M&A: New Trend in Crypto Fundraising

What Is M&A?

M&A (Mergers and Acquisitions) refers to the process of combining the assets of two companies, where the ownership of one company or its division is transferred to or consolidated with another company.

M&A transactions can be classified into several types:

-

Horizontal. These occur between two companies within the same industry that have similar products, business volumes, and capitalization.

-

Vertical. These occur between two companies within the same industry that have similar products but different business volumes and capitalization.

-

Conglomerate. These occur between two companies within the same industry but with entirely different products, business volumes, and capitalization.

Until recently, M&A transactions were typical for mature markets in TradFi. However, in recent years, these processes have increasingly emerged in the Web3 space, with their frequency steadily rising.

M&A Cases in Crypto

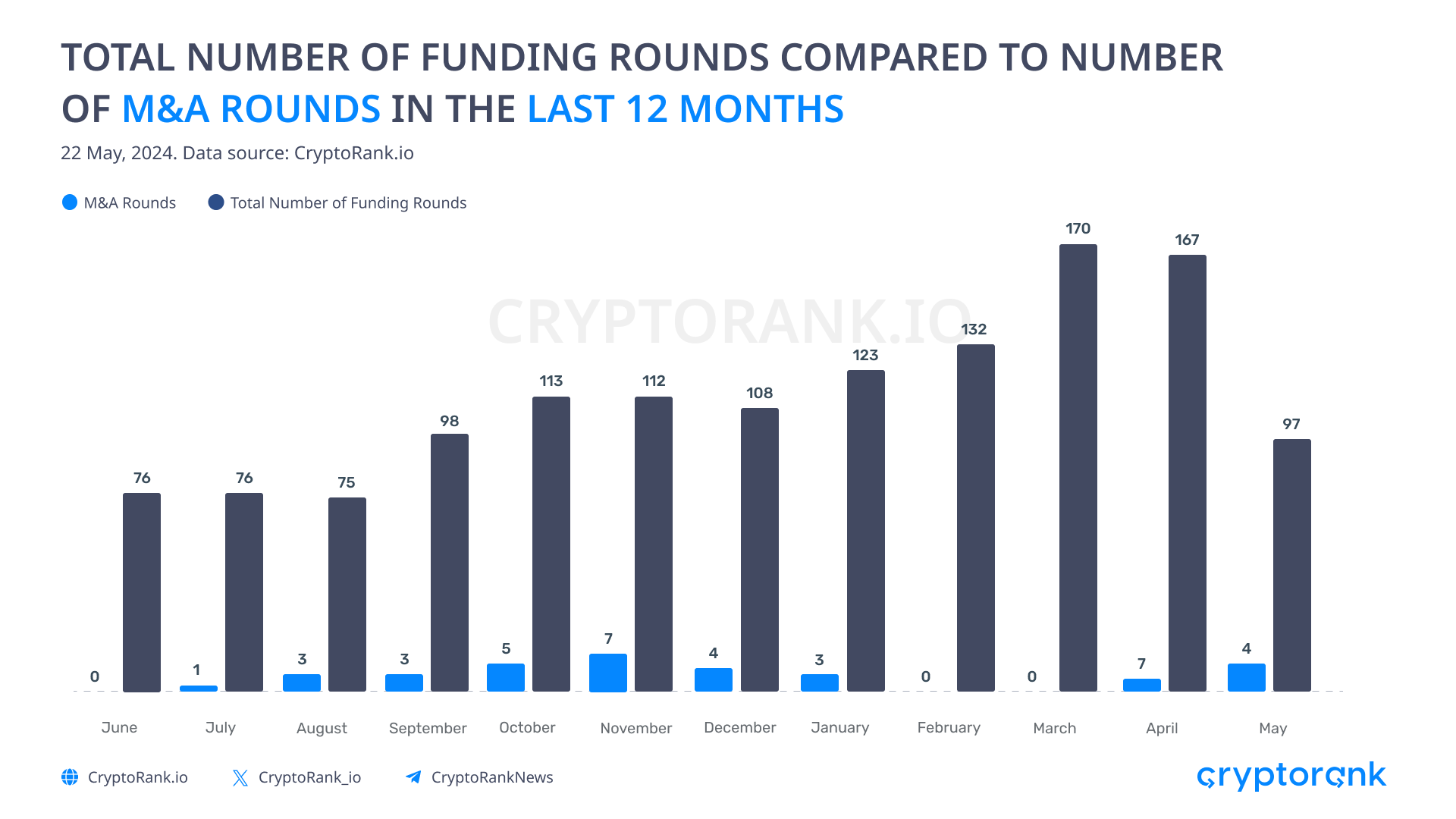

Over the past 12 months, there have been 33 M&A transactions in the market. While that’s a significant number, it only accounts for 2.4% of the total amount of all venture rounds.

Of these, 11 M&A rounds took place in 2024 (at the time of publishing this article).

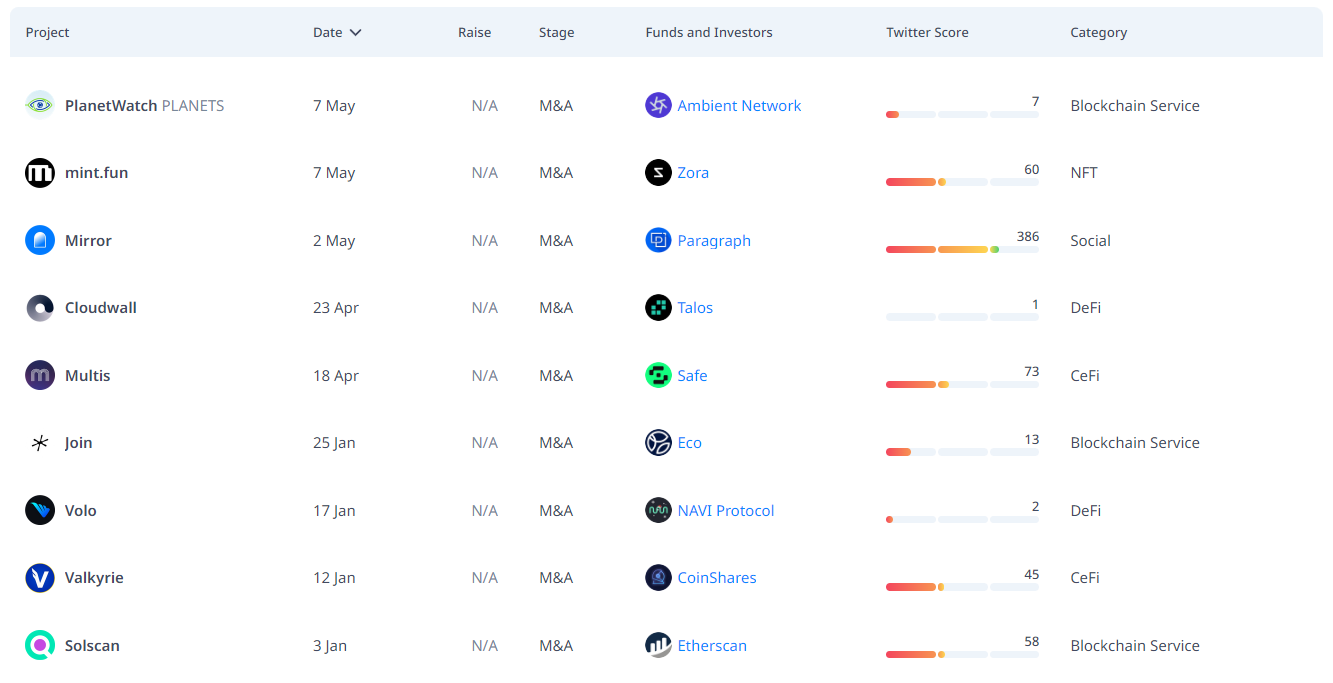

Among all M&A transactions, some stand out as particularly significant. Let’s take a closer look at them.

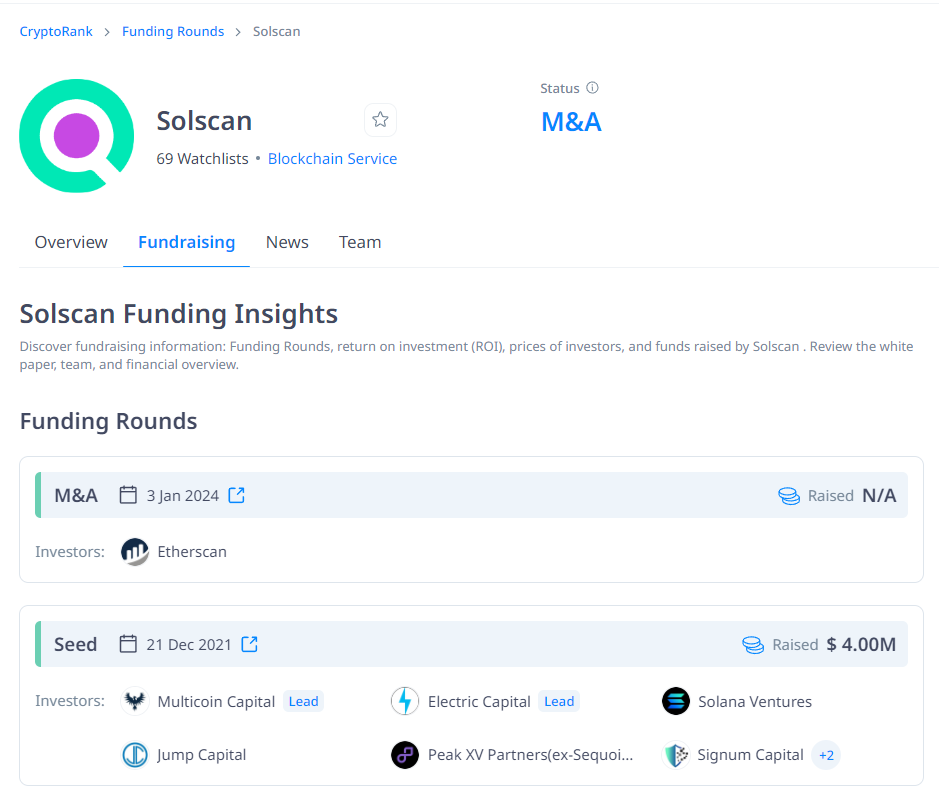

Early this year, Etherscan acquired Solscan, a block explorer for the Solana network. This positions Etherscan as a dominant player in providing on-chain block data for both EVM and non-EVM blockchains.

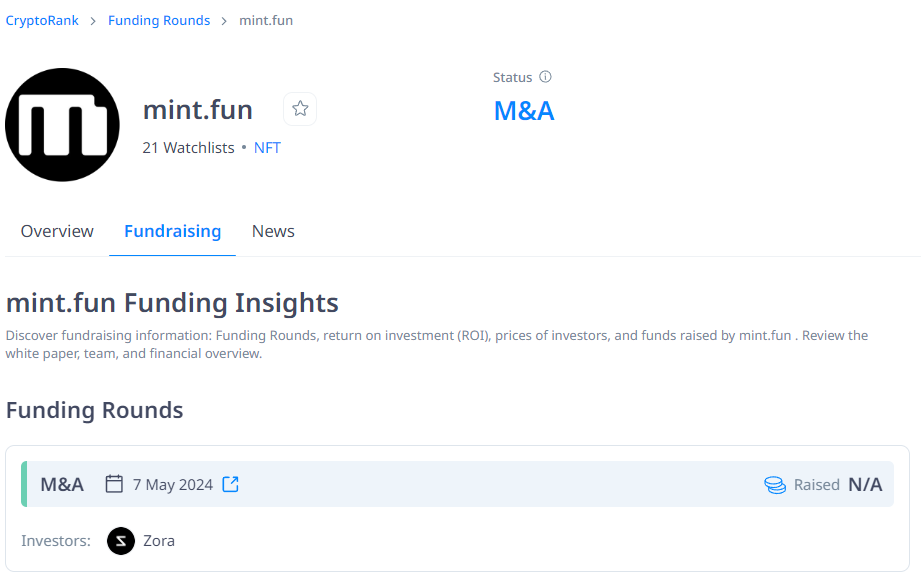

mint.fun and Zora merged to create a superior NFT service, aiming to offer a unique user experience.

This year’s most notable merger has been the formation of the Artificial Superintelligence Alliance, which combines three leading crypto AI projects: SingularityNET, Fetch.ai, and Ocean Protocol.

The goal of this merger is to create a decentralized alternative to the dominant AI corporations within Big Tech. The alliance will operate under a single token, ASI, with a total supply of 2.63 billion tokens and an initial price of $2.82 per token. The launch is scheduled for May 24.

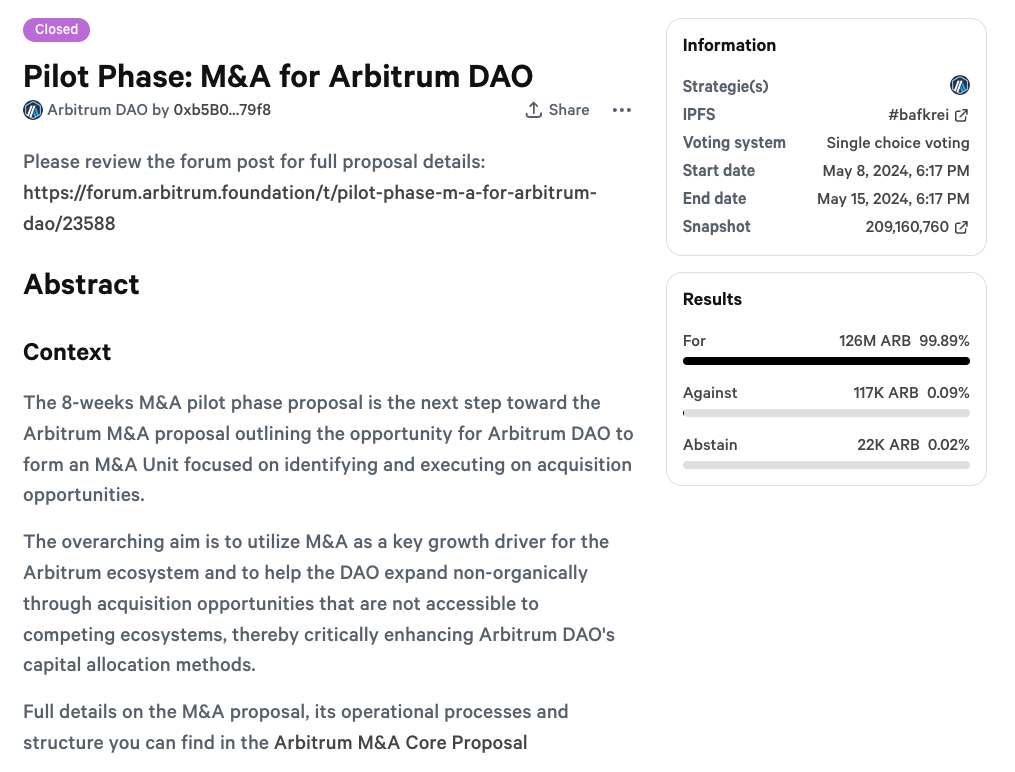

An intriguing precedent in the M&A sphere is currently being set by Arbitrum DAO.

In early May, a proposal was made for an eight-week pilot project aimed at establishing a separate DAO division dedicated to mergers and acquisitions. Potential targets include marketing companies, service providers, stablecoin issuers, and even other L2 blockchains.

If the pilot project yields positive results, Arbitrum plans to create a two-year M&A roadmap and allocate between $100 million and $250 million for these initiatives.

Preconditions for M&A Transactions Growth in Crypto

Several key factors are driving the increase in mergers and acquisitions within the cryptocurrency space:

-

Currently, the total market cap of crypto-assets now exceeds $2.7 trillion, with an uncountable number of existing projects across all categories. While this indicates the industry’s growth, it also highlights the problem of increased market fragmentation. Simply put, the market has been overwhelmed by “zombie projects” and “zombie blockchains” abandoned by their creators. Acquiring these projects could “clean up the market,” certainly enhancing the industry’s image and accelerating mass adoption.

-

Apart from abandoned startups, many projects in the market develop similar products and services that differ only in minor details and approaches. Merging these projects could potentially improve their economic performance, expand product lines, and increase market presence.

-

Following the approval of BTC ETFs, the market has seen a flood of institutional investors. The potential approval of ETH ETFs in the near future could further accelerate this process. Large funds are likely to invest in established crypto projects with constant cash flows, innovative services, and solid user bases, rather than building such startups from scratch. Moreover, we can see the opposite situation, with Web3 giants beginning to show interest in FinTech projects unrelated to blockchain, as exemplified by Arbitrum’s recent initiatives.

Potential Market Implications

The impact of M&A on the crypto market is nuanced, especially considering the unique nature of the decentralized landscape.

On the one hand, merging similar projects and acquiring smaller ones can lead to improved business processes and final products. We might see completely new and unique services emerging from M&A transactions in the foreseeable future. Furthermore, user security would improve, and UX could reach new heights.

On the other hand, for the M&A narrative to fully develop, a clear regulatory framework in this area is necessary, which would certainly lead to even stricter regulation. Another concern is potential market monopolization, which might lower returns on assets across all DeFi categories.

It’s safe to say that DeFi is slowly but surely becoming a more mature market. The described processes are likely to continue, shaping the future landscape of the crypto industry.

Etherscan

Etherscan Zora

Zora