very similar to Pendle's Yield Tokens (YT) & Principal Tokens (PT).

At the moment the project operates on two blockchains, Ethereum and Arbitrum, and provides USDC, USDT, DAI, stETH and weETH liquidity pools.

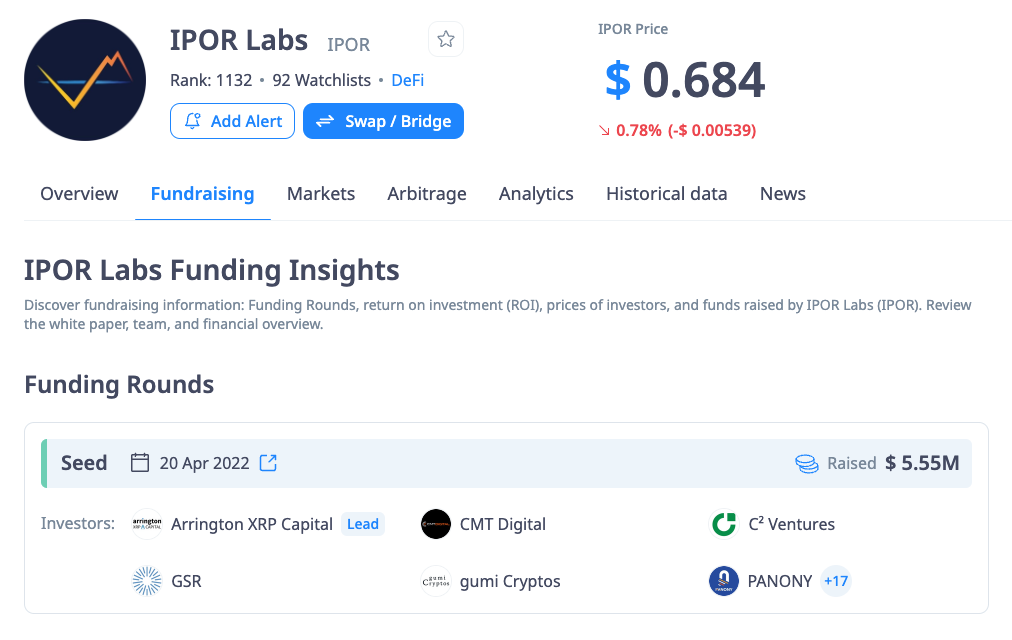

IPOR has raised $5.5M in a Seed round led by Arrington XRP Capital, with participation from CMT Digital, C² Ventures and others.

Spectra Finance

Spectra is a protocol for tokenization of future yield and trading, similar to Pendle’s mechanism. However, Spectra aims to introduce an innovative approach similar to Uniswap in the context of creating liquidity pools. Any user will be able to create liquidity pools and contribute liquidity with any token. It should be noted that liquidity pools can only be integrated into Pendle with the approval of the Pendle team.

The V1 version of the protocol went live on mainnet in September 2021, before Pendle was created. However, the project was suspended for a number of reasons.

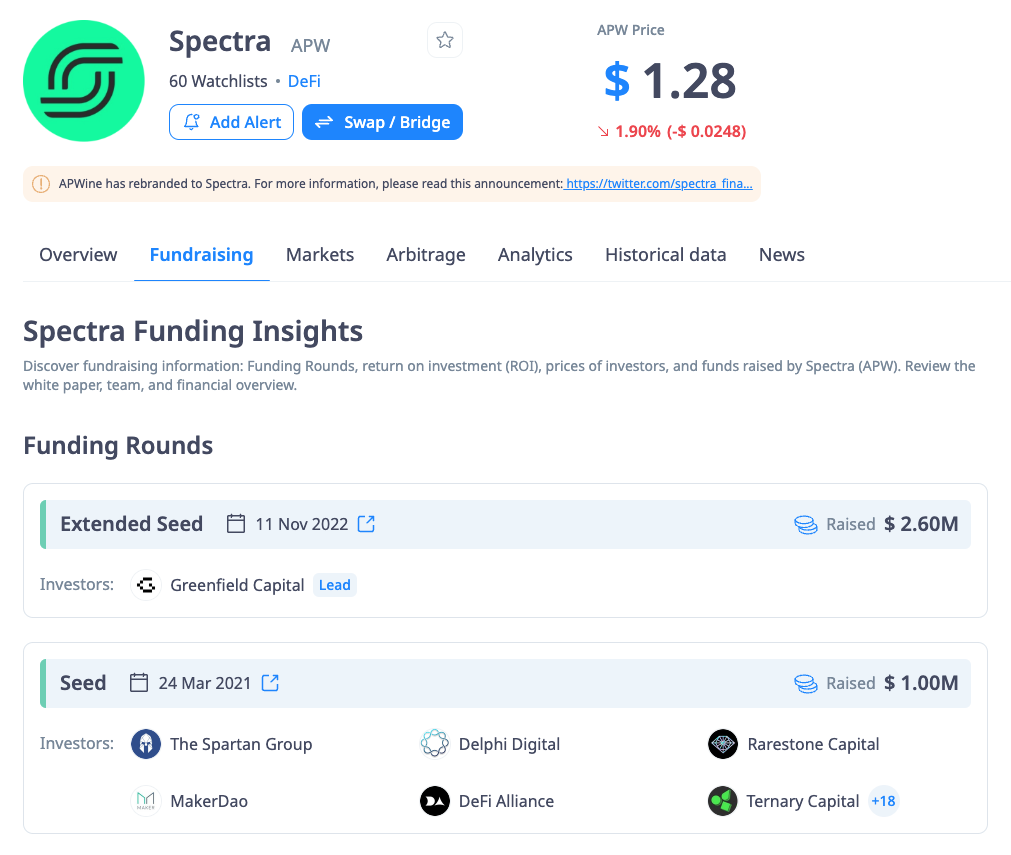

Spectra Finance has raised $2.6M in two rounds led by Greenfield Capital with participation from The Spartan Group, Delphi Digital and others. The Spectra team is currently preparing to launch the V2 version of the protocol, but the launch date has been pushed back once again.

Conclusion

With the team's effort, management decisions and continuous product improvement, Pendle has grown multiple times in every possible metric in just over six months and has become a true DeFi gem. Indeed, such success was reached with a share of luck.

At the moment Pende’s market cap seems high, and its token may seem quite overvalued. In addition, the points farming frenzy related to EigenLayer is coming to an end, and perhaps the price of PENDLE tokens will undergo a correction.

With these factors in mind, it would be wise to take a closer look at the Pendle’s peers covered above. Some of them are in the early stage and you can possibly get their tokens for free. Remember, you should always do your own research and be only guided by your strategy.